I Ran a Shopee Store for 3 Years — This Is How I Actually Use Shopee Data Analytics

Hi, I’m David.

I’ve been selling on Shopee for a little over three years now. Like most sellers, I didn’t start with a grand strategy or a data team. I started with a few products, a lot of trial and error, and a Seller Center dashboard that always felt almost helpful — but never quite enough.

For a long time, I thought I was doing “data-driven” operations because I checked my sales, traffic, and conversion rates every day. But the truth hit me hard after my second year: I wasn’t lacking data — I was lacking context. I could see what was happening inside my store, but I had no idea what was happening in the market around me.

That gap is exactly where proper Shopee data analytics begins.

Why Shopee Seller Data Often Leads to the Wrong Decisions

Shopee gives sellers plenty of numbers. Orders, impressions, clicks, conversion rates — all neatly displayed. But if you’ve been selling long enough, you’ll notice a pattern: even when you follow those numbers closely, decisions still feel risky.

I’ve launched products that looked “healthy” internally but failed within months. I’ve also paused products that later exploded in demand — just not inside my own store at that moment. The issue wasn’t effort or experience. It was that Seller Center only tells you your story, not the market’s story.

Shopee data analytics becomes truly useful only when you can answer questions like:

Is my category growing or shrinking overall?

Is demand shifting to new price ranges or product types?

Are competitors winning because they’re better — or because the market itself is changing?

Those answers don’t live inside a single shop’s dashboard.

Understanding the Market Before Optimizing the Product

The first real shift in my decision-making came when I started looking at Shopdora's Market Analysis data instead of jumping straight into product-level optimization.

