Reference for Selection of Plush Toys Category (4th Quarter of 2025-1st Quarter of 26th)

The plush toy market across Southeast Asia and Latin America is entering a new growth phase — driven by short-video trends, emotional consumption, and IP-based product waves. If you’re a Shopee seller exploring this niche, now is the time to move fast.

Based on Shopee’s 2025 official data and third-party research, here’s a complete overview of where the opportunities lie — from market scale and trending IPs to certification rules, hot search insights, and holiday timing.

1. Market Overview: Steady Growth, High Potential

Between 2024 and 2030, Southeast Asia’s plush toy market is projected to grow rapidly. Sales and exports continue to rise steadily, supported by strong demand in Indonesia, Vietnam, Thailand, and Brazil.

- Toy category growth: Orders up 25–30% YoY, sales up 20–25% YoY in 2025H1.

- Regional share: Southeast Asia makes up 60–65% of Shopee’s toy market, Latin America about 25–30%.

- Category mix: Plush toys account for roughly 20% of total toy sales.

Average order value (AOV):

| Region | AOV (USD) |

|---|---|

| Brazil, Taiwan | $15–20 |

| Thailand, Malaysia, Singapore | $10–15 |

| Indonesia, Vietnam, Philippines | $6–8 |

2. Product Subcategories and Key Features

Shopee classifies plush toys under several sub-niches, each with unique selling points and risks:

| Subcategory | Highlights | Recommended Markets |

|---|---|---|

| Plush Toys | Trend-sensitive, fast iteration, strong visual appeal, impulsive buying | Brazil, Vietnam, Indonesia, Thailand, Philippines |

| Dolls & Accessories | Dress-up sets, DIY parts, collectible items with strong bundling potential | Brazil, Singapore, Malaysia, Taiwan |

| Dollhouses & Accessories | Realistic, decorative, suitable for gift sets, high AOV | Brazil, Singapore, Malaysia |

Tip: For trend-based items, avoid heavy inventory — test via cross-border direct shipping, then restock in small batches.

3. Compliance and Certification

Before listing, sellers should review site-specific certification rules:

- Indonesia: SNI (Baby & Child Toys)

- Taiwan: BSMI (Below 14 years old)

- Brazil: INMETRO (Infant & toddler toys)

- Thailand: TISI (Under 14 years old)

While some are non-mandatory for cross-border sellers, displaying quality and safety certifications on product pages boosts trust and conversion.

4. Best Shopee Markets for Plush Toys

| Market | Why It’s Worth Entering |

|---|---|

| Brazil | Huge traffic, strong toy demand, 45–55% YoY growth, high profitability during campaigns |

| Vietnam | Fastest order growth, similar to China’s Gen-Z trends |

| Thailand | High AOV, strong campaign spikes, trend-driven consumers |

| Indonesia | Largest SEA market; supports live-streaming and video marketing |

| Malaysia & Singapore | Stable traffic, high-value buyers, preference for small cute items |

5. IP Trends and Creative Inspiration

The plush toy category thrives on IP-driven consumption — characters and stories are the heart of sales.

🔥 Top-selling IPs (2024–2025)

