Shopee Brazil Potential Product Categories – January 2026

Data-Backed Opportunities Based on Shopee Analytics and Market Growth

As Shopee continues to expand its presence in Brazil, early identification of high-potential product categories has become a key advantage for sellers planning their 2026 strategy.

Rather than looking only at historical best sellers, this article focuses on emerging and fast-growing categories on Shopee Brazil in January 2026, selected through data-driven filters that balance growth, competition, and market structure.

All insights in this report are based on Shopee analytics data provided by Shopdora, a third-party market intelligence platform.

👉 Click to Visit Shopdora

How These Potential Categories Were Selected (Methodology)

To ensure practical value for sellers, the categories highlighted in this report were filtered using the following criteria (as shown in Figure 1):

- Monthly sold growth ≥ 8%

- Shop concentration < 50%

- Brand concentration < 50%

- Top product sales proportion < 50%

These conditions help identify categories that are:

- Actively growing

- Not dominated by a small number of shops or brands

- Still open to new entrants with competitive listings

This approach goes beyond identifying current best selling products and focuses on scalable opportunities supported by market structure data.

Overview of Shopee Brazil Market Trends – January 2026

Shopee Brazil’s January 2026 data reveals several clear signals:

- Strong demand for everyday-use products and functional accessories

- Rapid growth in lightweight, frequently replaced items

- Continued preference for mid-to-low price ranges with clear utility

- Multiple categories showing healthy growth without excessive concentration

This makes Brazil an ideal market for sellers who rely on analytics Shopee data rather than short-term trends.

Top Potential Product Categories on Shopee Brazil (January 2026)

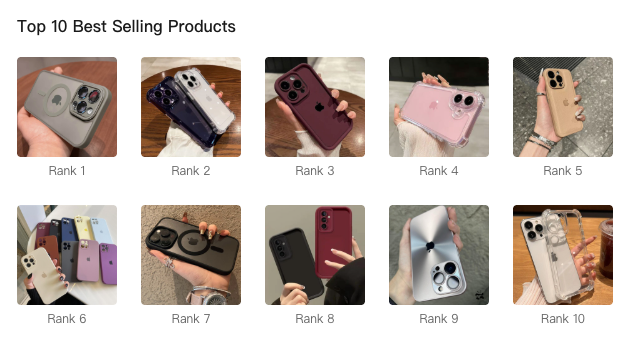

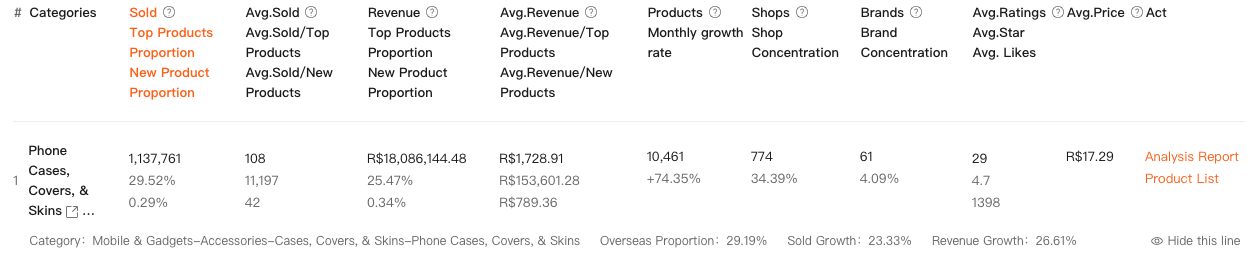

1. Phone Cases, Covers & Skins

Mobile accessories continue to show stable demand with strong growth momentum.

Key data highlights:

- Monthly sold growth above 20%

- Top products account for less than 30% of total sales

- Low brand concentration, indicating room for differentiation

Why it’s a strong opportunity:

High replacement frequency and clear model-based demand keep this category evergreen.

Seller tip:

Focus on model-specific listings and material clarity to stand out in search results.

