Shopee Data Analytics: How I Finally Understood the Market, Not Just My Store

Hi, I’m David. I’ve been running my own Shopee store for a little over three years now. No agency, no team—just me, my laptop, and a lot of trial and error. If you’ve sold on Shopee long enough, you’ll probably relate to this feeling: you work hard, optimize listings, tweak ads, but at some point growth slows down and you don’t really know why.

That was exactly where I got stuck.

Seller Center kept telling me how my shop was performing. Orders, revenue, conversion rate—it all looked reasonable. But what it couldn’t tell me was the one thing I needed most: what was happening in the market outside my store. And without that context, every decision felt like a guess.

This is where Shopee data analytics stopped being a “nice to have” and became essential for me.

When Store-Level Data Is No Longer Enough

For a long time, I believed that if I just optimized better than my competitors, results would follow. Better titles, cleaner images, more reviews. But Shopee isn’t a closed system where effort automatically equals reward. It’s a competitive marketplace, and performance is always relative.

The turning point came when one of my products plateaued. It wasn’t dropping dramatically, but it wasn’t growing either. I couldn’t tell whether the problem was my pricing, my positioning, or the category itself. Seller Center gave me no answers because it has no visibility into competitors or overall market trends.

That was the first time I seriously started looking into Shopee data analytics tools that focus on market-level insight, not just store operations. That’s how I ended up using Shopdora.

Understanding the Market Before Touching the Product

The first feature that changed how I think was Market Analysis.

