How Shopee Data and Shop Rankings Reveal Winning Products

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now. No team, no agency, no shortcuts. Just real products, real listings, and a lot of trial and error. Like most sellers, I didn’t start with “Shopee data” or analytics tools in mind. I started with instinct, copying what looked successful, and hoping my pricing was competitive enough.

It took me longer than I’d like to admit to realize this simple truth: what you see on Shopee is not the full story. The real decisions are hidden in data you can’t access from the seller backend alone.

That realization completely changed how I approach Shopee product analysis—and it’s why tools like Shopdora became part of my daily workflow.

The Core Problem Shopee Sellers Face

Most Shopee sellers ask the same questions again and again.

Why is this product selling well for others but not for me?

Is this niche actually growing, or am I too late?

Are top sellers winning because of ads, or because demand is real?

Shopee itself doesn’t answer these questions clearly. You can only see your own data. You can’t see how other shops are performing, how fast they are growing, or whether their success is stable or short-lived.

This is where Shopee analytics tools become essential—not optional.

Why Shop Ranking Is the Missing Piece in Shopee Analysis

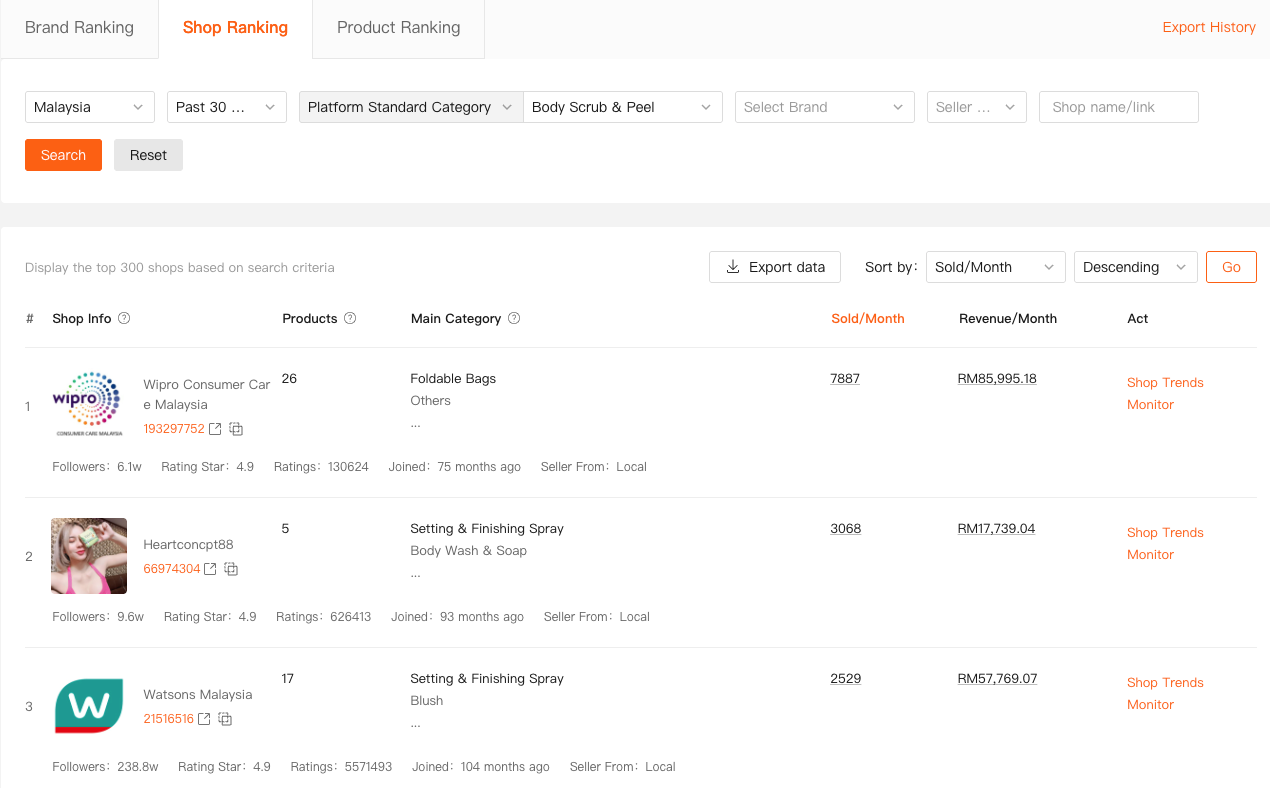

One of the most powerful shifts in my thinking came when I started using Shop Ranking inside Shopdora. Instead of staring at individual products, I could finally see which shops were actually dominating a category, how much they were selling, and how their performance changed over time.

This sounds simple, but it’s something Shopee itself doesn’t show you.

Shop Ranking lets you view shops ranked by sales and revenue within a specific site, category, and time period. More importantly, it allows you to track trends. Are the top shops growing steadily, or are they declining? Are new shops entering the rankings, or is the market controlled by a few long-established players?

When I analyzed a category I was planning to enter, the results surprised me. The top shops looked unbeatable at first glance. But once I checked their trends, I saw sales flattening. Demand wasn’t growing. The market wasn’t dead, but it wasn’t expanding either.

