Shopee Analysis Tools: How I Finally Stopped Guessing and Started Reading the Market Like a Pro

I’m David. I’ve been running my own Shopee store for a little over three years now, and like most solo sellers, I didn’t start with some grand strategy or insider advantage. I started by listing products, tweaking prices, watching my own sales dashboard, and reacting to whatever seemed to work. For a long time, I thought that was what “data-driven” selling looked like.

It wasn’t.

What I didn’t realize back then is that Shopee’s seller center only tells you what’s happening inside your own store. It doesn’t tell you what’s happening in the market. You can see your SKU sales, your traffic, your ads—but you have no visibility into competitors, category shifts, or whether the market itself is growing, shrinking, or quietly changing direction.

That blind spot is exactly why many sellers plateau. And it’s also why I started relying on proper Shopee analysis tools that focus on market-level data, not just store-level stats.

In this article, I want to share how using market and product-level analytics—specifically through Shopdora’s Market Analysis and Comprehensive Analysis features—changed the way I evaluate opportunities, avoid bad launches, and make decisions with far more confidence than before.

The Real Problem With Shopee Data (And Why Most Sellers Don’t Notice It)

Shopee doesn’t lack data. The problem is where that data stops.

Inside the seller dashboard, everything revolves around your SKUs: your impressions, your clicks, your conversions. That’s useful—but only after you’ve already committed to a product. By the time your own data tells you something isn’t working, you’ve often already paid the price in inventory, ads, or time.

What you can’t see natively is what every serious seller actually needs before making decisions: how big the category really is, how concentrated the competition is, whether sales are dominated by a few top products, how many new products are entering, and whether demand is trending up or quietly cooling off.

This is where proper Shopee analysis tools should step in. Not to replace your seller center, but to answer the questions Shopee itself doesn’t.

Using Market Analysis to Understand the Game Before Playing It

The first time I used Shopdora’s Market Analysis, it felt like stepping back and finally seeing the entire chessboard.