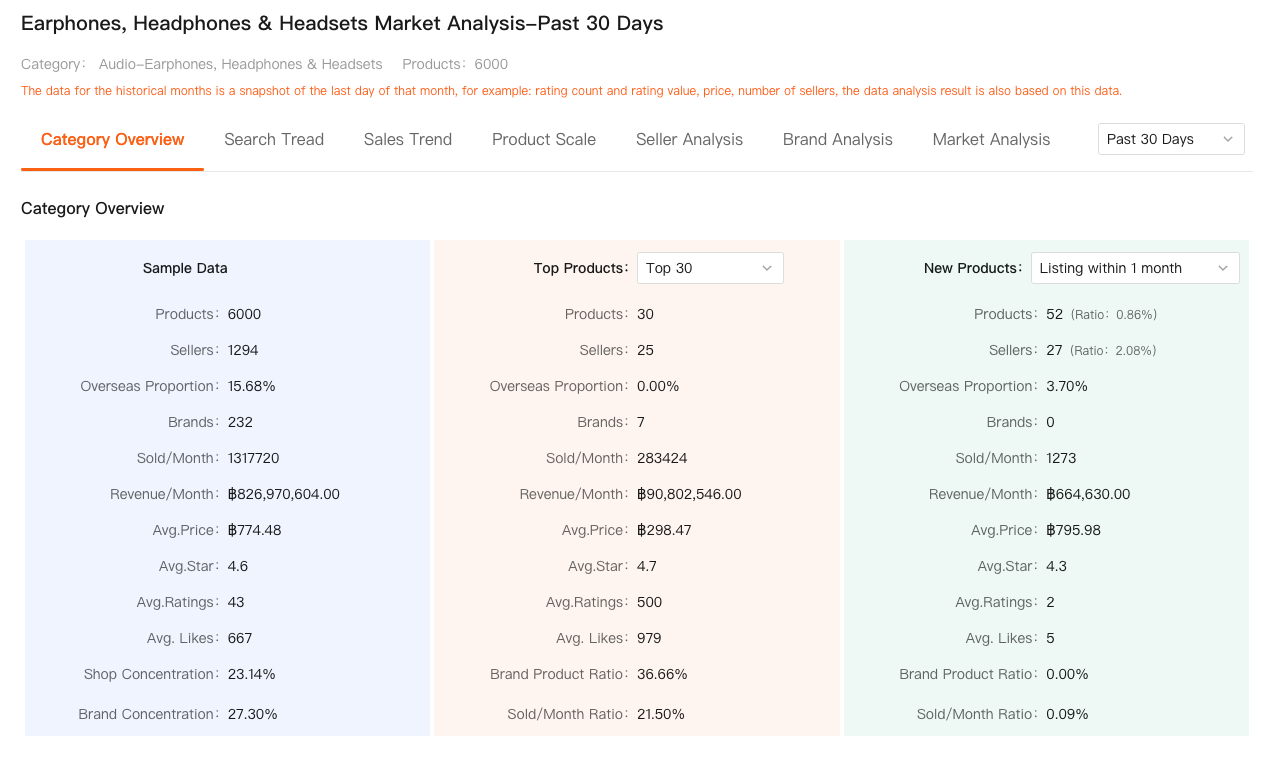

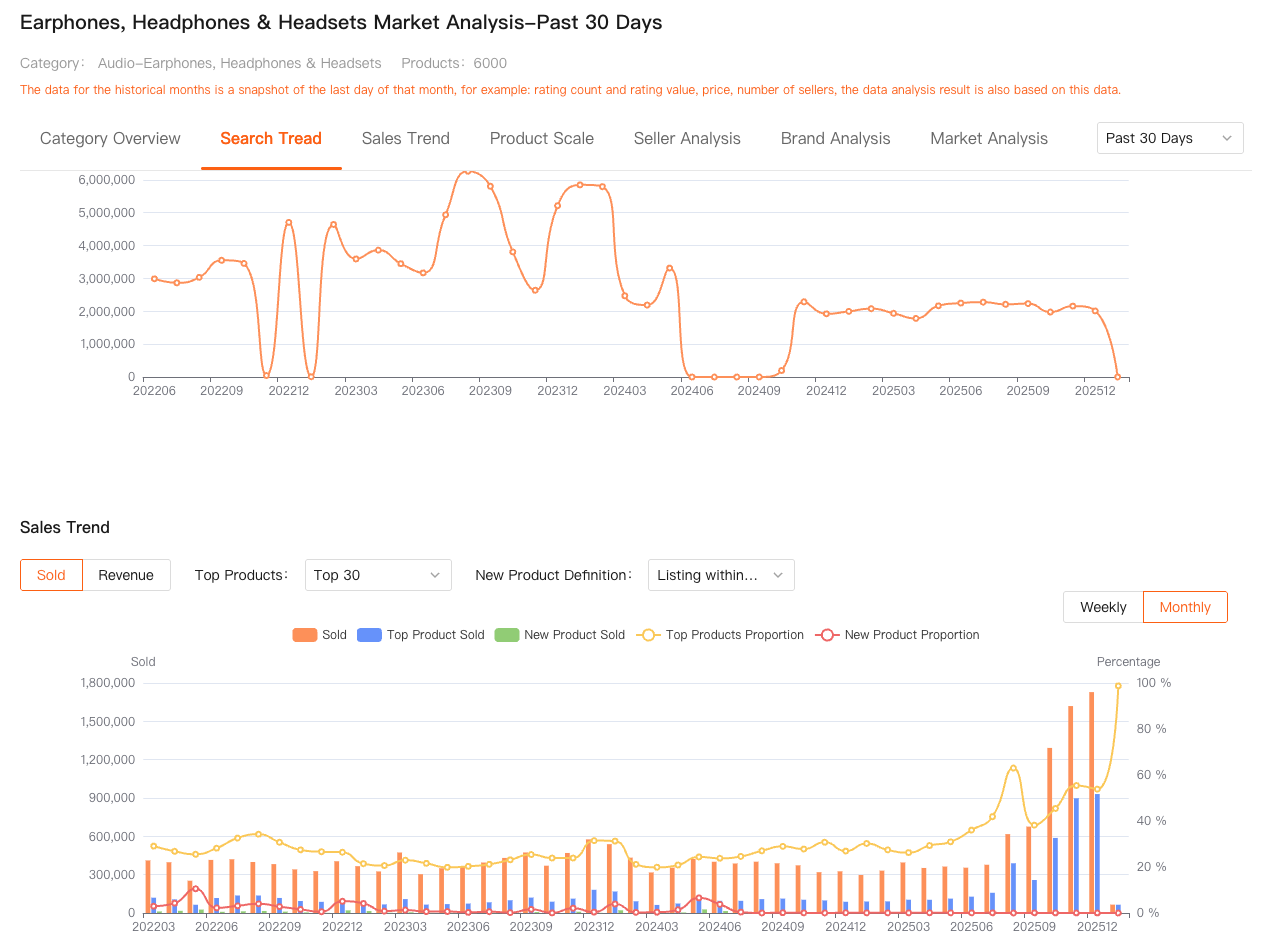

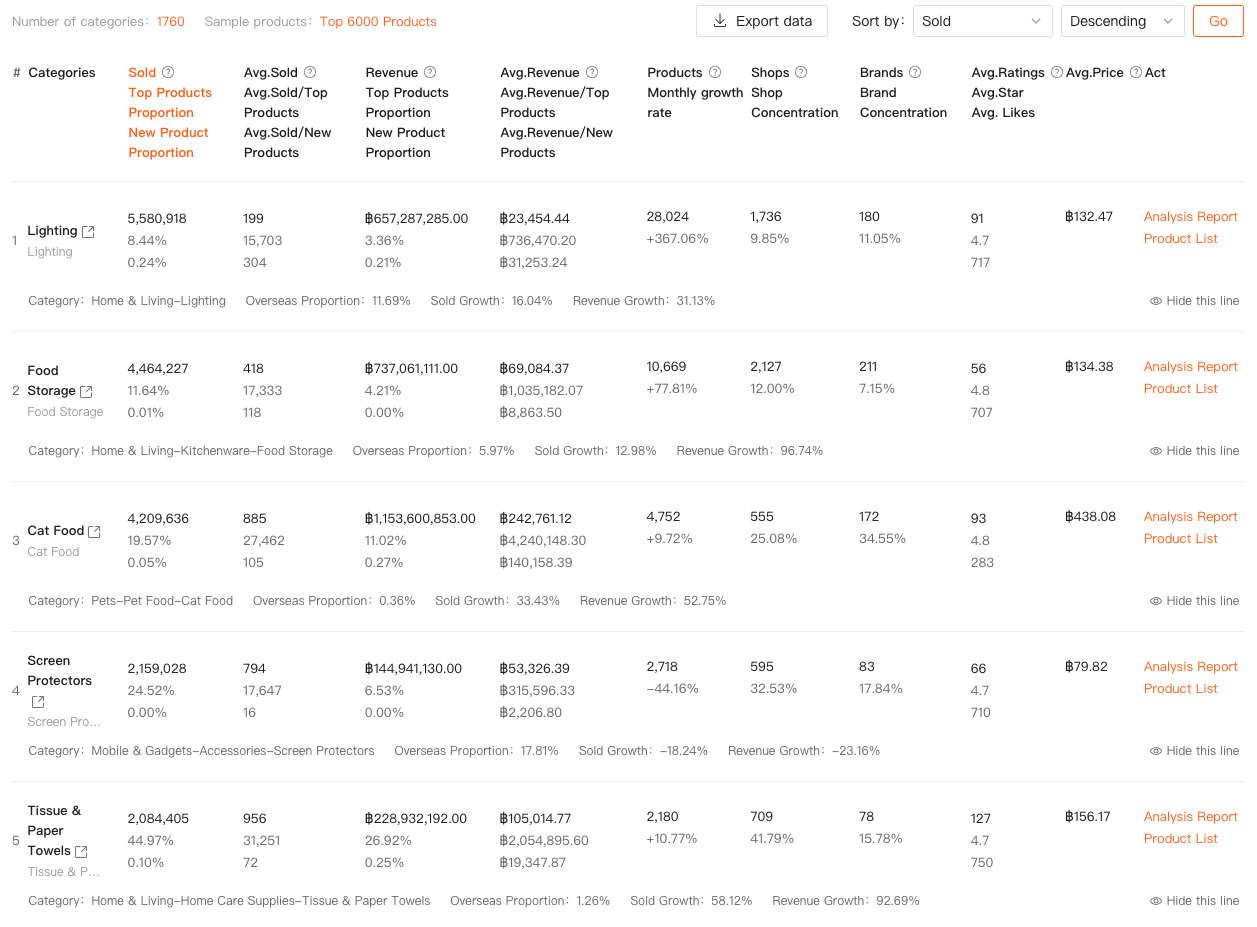

Instead of starting with my product, I started with the category. Market Analysis allowed me to see overall category trends—whether demand was growing or shrinking, how competitive the space was becoming, and how concentrated sales were among top sellers.

One category I had been planning to expand into looked promising on the surface. Products were selling well, and prices seemed healthy. But when I checked the market data, I noticed something important: growth had slowed significantly, and sales were heavily concentrated among a few dominant players. New listings were increasing, but their sales contribution was minimal.

That insight alone saved me months of wasted effort.

Shopee data analytics, when done right, isn’t about telling you what to sell—it’s about telling you what not to chase. Market Analysis helped me step back and ask a more strategic question: does this market actually have room for me?

