How Sellers Really Win on the Shopee Marketplace with Data

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now. No agency, no big team—just me, spreadsheets, a lot of trial and error, and more late nights than I’d like to admit. If you’ve sold on the Shopee marketplace long enough, you’ll know this feeling: you think your product is competitive, but sales suddenly drop. You check your store backend, everything looks normal, yet competitors seem to be moving faster, pricing smarter, and reacting earlier.

That gap between what you can see and what’s actually happening in the market is where most Shopee sellers struggle. And it’s exactly where Shopee data—real marketplace-level data—starts to matter.

The Blind Spot Most Shopee Sellers Don’t Realize They Have

Shopee’s seller center is useful, but it’s also very limited. You can see your own prices, your own sales, your own conversion rate. What you can’t see is how prices are shifting across the Shopee marketplace, how competitors adjust their pricing during campaigns, or whether a sudden dip in your sales is caused by market saturation, aggressive price cuts, or a new competitor entering the category.

For a long time, I made decisions based purely on intuition. If sales slowed, I discounted. If orders increased, I raised prices slightly. Sometimes it worked. Often, it didn’t. The problem wasn’t effort—it was that I was operating in the dark, without a reliable Shopee price tracker or broader Shopee data to guide decisions.

Why Price Tracking Is More Than Just “Watching Competitors”

Many sellers misunderstand price tracking. They think it’s simply about finding the cheapest competitor and matching them. In reality, price is a signal. On the Shopee marketplace, price changes usually reflect deeper movements: inventory pressure, ad scaling, seasonal demand, or even sellers testing new positioning.

When I started tracking price movements across competing listings, patterns became obvious. Some sellers only dropped prices during flash sales. Others permanently lowered prices but quietly reduced SKU variety. A few raised prices while maintaining sales volume—usually because their traffic sources were stronger.

This kind of insight doesn’t come from manually checking listings every day. It comes from structured Shopee data, aggregated and tracked over time.

How I Use Market Analysis to Understand the Shopee Marketplace

One of the biggest turning points for me was shifting from product-level thinking to market-level thinking. Instead of asking, “Why isn’t my product selling?”, I started asking, “What’s happening in this category right now?”

