One Shopee Tool I Use to Analyze Markets and Avoid Bad Niches

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now. Like most solo sellers, I didn’t start with a big team, insider resources, or special access to platform data. What I did have was the Shopee seller backend, spreadsheets, and a lot of trial and error.

If you’ve sold on Shopee long enough, you’ll know this feeling: your backend tells you everything about your products, but almost nothing about the market outside your shop. You can see your own SKU sales, impressions, and conversion rate—but you can’t see how competitors are actually performing, how crowded a category really is, or whether a “hot” niche still has room for a new seller.

That gap is exactly where a good Shopee tool should help. In this article, I want to talk about a very practical problem Shopee sellers face—and how I now approach it using a few data-focused features from Shopdora, especially its Category Research capability.

The Real Problem: Sellers Lose Money Because They Enter the Wrong Market

Most failed Shopee products don’t fail because the listing looks bad or the ads aren’t optimized. They fail much earlier, at the decision stage.

I’ve personally launched products that looked great on the surface:

- Decent search volume

- Plenty of listings ranking

- Lots of reviews on top products

But after launch, the numbers didn’t add up. Ads were expensive, organic traffic was weak, and margins kept shrinking. Looking back, the problem wasn’t execution—it was that I never truly understood the category structure before entering.

The Shopee seller center doesn’t show you:

- How concentrated a category is

- Whether sales are dominated by a few top products

- How many real sellers are fighting for the same demand

- Whether new products are actually succeeding or just existing

This is where a data-oriented Shopee tool becomes less about “optimization” and more about risk control.

Using Category Research to Decide Whether a Market Is Worth Entering

The biggest shift in my workflow came when I stopped asking, “What product should I sell?” and started asking, “Which category actually makes sense for me to enter?”