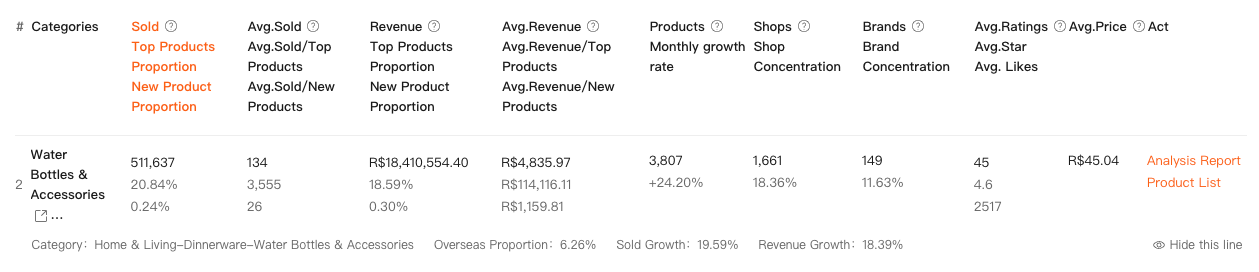

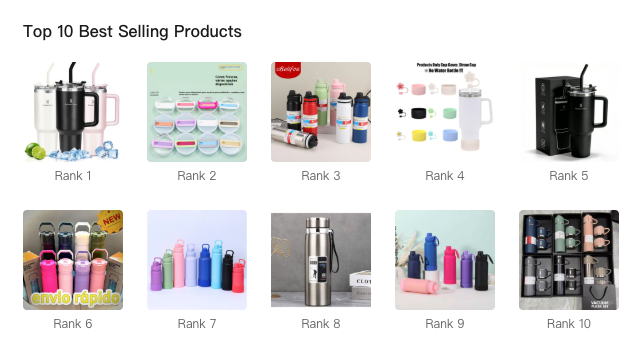

2. Water Bottles & Accessories

This category combines practical daily use with consistent growth.

Key data highlights:

- Over 500,000 units sold

- Stable revenue growth with low concentration

- Strong average ratings and engagement

Why it’s a strong opportunity:

Health awareness and daily commuting habits support long-term demand.

Seller tip:

Highlight capacity, material (BPA-free), and usage scenarios.

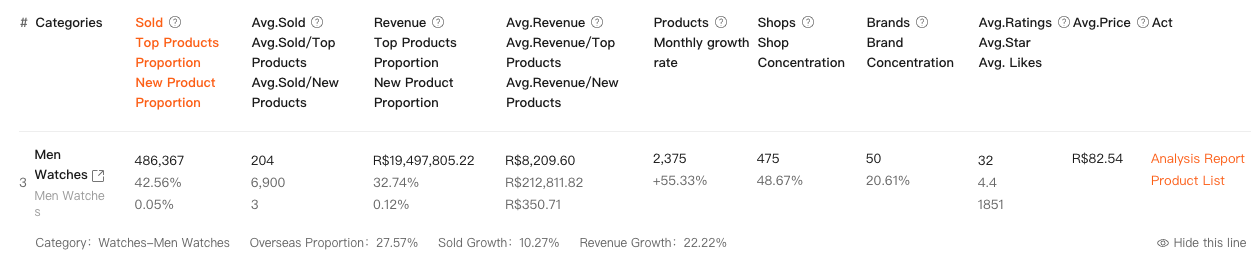

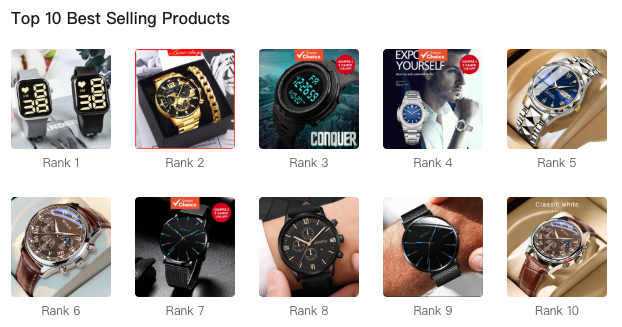

3. Men’s Watches

Men’s watches show balanced growth and healthy pricing power.

Key data highlights:

- Revenue growth above 20%

- Moderate shop concentration (~48%)

- Average selling price significantly higher than many accessories

Why it’s a strong opportunity:

Affordable watches combine fashion appeal with gift-oriented purchasing behavior.

Seller tip:

Clear visuals and specification tables improve trust and conversion.

