How Shopee Data Turns Product Analysis Into Real Sales Growth

Hi, I’m David.

I’ve been selling on Shopee for a little over three years, running my own store without a team behind me. Like many sellers, I didn’t start with fancy tools or deep analytics. I started with screenshots, spreadsheets, and a lot of guesswork. For a long time, I believed that if a product sold well, copying it was enough. Same price range, similar images, similar keywords. But results were always inconsistent.

What finally changed things for me wasn’t working harder. It was learning how to properly use Shopee data, and more importantly, how to connect Shopee product analysis with real execution—especially visuals.

The Hidden Cost of “Surface-Level” Product Analysis

Most Shopee sellers think they’re doing product analysis. In reality, they’re only scratching the surface. We look at price, monthly sales, maybe ratings. Then we jump straight into sourcing or listing optimization.

The problem is that Shopee’s seller backend only shows you your own data. It doesn’t tell you how competitors structure their SKUs, how long a product has been selling, or whether its sales are rising or already declining. I’ve launched products that looked “hot” on the surface, only to realize later that I entered at the worst possible time.

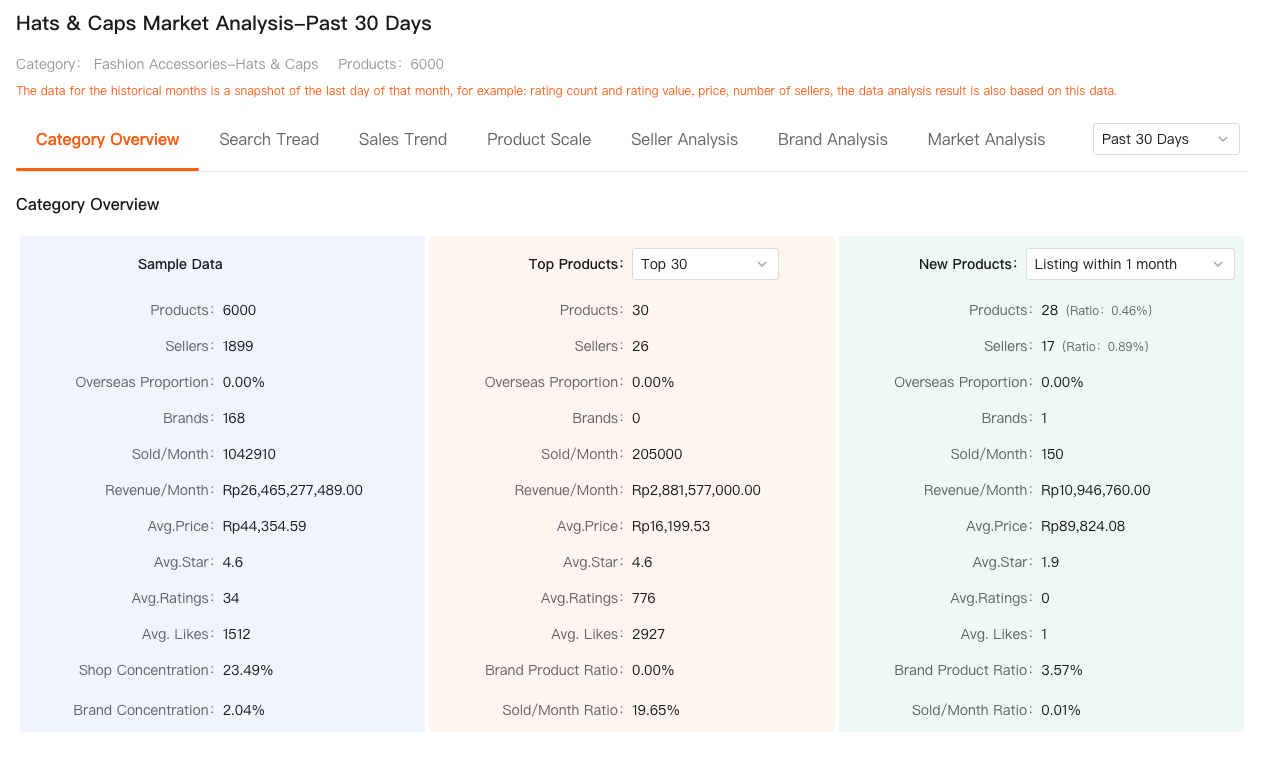

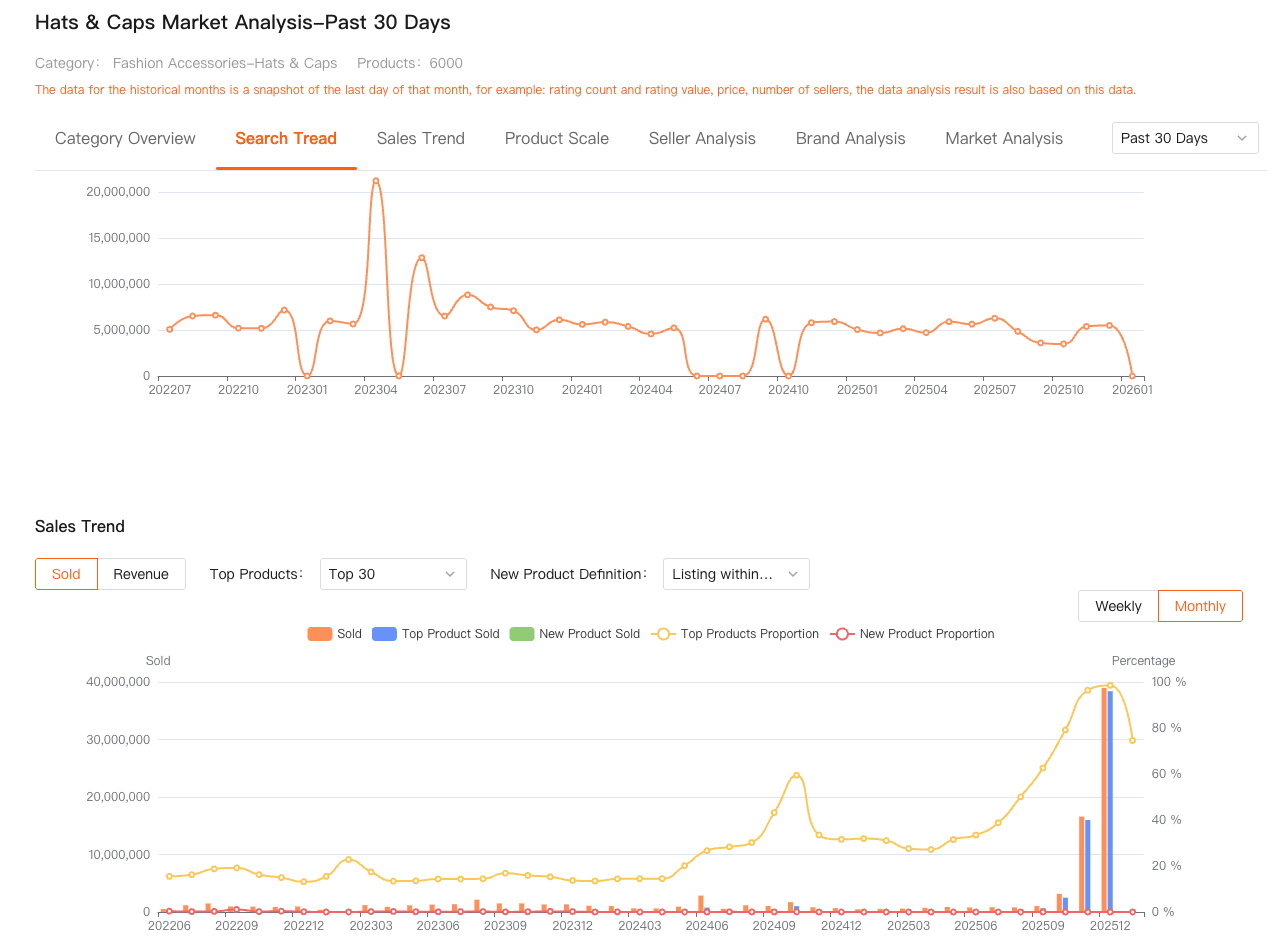

That’s when I started relying on market-level Shopee data instead of gut feeling.