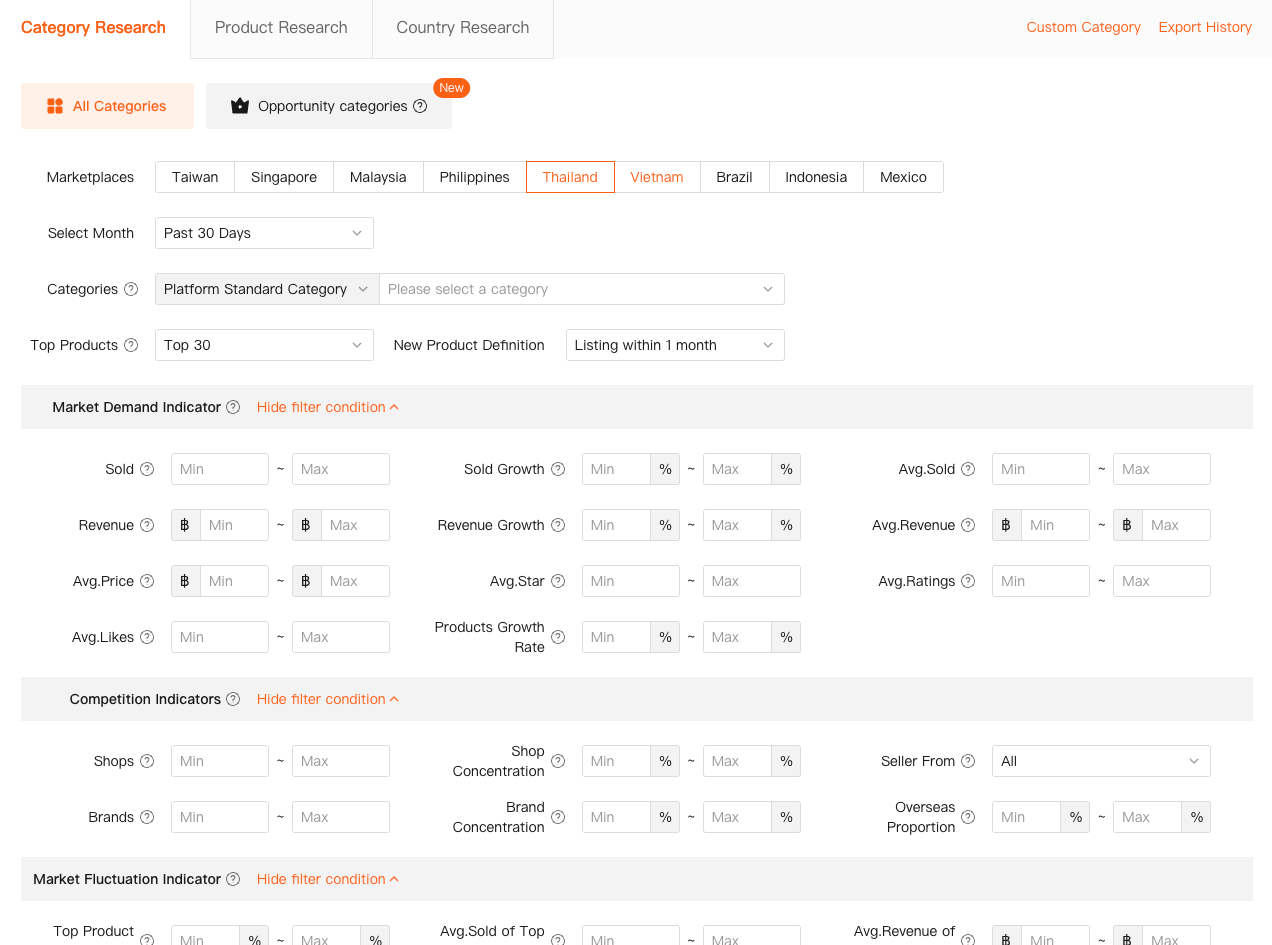

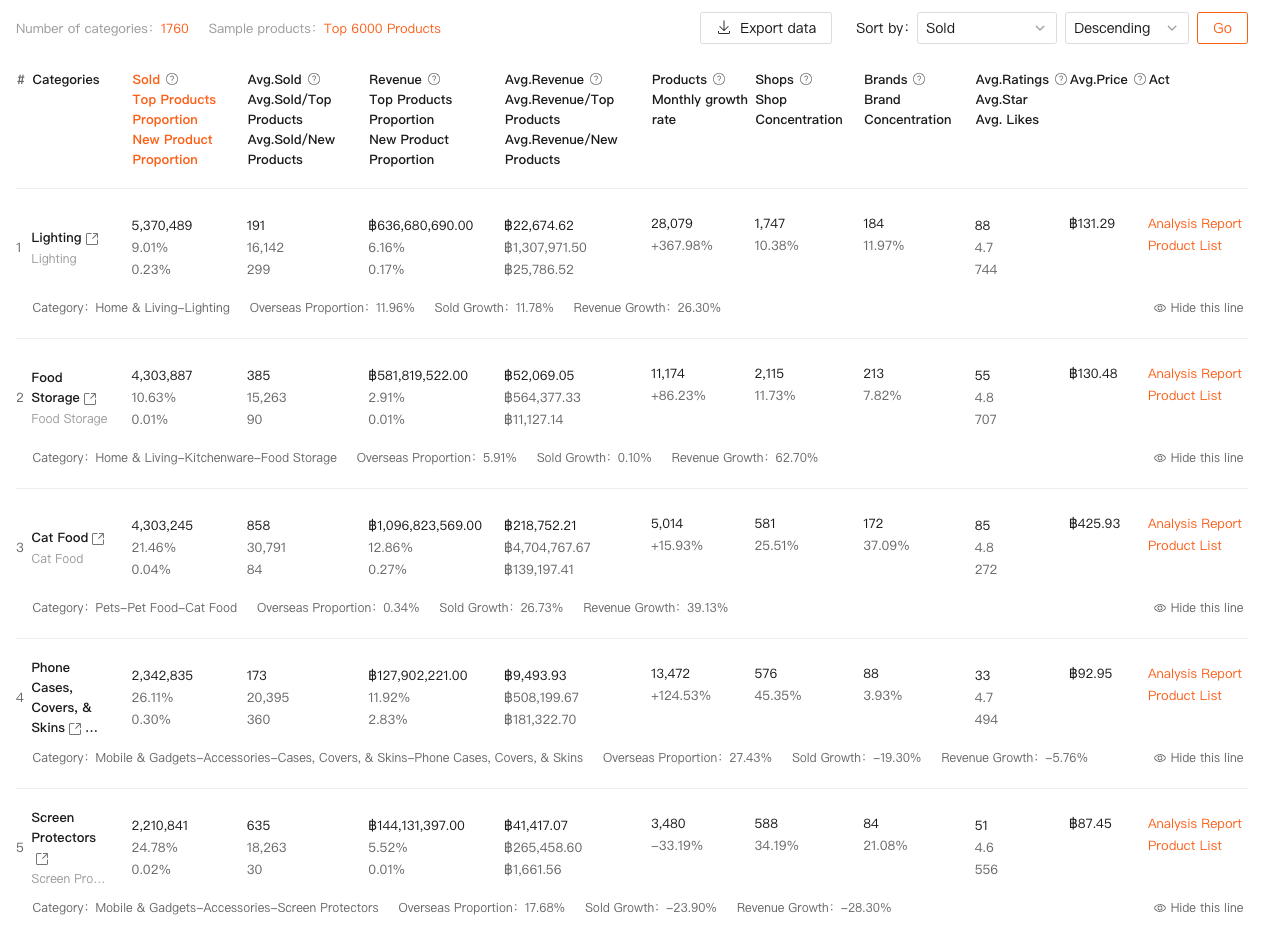

Shopdora’s Category Research feature is designed exactly for that stage. Instead of starting from individual products, it lets you look at the market from above—by site, by category, and by time range.

What matters here isn’t one single metric. It’s how multiple signals line up. When I analyze a category, I’m usually looking at overall sales volume, revenue trends, number of products, number of shops, and how concentrated the top sellers are. If a category has strong demand growth but sales are heavily controlled by a small group of brands, that’s a red flag for smaller sellers. On the other hand, a category with steady demand, moderate competition, and a healthy share of sales coming from newer products often signals opportunity.

This kind of view simply doesn’t exist inside Shopee’s native tools. You’re not spying on competitors—you’re understanding the market structure. That distinction matters.

From Category-Level Insight to Product-Level Validation

Once a category passes my initial filter, the next question becomes: What kind of products are actually working inside this category?