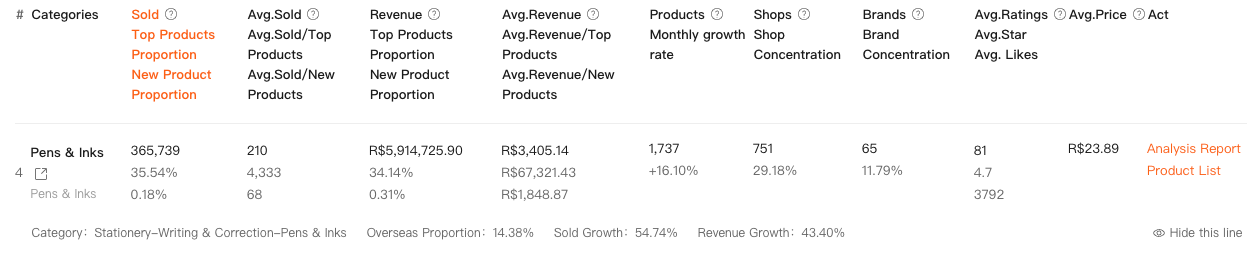

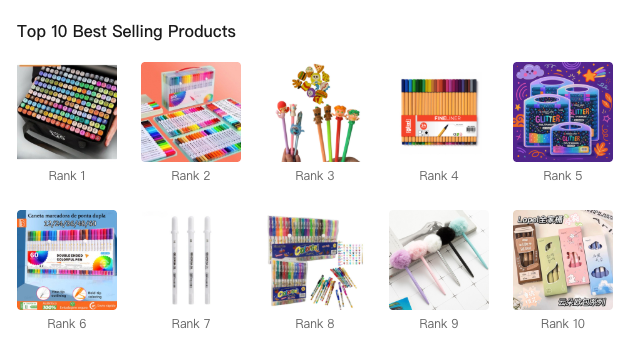

4. Pens & Inks (Stationery)

Stationery products demonstrate unexpectedly strong momentum.

Key data highlights:

- Sold growth exceeding 50%

- Low top-product dominance

- High number of active shops, indicating demand breadth

Why it’s a strong opportunity:

Used in schools, offices, and home settings, this category benefits from repeat purchases.

Seller tip:

Bundle packs and usage positioning (school, office, art) perform better than single-item listings.

