How Shopee Data Really Helps Sellers Make Better Decisions

I’m David. I run a single Shopee store, and I’ve been doing it hands-on for a little over three years now. No agency. No fancy team. Just me, spreadsheets, late nights, and a lot of mistakes I had to pay for myself.

For a long time, I thought I was “data-driven.”

I checked sales every day. I read reviews. I tracked my own SKUs religiously. On paper, I was doing everything right. But my decisions still felt slow, reactive, and sometimes just… wrong. I would double down on products that stalled. I’d miss trends that were clearly working for other sellers. And worst of all, I often couldn’t explain why something failed — only that it did.

The uncomfortable truth I eventually had to accept was this:

Shopee data is fragmented. And most sellers, including me back then, only see a tiny slice of it.

This article is about how I changed the way I look at Shopee data — not by staring harder at my own dashboard, but by learning how to read the market itself.

Why Most Shopee Sellers Misunderstand Their Own Data

Shopee’s seller backend shows you your performance. That’s useful, but it’s also dangerously incomplete.

You can see:

- Your sales

- Your ratings

- Your reviews

- Your SKUs

What you can’t see is just as important:

- How competitors’ products are performing at scale

- What customers complain about across the entire category

- Which keywords are driving traffic in the market, not just your store

- Whether a problem is unique to you, or systemic across similar products

When sellers say, “Shopee data doesn’t help,” what they usually mean is:

“I only see my own corner of the room, not the whole house.”

That was exactly my situation.

The Turning Point: Learning to Read Reviews as Market Signals, Not Feedback

Reviews were the first place I realized I was wasting valuable Shopee data.

I used to read reviews defensively.

One-star? Customer is picky.

Three-star? Shipping issue.

Five-star? Great, move on.

That mindset changed when I started looking at reviews across competing products, not just my own.

