Shopee Data Most Sellers Are Still Missing

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now, and like most sellers, I didn’t start with “data.” I started with instinct.

At the beginning, Shopee felt simple. You list products, tweak prices, run ads, and wait. When something sells, you double down. When it doesn’t, you move on. For a while, that worked. But eventually, my store hit a ceiling. Sales became inconsistent, and every decision started to feel like a gamble.

That was the moment I realized something uncomfortable: I wasn’t lacking effort — I was lacking real Shopee data.

And no, I don’t mean the numbers inside Seller Center.

The Shopee Data Sellers Think They Have (But Don’t)

Shopee gives sellers a lot of numbers. Orders, clicks, impressions, conversion rates — all useful, but painfully limited. Everything you see is your own store, your own SKUs, your own performance.

What you don’t see is the market.

You don’t know how many similar products are selling across Shopee.

You don’t know whether a category is growing or quietly declining.

You don’t know if competitors are winning because of demand — or because they got in early.

For a long time, I confused “having data” with “having visibility.” In reality, I was making decisions in the dark.

That’s where my understanding of Shopee data completely changed.

Why Market-Level Shopee Data Changes Everything

The first shift for me came when I stopped asking, “How is my product doing?” and started asking, “What is the market doing?”

This is a critical difference.

When you only look at your own numbers, every result feels personal. A drop in sales feels like a failure. A spike feels like success. But without market-level Shopee data, you don’t know whether those changes are caused by seasonality, competition, or real demand shifts.

