Shopee Competitor Analysis: How I Break Down Competitors Without Guessing

Hi, I’m David.

I’ve been selling on Shopee for a little over three years — not as an agency, not as a course seller, but as a solo seller running my own store day in, day out. I’ve launched products that failed, fixed listings that were “dead,” and spent more time than I’d like to admit staring at competitor pages, trying to figure out why they were selling and I wasn’t.

This article is based on how I personally do Shopee competitor analysis today — using Shopdora, not guesswork, screenshots, or gut feeling.

Why “Shopee Competitor Analysis” Is Harder Than It Looks

Most sellers say they want to analyze competitors, but what they usually mean is:

- “Why is this product selling so well?”

- “Should I copy their price?”

- “Is their traffic organic or paid?”

- “Am I losing because of my listing, or because the market is saturated?”

The problem is that Shopee’s front-end only shows surface-level signals: price, sales count, reviews.

Real competitor analysis needs structure, not vibes.

This is where I rely on Shopdora — specifically three functions that work together:

- Find Similar

- Traffic Analysis

- Comprehensive Analysis

Step 1: Identify Real Competitors (Not Just Lookalikes)

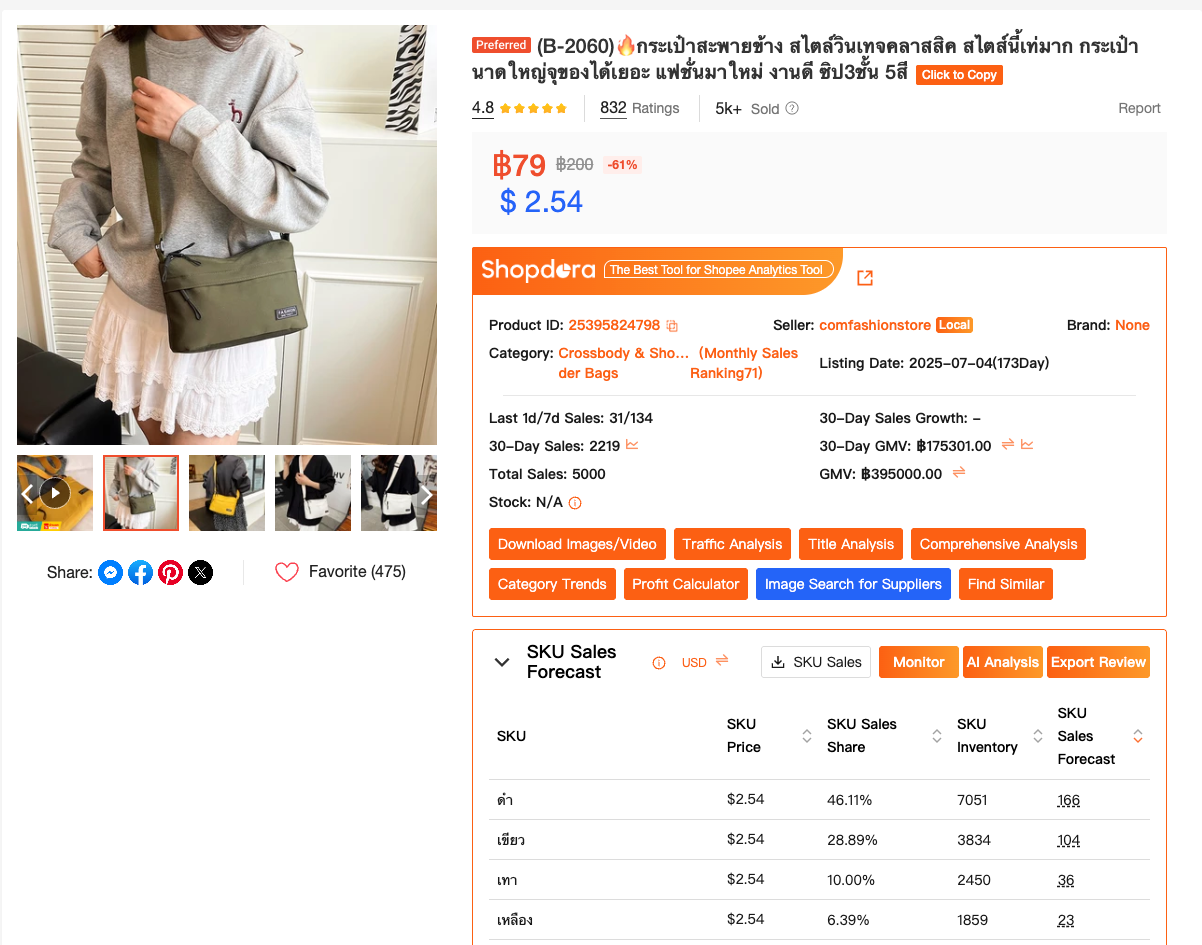

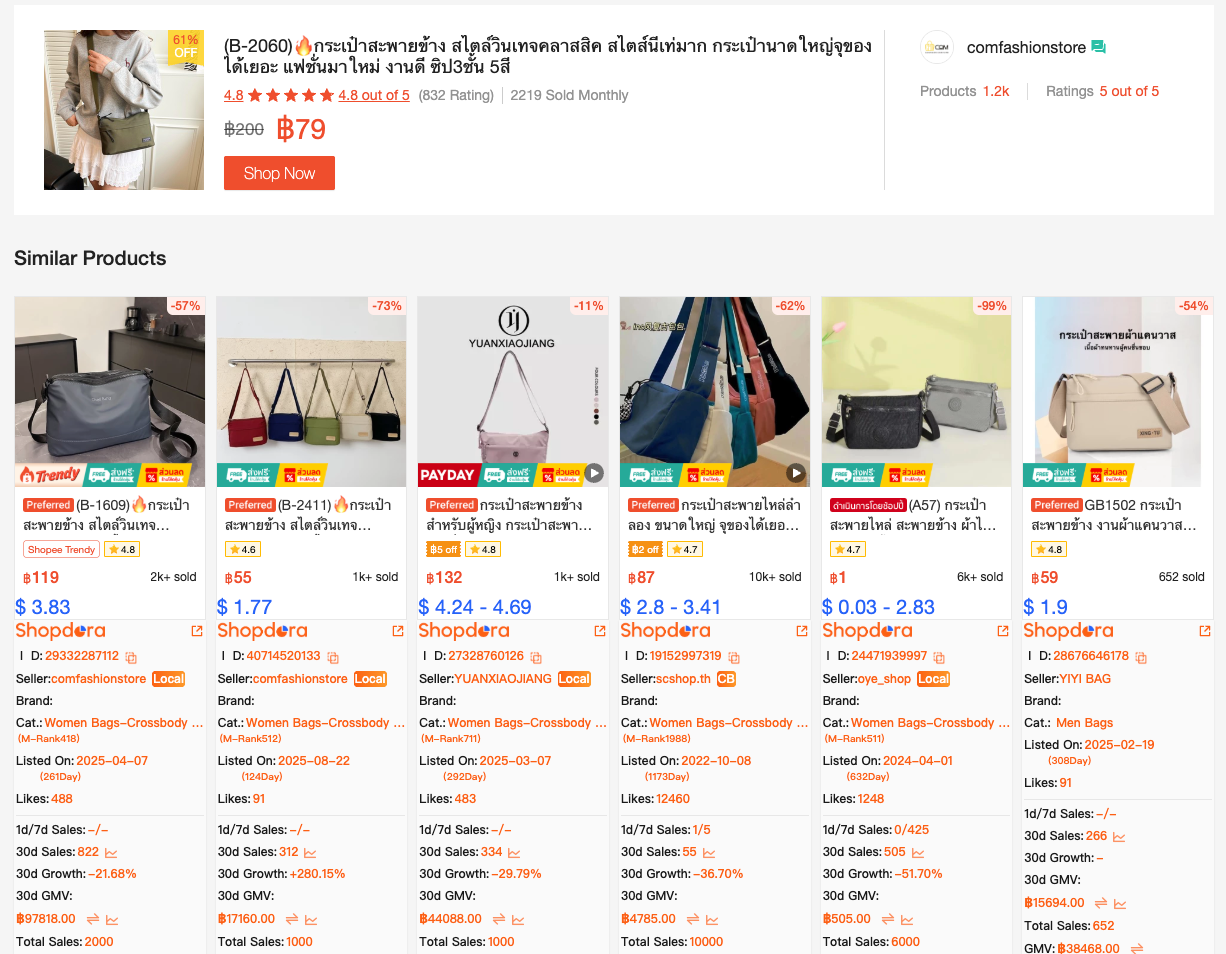

Tool used: Shopdora – Find Similar

When I analyze competitors, the first mistake I used to make was comparing myself with everything in the category. That’s useless.

With Shopdora’s Find Similar, I click directly on my product (or any competitor’s product) and instantly see:

- Highly similar listings on Shopee

- Their prices, sales, reviews, and listing age

- Which sellers are actually moving volume, not just existing

This step matters because Shopee competitor analysis only works if you’re comparing apples to apples.

What I’m looking for here:

- Sellers with similar positioning but higher sales

- Products launched later than mine but already outperforming

- Listings priced close to mine but converting better

Once I shortlist 2–3 real competitors, I move to the next step.

