How I Use a Shopee Price Tracker to Protect My Margins

Hi, I’m David. I’ve been running my own Shopee store for a little over three years now, mostly in highly competitive categories where price moves fast and margins are thin. If there’s one lesson I learned the hard way, it’s this: guessing prices is expensive.

Early on, I adjusted prices based on instinct, a few spot checks, or what my competitors “seemed” to be doing. Sometimes it worked. More often, I either priced too high and lost traffic, or joined a race to the bottom without realizing competitors had already changed strategy. That frustration is what pushed me to seriously look into using a Shopee price tracker mindset—not just tracking my own prices, but understanding how prices move across the market.

In this article, I want to share how I now approach price tracking on Shopee, using real data from the market rather than assumptions, and how tools like Shopdora fit into that workflow without turning pricing into a blind price war.

Why price tracking on Shopee is harder than it looks

Most Shopee sellers already know their own prices by heart. The real challenge is everything outside your store. Shopee’s seller center is great for internal metrics, but it doesn’t tell you how competitors are adjusting prices, how often they discount, or whether a sudden drop in your sales is caused by price changes elsewhere in the market.

This is especially painful in non-standardized products or categories with many similar SKUs. Prices don’t move in isolation. One competitor quietly testing a lower price can shift rankings, traffic distribution, and conversion patterns across an entire category. Without proper Shopee data, sellers often react too late.

This is where a proper Shopee price tracker approach matters. Not a single snapshot, but continuous observation of how prices, rankings, and sales interact over time.

What I actually track (and what I stopped tracking)

One mistake I see new sellers make is obsessing over a single “lowest price.” In reality, price only makes sense when viewed alongside performance. I stopped asking, “Who is cheapest today?” and started asking, “Who is winning traffic and sales at what price point?”