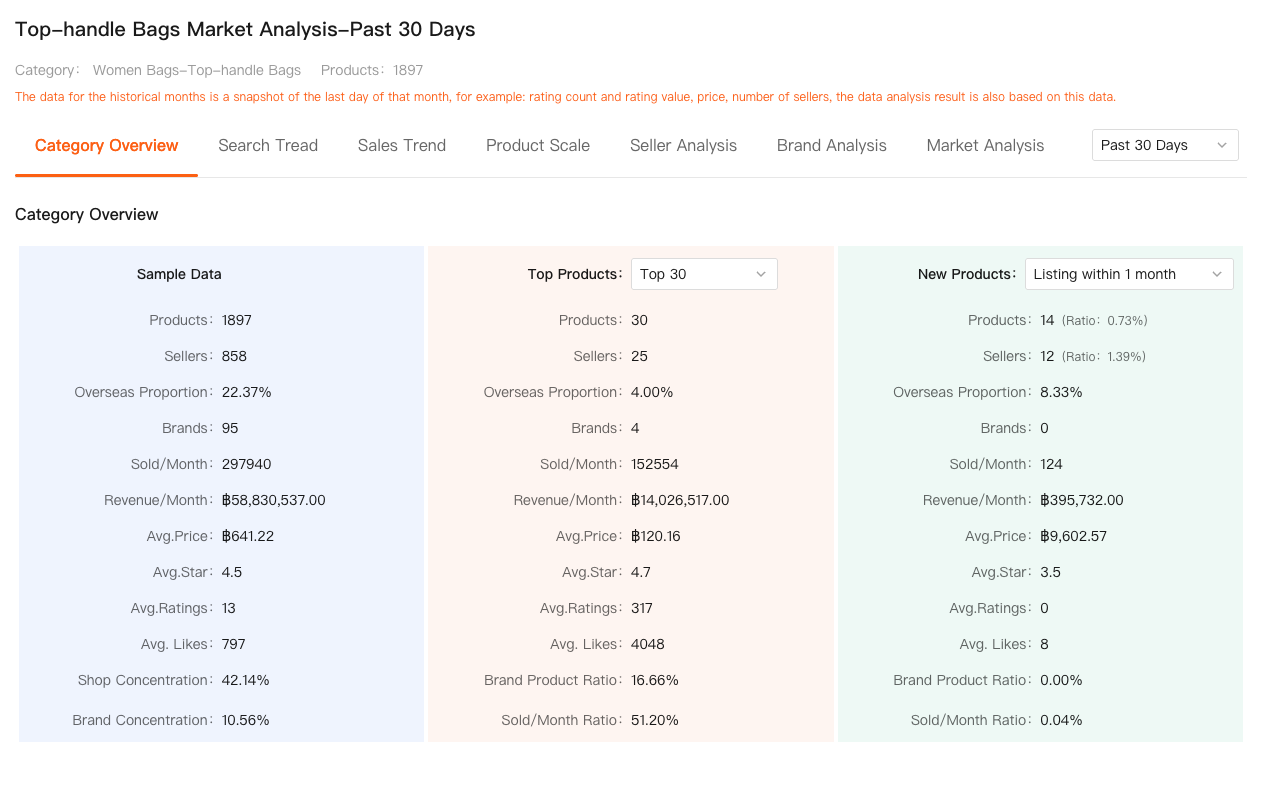

Market Analysis, as provided through Shopdora, looks at category-level performance across Shopee — things like overall sales trends, growth rates, competitive density, and how demand evolves over time. What I found most valuable wasn’t just whether a category was “big,” but how stable and sustainable it actually was.

I remember one category where my own sales were climbing steadily. If I had relied only on internal data, I would have scaled inventory aggressively. But when I reviewed the broader market trend, I saw something uncomfortable: total category growth was flattening, while the number of competing products and stores kept rising. In other words, sellers were piling in faster than buyers.

That insight completely changed my approach. Instead of scaling volume, I focused on differentiation and margin protection. I avoided what later became a brutal price war — one I would’ve walked straight into without market-level analytics.

Shopee data analytics isn’t about finding “hot” categories. It’s about identifying healthy markets before committing time, capital, and attention.

