Shopee Data Secrets Behind Brand Ranking and Product Growth

Hi, I’m David.

I run my own Shopee store and have been doing so for more than three years. No team, no outsourcing, no “guru” shortcuts. Just hands-on selling, launching products, failing, fixing, and repeating. Over time, I’ve learned that the biggest difference between struggling sellers and consistent ones isn’t effort. It’s how they read Shopee data.

For a long time, I thought competition on Shopee was about products. Better photos. Lower prices. More reviews. But eventually I realized something deeper: on Shopee, brands matter far more than most sellers admit. And if you don’t understand how brands behave in your category, your product analysis is incomplete from the start.

That realization came from one feature I now rely on heavily: Brand Ranking, accessed through Shopdora.

The Invisible Problem: Competing Blind Against Brands

Shopee sellers often ask, “Is this product niche too competitive?”

Most people answer that question by counting listings or checking prices. I used to do the same.

But competition isn’t just about how many products exist. It’s about who controls the sales.

In many categories, a handful of brands quietly dominate revenue. Their listings don’t always look special. Sometimes their prices aren’t even the lowest. But they keep winning month after month. From the seller backend alone, you can’t clearly see this pattern.

This is where Shopee analytics tools become essential. Without brand-level visibility, you might think you’re competing with dozens of individual sellers, when in reality you’re up against three brands that control half the market.