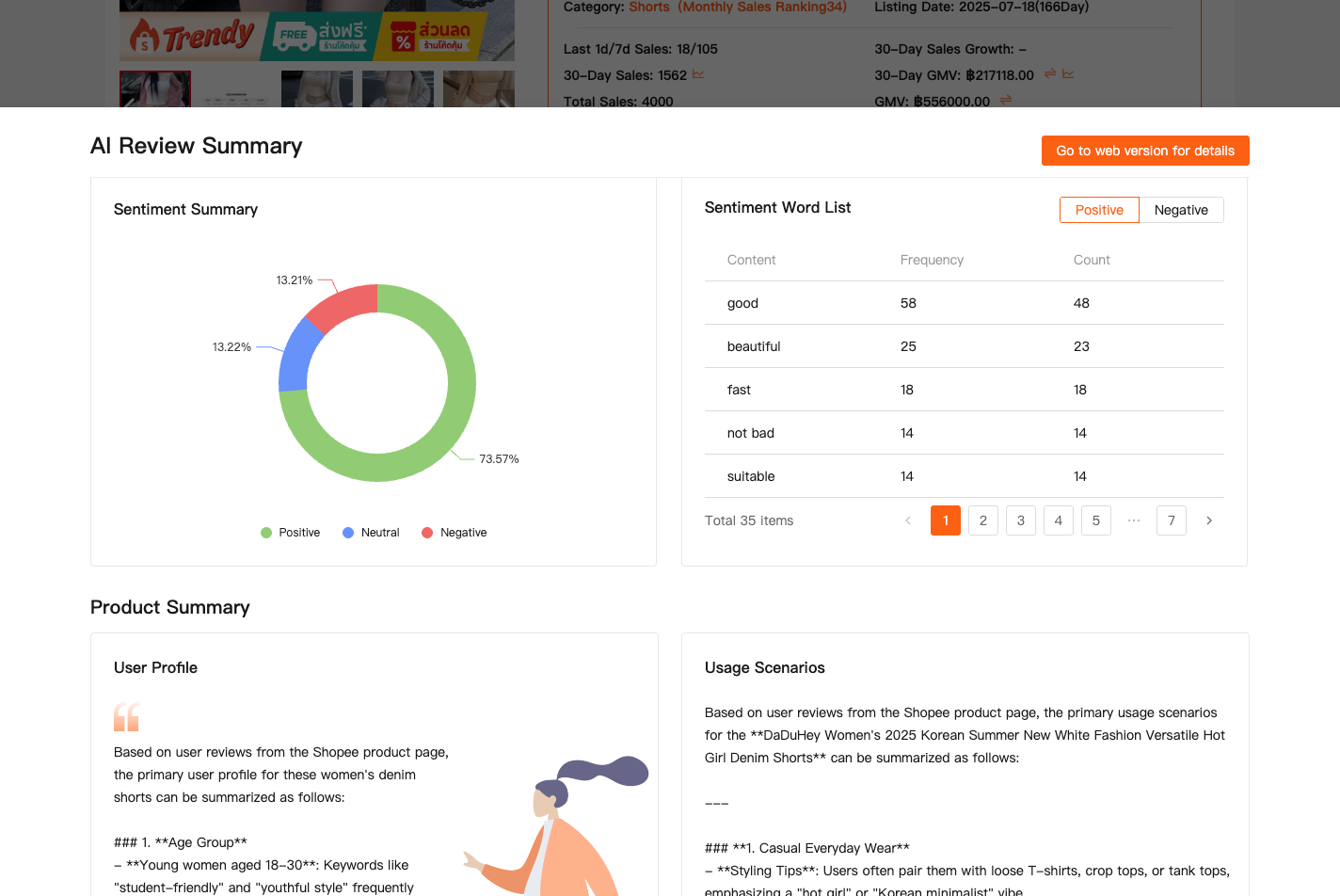

Using Shopdora’s AI Review Analysis, I could aggregate and structure reviews at the product and market level. Instead of scrolling manually, I could see recurring complaint themes, positive triggers, and emotional keywords extracted from real buyer feedback — across multiple competing listings.

What surprised me wasn’t the negativity.

It was the patterns.

For example:

- Multiple top-selling products in the same category were getting consistent complaints about size inconsistency.

- “Good quality” appeared frequently, but often paired with “packaging damaged.”

- Some features sellers heavily promoted in titles barely showed up in positive reviews at all.

That’s when it clicked:

Reviews aren’t just about satisfaction. They’re unfiltered product-market fit data.

Once I started treating reviews as structured Shopee data — not emotional noise — my product decisions became far more grounded.

From Guesswork to Context: Why Product Performance Needs Market Comparison

Even with review insights, I still struggled with one big question:

Is my product actually underperforming, or is the whole market slowing down?

You can’t answer that from your seller backend.