Why Product Performance Needs More Than Sales Numbers

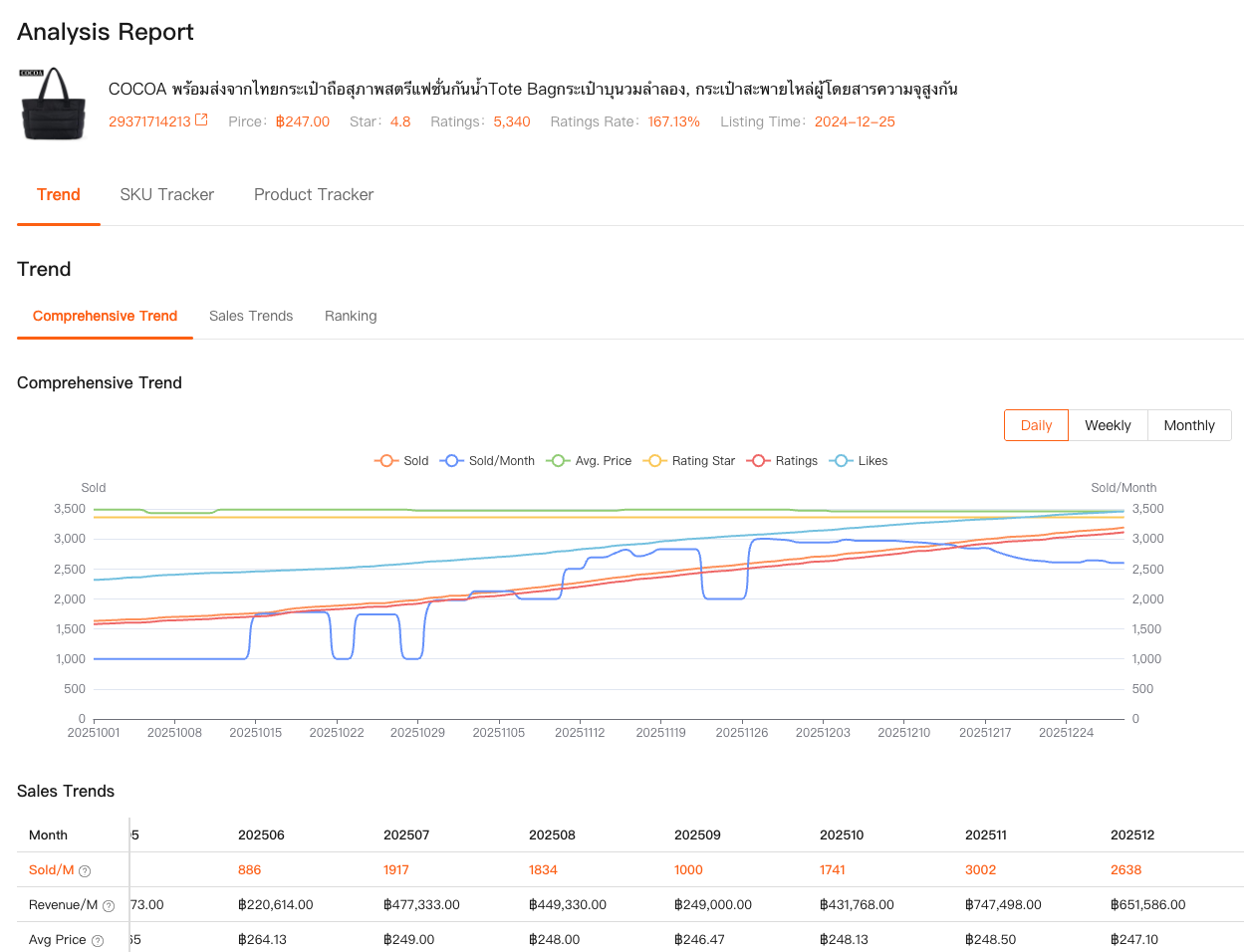

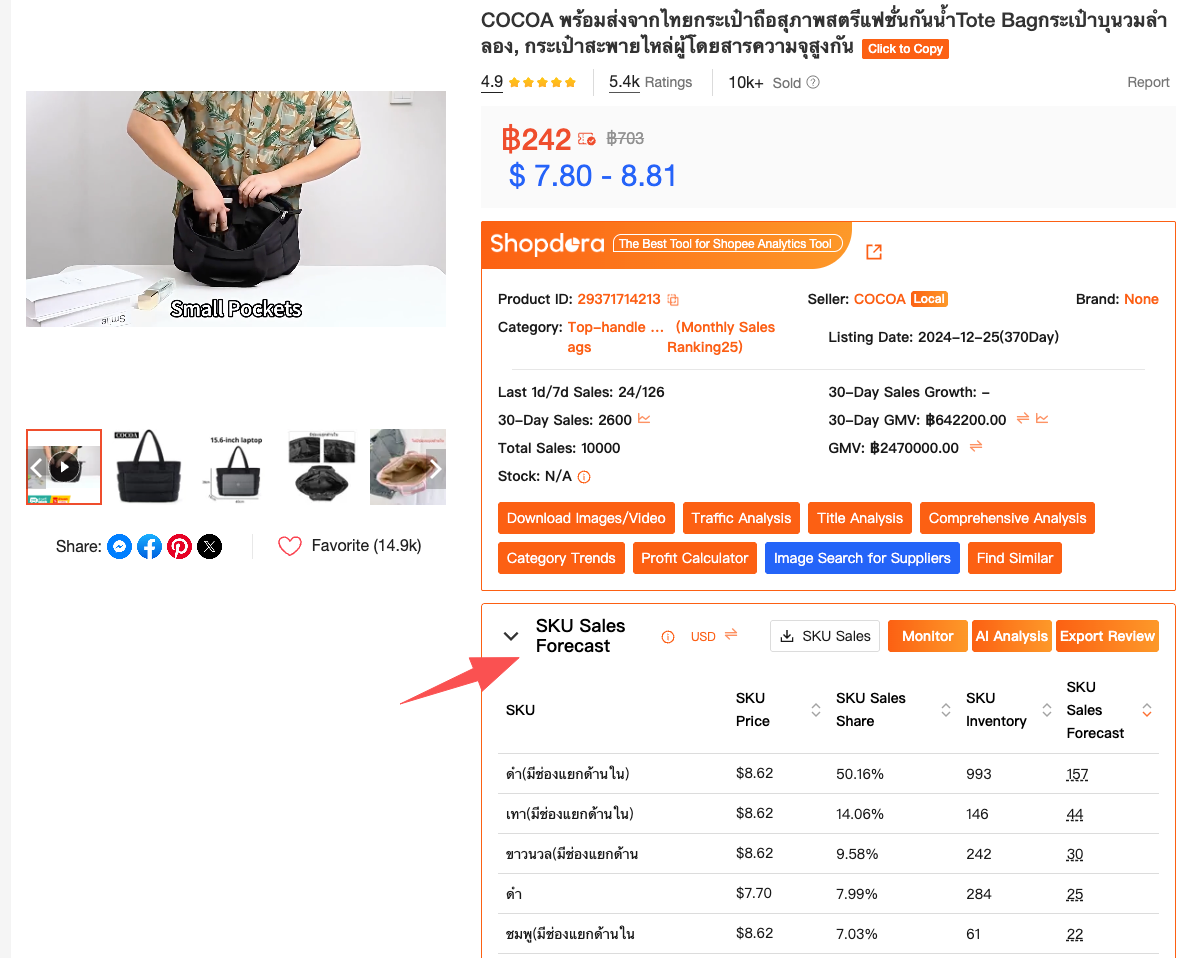

Once you understand the market landscape, the next challenge is interpreting what’s happening at the product level without overreacting. That’s where Comprehensive Analysis became essential for me.

A single metric rarely tells the truth. A sales spike can look exciting, but without knowing whether it’s driven by temporary promotions, ranking volatility, or real demand growth, it’s easy to misread the signal. Comprehensive Analysis brings multiple dimensions together — sales trends, ranking movement, pricing changes, and performance over time — so you’re not reacting to noise.

There was a period when one of my SKUs suddenly climbed in ranking. Sales followed, but only briefly. By looking at the broader performance pattern through comprehensive data, I realized the spike wasn’t organic growth. It was tied to short-term visibility changes across the category, not sustained buyer interest.

That understanding stopped me from making a costly mistake. Instead of investing more stock and ad budget, I treated the spike as temporary and focused on improving listings with more durable demand signals. A few months later, competitors who misread the same spike were stuck clearing inventory at a loss.

This is the kind of clarity Shopee data analytics is supposed to deliver — not excitement, but confidence.