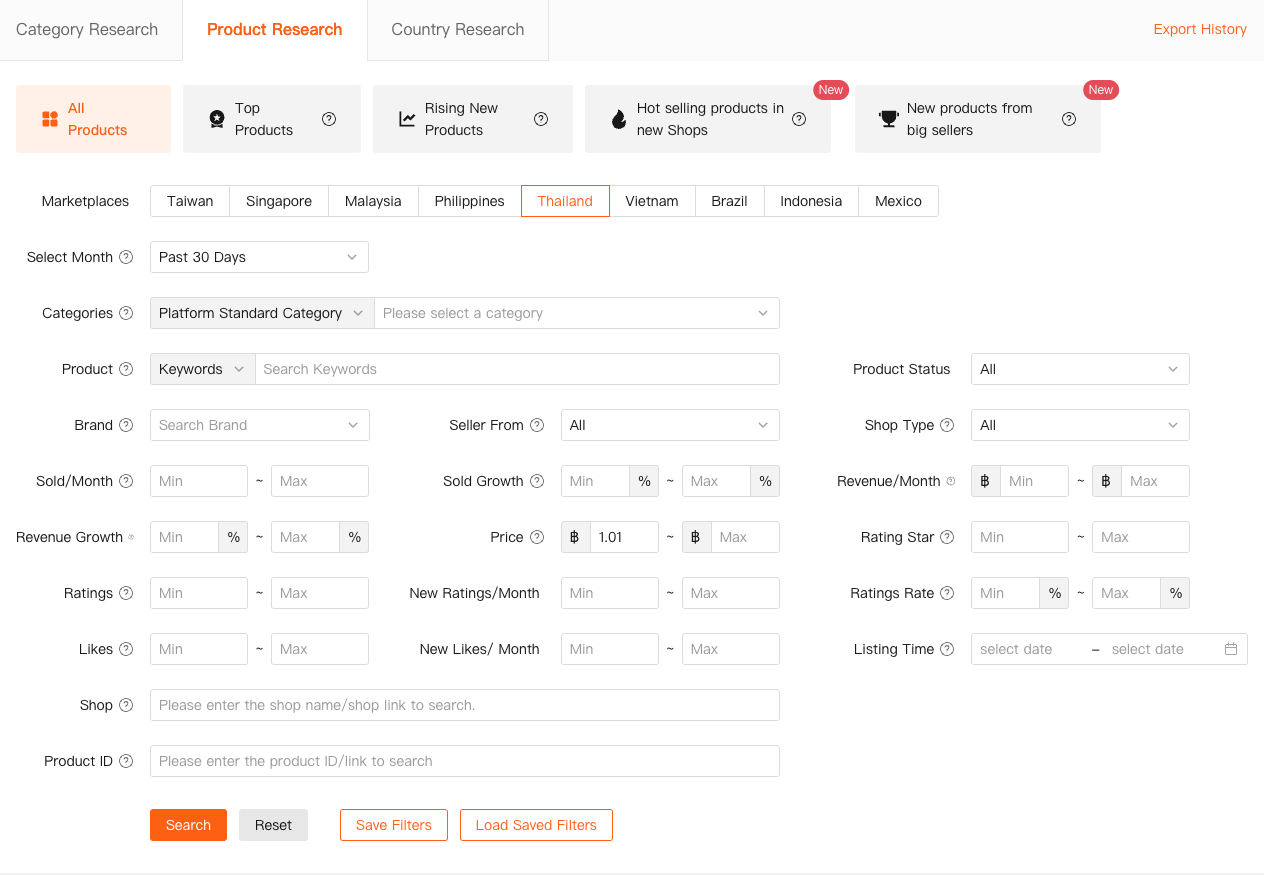

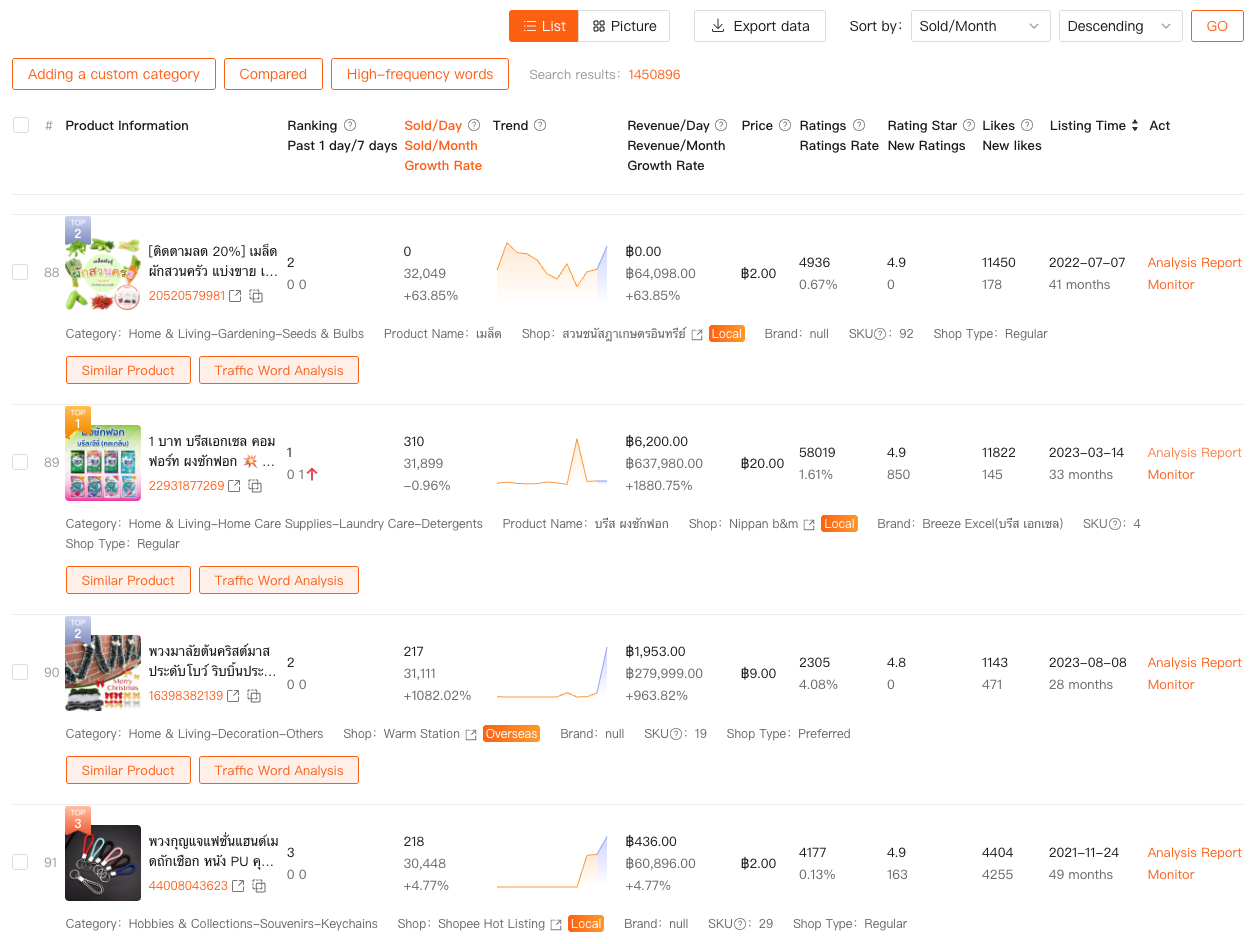

This is where I usually combine Category Research with Shopdora’s Product Research function. Category Research helps me decide where to play; Product Research helps me understand how others are winning inside that space.

Instead of guessing based on bestseller badges or search rankings, I look at historical sales trends, revenue performance, and how long top products have been listed. A product that ranks high but has flat or declining sales tells a very different story from one that’s steadily growing.

What’s important here is context. A product selling 3,000 units a month might sound impressive—until you realize there are 5,000 similar listings and ad costs are rising fast. Product-level data only becomes meaningful when you already understand the category it lives in. Used together, these two features turn guesswork into a structured evaluation process.

Why Market Data Matters More Than Your Own SKU Data

This might sound counterintuitive, but after a certain point, your own store data becomes the least useful input for strategic decisions.

Your backend is excellent for optimization—pricing, ads, stock planning. But it’s almost useless for answering bigger questions like:

- Is this niche becoming overcrowded?

- Are competitors expanding or pulling back?

- Is demand growing organically, or driven by aggressive ads?

Shopdora exists specifically to fill this blind spot. Its analysis isn’t about your SKUs—it’s about everyone else’s. That’s the part Shopee doesn’t show you, but the part that determines whether your next move will scale or stall.

When sellers say “this Shopee tool helped me,” what they usually mean is: it helped them avoid a bad decision before it became expensive.