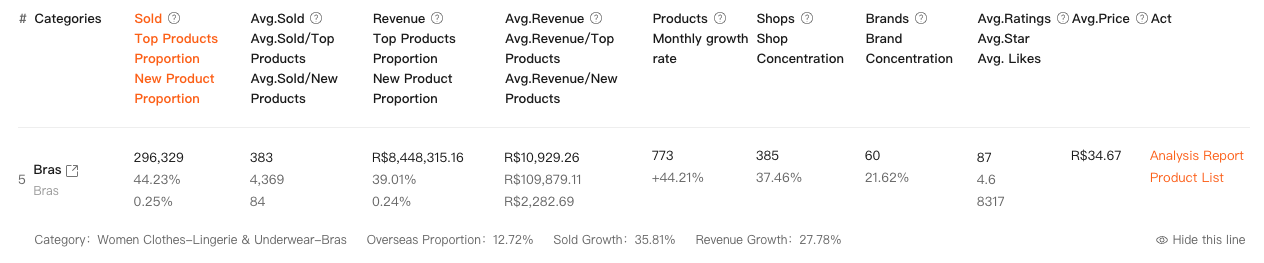

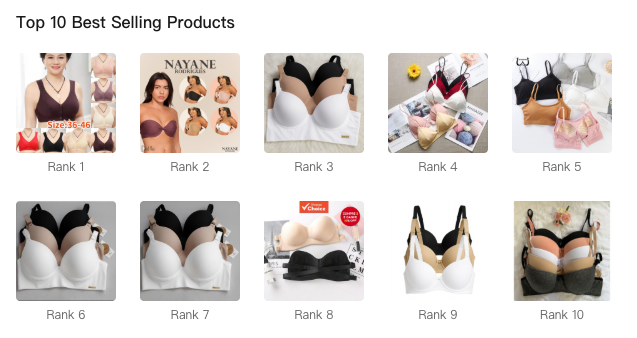

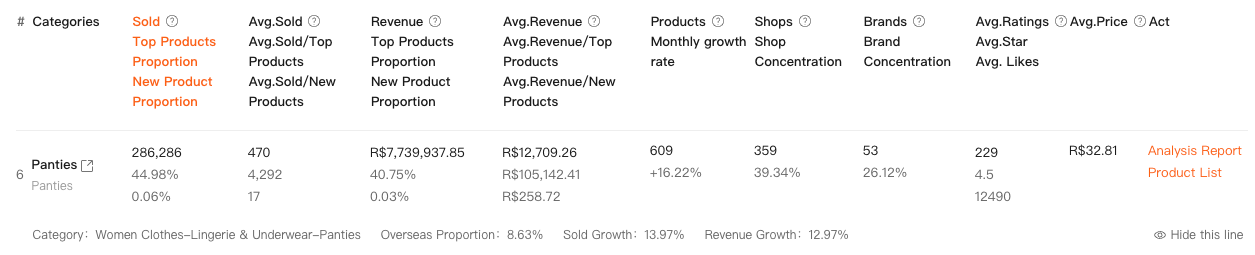

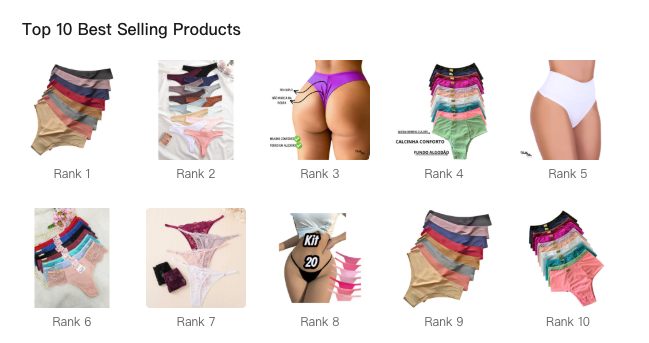

5. Bras and Panties (Lingerie Basics)

Core apparel essentials continue to grow steadily.

Key data highlights:

- Monthly growth above 15%

- Relatively balanced brand distribution

- High engagement and review volume

Why it’s a strong opportunity:

Basic apparel items are less trend-dependent and generate repeat demand.

Seller tip:

Sizing accuracy and material transparency are critical for reviews and ranking.

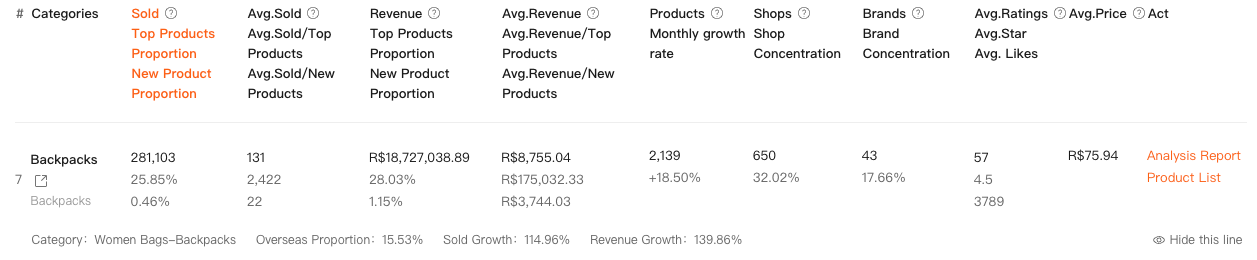

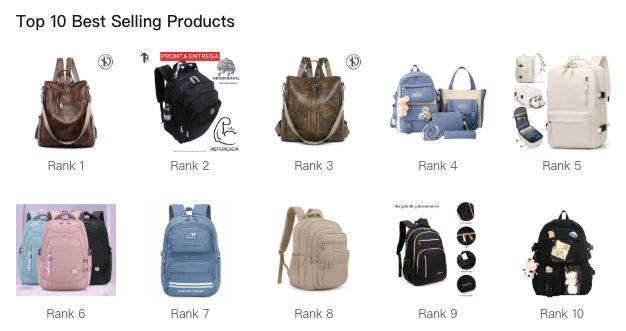

6. Backpacks

Backpacks show strong acceleration in both sales and revenue.

Key data highlights:

- Sold growth exceeding 100%

- Revenue growth close to 140%

- Moderate concentration levels

Why it’s a strong opportunity:

Demand is driven by school, commuting, and casual travel use cases.

Seller tip:

Segment listings clearly by usage (school, work, travel).