Step 2: Understand Where Their Traffic Comes From

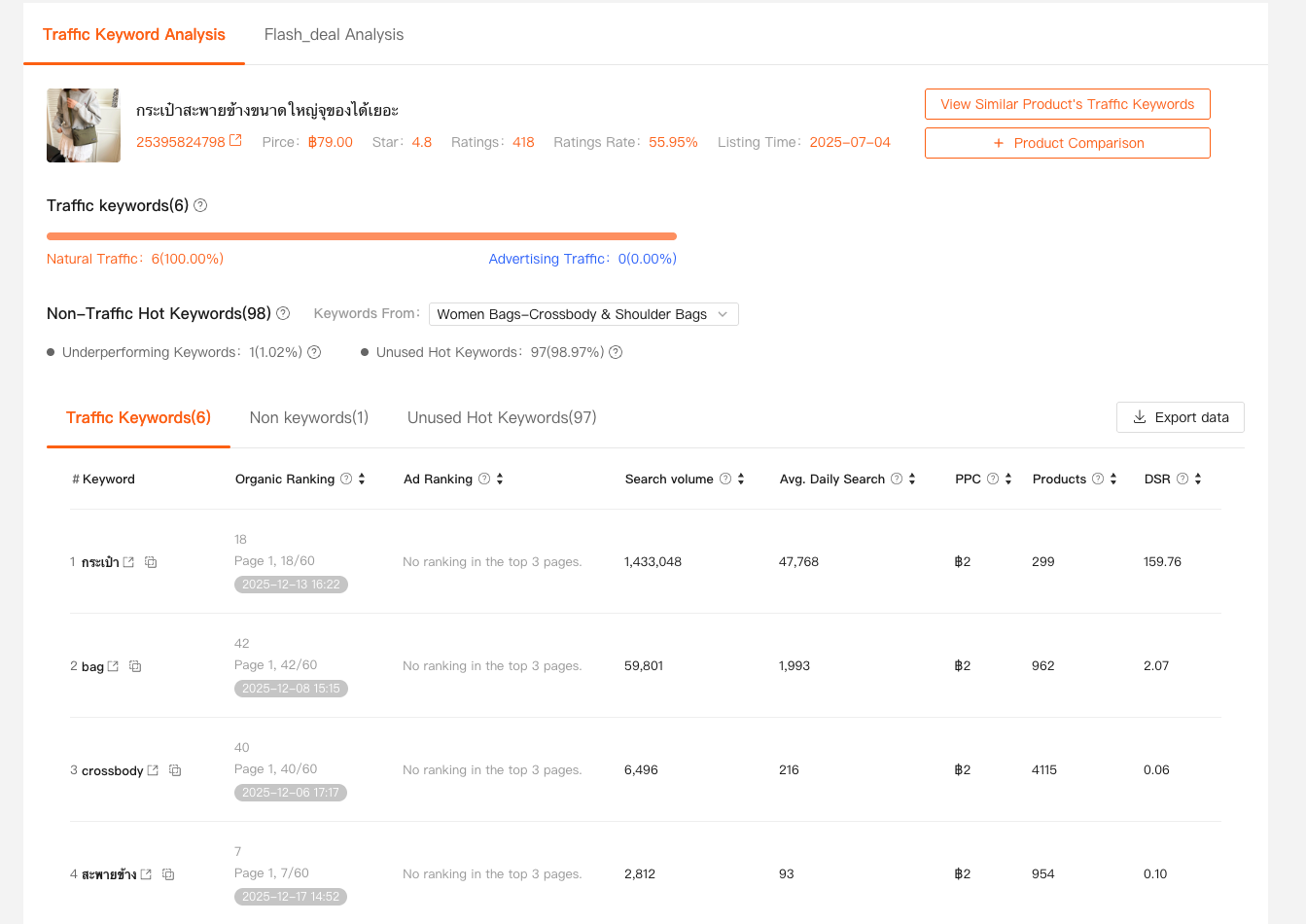

Tool used: Shopdora – Traffic Analysis

This is where most sellers’ competitor analysis stops — but for me, this is where it starts.

Inside Traffic Analysis, Shopdora shows me:

- Natural traffic vs. advertising traffic ratio

- Keywords that actually bring traffic to the competitor

- Organic ranking and ad ranking for each keyword

- Search volume, daily searches, PPC reference, and competition level

Here’s why this matters.

I’ve seen competitors with:

- High sales but 80% ad-driven traffic

- Strong rankings on long-tail keywords, not main keywords

- Titles stuffed with keywords that bring zero traffic

This tells me things like:

- Whether the competitor is profitable or burning ads

- Whether their growth is sustainable

- Which keywords are working in real life, not just “popular”

A key insight I often find

Some competitors rank well not because their product is better, but because:

- Their title structure matches how users actually search

- They picked the right traffic keywords early

That’s actionable intelligence.

Step 3: Track Competitor Behavior Over Time (Not Just Today)