Why Brand Ranking Changes How You Read Shopee Data

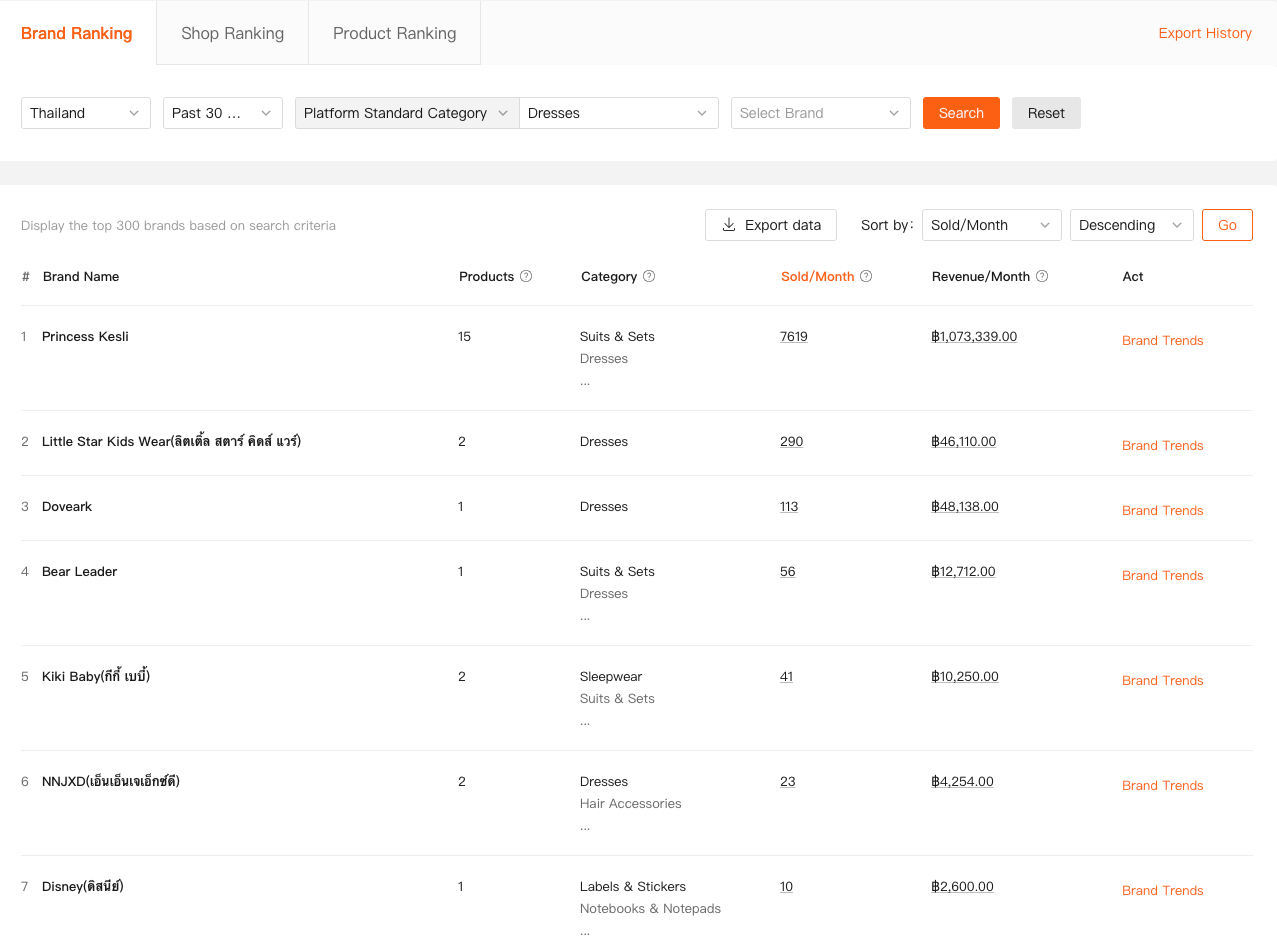

Brand Ranking lets you see brands ranked by sales and revenue within a specific site, category, and time period. More importantly, it allows you to track how brand performance changes over time, not just who’s on top right now.

When I first used Brand Ranking in Shopdora, I stopped thinking in terms of “top products” and started thinking in terms of brand dominance.

In one category I was researching, the top ten products looked evenly distributed across many sellers. But when I checked Brand Ranking, I saw that over 60% of total revenue came from just two brands. The rest were fighting for scraps.

That insight completely changed my decision. The market wasn’t crowded—it was controlled.

Brand Dominance vs. Brand Opportunity

Not all strong brands are bad news. This is where proper Shopee product analysis matters.

By looking at Brand Ranking trends over several months, I can tell whether a category is locked or still open. If top brands are stable but slowly declining, that often signals fatigue. Demand may still exist, but brand loyalty is weakening. That’s sometimes the best entry point for smaller sellers with differentiated products.

On the other hand, if brand rankings are stable and growing, and new brands struggle to break in, that’s usually a warning sign. You’re not just competing on product features—you’re competing against accumulated trust, historical sales, and algorithm momentum.

Shopee data without brand context is misleading. Brand Ranking gives that missing layer.