Seeing Patterns Instead of Isolated Events

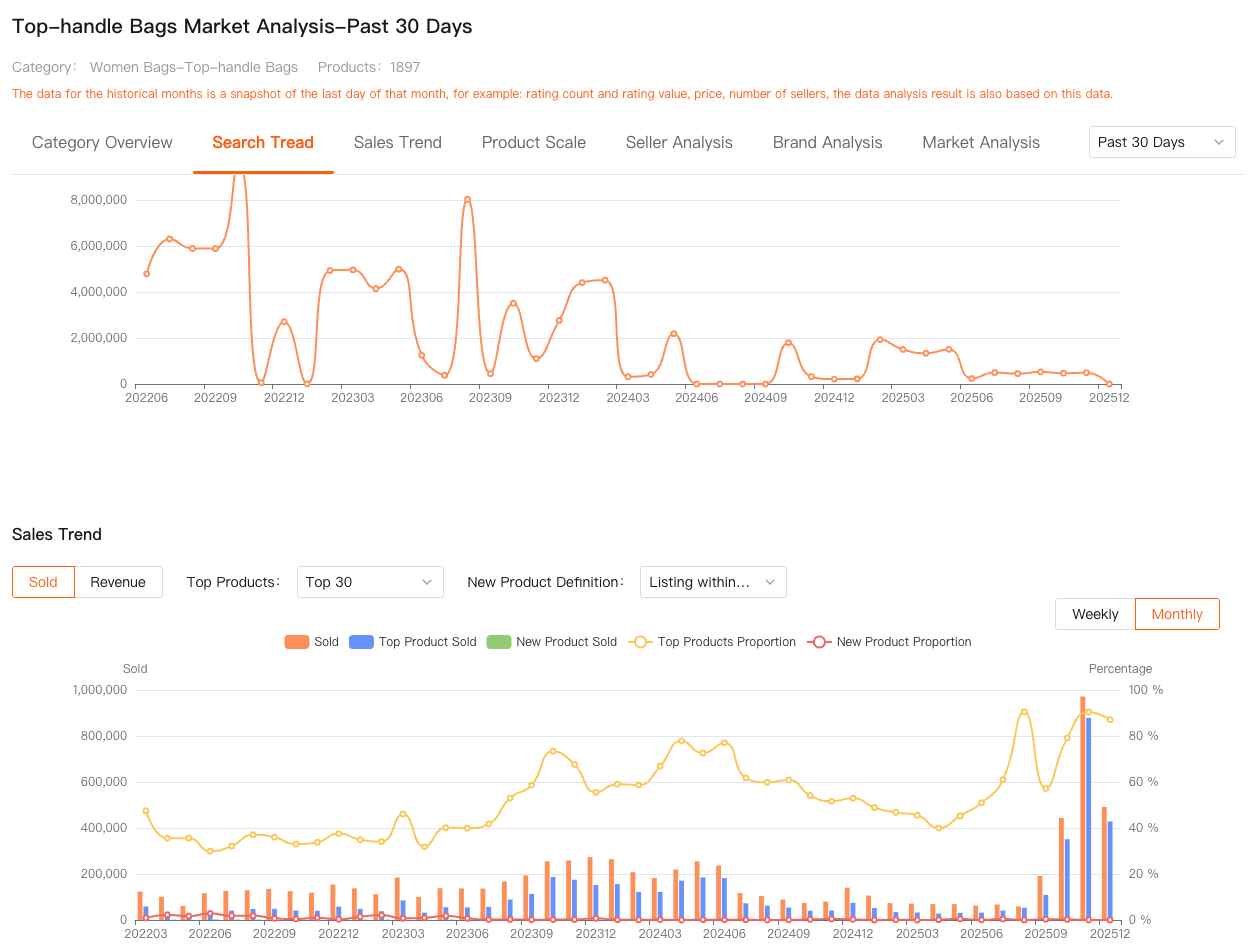

One thing I’ve learned the hard way is that Shopee doesn’t move in straight lines. Demand rises and falls, competitors enter and exit, and buyer behavior shifts quietly before it becomes obvious.

When sellers rely on isolated data points, every change feels urgent. A dip looks like a failure. A spike feels like a breakthrough. But when you look at data over time and across the market, patterns emerge.

By combining Market Analysis with Comprehensive Analysis, I could finally see whether changes were store-specific, product-specific, or market-wide. That distinction matters more than any single KPI.

For example, during a slow quarter, my sales dropped noticeably. In the past, I would’ve assumed my listings were the problem. But market-level data showed that the entire category was cooling, while a few adjacent categories were growing. That insight helped me shift focus early — testing new product directions while competitors stayed stuck optimizing declining niches.

Shopee data analytics becomes powerful when it helps you anticipate rather than react.

Making Strategic Decisions With Less Stress

What surprised me most after adopting a more structured analytics approach wasn’t just better decisions — it was less stress.

When you understand the market context, you stop blaming yourself for every fluctuation. You know when to optimize, when to wait, and when to move on. Tools like Shopdora don’t replace experience, but they compress the learning curve by showing what individual sellers can’t see on their own.

Instead of asking “Why is this product failing?”, I now ask “What is the market telling me right now?” That shift alone has saved me months of wasted effort.

Shopee Data Analytics Is About Direction, Not Perfection

After three years on Shopee, I don’t believe there’s a perfect strategy or a guaranteed winning product. But I do believe there’s a massive difference between guessing with confidence and deciding with evidence.

Shopee data analytics, when done properly, gives you direction. It helps you understand where demand is moving, how competitive pressure is changing, and whether your product decisions align with real market behavior.

By using market-level insights alongside comprehensive product analysis, I stopped chasing short-term signals and started building strategies that actually held up over time.

And in a marketplace as competitive as Shopee, that difference compounds faster than most sellers realize.