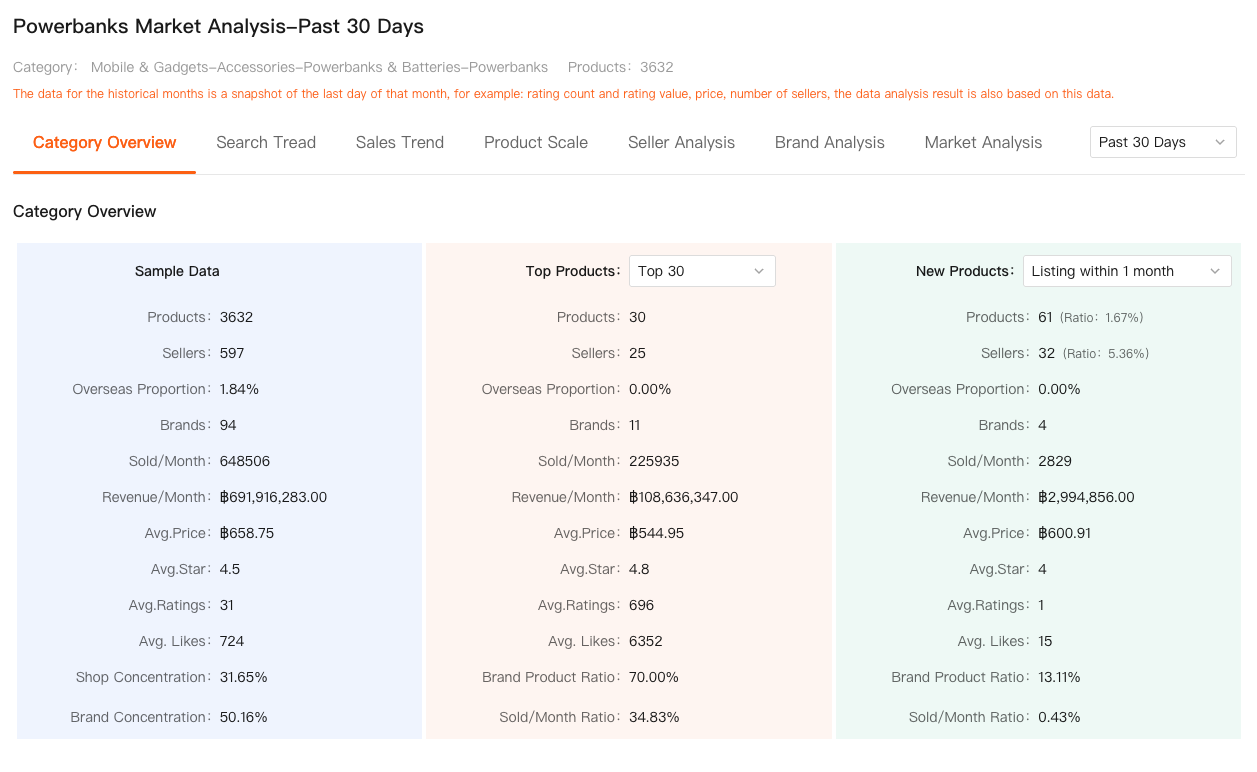

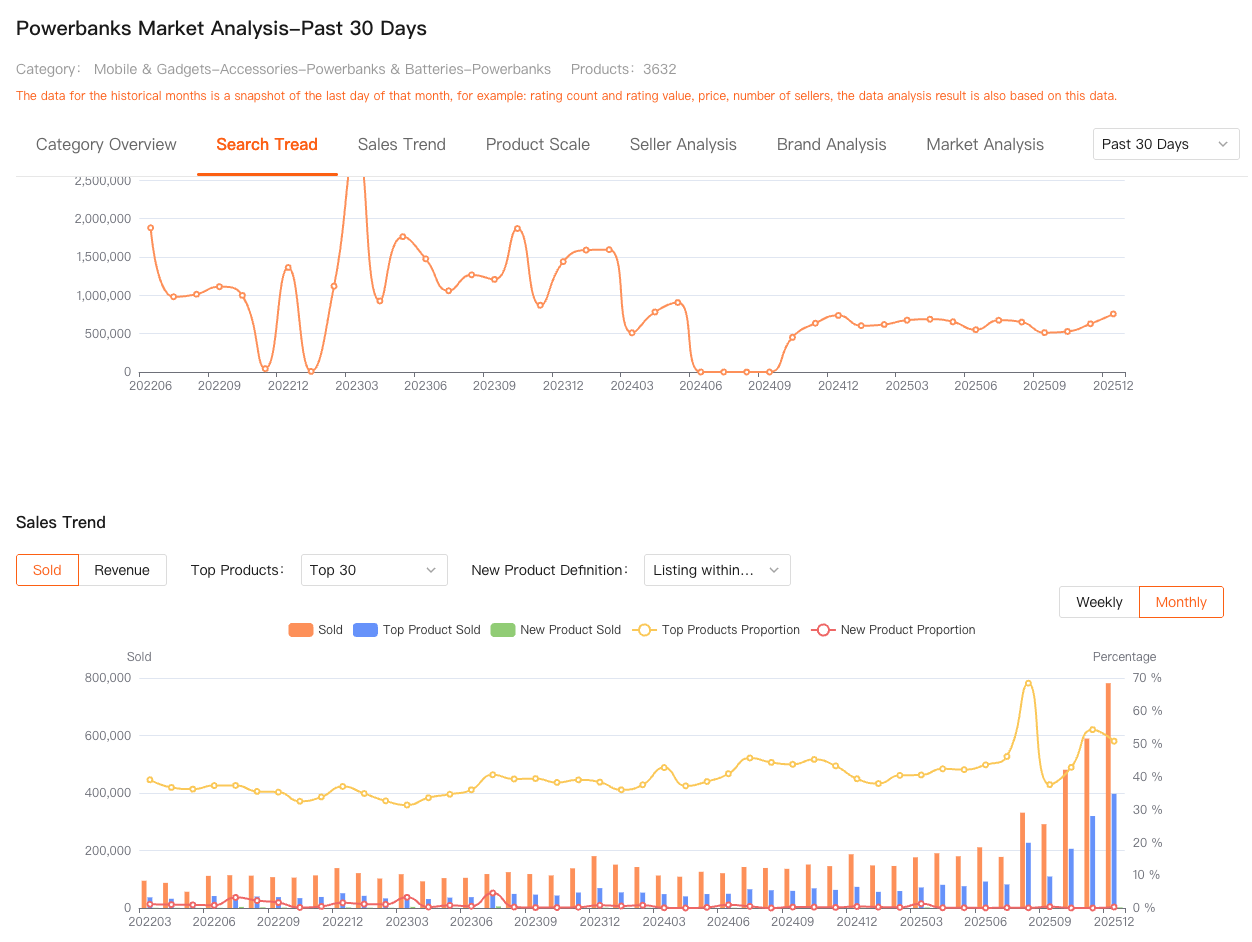

Instead of looking at individual products in isolation, Market Analysis lets you examine a Shopee category as a whole. You can see total market sales, revenue trends, average prices, product counts, store counts, brand distribution, and how concentrated or fragmented a category really is. You can also observe how much of the category is controlled by top products versus long-tail sellers, and how active new product entry actually is.

This matters more than most sellers realize.

I’ve personally avoided at least two product launches simply because Market Analysis showed that while demand existed, the category was already dominated by a small number of top sellers with massive SKU depth and price advantages. On the surface, the niche looked attractive. At the market level, it was a trap.

On the flip side, I’ve also discovered categories where total demand wasn’t explosive, but competition was fragmented, new products were performing well, and the market structure favored differentiated sellers. Those insights don’t come from your own store data—they come from understanding the market context.

That’s the real value of market-level Shopee analysis tools: they help you decide where you should even bother competing.

Why Product-Level Data Still Matters (But Only in the Right Way)

Once you’ve identified a market worth entering, the next mistake many sellers make is obsessing over a single competitor’s headline numbers. High sales don’t automatically mean a product is easy to replicate or profitable.

This is where Shopdora’s Comprehensive Analysis became essential in my workflow.