Turning Data into Action Instead of Drowning in Numbers

One mistake I see often is sellers collecting too much data without a clear purpose. Data only helps when it leads to a decision.

My current process is simple:

- Use Category Research to eliminate high-risk markets

- Use Product Research to understand winning patterns

- Compare those patterns with my own cost structure and strengths

If the numbers don’t align, I walk away. That alone has saved me months of wasted effort.

The goal isn’t to find a “perfect” category. It’s to find one where the odds are reasonable and transparent. A good Shopee tool doesn’t promise success—it helps you see the battlefield before you enter it.

Why I Still Think Tools Don’t Replace Experience (But They Sharpen It)

After three years on Shopee, I don’t believe any tool can replace seller judgment. But I do believe the right tool compresses your learning curve.

What used to take me multiple failed launches, I can now identify in a few hours of structured analysis. Not because I’m smarter—but because I’m finally looking at the right data.

Shopdora isn’t something I use to impress people with dashboards. I use it quietly, before I commit money, time, and inventory. That’s where it adds real value.

Final Thoughts

If you’re searching for a Shopee tool, my honest advice is this: don’t start by asking what can help you sell more today. Start by asking what can help you make fewer wrong decisions tomorrow.

For me, learning to read category-level and market-level data changed how I approach Shopee entirely. I still test, I still fail sometimes—but now those failures are smaller, faster, and far less expensive.

I’m David, just a solo Shopee seller sharing what actually changed my workflow. If this article helps you skip even one bad launch, it’s already done its job.