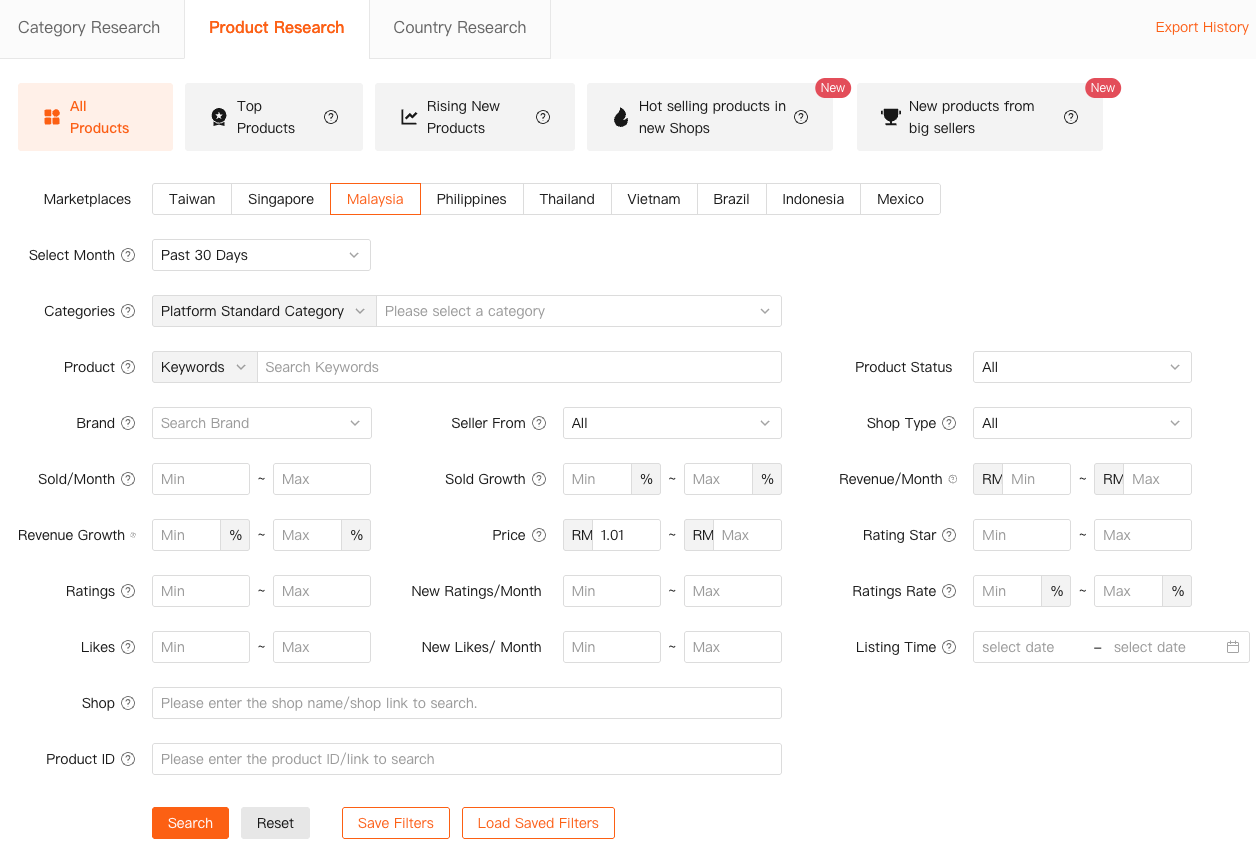

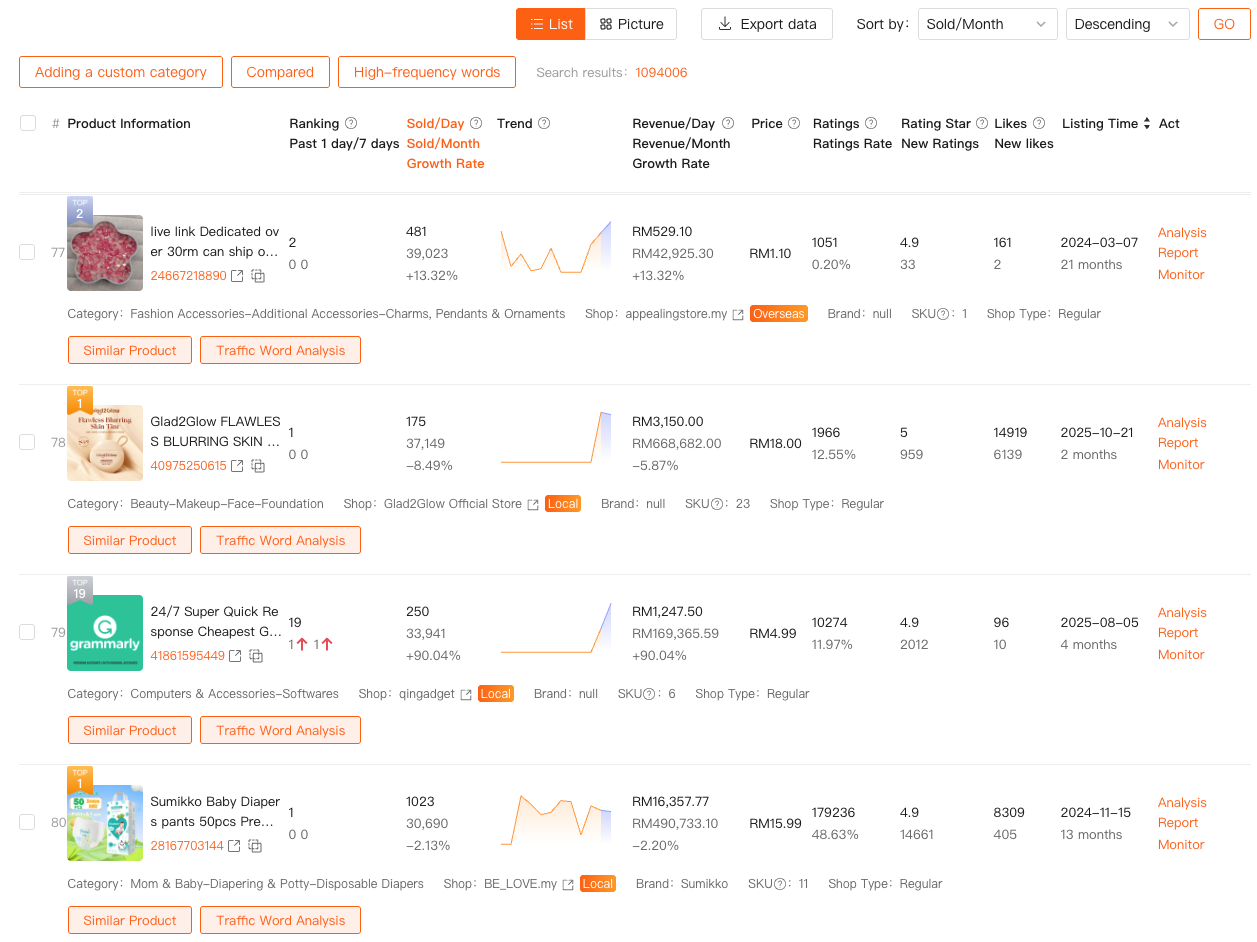

This is where Product Research became essential for me. Instead of evaluating my SKU in isolation, I started looking at:

- Category-level sales trends

- Revenue distribution across top products

- Launch timing and product lifecycle stages

- Growth vs. saturation signals in the same niche

With market-level Shopee data, I could finally see context.

Sometimes my sales dipped because:

- A newer product entered the market and absorbed demand

- Price bands shifted upward or downward

- Customer preference moved toward a different feature set

Other times, I realized the opposite: the market was growing, but my product wasn’t keeping up — which meant the problem was execution, not demand.

That distinction alone saved me from killing several products too early.

Traffic Without Visibility Is Just Hope

Traffic is one of the most misunderstood parts of Shopee data.

Most sellers assume:

“If my sales are low, traffic must be low.”

But traffic isn’t one thing. It’s keywords, search intent, and visibility — most of which Shopee doesn’t fully show sellers.