Seeing the Full Picture With Product Analysis

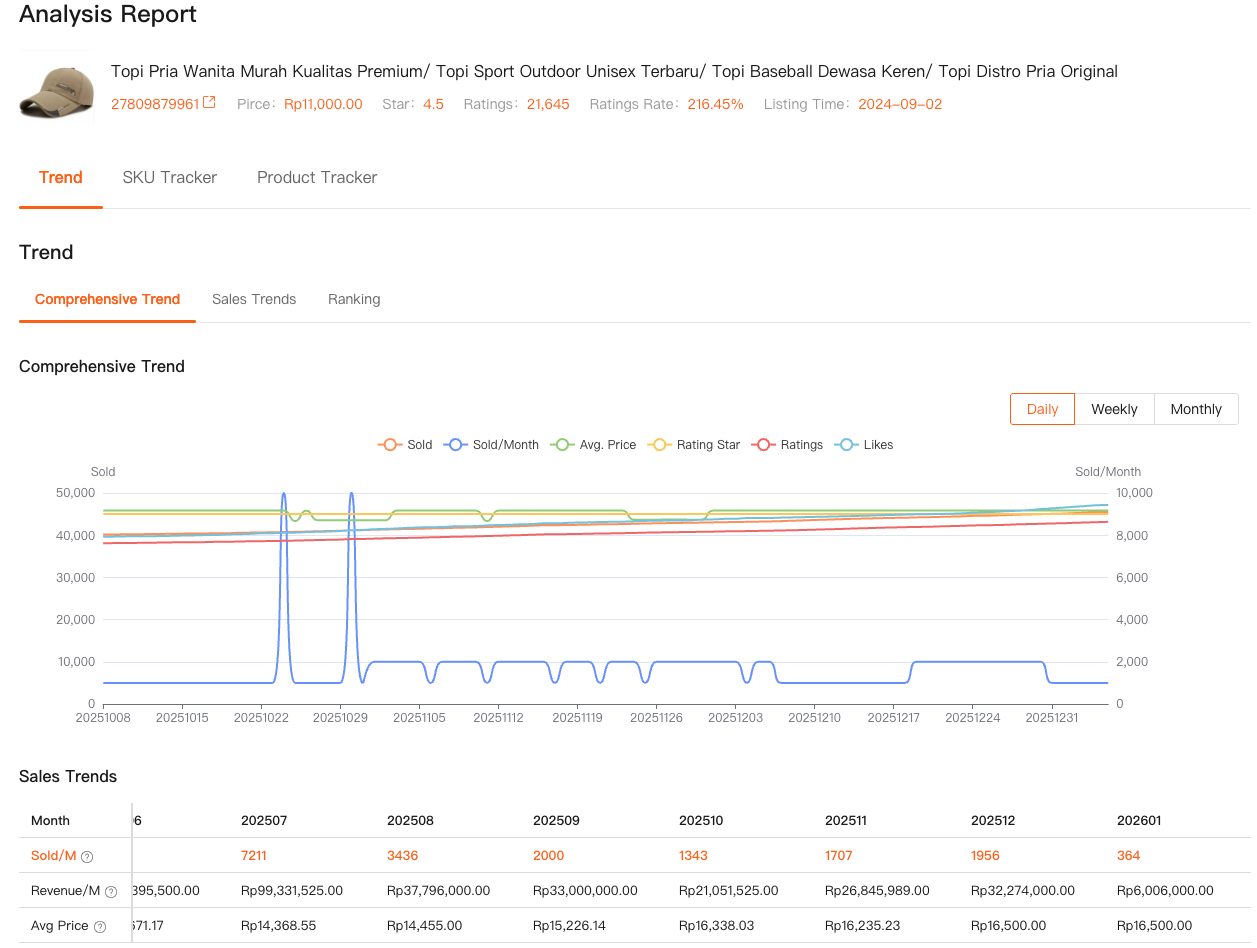

Using Comprehensive Analysis from Shopdora was the first time I felt like I was actually understanding a product, not just copying it. Instead of isolated numbers, I could see sales trends over time, revenue changes, ranking movement, and how stable or risky a product really was.

One case still sticks with me. I found a product with high sales and decent reviews. On Shopee, it looked perfect. But when I checked the broader data, I saw sales had peaked two months earlier and were already trending down. Several new sellers had entered, prices were slowly dropping, and top listings were losing momentum.

That single insight saved me weeks of work and inventory costs. Without proper Shopee product analysis, I would’ve blamed myself for “poor execution,” when in reality the market timing was wrong.

Why Images Matter More Than Most Sellers Admit

Here’s something many sellers don’t like to hear: your product images are often the real bottleneck, not your price.

When I reviewed competitors using Shopee data, I noticed a pattern. Listings with similar prices and products performed very differently. The difference was almost always visuals. Better angles, clearer use cases, cleaner layouts. Some sellers weren’t even cheaper—they just looked more trustworthy.