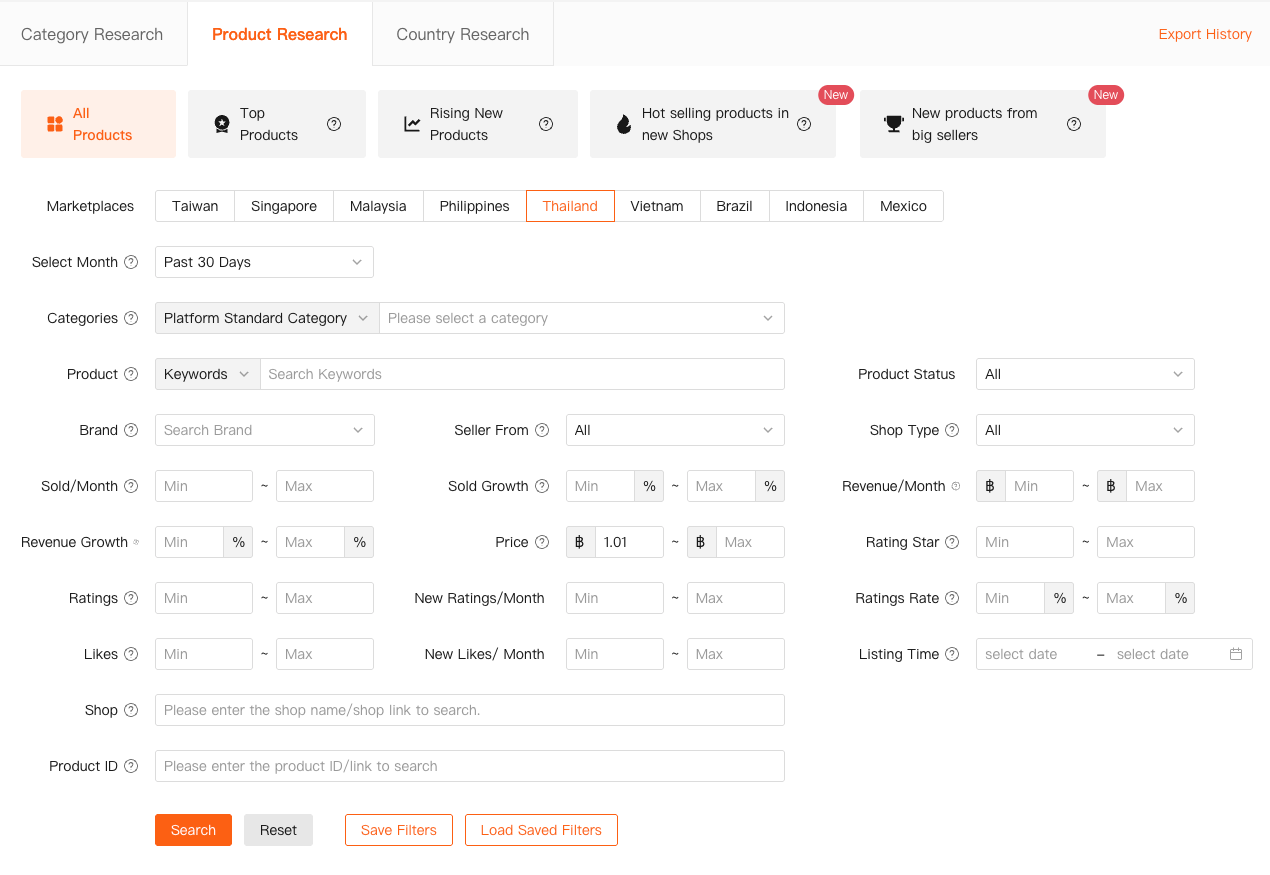

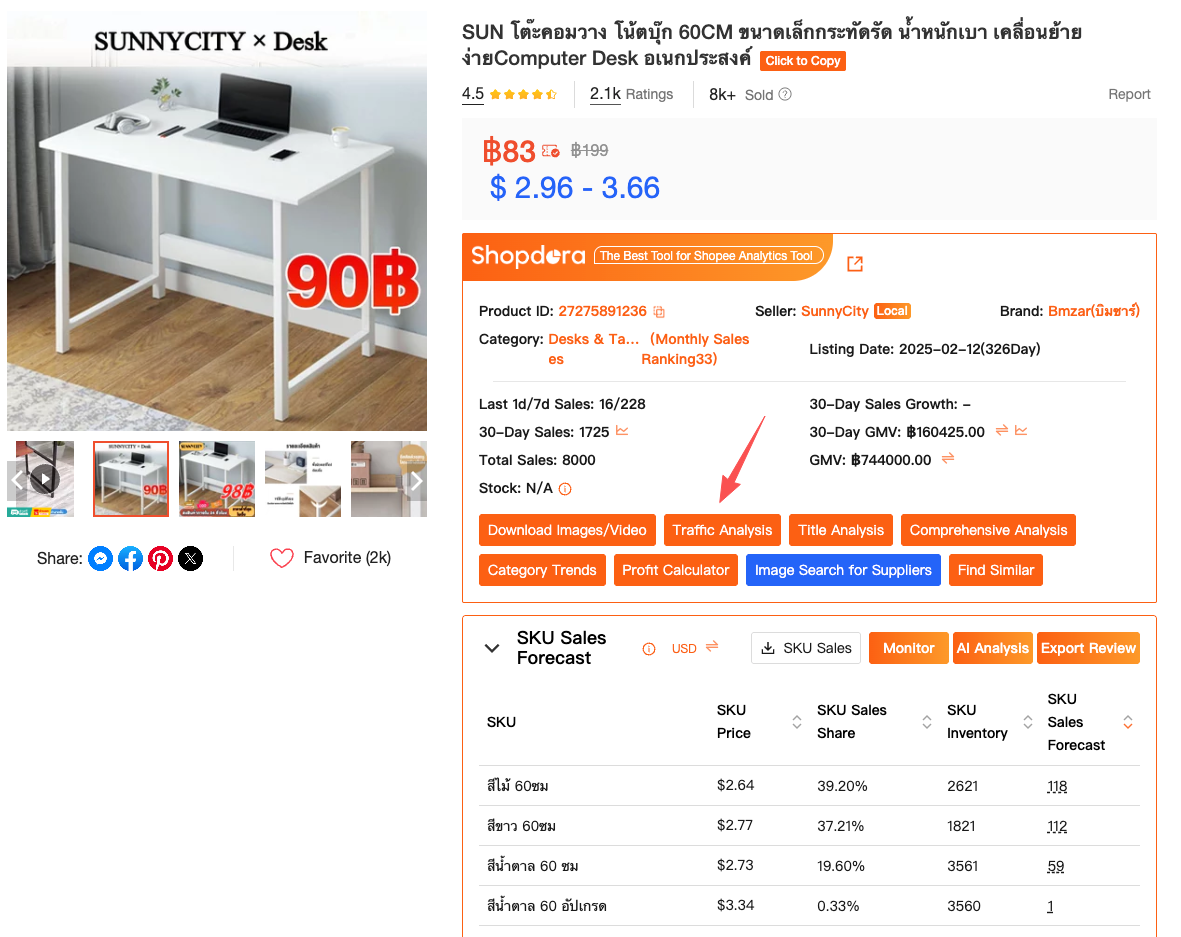

Using Shopdora’s Product Research feature was the first time I could step outside my own store and look at Shopee as a whole. Instead of guessing which products were “hot,” I could filter by site, category, sales volume, growth rate, price range, and even how long products had been listed.

Suddenly, product decisions stopped being emotional.

From “This Looks Promising” to “This Is Proven”

Before, my product selection process was mostly pattern imitation. I’d see something trending, assume it would keep selling, and rush to source it. Sometimes it worked. Often, it didn’t.