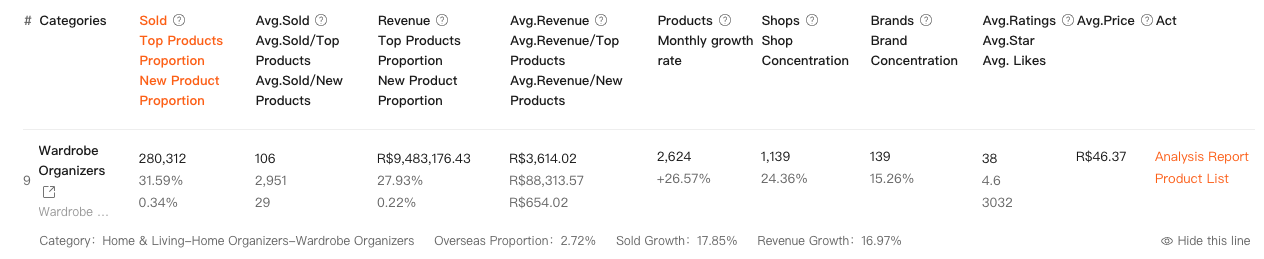

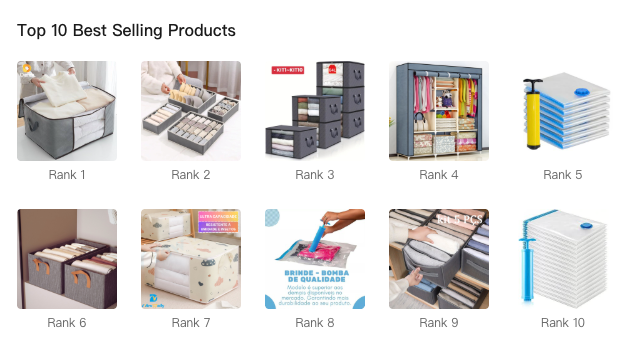

7. Wardrobe Organizers

Home organization products remain a low-risk expansion category.

Key data highlights:

- Stable double-digit growth

- Low overseas proportion, indicating local demand

- Healthy average pricing

Why it’s a strong opportunity:

Urban living and storage needs support consistent sales.

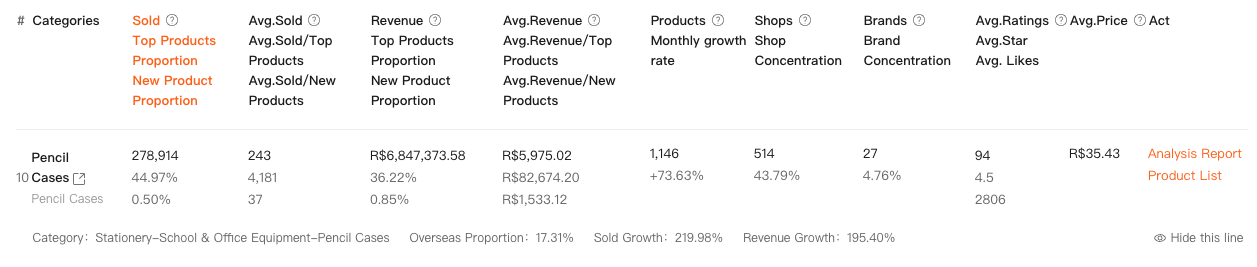

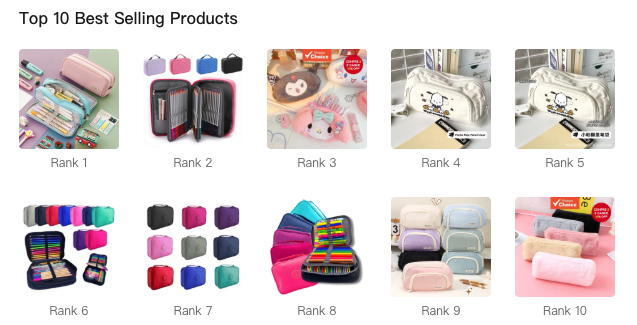

8. Pencil Cases

A fast-growing niche within stationery.

Key data highlights:

- Sold growth above 70%

- Revenue growth near 200%

- Very low brand concentration

Why it’s a strong opportunity:

Small size, low shipping cost, and strong appeal to students.

What This Means for Shopee Sellers in 2026

Focus on Market Structure, Not Just Volume

Categories with moderate competition and distributed demand often outperform saturated “hot” niches in the long run.

Use Data to Time Your Entry

January data is particularly valuable for identifying early-year momentum, allowing sellers to build rankings before peak seasons.

Build Depth Within a Category

Instead of launching many unrelated products, expanding variations within one strong category improves visibility and store authority.

Data Source & Transparency

All category insights in this article are based on Shopdora’s Shopee analytics, including sold growth, revenue trends, shop concentration, and brand concentration metrics.

📊 Data source: Shopdora – Shopee Market Analytics Platform

🔗 Click to Visit Shopdora

Conclusion

Shopee Brazil’s January 2026 data shows that opportunity lies where growth meets low concentration. Categories such as phone accessories, water bottles, stationery, backpacks, and home organizers offer sellers a strong balance between demand and competition.

For sellers aiming to capture 2026 growth, leveraging analytics Shopee data rather than intuition will be the defining factor between short-term sales and sustainable success.