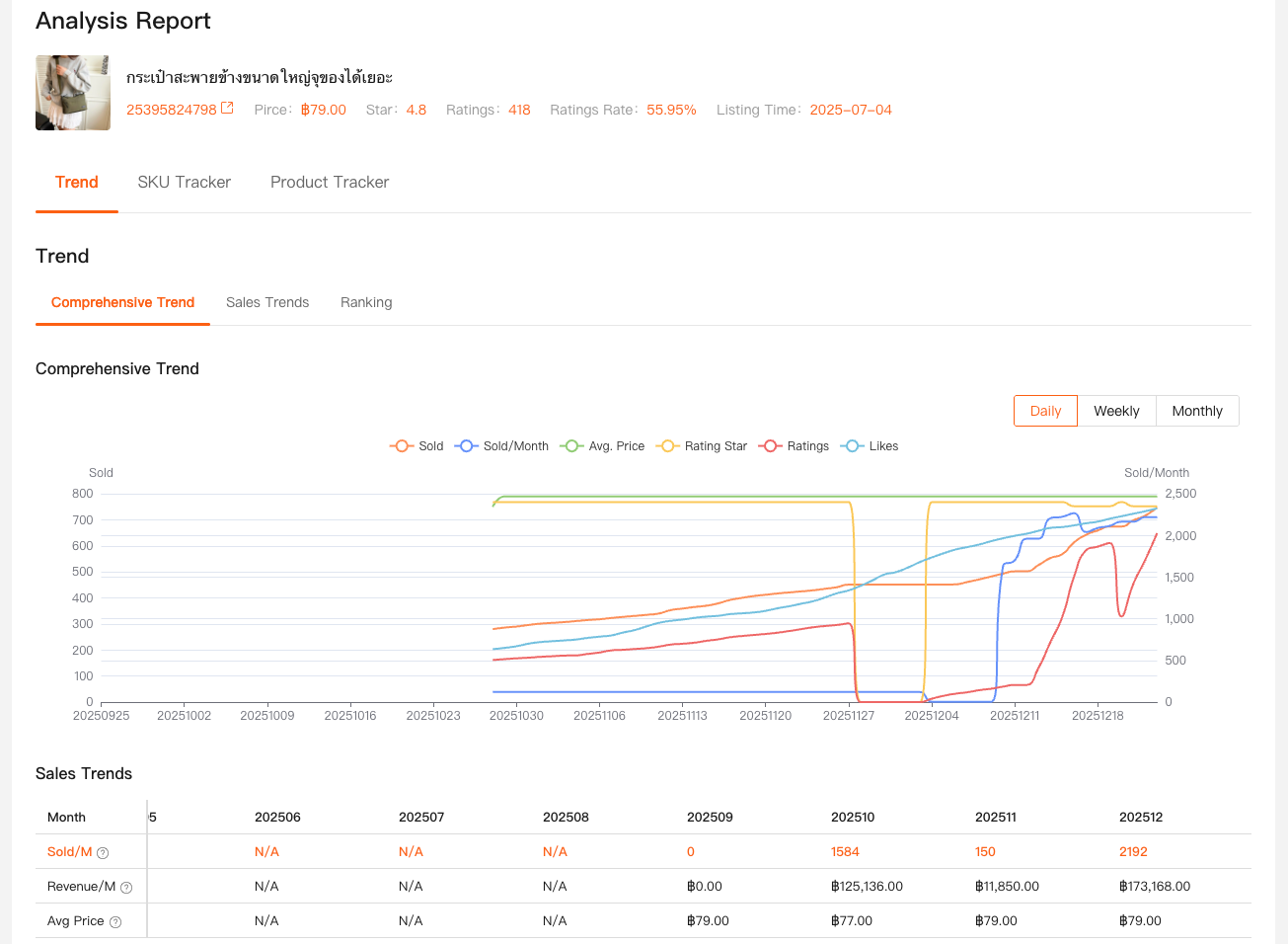

Tool used: Shopdora – Comprehensive Analysis

Shopee is dynamic. A snapshot is not enough.

With Comprehensive Analysis, I can track:

- Sales and revenue trends (daily, weekly, monthly)

- Price changes over time

- Category and product ranking movement

- SKU-level price changes

- Listing updates and inventory signals

This changes how I interpret competitors.

For example:

- If sales spike after a price drop → price-sensitive market

- If rankings improve without price change → traffic or content optimization

- If price keeps dropping → race to the bottom (usually not worth joining)

This helps me answer questions like:

- “Is this competitor actually winning, or just short-term pushing volume?”

- “Should I match their price, or differentiate instead?”

- “Is this market growing, or peaking?”

That’s real Shopee competitor analysis, not surface copying.

How I Turn Competitor Analysis Into Action

Here’s how these three Shopdora functions work together in practice:

- Find Similar → Identify who to analyze

- Traffic Analysis → Understand why they’re getting traffic

- Comprehensive Analysis → Decide whether their strategy is worth following

Instead of copying blindly, I usually end up doing one of three things:

- Adjust my keyword focus, not my price

- Optimize my listing structure, not my product

- Avoid a category that looks profitable on the surface but is actually ad-heavy

That’s the difference between reacting and making decisions.

Why I Trust This Process

I didn’t build this workflow overnight. It came from:

- Losing money chasing the wrong competitors

- Copying prices that didn’t work

- Entering categories that looked hot but weren’t sustainable

Shopdora didn’t magically make me profitable — but it removed blind spots.

If you’re serious about Shopee competitor analysis, tools matter because:

- Shopee doesn’t show you the full picture

- Gut feeling doesn’t scale

- One wrong assumption can cost months

Final Thoughts

I still analyze competitors every week. The difference now is that I don’t guess.

I look at:

- Who’s actually competing with me

- Where their traffic really comes from

- Whether their success is structural or temporary

And for that, Shopdora’s Find Similar, Traffic Analysis, and Comprehensive Analysis are the tools I rely on daily.