That single insight stopped me from launching a product that would have struggled from day one.

Turning Shopee Data Into Real Product Decisions

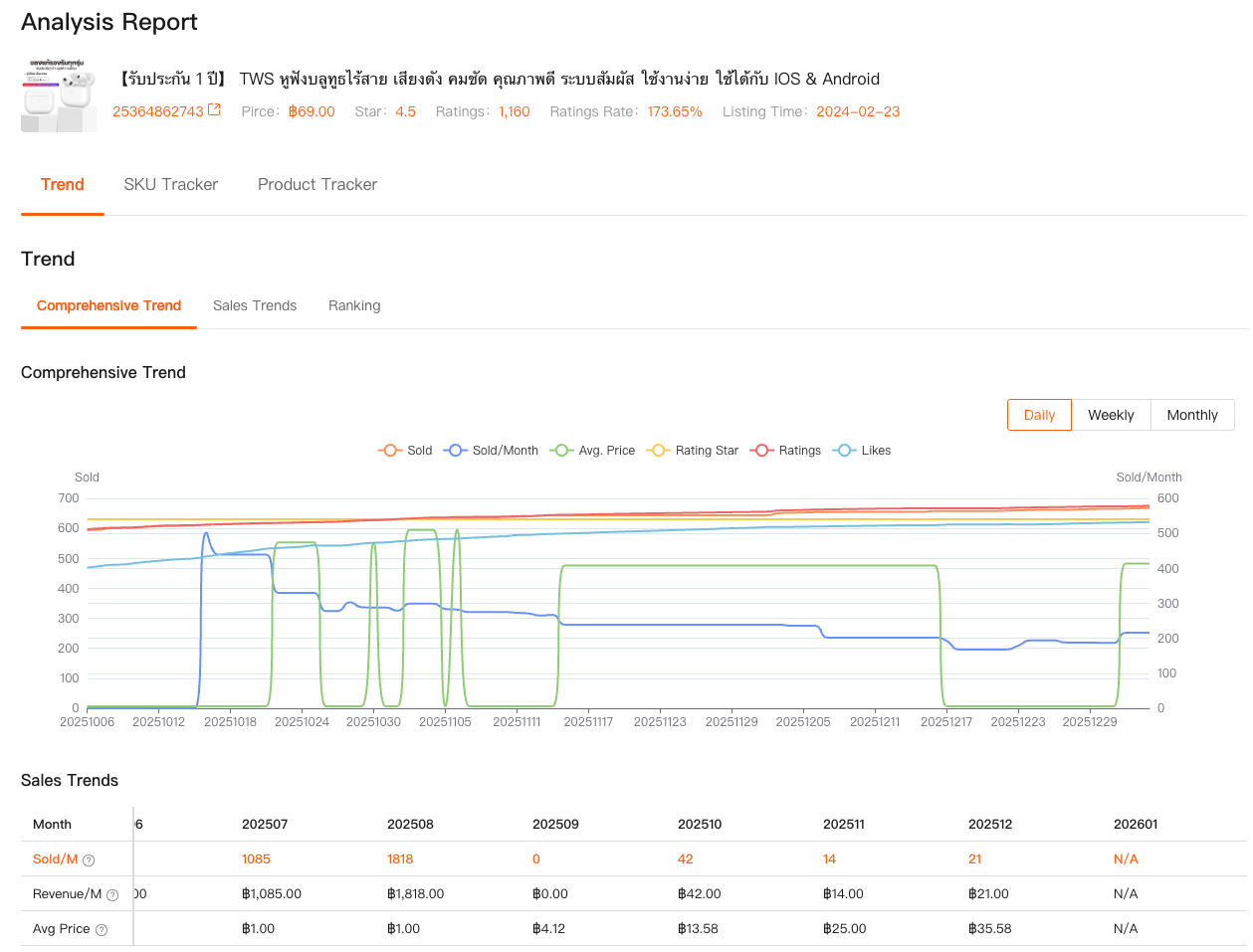

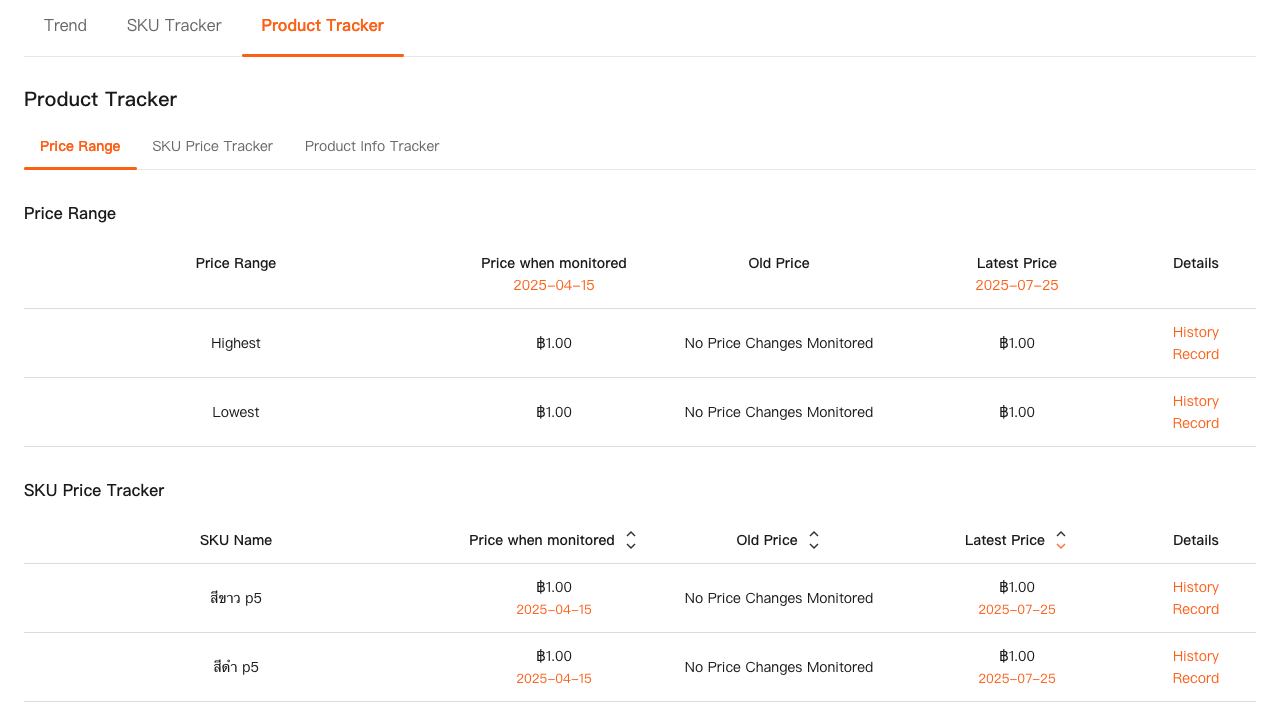

Shopee data only becomes useful when you connect it to decisions. That’s where Comprehensive Analysis plays a critical role. Instead of looking at rankings in isolation, I combine shop rankings with product-level performance, sales trends, and lifecycle signals.

For example, if top-ranked shops are stable but not growing, I look at whether new products are breaking into the rankings. If they aren’t, it usually means competition is high and differentiation is difficult.

On the other hand, if I see new shops climbing the rankings within a few months, that’s a strong signal. It tells me the market still has room, and demand is not locked up by legacy sellers.

This kind of Shopee product analysis isn’t about chasing “hot products.” It’s about understanding who is winning, why they’re winning, and how sustainable that success really is.

A Real Mistake That Taught Me the Value of Shop Ranking

I once launched a product simply because search results looked busy. Lots of listings. Lots of reviews. It felt like demand was strong.

But after the launch underperformed, I went back and analyzed the category using Shop Ranking. The truth was uncomfortable. Almost all sales were concentrated in three large shops. Smaller sellers barely moved volume, no matter how good their listings were.

I hadn’t entered a growing market. I had entered a locked market.

If I had checked shop rankings before launching, I would have seen this immediately. That lesson alone paid for months of data access.

Why Shopee Analytics Should Start With Shops, Not Products

Most sellers analyze products first. I used to do the same. But products don’t exist in isolation. Shops matter more than we think.