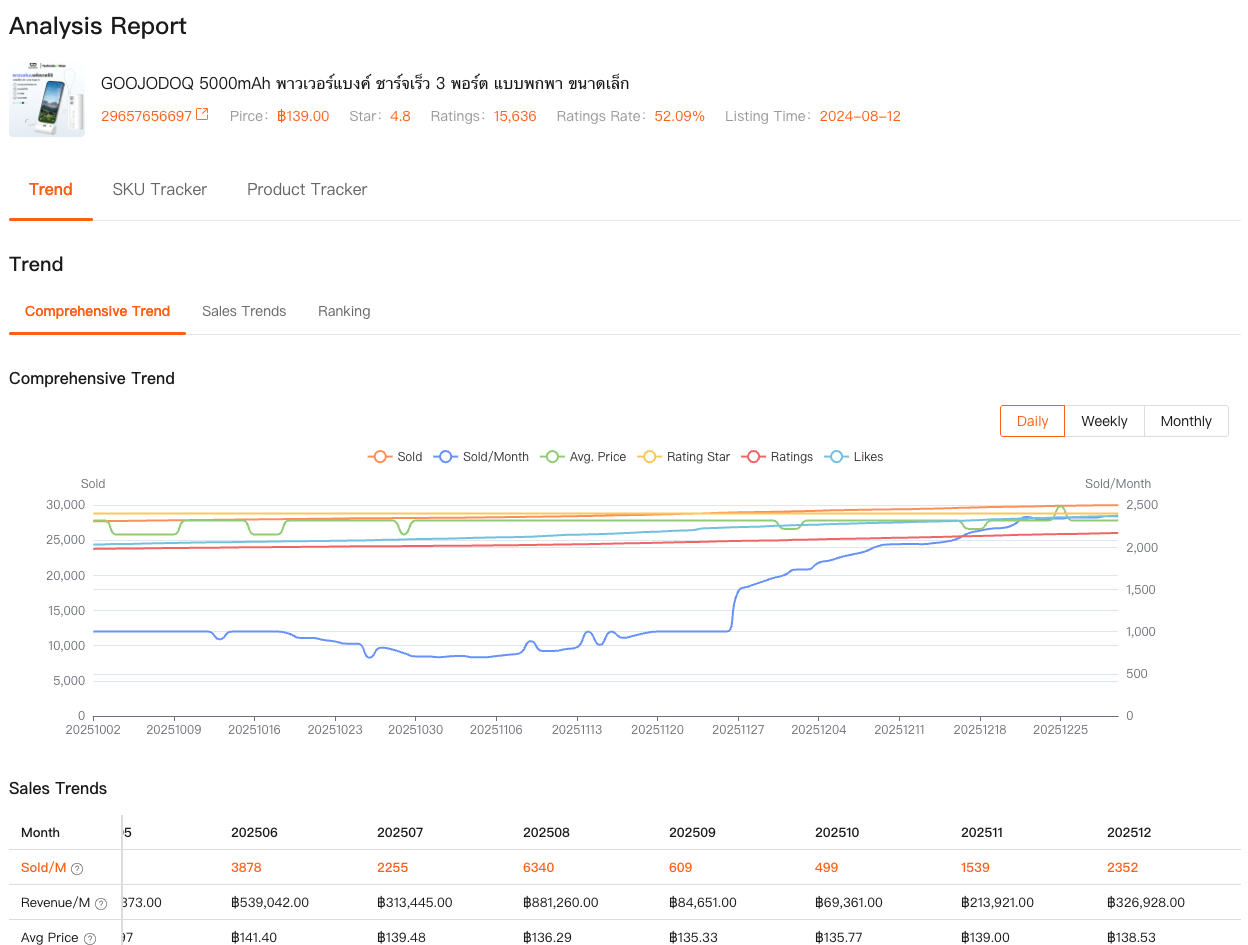

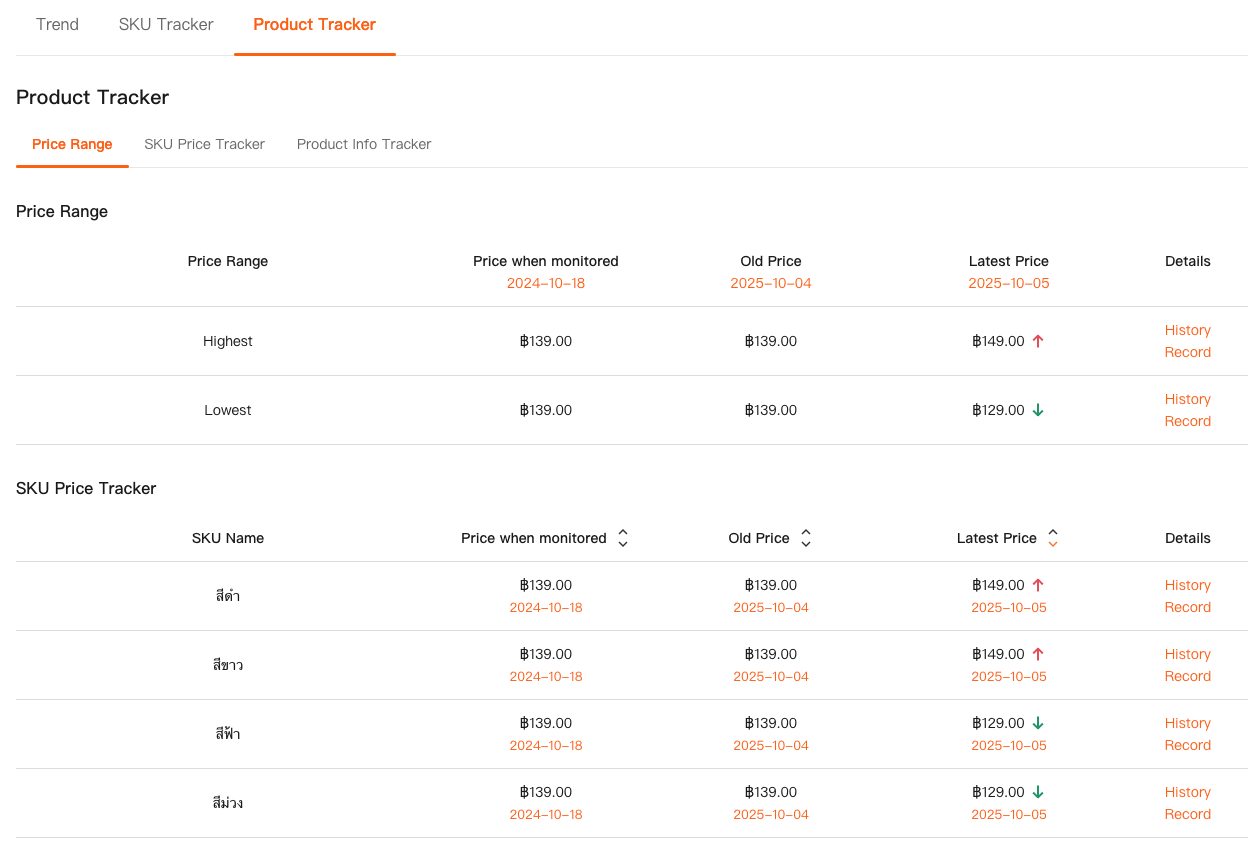

Comprehensive Analysis allows you to examine individual products within the context of the market. You’re not just seeing sales snapshots—you’re seeing trends, lifecycle signals, ranking movement, SKU structure, pricing behavior, and how a product performs over time rather than in a single moment.

I’ve learned to look for consistency over hype. Products with stable sales curves, rational pricing, and clear SKU strategies often indicate healthier opportunities than products with sudden spikes driven by aggressive promotions. Comprehensive Analysis helps surface those patterns without forcing you to guess.

Most importantly, it bridges the gap between market-level reality and product-level execution, which is exactly where many Shopee sellers struggle.

Why Shopee Analysis Tools Should Focus on Competitors, Not Just You

One hard truth I had to accept is this: your own data is reactive. Market data is proactive.

By the time your store metrics change, the market has often already moved. Competitors adjusted pricing, new products entered, or demand shifted weeks earlier. Shopee analysis tools that focus on competitor products, category structure, and market trends give you a time advantage that seller dashboards simply can’t.

Shopdora doesn’t replace Shopee’s backend—it complements it by showing what Shopee itself doesn’t show you: how other sellers are performing, how categories evolve, and where real opportunities or risks are forming.