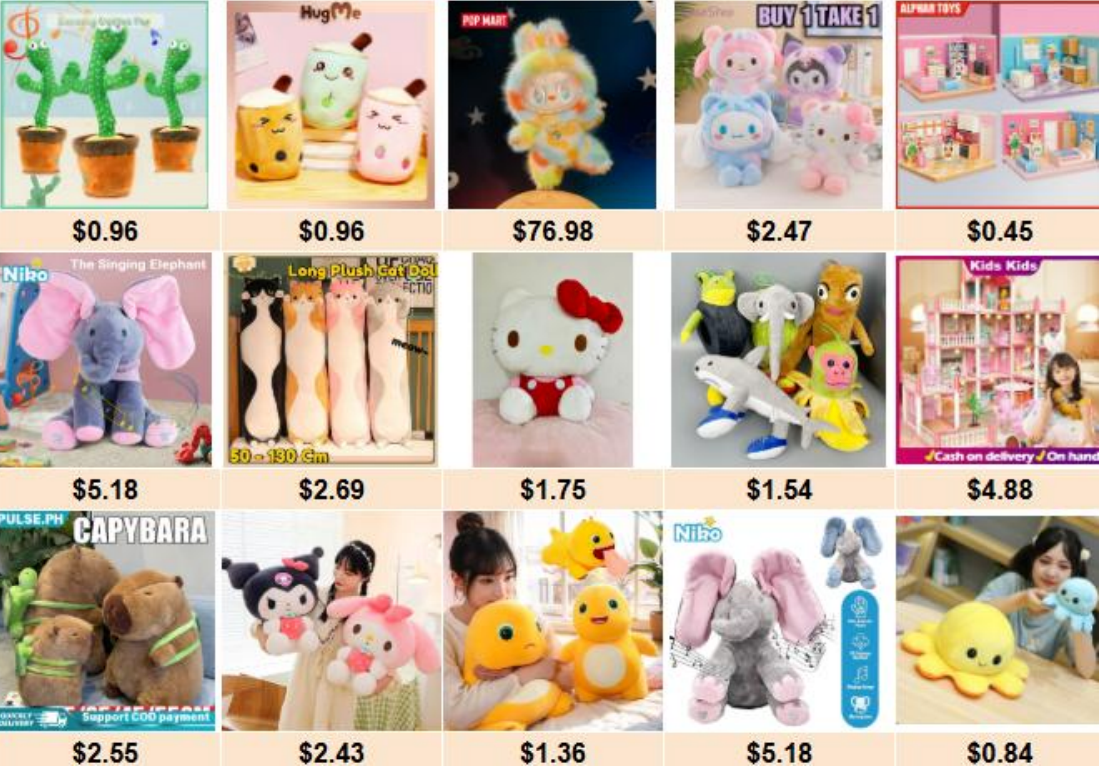

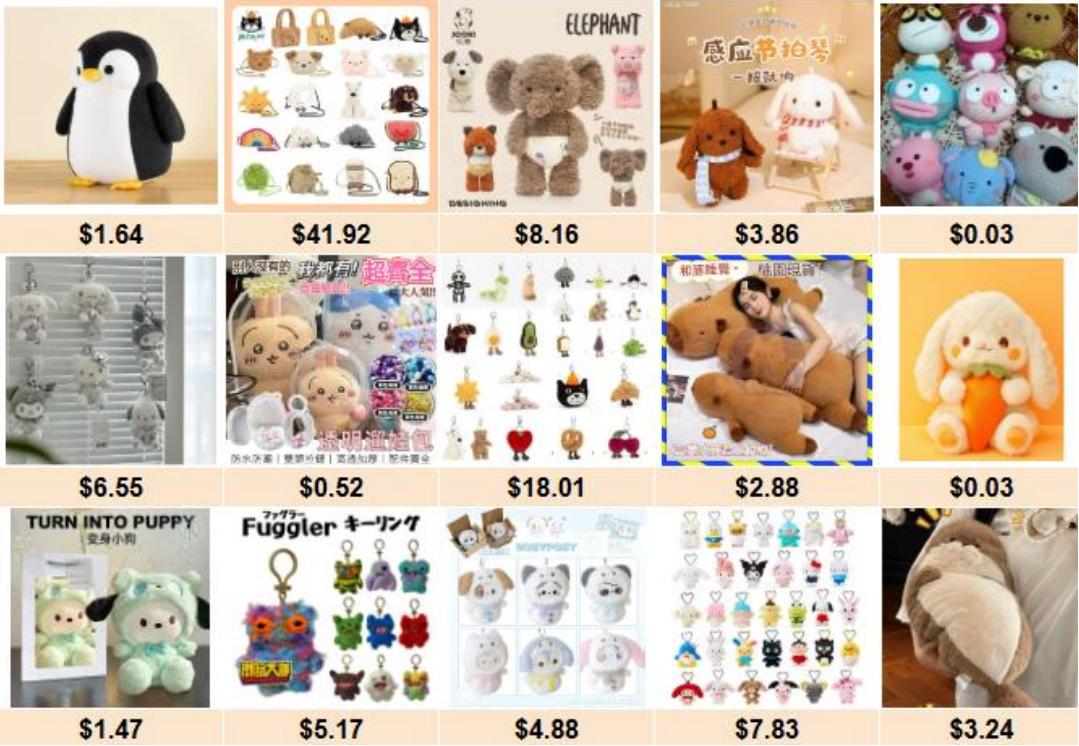

- Labubu, Babythree, Capybara, Nailoong, K-pop mascots (SKZOO, BT21)

- Sanrio family, Crayon Shin-chan, Chiikawa, Doraemon

How to Catch IP Trends:

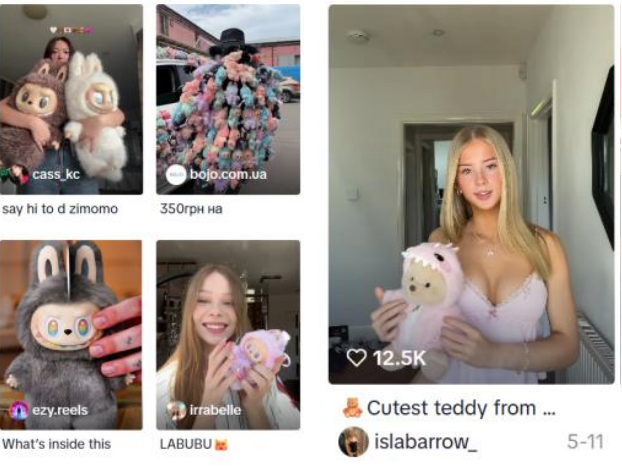

- K-pop & celebrity collabs: Lisa-Labubu, Stray Kids SKZOO, BTS plushies

- Anime & movie franchises: Pokémon, Chiikawa, Crayon Shin-chan

- Short-video virality: Track plush toy trends on TikTok and Shopee Live

- Mobile games: Local game characters offer licensing and design inspiration

⚠️ Avoid IP infringement. Shopee strictly penalizes fake or unauthorized goods — repeated violations can permanently suspend stores. Avoid keywords like Lego, Marvel, Disney, Barbie, DC, etc.

6. Seller Case Studies

ISBON (Indonesia)

- Builds an original brand with its own animal characters and storytelling.

- Combines Shopee promotions with social-media storytelling.

- Displays ISO/SNI certifications and “premium material” claims — boosting conversions.

JINO SHOP (Vietnam)

- Wins market share via low-price strategy and continuous discounts.

- Ties products to gift occasions (birthday, Valentine’s Day).

- Uses “Free gift with purchase” to increase satisfaction and repeat sales.

NaDu SHOP (Vietnam)

- Focuses on short videos and livestreams to show real use.

- Offers coupons for video viewers — lifting click-through and retention rates.

- Builds private traffic through coupons and member gifts.

7. Hot Search Keywords by Shopee Market

Understanding what buyers are searching for helps identify new opportunities fast.

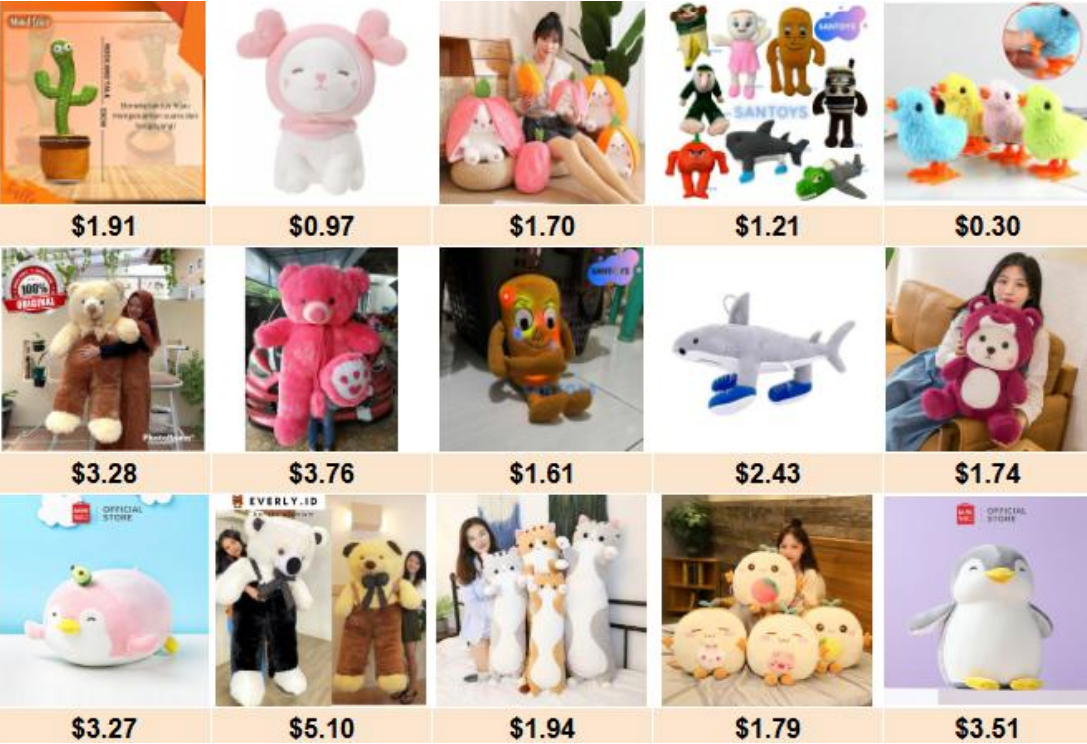

Here’s a summary of top plush toy search keywords and preferences across key Shopee markets (2025 Q3–Q4 data):

🇧🇷 Brazil

Top keywords: labubu, reborn baby, realistic silicone doll, teddy bear, plush capybara, big teddy bear, children’s dolls for girls

Insights:

- Classic plush toys dominate; reborn baby dolls priced $10–30 sell best.