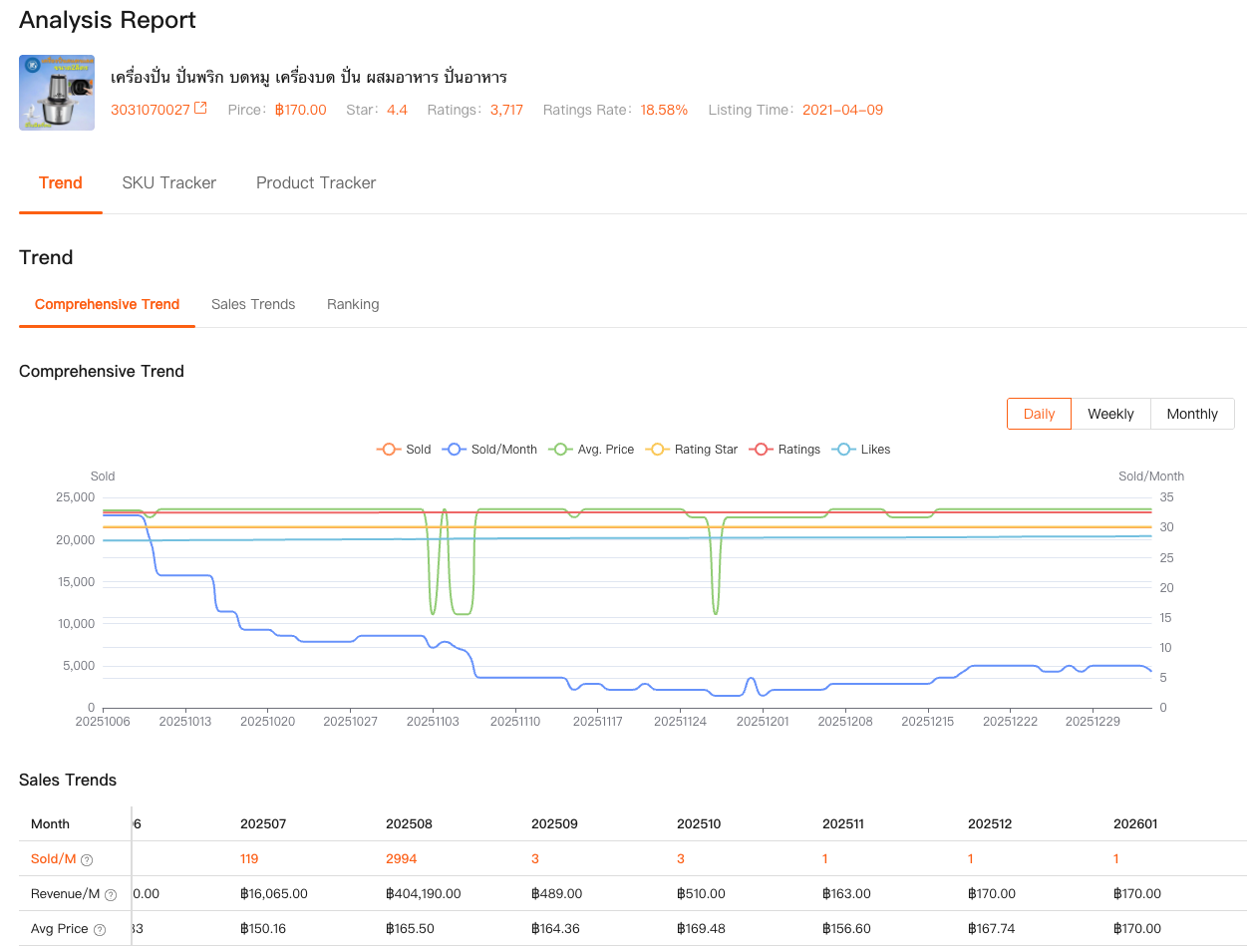

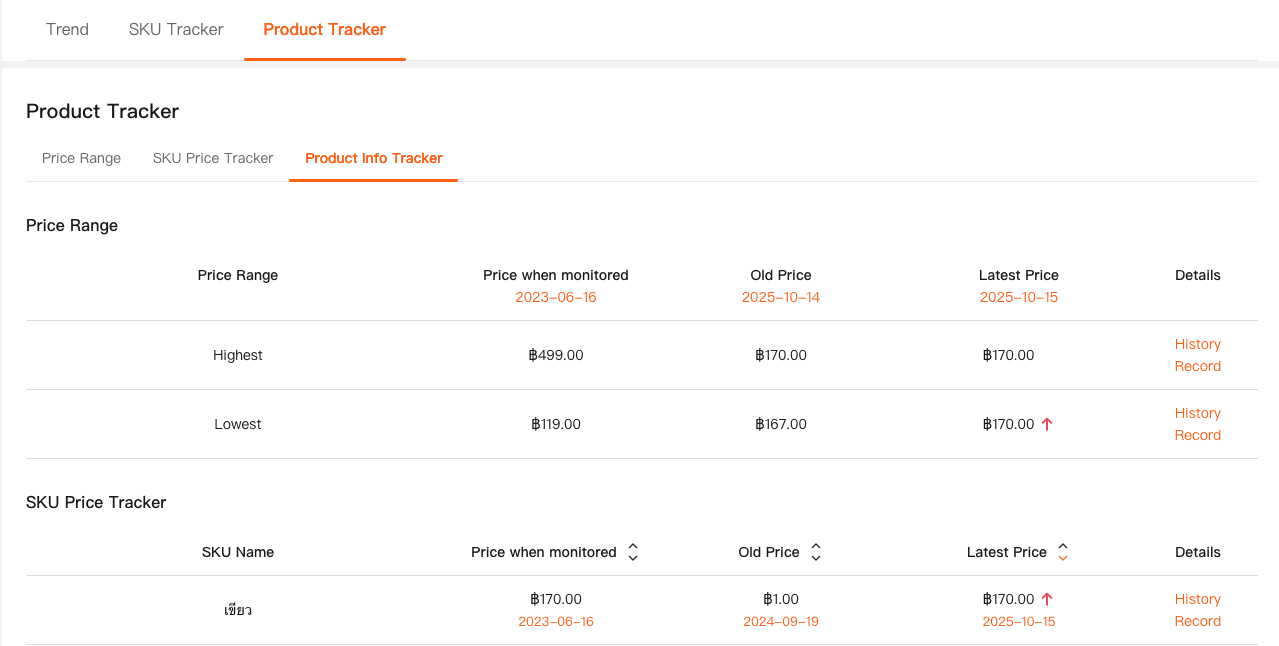

This shift happened when I began using Shopdora’s Comprehensive Analysis features as part of my daily routine. Instead of manually checking product pages, I could see how competing products were trending over time—sales movement, ranking changes, and price adjustments presented together.

That context matters. A competitor lowering price but losing ranking tells a very different story from one lowering price and gaining momentum. As a Shopee seller, those patterns are far more actionable than raw prices alone.

Using Comprehensive Analysis to read price signals, not just numbers

The biggest value I get from Comprehensive Analysis isn’t just “price tracking” in the narrow sense. It’s the ability to connect price changes with outcomes.

For example, I often notice that when a competitor adjusts pricing aggressively, there’s a short-term spike in sales followed by stabilization. Sometimes the spike doesn’t happen at all. By tracking sales trends and rankings alongside pricing, I can judge whether a price move is actually effective or just burning margin.

This kind of Shopee data helps me avoid emotional decisions. Instead of matching a competitor’s price instantly, I wait to see whether their strategy actually works. Over time, this has saved me from unnecessary discounts more times than I can count.