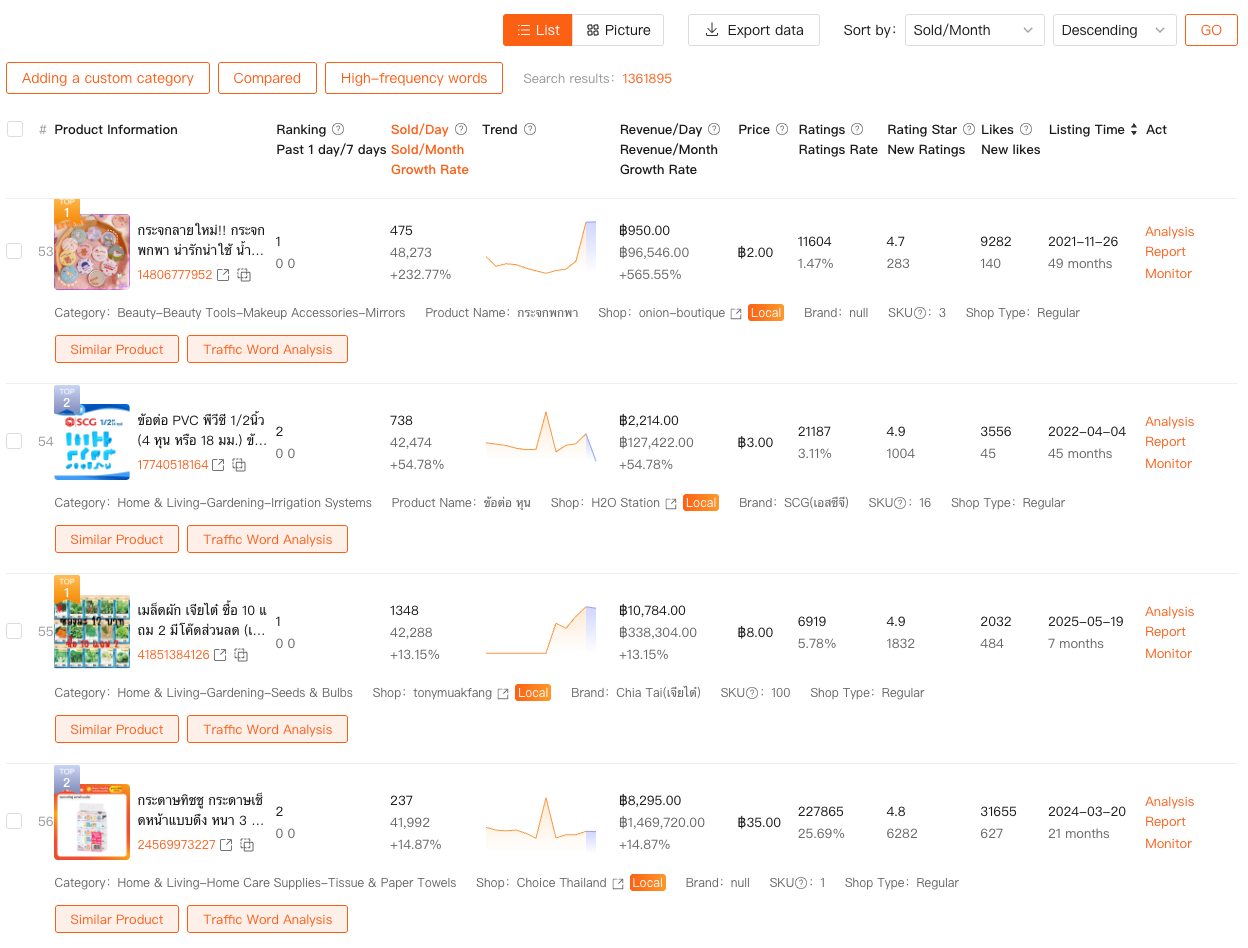

With Product Research-based Shopee data, I started noticing patterns I’d never seen before. For example, some products had impressive total sales but almost no recent growth. Others had modest sales numbers but strong upward momentum and relatively new listings.

That distinction matters more than most sellers realize.

One product category I was considering looked saturated at first glance. High sales everywhere. But when I drilled deeper, I noticed that most of the revenue was concentrated in older listings, while newer products were struggling to gain traction. That wasn’t a “hot niche” — it was a mature one with little room for late entry.

Without Shopee data at the market level, I would have entered blindly.