Category-Level Decisions Beat Product-Level Guessing

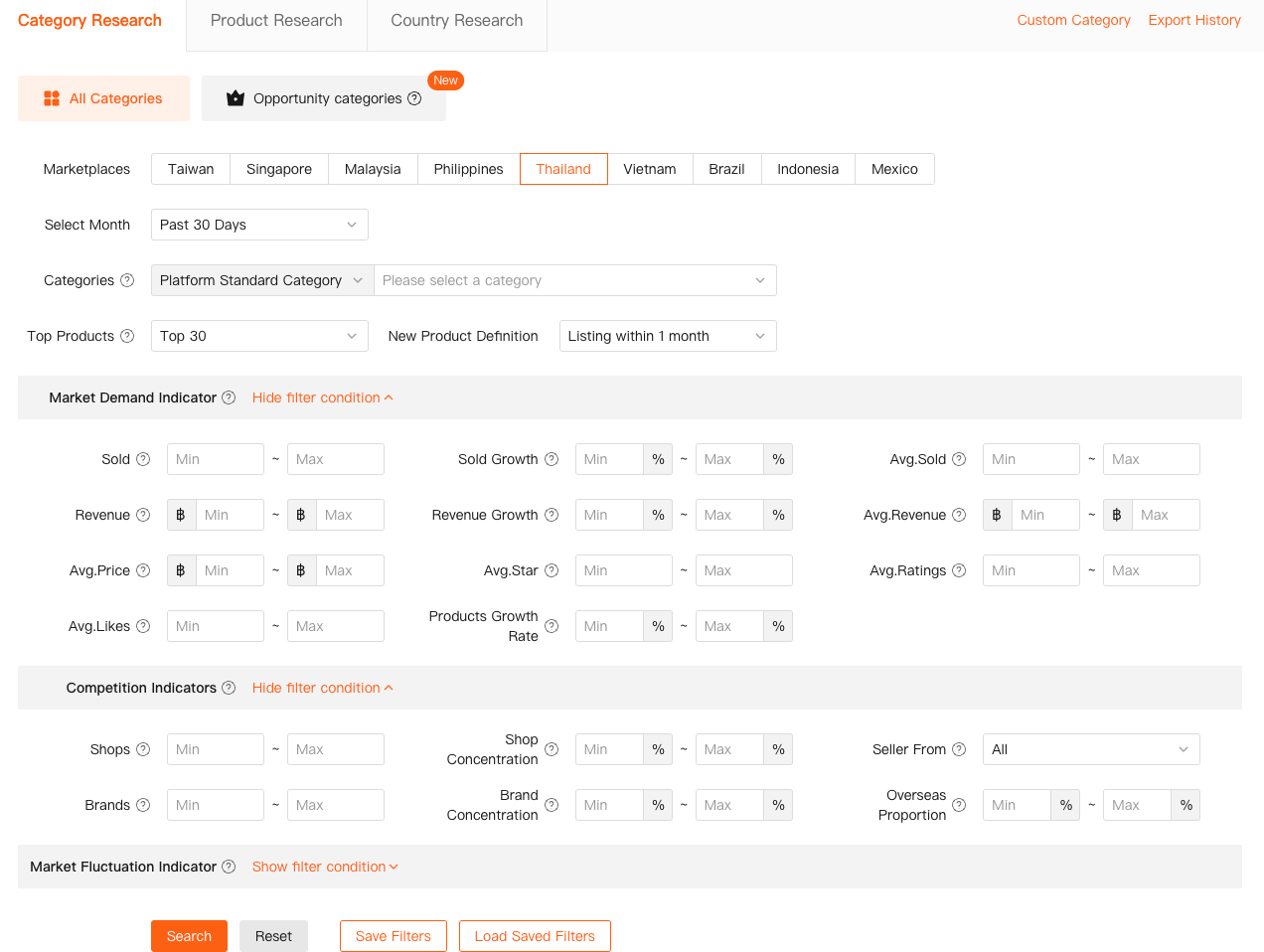

Later on, I started using Category Research, and this is where things became even clearer.

Category Research allowed me to filter categories by site, time range, and multiple indicators—market size, growth, competition structure, and the role of new products. Instead of relying on intuition or random browsing, I could systematically narrow down categories that matched my risk tolerance and resources.

I remember comparing two categories that looked almost identical in revenue size. One had higher total sales, but the other showed healthier growth and a more balanced competition structure. Fewer dominant brands, lower concentration, and a stronger performance from newer products.

Without category-level Shopee data analytics, I would have chosen the bigger-looking category and struggled. Instead, I entered the one with better long-term potential, and results came faster than expected.

What I like about this approach is that it shifts your mindset. You’re no longer “finding products.” You’re evaluating markets. That’s a much more sustainable way to build a store.