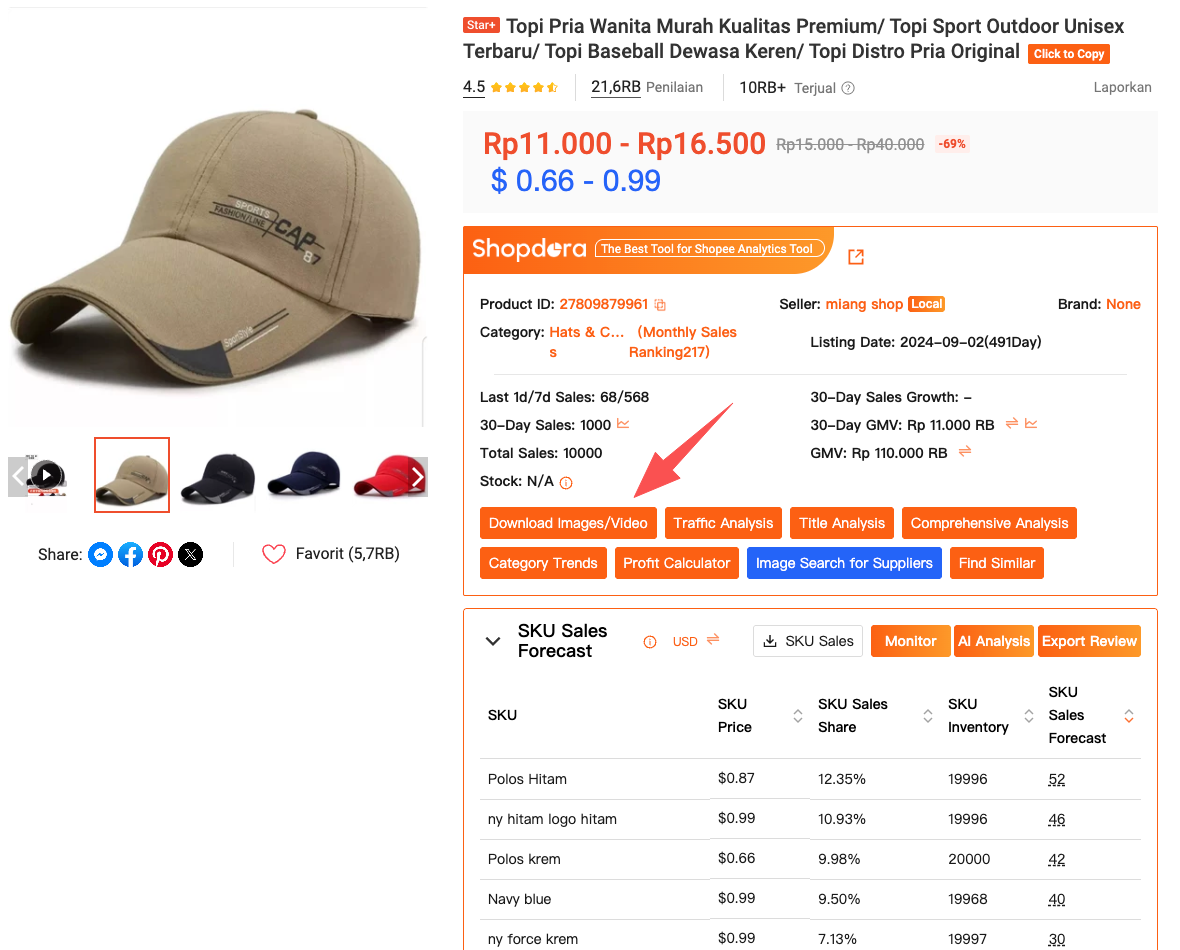

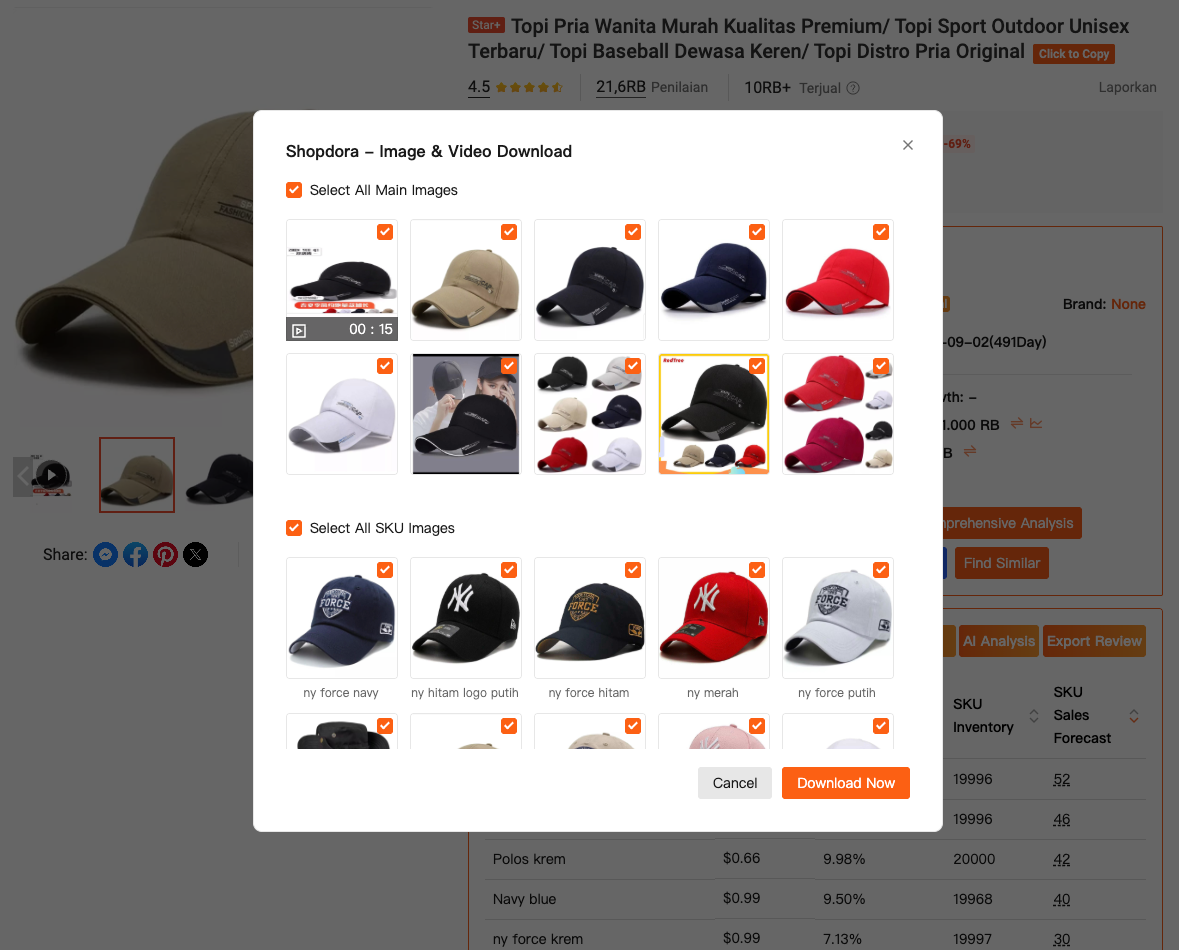

This is where Download Product Images/Video became surprisingly useful. Being able to download competitor images and videos allowed me to study what actually worked. Not to copy blindly, but to understand structure. How many images they used, what they showed first, how they explained features visually.

For the first time, my image optimization was based on evidence, not personal taste.

Combining Shopee Image Downloader With Data Insights

Downloading images alone doesn’t solve anything. The real value comes when you combine it with Shopee product analysis.

For example, I once analyzed two competing listings selling the same product at nearly the same price. One sold twice as much. The data confirmed it wasn’t traffic or timing—it was conversion. After reviewing the images, the reason was obvious. One listing clearly showed usage scenarios and size comparisons. The other didn’t.

That insight changed how I briefed my designer. Instead of vague feedback like “make it look better,” I could say, “Top sellers always show X by the third image” or “Videos that convert well focus on Y in the first five seconds.” Those decisions were grounded in Shopee data, not opinion.

Turning Analysis Into Action, Not Reports

One mistake I made early on was over-analyzing and under-acting. Data is only useful if it leads to decisions.

Now my workflow is simple. I use Market Analysis to understand whether a category is growing or saturated. I use Comprehensive Analysis to evaluate individual products and their lifecycle stage. Then I use the image downloader to reverse-engineer why certain listings convert better.

This approach helped me avoid entering crowded categories too late and improved my conversion rate on existing listings. In one case, I didn’t change the product or price at all—just reworked images based on competitor analysis. Sales picked up within two weeks.

Why Shopee Data Is a Long-Term Advantage

The Shopee marketplace is more competitive every year. New sellers, cross-border competition, and faster product cycles mean mistakes cost more than they used to.

What I’ve learned is that Shopee data isn’t about predicting the future perfectly. It’s about reducing blind spots. It helps you understand why something works, not just what works.

Shopdora isn’t magic. It doesn’t sell products for you. But it gives access to data that individual sellers simply don’t have on their own. When used correctly, it turns product analysis from guesswork into a structured process.

Final Thoughts

I still make mistakes. Every seller does. But the difference now is that my decisions are backed by real Shopee data. I know when to push a product, when to hold back, and when to walk away entirely.

If you’re serious about scaling on Shopee, don’t rely only on instinct or surface metrics. Learn to connect product analysis, market data, and visual execution. That combination is where sustainable growth really comes from.

And speaking as someone who learned this the hard way—once you start making decisions with clarity instead of hope, selling on Shopee becomes a lot less stressful, and a lot more predictable.