That shift—from self-focused analytics to market-focused analysis—is what separates sellers who react from sellers who plan.

How This Changed My Day-to-Day Decisions as a Seller

Today, before I consider launching, expanding, or even heavily promoting a product, I always start from the same place: market analysis first, product analysis second, execution last.

I use Market Analysis to decide whether a category is worth entering. I use Comprehensive Analysis to understand how products in that category succeed or fail. Only then do I look inward at my own costs, branding, and supply chain.

This approach hasn’t made selling easier—but it has made it far more predictable. I waste less money testing dead-end ideas, and I feel more confident doubling down when the data supports it.

For me, that’s what good Shopee analysis tools are supposed to do: reduce uncertainty, not just display numbers.

Final Thoughts

If you’re a Shopee seller relying only on your seller center, you’re playing with partial information. You’re reacting to your own performance without understanding the environment shaping it.

True analytics starts when you step outside your own store and look at the market as it really is—competitive, dynamic, and often unforgiving to guesswork.

Tools like Shopdora exist not to make selling effortless, but to make decision-making clearer. And in a platform as competitive as Shopee, clarity is often the biggest advantage you can get.

If you’ve ever felt like you’re working hard but still unsure why some products succeed while others don’t, the answer usually isn’t inside your dashboard. It’s in the market you’re competing in.