How Shopee Data and Video Downloader Improve Product Research

Hi, I’m David.

I run my own Shopee store, and I’ve been doing it solo for a little over three years. No team, no outsourced analysts, no fancy dashboards at the beginning. Just me trying to figure out why some products took off while others quietly died, even though they looked similar on the surface.

For a long time, I thought Shopee success was mostly about pricing and ads. But the deeper I got, the more I realized something else mattered just as much: understanding the market through Shopee data, and knowing how to turn that data into better product decisions—especially when it came to content like images and videos.

That’s where Shopee analytics, and later Shopdora, fundamentally changed how I work.

The Hidden Problem Most Shopee Sellers Don’t Notice

Most sellers focus on their own store backend. Orders, clicks, ads, conversion rate. That’s fine, but it’s also incredibly limited. Shopee doesn’t show you what other sellers are really doing.

When I launched new products early on, I relied heavily on instinct. I copied a few competitor listings, downloaded images manually, rewrote titles, and hoped for the best. Sometimes it worked. Often, it didn’t. And I never really knew why.

The core issue wasn’t effort. It was visibility. I lacked real Shopee data beyond my own shop.

Why Shopee Analytics Needs to Go Beyond Your Store

True Shopee analytics is about understanding the market, not just your performance inside it. You need to see which products are growing, which are declining, and how competitors structure their listings over time.