Strong shops often have advantages that aren’t obvious on the surface. Better supply chains. Faster fulfillment. Stronger historical performance that boosts algorithm trust. When you see the same shops ranking high month after month, it’s not luck.

By starting with shop rankings, I now reverse my analysis. I first ask: which shops are winning in this category? Then I look at their product structures, pricing strategies, and launch timing.

That shift made my Shopee analytics process much more grounded in reality.

How Shopdora Fits Naturally Into This Workflow

I don’t use Shopdora to “predict” success. I use it to reduce blind spots.

Shop Ranking shows me who controls the market.

Comprehensive Analysis shows me how products perform over time.

Together, they give me context I simply can’t get from Shopee itself.

I still make judgment calls. I still take risks. But they’re informed risks, not emotional ones.

And importantly, I don’t rely on a single data point. Rankings, trends, and product performance all need to align before I commit.

Shopee Data Is About Confidence, Not Certainty

No tool guarantees success. Anyone who says otherwise hasn’t sold long enough.

What Shopee data gives you is confidence. Confidence that the market exists. Confidence that demand is real. Confidence that competition is understandable, not chaotic.

Before I used proper Shopee analytics tools, launching a product felt like gambling. Now it feels like strategy.

What I’d Tell New Shopee Sellers Today

If you’re serious about Shopee, stop looking only at your own store numbers. They tell you how you’re doing, not how the market works.

Start with shop rankings. Understand who’s winning and why. Use Shopee data to see patterns, not just snapshots. And treat product analysis as an ongoing process, not a one-time checklist.

Tools like Shopdora don’t replace experience. They accelerate it.

And if I had access to this level of insight earlier, I would have made far fewer expensive mistakes.

That’s not theory. That’s experience.