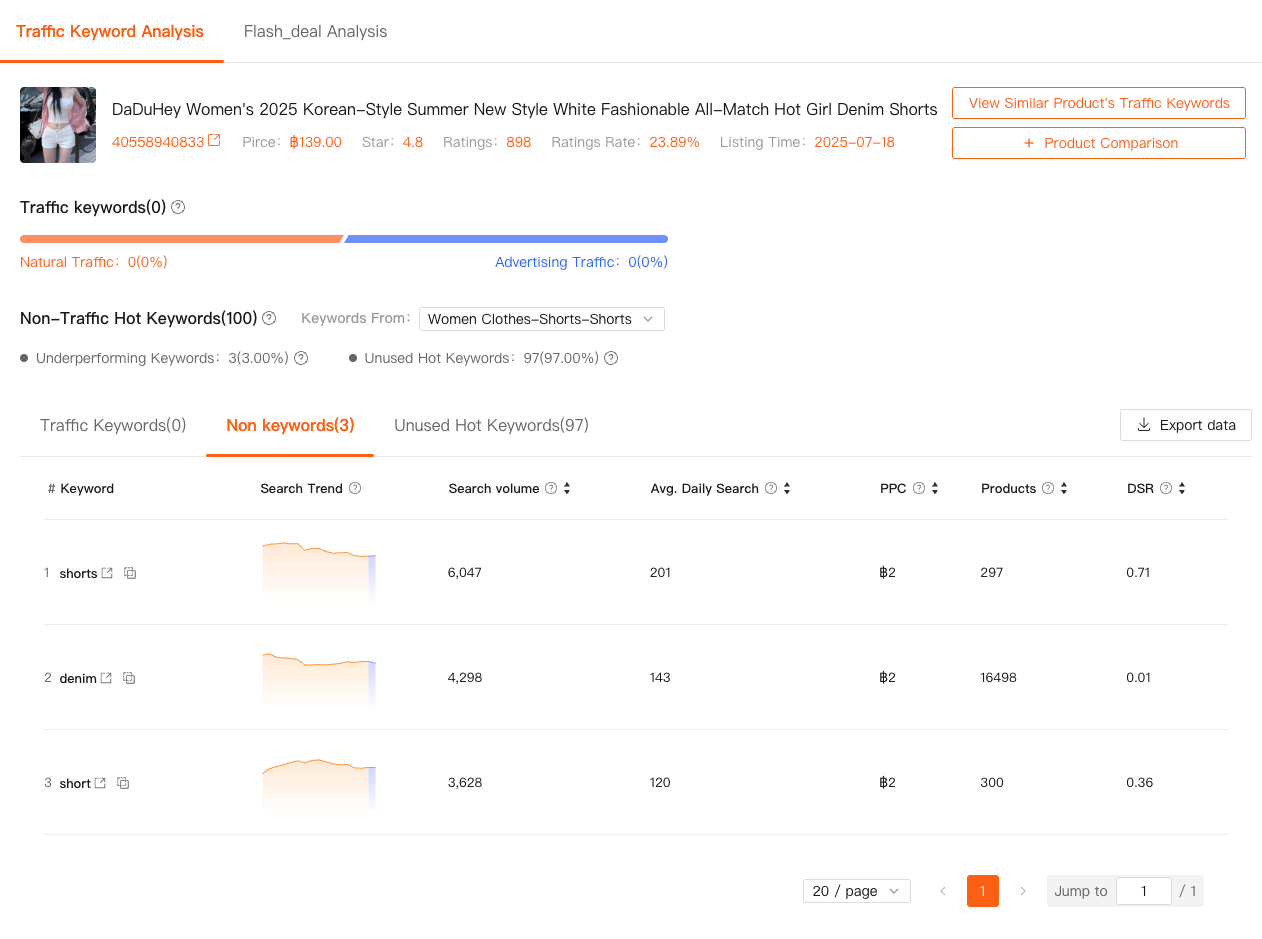

Through Traffic Analysis, I started understanding:

- Which keywords were actually driving traffic in the market

- Which keywords competitors were benefiting from

- Which high-interest keywords weren’t being fully used by existing listings

This wasn’t about ads or conversion rates.

It was about visibility gaps.

I discovered situations where:

- My product had solid reviews and pricing, but wasn’t aligned with dominant traffic keywords

- Competitors ranked simply because their listings matched market language better

- Some keywords were popular but underserved by quality products

That insight helped me adjust titles, content focus, and even SKU positioning — based on real Shopee data, not intuition.

How These Three Data Layers Changed My Decision-Making

Once I combined:

- Market-wide review intelligence

- Product-level performance comparison

- Traffic and keyword visibility

My workflow fundamentally changed.

I stopped asking:

- “Why isn’t my product selling?”

And started asking:

- “What does the Shopee market expect from products like this right now?”

That shift sounds subtle, but it’s everything.

Instead of reacting emotionally to sales dips, I now:

- Validate issues through review patterns

- Confirm demand through product research

- Adjust positioning through traffic insights

Every decision is slower — but far more accurate.

Why Shopee Data Is Only Powerful When It’s Complete

Shopee data isn’t lacking.

What’s lacking is access to the parts that matter most for strategy.

Your seller backend tells you what happened.

Market-level tools help you understand why.

Shopdora happens to be where I found these missing pieces — especially for review analysis, product research, and traffic visibility — but the bigger lesson goes beyond any single tool.

If you’re serious about growing on Shopee, you can’t afford to make decisions in isolation.

Because in Shopee, you’re not competing against your past performance.

You’re competing against the market’s next move.

And the market always leaves clues — hidden in data most sellers never look at.