Putting Individual Products Into Context

Once I had a clear category direction, I still needed to understand how individual products behaved inside that market. This is where Comprehensive Analysis came in.

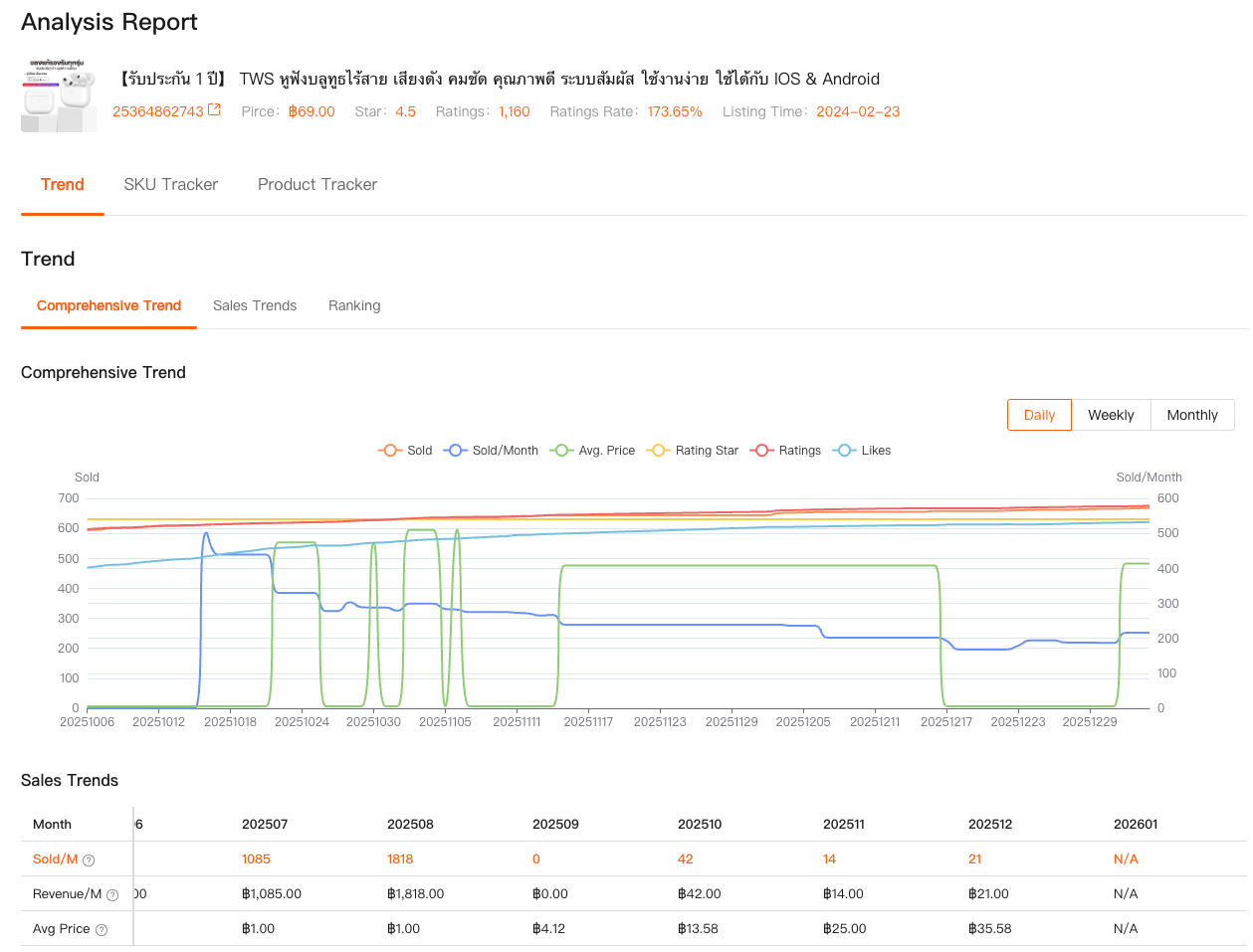

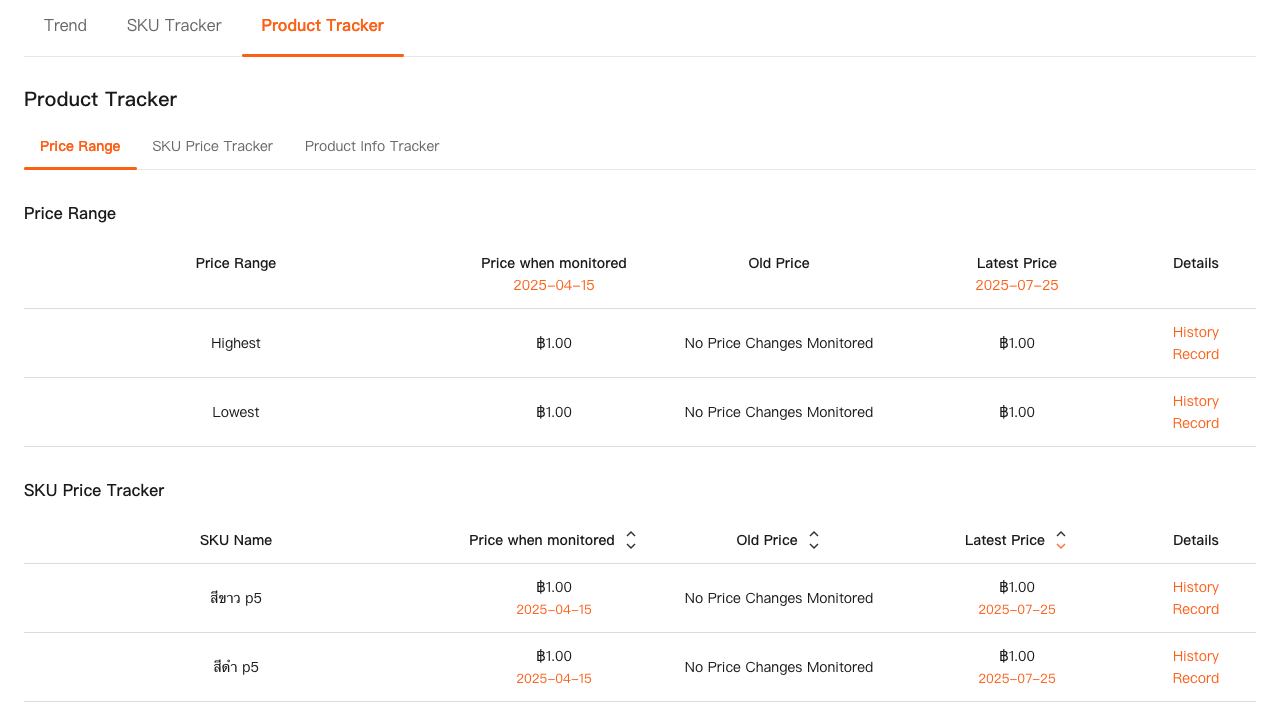

Rather than focusing on daily fluctuations, Comprehensive Analysis allowed me to track longer-term performance trends of products—sales movement, ranking stability, and lifecycle patterns. I used it to compare my listings with competing products that seemed similar at first glance.

One competitor consistently outsold me, which initially made me feel behind. But when I looked at the historical data, I realized their sales were heavily promotion-driven, with sharp spikes and equally sharp drops. My product, while slower, showed steady and predictable growth.

That changed my strategy completely. Instead of reacting emotionally, I leaned into stability—adjusting inventory planning, pricing cadence, and promotion timing with more confidence.

This is something Seller Center simply cannot provide. Shopee data analytics only becomes meaningful when you can view performance over time and relative to the market.

Fewer Reactions, Better Decisions

The biggest change for me wasn’t a single winning product—it was how I started making decisions.

Before, a dip in sales would trigger immediate action: change prices, increase ads, rewrite titles. Now, my first response is to check the data. Is the whole category slowing down? Are competitors experiencing the same pattern? Is this seasonal behavior or a structural shift?

By combining Market Analysis, Category Research, and Comprehensive Analysis, I stopped reacting to noise and started responding to signals. That alone reduced wasted ad spend and unnecessary listing changes.

Shopdora didn’t “tell me what to do.” It gave me enough context to decide why I should do something—or why I shouldn’t.

Final Thoughts

I’m not a data scientist. I don’t enjoy staring at spreadsheets for fun. What I care about is clarity. And after years of selling on Shopee, I’ve learned that clarity rarely comes from looking inward—it comes from understanding the market you’re part of.

Shopee data analytics gave me that perspective. Not overnight, and not magically—but consistently enough that my decisions became calmer, more strategic, and more sustainable.

If you’re at a stage where effort alone no longer guarantees growth, the issue might not be your execution. It might be that you’re missing the bigger picture.

And once you see that picture clearly, everything else starts to make a lot more sense.