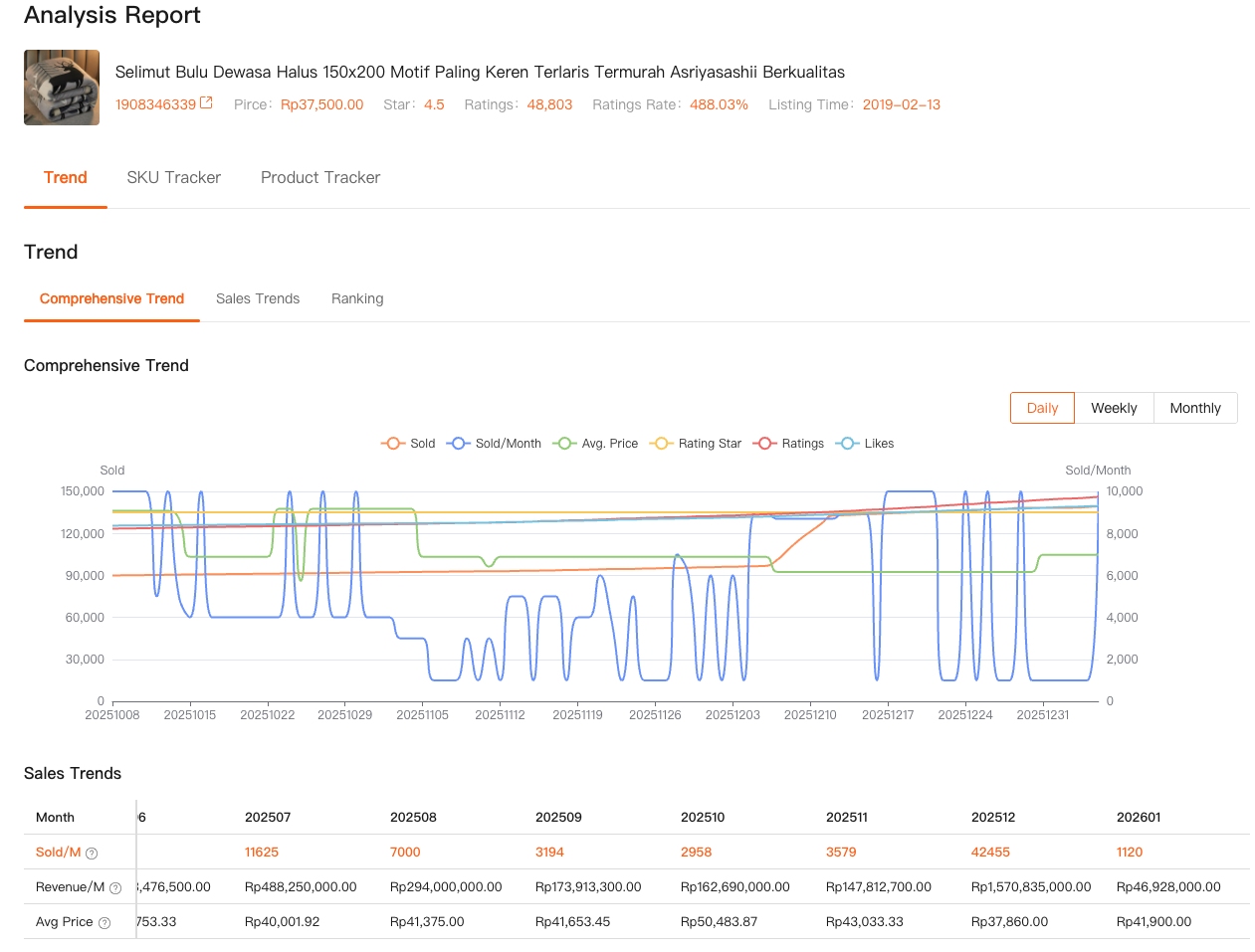

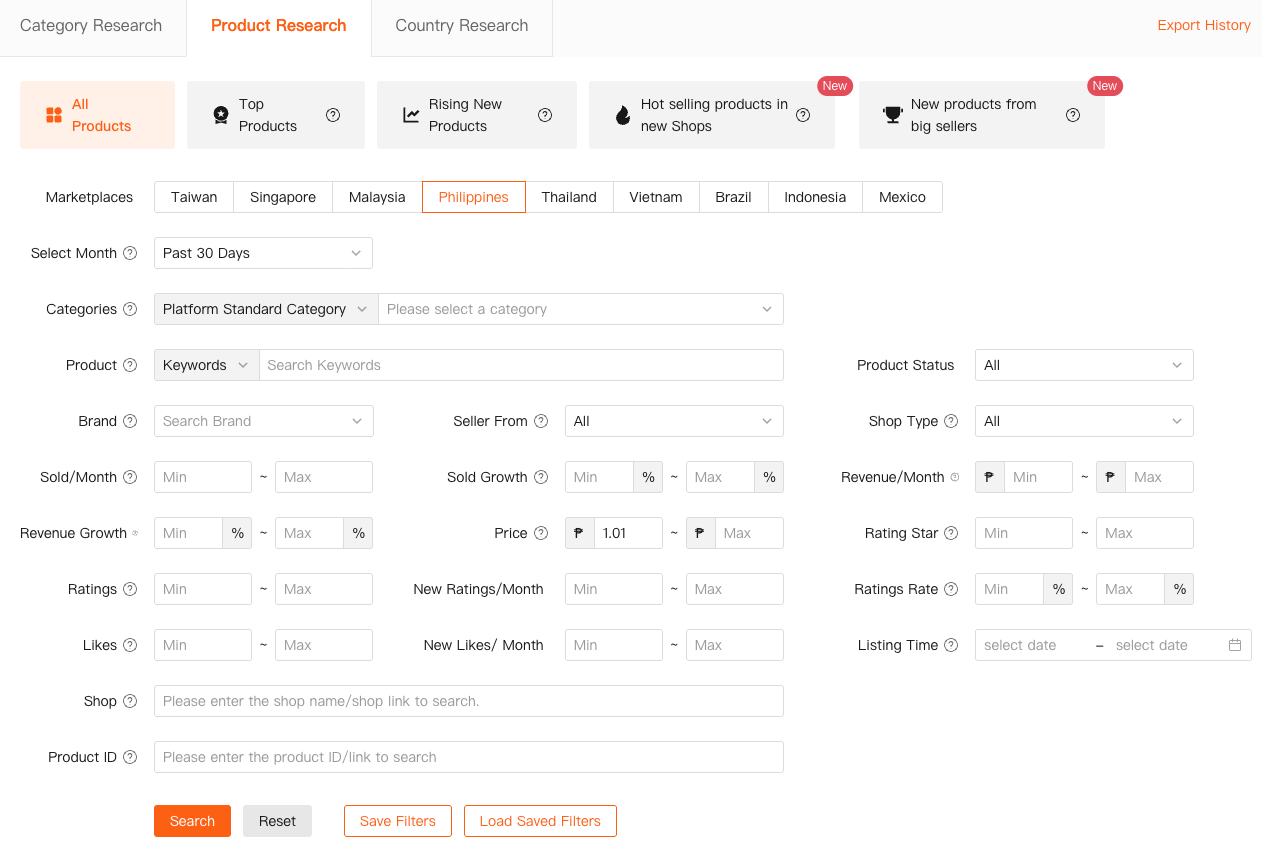

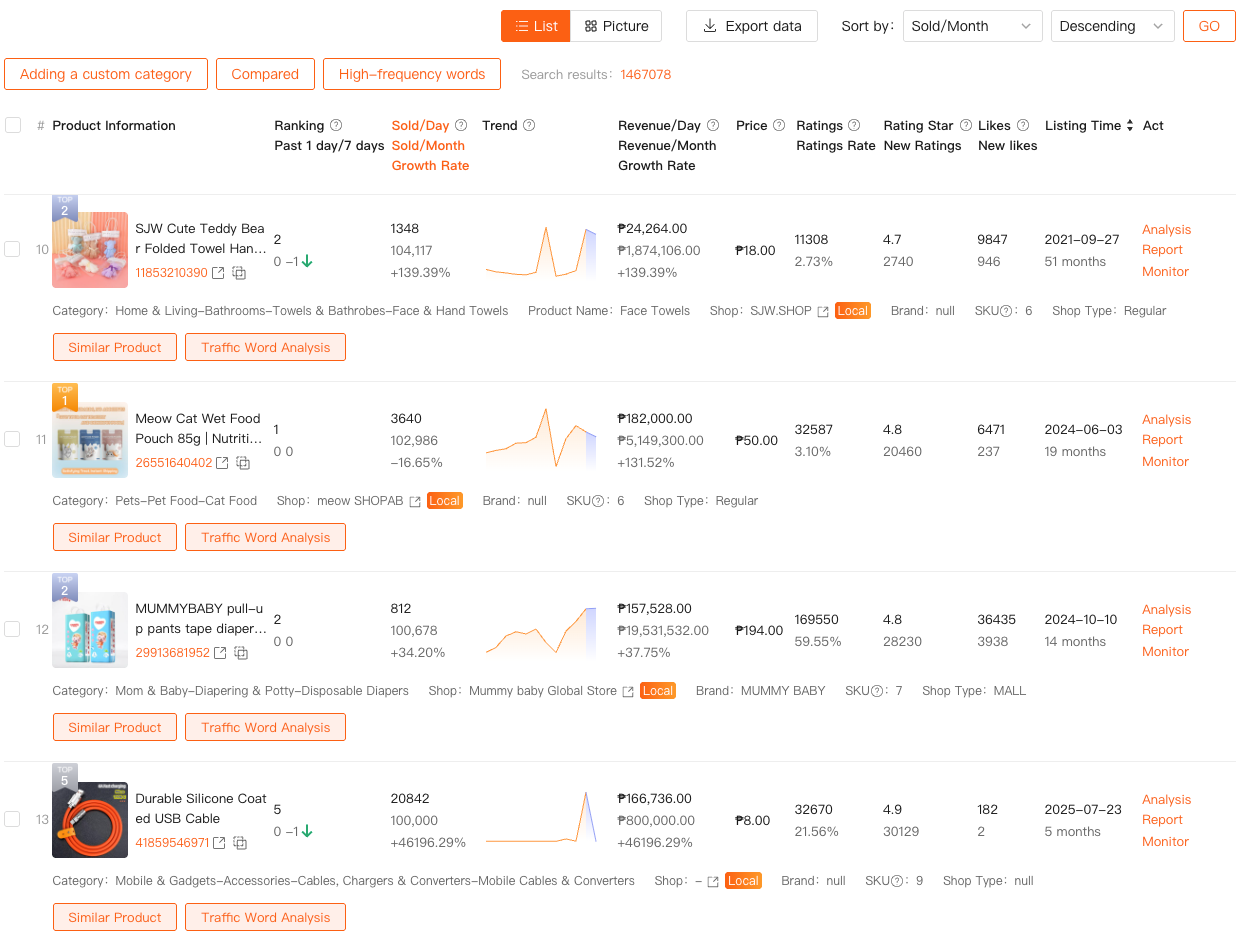

Using Shopdora’s Comprehensive Analysis, I could finally see sales trends, revenue changes, rankings, and product lifecycle signals across the market. This wasn’t theory. It was concrete data, updated regularly.

One product category I was testing looked promising at first glance. Search results were full, prices were decent, and reviews looked strong. But the data told a different story. Total category sales were flat, and most volume was concentrated in a few old listings. New products struggled to gain traction.

That insight alone saved me weeks of wasted work.

Content Is Not Just Design—It’s Data

Here’s something many sellers underestimate: product images and videos are not just creative assets. They’re competitive signals.