Market-level price awareness beats SKU-level panic

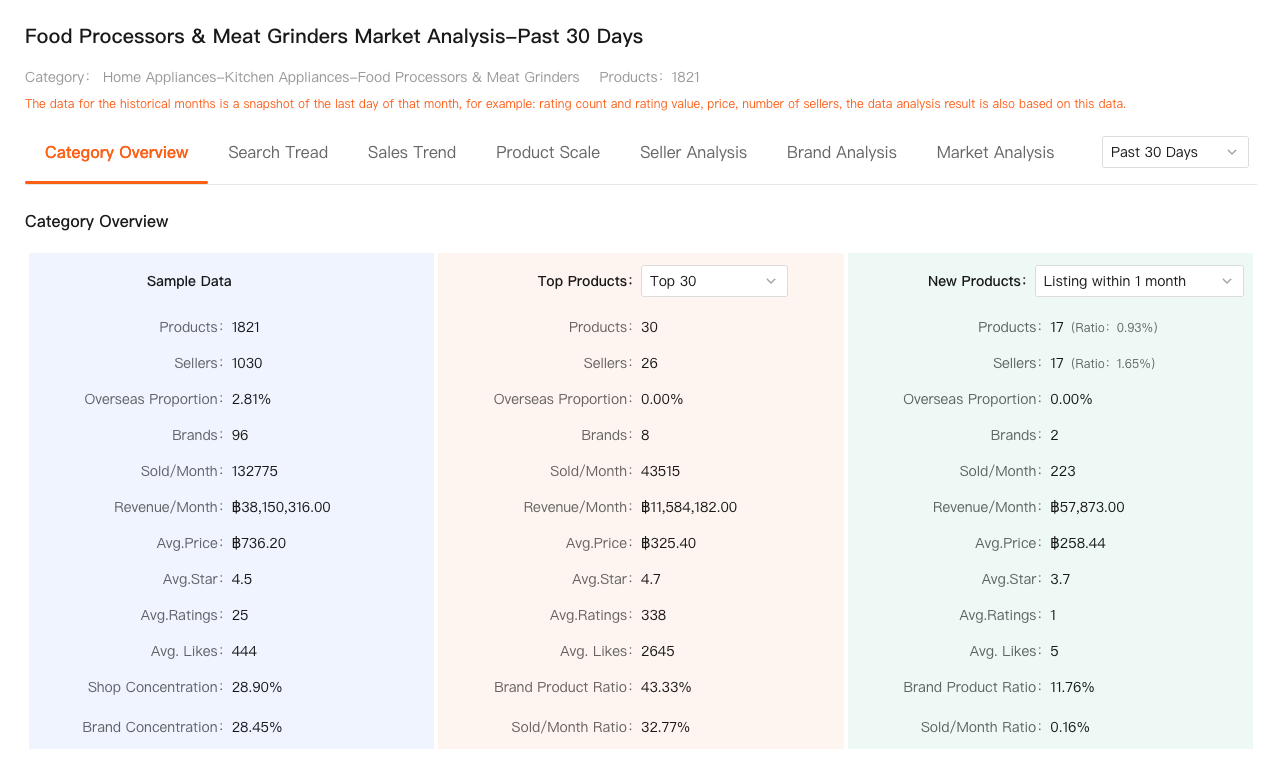

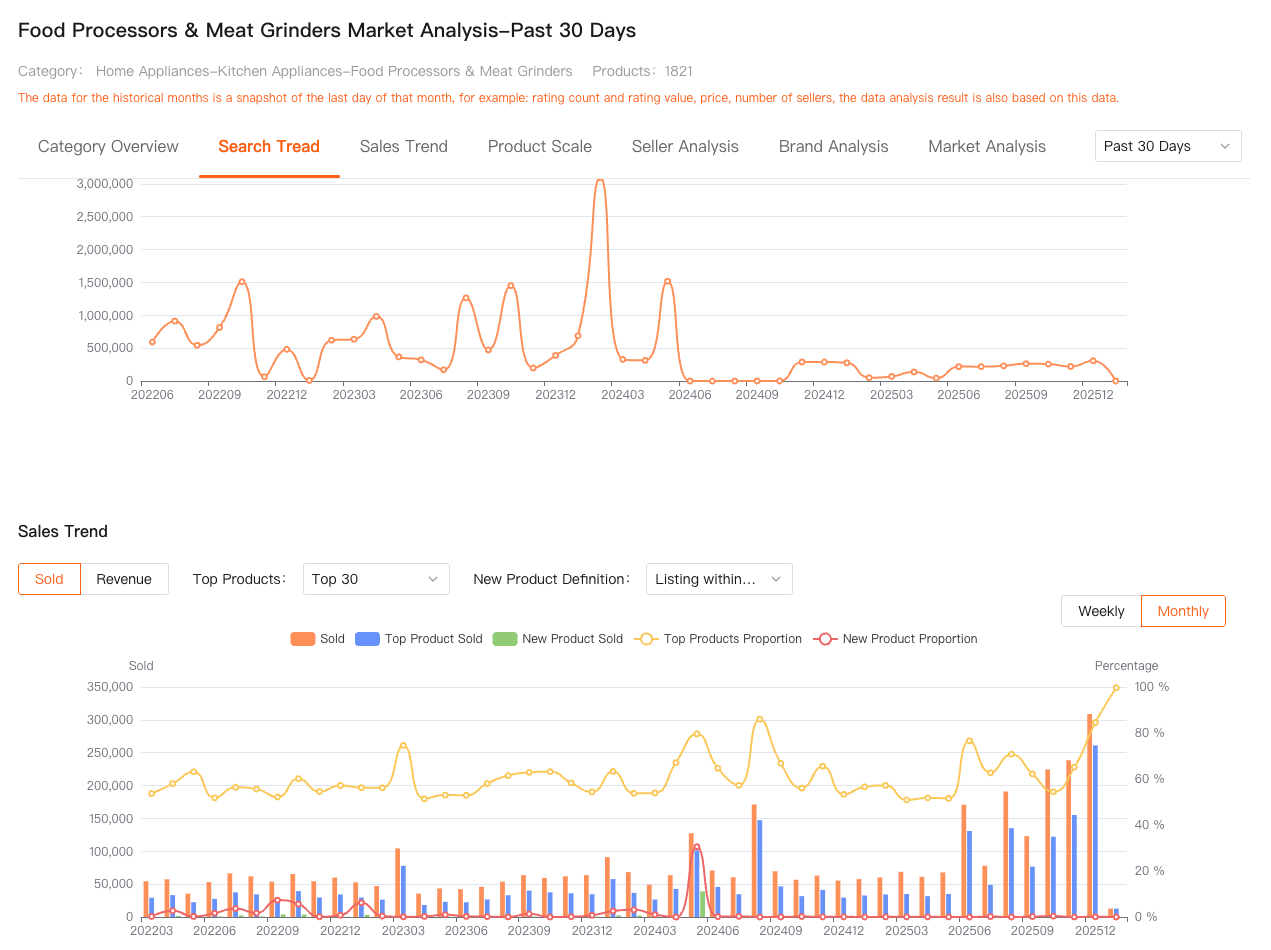

Another shift in my thinking came from using Market Analysis. Instead of staring at individual products, I zoom out and look at the category as a whole.

Market Analysis helps me understand the overall price range, how concentrated sales are among top products, and whether the category is trending toward premium positioning or price competition. This matters because price pressure often comes from market structure, not just individual competitors.

For instance, in categories where top products dominate most sales, minor price changes from small sellers rarely move the needle. In those cases, I focus on differentiation and stability rather than aggressive price tracking. In more fragmented markets, however, small price shifts can cause big ranking swings, and that’s where active price monitoring becomes critical.

Seeing these patterns clearly changed how I define a “good” price.

Pricing decisions backed by Shopee data feel different

There’s a noticeable psychological difference when pricing decisions are backed by data. Instead of feeling rushed or anxious, I feel prepared. When sales dip, I don’t immediately blame price. I check whether competitors moved, whether rankings shifted, or whether market demand softened.

This is where Shopdora quietly fits into my workflow. It doesn’t replace judgment, but it gives me enough Shopee data to make informed calls. I still decide the strategy—but I’m no longer flying blind.

A realistic take on price tracking tools

It’s worth saying this clearly: no Shopee price tracker will magically tell you the perfect price. Pricing is always contextual. Costs, brand positioning, logistics, and customer expectations all matter.

What tools like Shopdora offer is clarity. By combining Comprehensive Analysis and Market Analysis, I get a realistic view of how prices behave in the wild. That alone is often the difference between reactive pricing and strategic pricing.

For sellers who are serious about long-term growth, that clarity is invaluable.

Final thoughts

If you’re searching for a Shopee price tracker, my advice is simple: don’t just track prices—track outcomes. Look at how prices interact with sales, rankings, and market structure.

That mindset shift changed how I run my store. It helped me protect margins, avoid unnecessary price wars, and respond faster when real threats appeared.

After three years on Shopee, I can confidently say this: the sellers who last aren’t the ones with the lowest prices. They’re the ones who understand the data behind pricing decisions. And once you start treating price tracking as market analysis rather than guesswork, everything else gets easier.