Category-Level Shopee Data Reveals What Product Pages Can’t

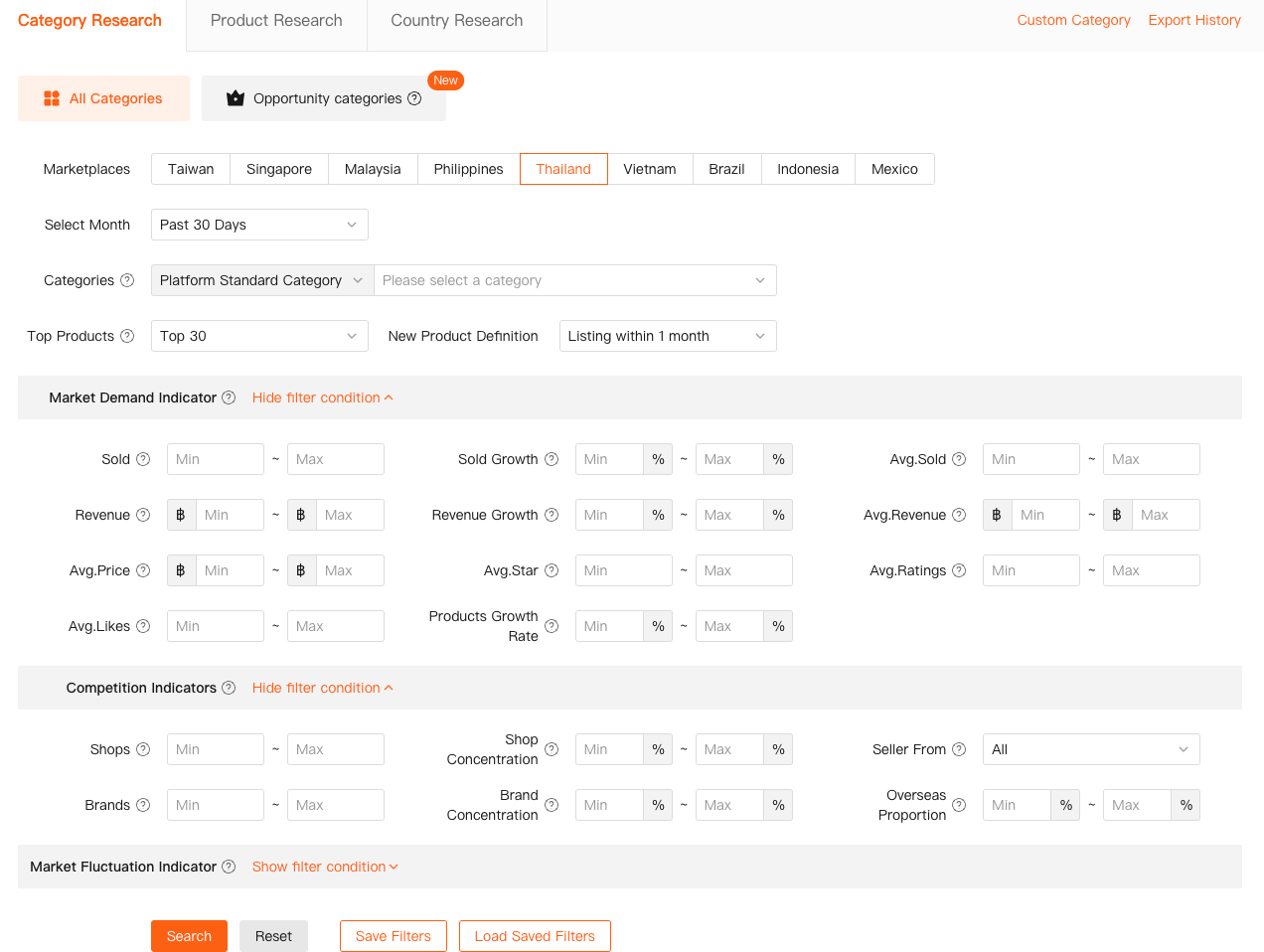

Product-level data is powerful, but it’s incomplete without category context. This is where Category Research became one of my most-used features inside Shopdora.

Instead of asking whether a single product could sell, I started asking whether the category itself was worth my time.