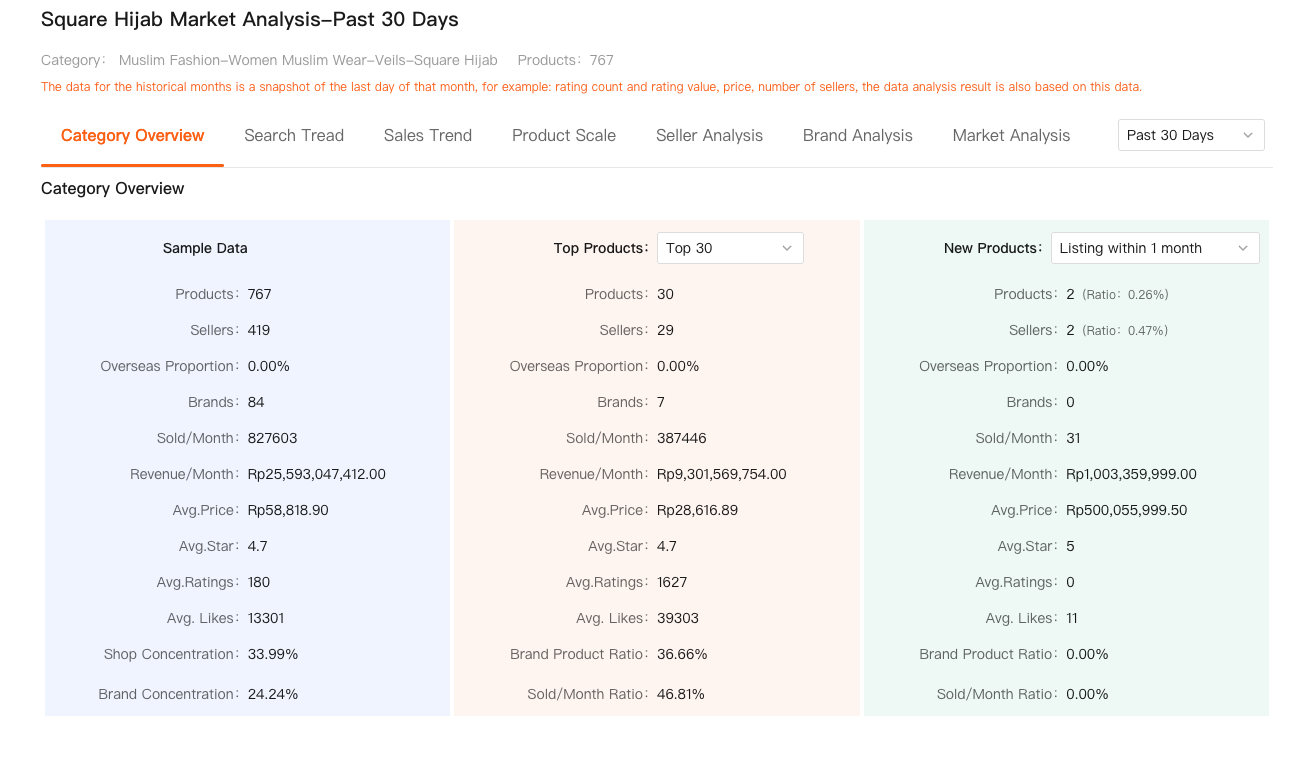

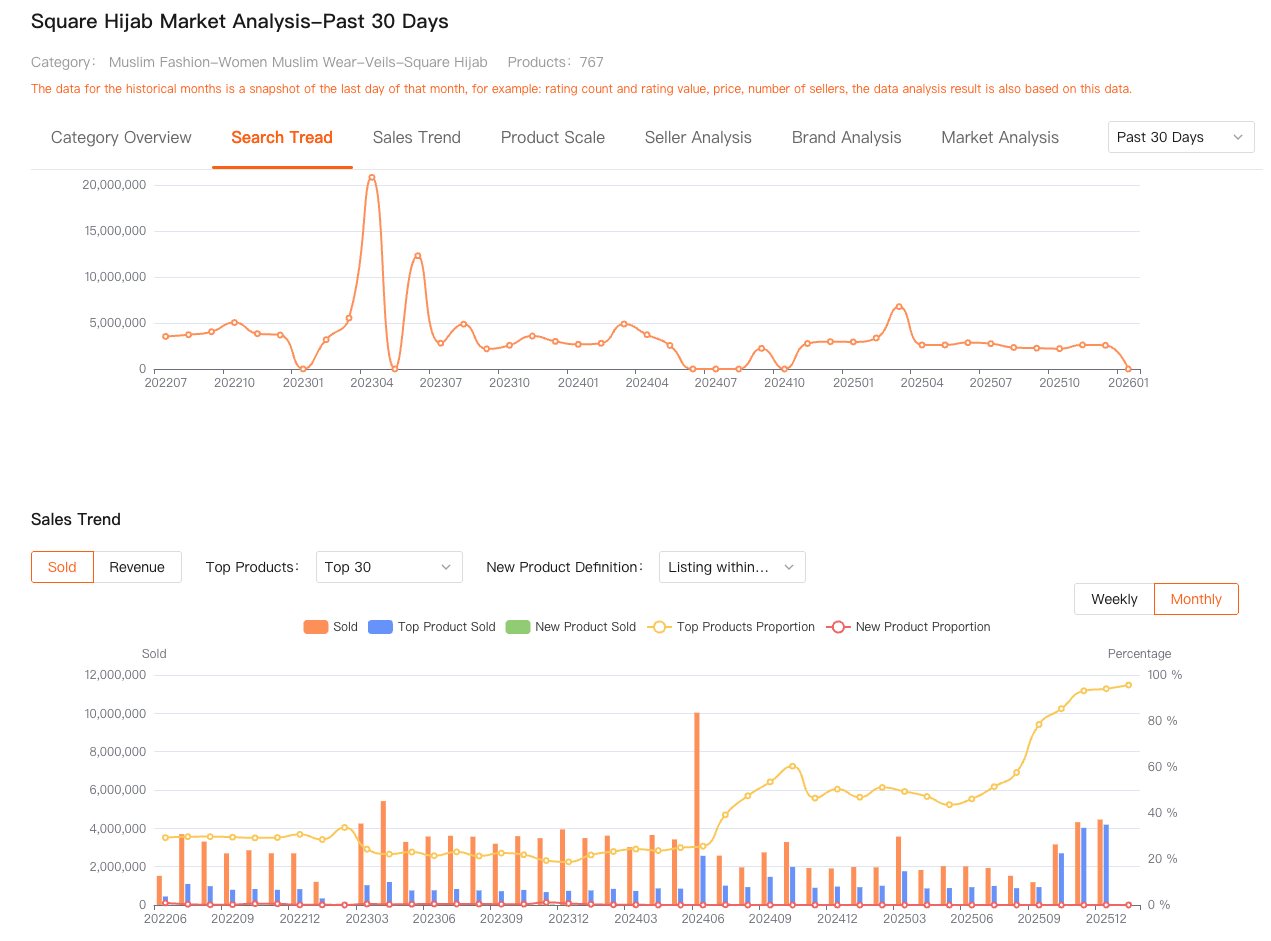

Using Shopdora’s Market Analysis, I could finally see the Shopee marketplace as a whole: category sales trends, revenue changes, and how concentrated or competitive a category really was. I learned that some price drops weren’t aggressive competition at all—they were signals of declining demand. In those cases, lowering prices only hurt margins without saving volume.

Market Analysis helped me avoid that trap. When I saw overall category revenue shrinking, I focused on clearing inventory quickly instead of fighting for top position. When the data showed rising demand but stable prices, I knew it was a moment to hold pricing and invest more in traffic.

This kind of Shopee data isn’t available inside the seller backend, but it’s critical if you want to survive long-term in a competitive marketplace.