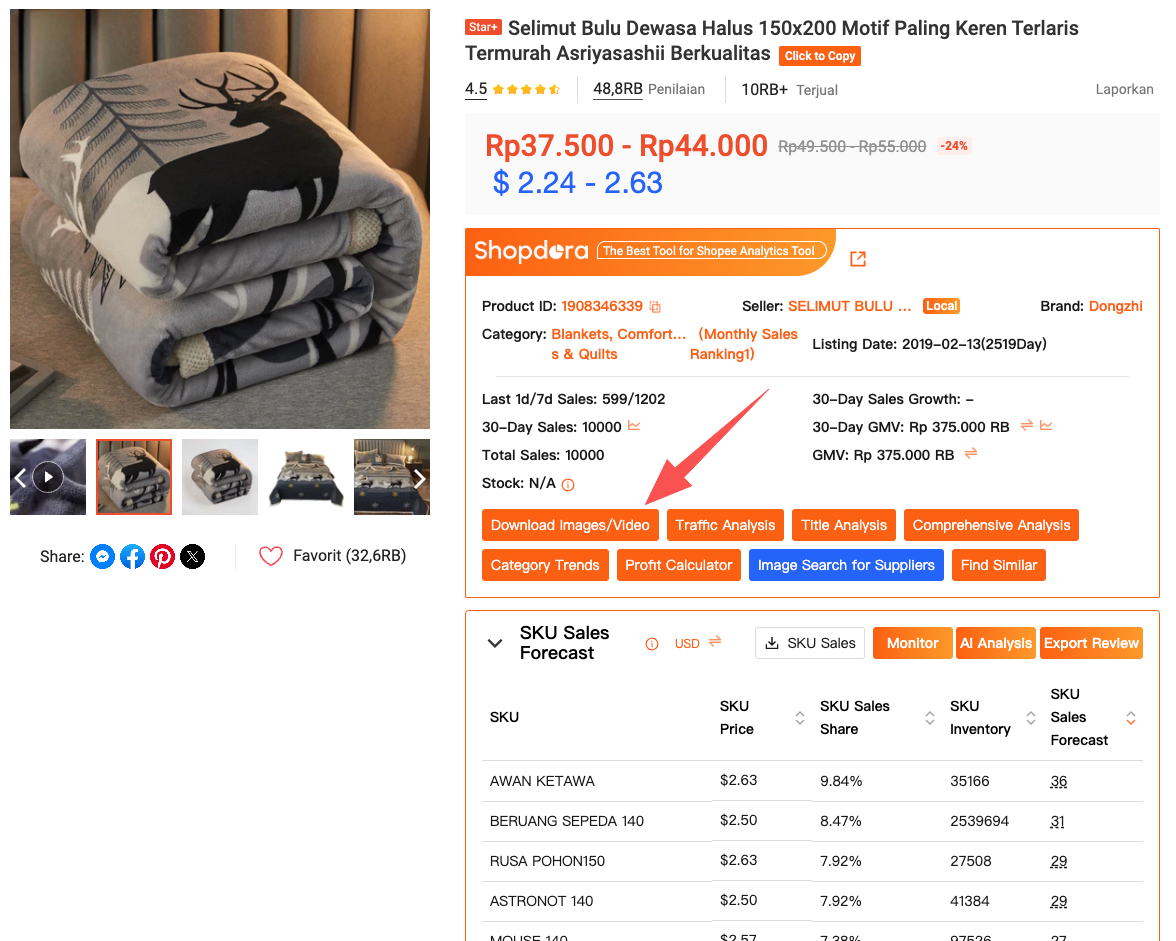

I used to think, “As long as my images look good, I’m fine.” But after analyzing competitors with Shopdora, I noticed patterns. Certain video styles appeared again and again in top-selling products. Others almost never converted well.