- Trend adoption lags about 6–12 months behind Southeast Asia.

- Labubu and Capybara toys are rising quickly — try accessories and bundles.

🇻🇳 Vietnam

Top keywords: teddy bear, cute teddy bear, baby three, giant teddy bear, hello kitty teddy bear, capybara

Insights:

- Cute Japanese/Korean-style plush dominates.

- Consumers react fast to online trends; $3–5 is the sweet spot.

- Plush cushions and pillow-type toys trending strongly.

🇹🇭 Thailand

Top keywords: jellycat, cute dolls, 10cm doll set, Monchhichi, Care Bears, sylvanian families, rabbit doll

Insights:

- Cute and influencer-driven items perform best.

- Fastest trend cycle across SEA.

- Shoppers often buy in multiples; Care Bears and Monchhichi stay evergreen.

🇮🇩 Indonesia

Top keywords: cute soft doll for girls, jumbo doll, nailoong, tung tung sahur, Kuromi doll, elephant doll

Insights:

- Consumers prefer large teddy bears and cute jumbo dolls.

- The Tung Tung Sahur theme surges during Ramadan.

- Ideal pricing: $2–5.

🇵🇭 Philippines

Top keywords: plushie, teddy bear, labubu, kuromi stuffed toy, sylvanian families, squishmallow, nailoong plushie

Insights:

- Sanrio and Western IPs remain strong.

- Talking plush toys are trending in late 2025.

- Best price range: $2–6.

🇲🇾 Malaysia

Top keywords: plushie, capybara, jellycat, teddy bear, labubu, sylvanian families, plushie pillow, labubu clothes

Insights:

- Loves dress-up plush and trend-driven accessories.

- Popular range: $2–6.

- “Labubu outfits” among the fastest-growing keywords.

🇸🇬 Singapore

Top keywords: jellycat, labubu, sylvanian families, fuggler, rolife, milo plush, polly pocket

Insights:

- Prefers premium collectibles and handcrafted plush.

- Jellycat and Rolife plush stay top-of-list.

- Price range: $10–30.

🇨🇳 Taiwan

Top keywords: jellycat, cotton doll, 10cm baby clothes, sylvanian family, Jiyikawa doll, comfort doll, big eared dog

Insights:

- Favors minimalist Japanese-style designs.

- Jellycat and Sylvanian Families remain evergreen.

- Prefers small hanging dolls, $8–20 range.

💡 Pro Tip:

Most Shopee search surges come 2–3 weeks after a trend goes viral on TikTok or local short-video platforms. Monitoring both helps you identify hot products early and capture the wave before competitors do.

8. Product Opportunities: 2025–2026

Shopee encourages sellers to upload these trending styles:

- Animal companions & sleeping plush

- Reversible plush (double expression)

- Custom or DIY plush

- Capybara plush

- Gift box plush & couple plush

- Funny plush & sound/music toys

- Plush pillows & hugging cushions

9. Seasonal Strategy

Align your product launches with local holidays and shopping peaks:

| Time | Key Markets | Suggested Focus |

|---|---|---|

| Jan–Feb | PH, TH, VN | Children’s Day, Lunar New Year, Back-to-School |

| Mar–May | ID, MY, SG | Ramadan, Mother’s Day |

| Sep–Dec | All | Halloween & Christmas themes |

🎄 Christmas Wish List (Global):

Focus on Santa, reindeer, red-green color plushies, or Christmas-themed IP outfits.

Hot price band: $1–10.

10. Key Takeaways for Shopee Sellers

- Follow trends fast — plush toys are short-cycle items; stay close to TikTok & Shopee keyword trends.

- Avoid infringement — focus on original designs or low-risk regional IPs.

- Leverage festivals — align product launches with local events and back-to-school seasons.

- Show certification & quality — boosts trust and helps justify higher pricing.

- Invest in video marketing — short videos and livestreams greatly improve engagement and conversion.

Final

The plush toy market in Shopee is a high-emotion, high-velocity segment — perfect for sellers who can react quickly to pop culture and social media waves. Whether you create your own characters or ride on regional trends, success comes from timing, differentiation, and storytelling.

Now’s the time to soft-launch new plush SKUs and ride the festive wave into early 2026.