Turning a Shopee Price Tracker into a Real Strategy

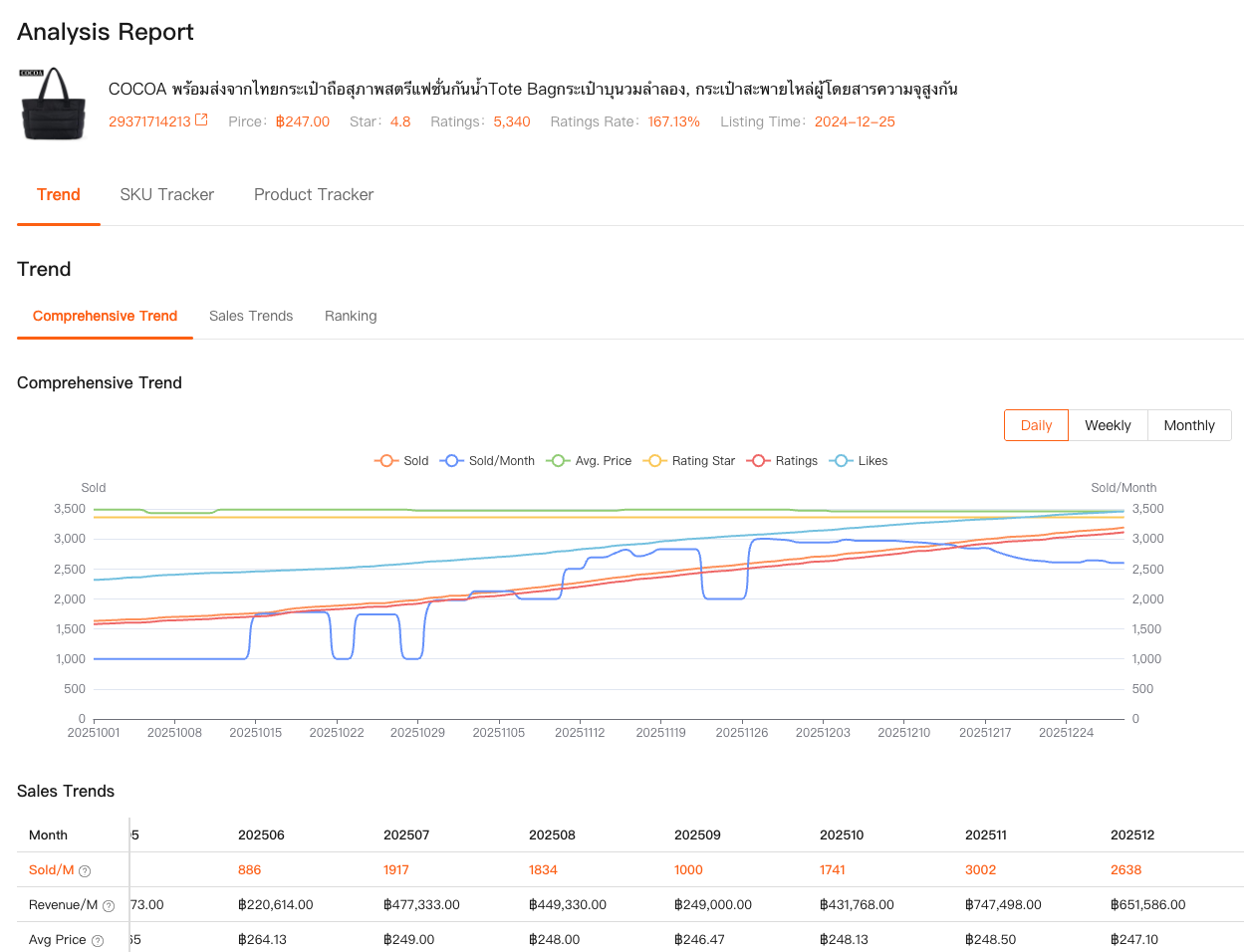

Tracking prices alone is useless if you don’t connect them to outcomes. That’s where Comprehensive Analysis became my daily tool.

Instead of looking at prices in isolation, I could see how price changes aligned with sales trends, ranking shifts, and product lifecycle stages. For example, one of my SKUs started losing ranking even though I had lowered the price. Comprehensive Analysis showed that competitors weren’t just cheaper—they had newer listings gaining traction fast. The issue wasn’t price; it was freshness and momentum.

That insight saved me from continuing a price war I was guaranteed to lose. Instead, I repositioned the product, adjusted SKU structure, and prepared a new listing while gradually exiting the old one.

A good Shopee price tracker tells you what changed. Combining it with broader Shopee data helps you understand why it changed.

Learning to Read the Marketplace, Not Fight It

One thing I’ve learned the hard way is that the Shopee marketplace always moves faster than individual sellers. Campaign cycles, algorithm shifts, and competitor behavior create waves. You either ride them—or get knocked over.

By consistently reviewing Shopee data from Market Analysis and tracking price behavior through Comprehensive Analysis, I stopped reacting emotionally. Decisions became calmer, more deliberate. I knew when to follow the market and when to ignore it.

For example, during a major campaign, I noticed prices across my category dropping sharply, but total sales volume wasn’t increasing. That told me sellers were over-discounting. I held my price steady, accepted fewer orders, but ended the campaign with higher profit than expected. Without marketplace-level Shopee data, I would’ve joined the race to the bottom.

Why This Matters More Than Ever on Shopee

The Shopee marketplace today is far more competitive than it was even a year ago. More sellers, more cross-border products, and more automation on pricing and ads mean small mistakes get punished faster.

If you rely only on your seller dashboard, you’re always one step behind. Real growth comes from understanding how your store fits into the wider market—and how prices, sales, and trends move together.

That’s why tools like Shopdora exist. Not to replace your judgment, but to give it context. Market Analysis shows you the battlefield. Comprehensive Analysis helps you choose where and how to fight. And a proper Shopee price tracker ensures you’re never guessing when competitors make a move.

Final Thoughts from One Seller to Another

I’m not writing this as a “tool recommendation.” I’m writing it as someone who’s made pricing mistakes, misread demand, and learned—slowly—that Shopee success isn’t about working harder. It’s about seeing clearer.

The moment you start treating Shopee data as a strategic asset, not just numbers, everything changes. Pricing becomes intentional. Campaigns become calculated. And the Shopee marketplace stops feeling unpredictable.

If you’re serious about selling on Shopee long-term, stop asking only “How should I price today?” Start asking, “What is the market telling me?” That’s where real seller growth begins.