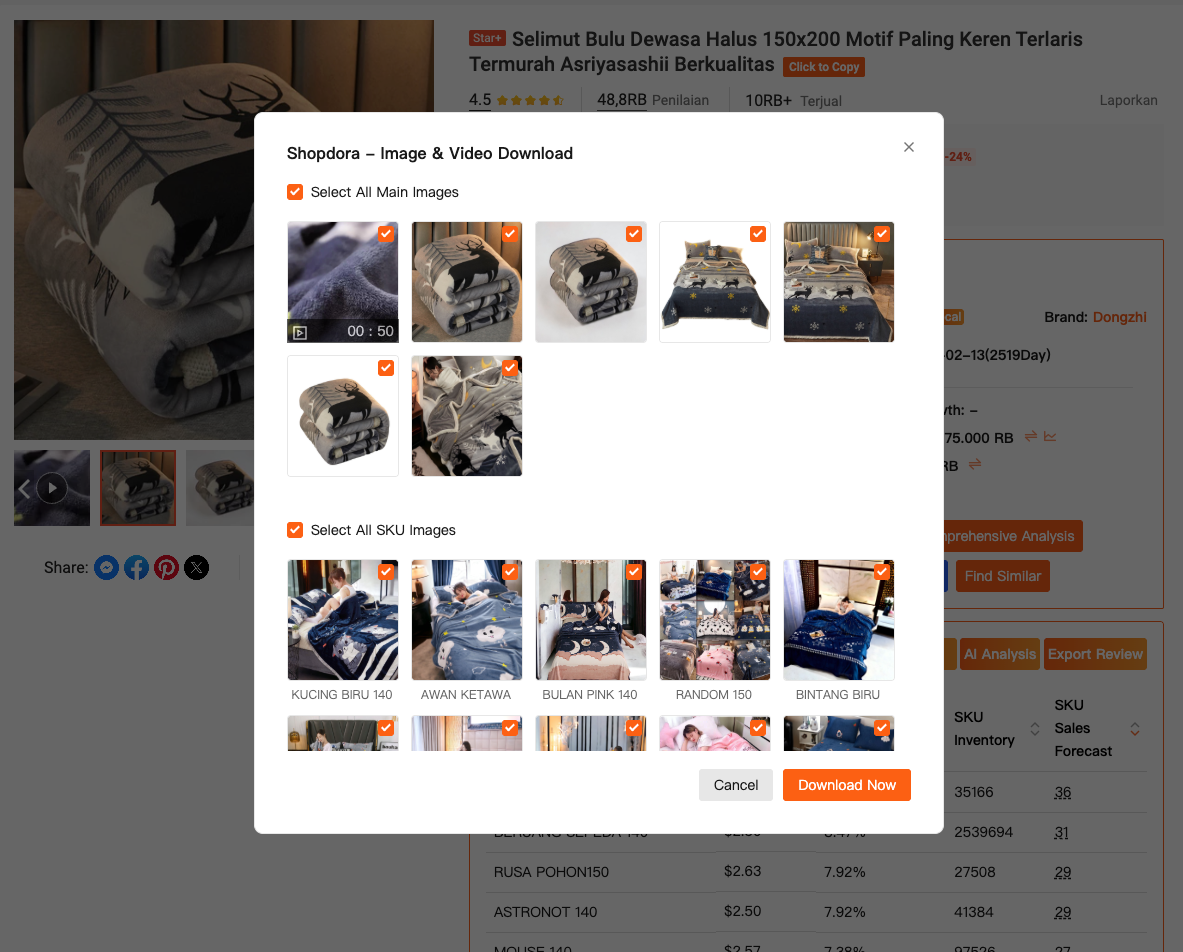

With the Download Images/Video feature, I could directly download competitor product images and videos for analysis. Not to blindly copy them, but to understand structure. Length of video, opening shots, use of text overlays, angle choices, even pacing.

When I compared high-performing listings against low-performing ones, the differences were obvious. And I would never have noticed them without proper Shopee analytics.

Turning Shopee Video Downloads Into Actionable Insights

This is where the idea of a “Shopee video downloader” becomes practical for sellers. The real value isn’t downloading for the sake of saving files. It’s about studying what actually works in the market.

In one case, I noticed that top listings didn’t try to explain everything. Their videos focused on one core problem and showed the solution within the first three seconds. My videos, on the other hand, were slow and overly detailed.

I reworked my content strategy based on that insight. Shorter videos. Clear opening. Real usage scenarios. No unnecessary effects.

Sales didn’t explode overnight, but conversion rate improved steadily. That kind of improvement comes from observation backed by data, not guesswork.

How Shopdora Fits Into This Workflow

I want to be clear: Shopdora didn’t “replace” my judgment. It sharpened it.