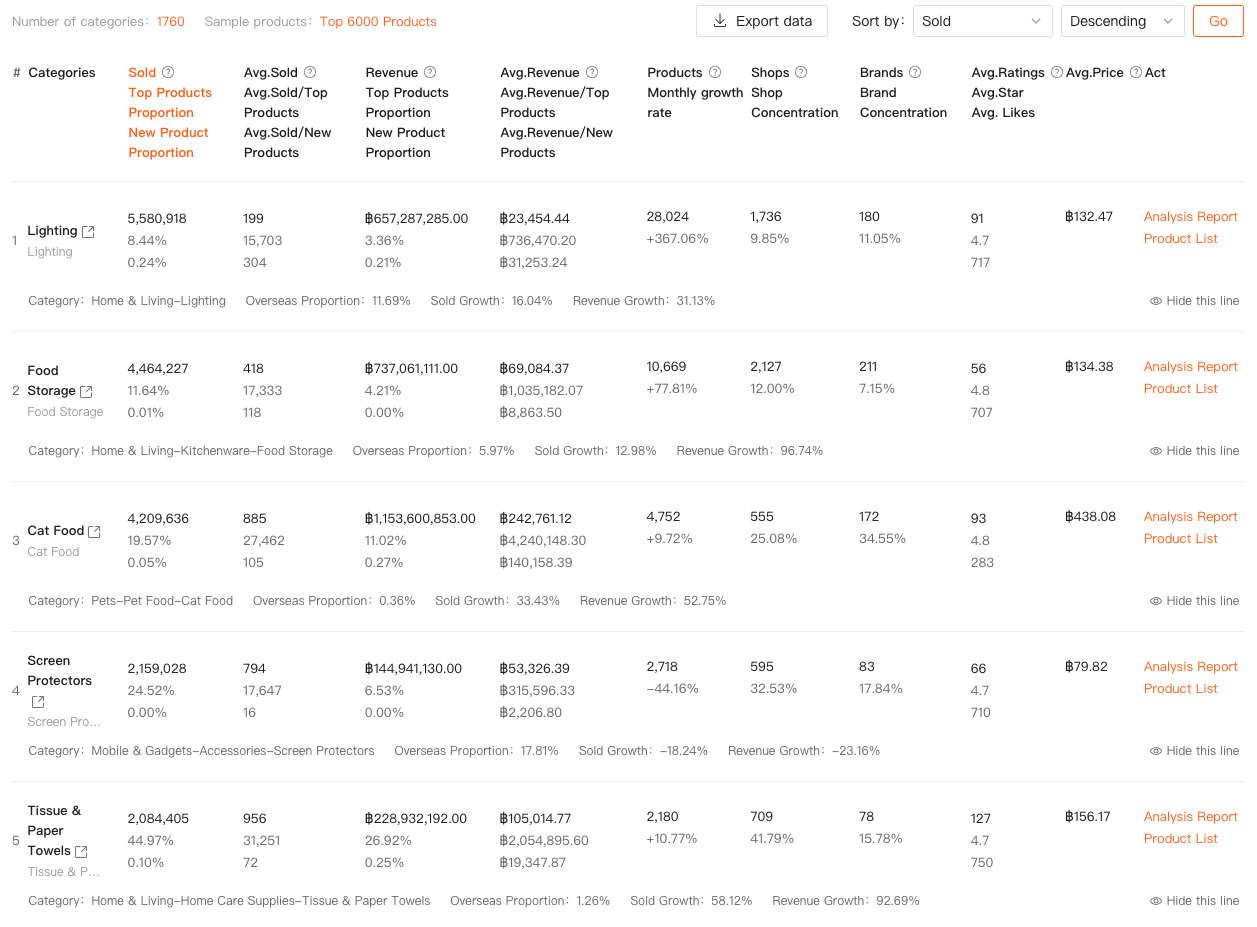

Category-level Shopee data shows you things most sellers never look at: how concentrated sales are among top products, how many stores and brands dominate the space, how fast the category is growing, and how new products are actually performing.

I’ve walked away from categories that looked attractive on the surface but had extremely high concentration — meaning a few top products controlled most of the sales. Competing there would’ve required budgets and resources I simply didn’t have.

On the flip side, I’ve found categories with moderate size, steady growth, and healthy new-product performance. Those don’t look exciting on social media, but they’re often where sustainable profits live.

Traffic Data: The Missing Layer Most Sellers Ignore

Even with good products and promising categories, I still struggled with one question: why do some listings get traffic so easily while others don’t?

This is where Traffic Analysis completed the picture.