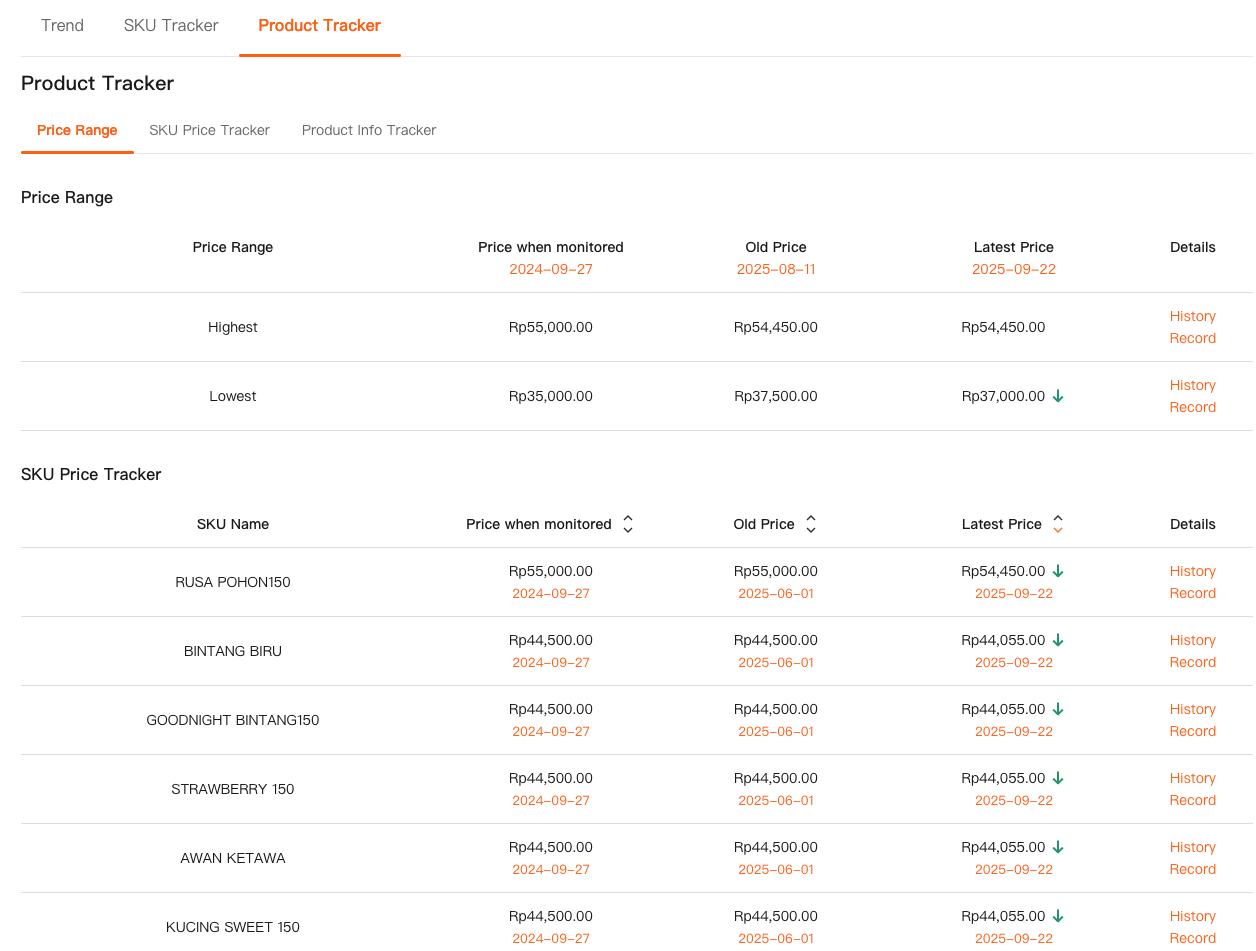

I typically start by using Product Research or Comprehensive Analysis to understand whether a product or niche is worth entering. I look at sales trends, revenue growth, and how long top products have been on the market.

Once I decide to move forward, I analyze competitors’ listings. That’s where Shopee analytics meets content. I download images and videos, study patterns, and combine that with what the data says about performance.

Everything I do is grounded in the fact that Shopdora shows market-level data, not just my own store numbers. That distinction matters more than most sellers realize.

A Real Example From My Store

Last year, I tested a product that looked visually perfect. Clean images, high-quality video, professional feel. But it didn’t sell.

When I revisited the niche using Shopdora, I noticed something I had missed. The top competitors were not selling on looks. They were selling on use cases. Their videos showed quick scenarios, not polished shots.

I adjusted my listing. Same product. Same price. Different content strategy.

The difference wasn’t dramatic, but it was consistent. Orders started coming in daily instead of sporadically. That’s when I fully understood how Shopee data and content analysis work together.

Why This Matters for Sellers in 2026 and Beyond

Shopee is more competitive than ever. More sellers, more cross-border products, more noise. Standing out isn’t just about ads or discounts anymore.

If you don’t understand the data behind what works—pricing, content, positioning—you’re always reacting instead of planning.

Shopee analytics tools like Shopdora give sellers something incredibly valuable: context. They show you why certain products win, not just that they win.

Final Thoughts

I don’t believe in shortcuts. I believe in clarity.

Shopee data helped me stop guessing. Shopee analytics helped me stop copying blindly. And features like image and video downloads helped me turn competitor research into something practical.

If you’re serious about selling on Shopee, treat data as part of your creative process, not something separate. When data and content work together, decisions feel lighter, risks feel smaller, and growth feels intentional.

That shift changed how I run my store—and it’s something I wish I had learned much earlier.