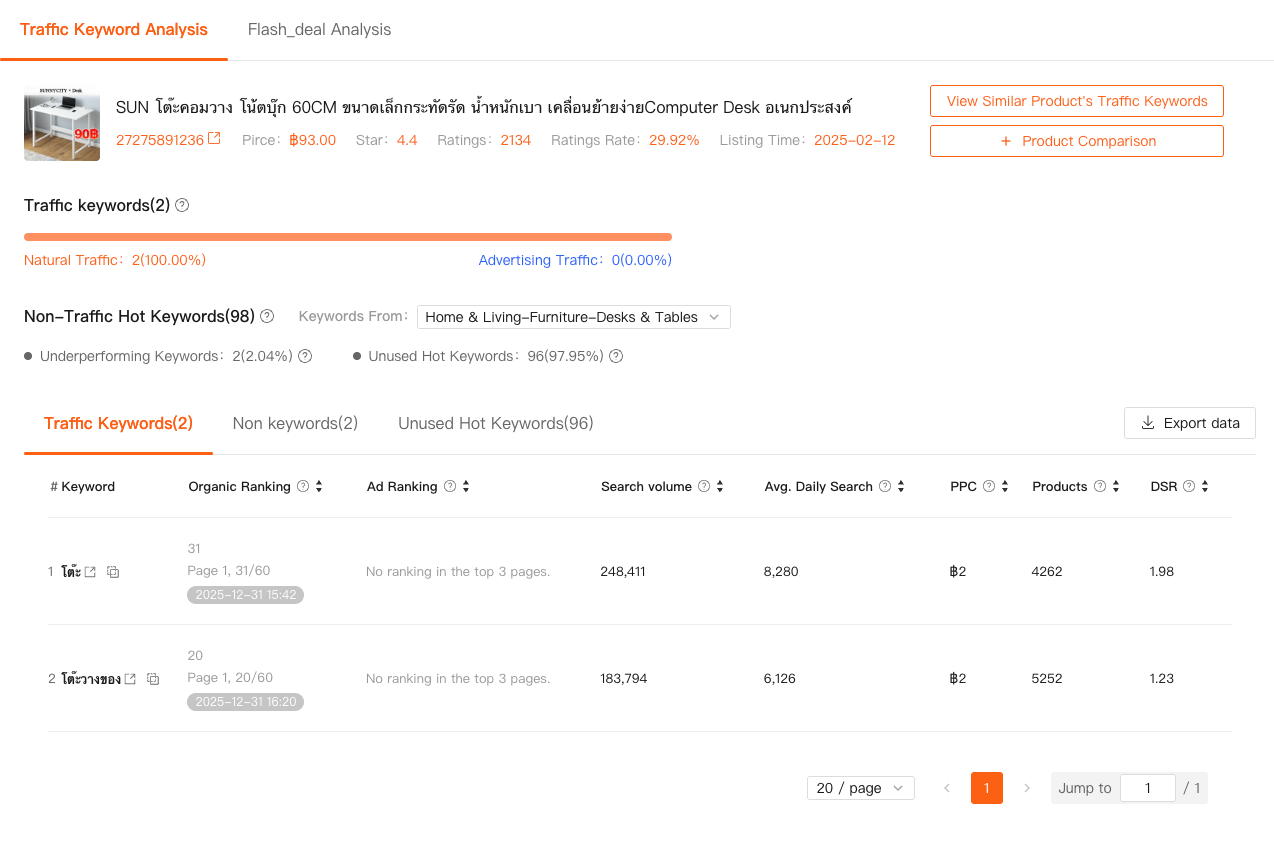

Shopee traffic isn’t just about ads. Organic traffic, keyword exposure, and search behavior play a massive role, but sellers rarely see this clearly. Traffic Analysis helped me understand which keywords actually bring traffic, which ones competitors rely on, and where gaps exist.

More importantly, it showed me when a product’s sales were driven by paid traffic versus organic demand. That distinction changes how you price, how you optimize listings, and whether a product is scalable long-term.

Without traffic-level Shopee data, many sellers end up pouring money into ads without realizing they’re fighting against weak demand.

How Shopee Data Changed My Decision-Making Style

The biggest change wasn’t tactical — it was psychological.

Once I had access to real Shopee data across products, categories, and traffic, I stopped chasing “opportunities” and started evaluating risks. Every decision became calmer. More boring, even. And that’s a good thing.

I no longer launch products because they feel exciting. I launch them because the data tells a coherent story: demand exists, competition is manageable, and traffic sources are identifiable.

Shopdora didn’t make those decisions for me. It simply made the market visible.

Shopee Data Isn’t About Numbers — It’s About Context

If there’s one thing I wish more sellers understood, it’s this: Shopee data isn’t just metrics on a dashboard. It’s context.

Context tells you whether a bad week is your fault or the market’s.

Context tells you whether a winning product is repeatable or an outlier.

Context tells you when to push harder — and when to walk away.

Seller Center will never give you that perspective. Tools like Shopdora exist precisely because sellers need a way to see beyond their own stores.

You don’t need to use every feature. I don’t. But if you’re serious about growing on Shopee, relying only on internal data is like navigating with half a map.

Final Thoughts

For a long time, I thought experience meant trusting my gut. Now I think experience means knowing when not to.

Shopee data, when used correctly, doesn’t remove intuition — it sharpens it. It keeps you from making the same expensive mistakes over and over again.

If you’re feeling stuck, uncertain, or constantly reacting to competitors, the problem may not be your execution. It may simply be that you’re missing the bigger picture.

And once you finally see the market clearly, everything else becomes easier.