Combining Brand Ranking With Product-Level Analysis

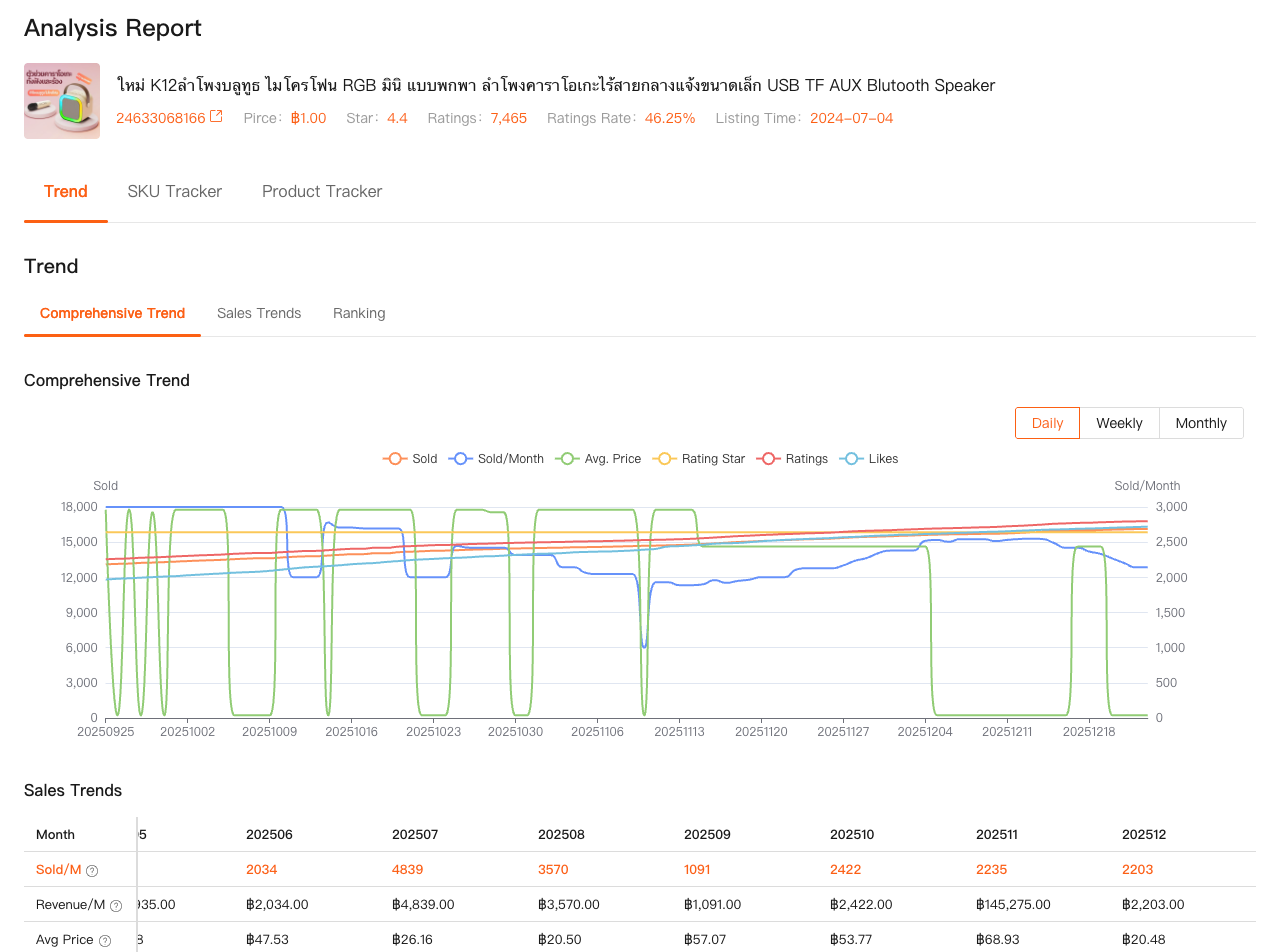

I don’t use Brand Ranking in isolation. I pair it with Comprehensive Analysis, another Shopdora feature that helps me understand product trends, sales performance, and lifecycle signals.

Here’s how that plays out in practice.

If I see a brand ranking high, I look at their product structure. Are they relying on one hero SKU, or multiple stable products? If their revenue is concentrated in one product, that’s fragile. If they have several mid-performing products, that’s harder to compete with.

Then I look at how new products perform in the same category. If new SKUs—even from strong brands—fail to gain traction, that tells me demand may be saturated. But if new products still climb steadily, the market may be evolving.

This kind of Shopee analytics workflow isn’t fast. But it’s realistic.

A Hard Lesson I Learned the Expensive Way

I once entered a category that looked perfect on the surface. Search volume was healthy. Prices weren’t extreme. Reviews were manageable.

But I skipped one step: brand analysis.

After launch, my product barely moved. Ads helped temporarily, but organic sales never followed. Only later did I check Brand Ranking. The top brand had been number one for over a year, with stable growth and multiple SKUs covering every price point.

I hadn’t entered a product niche. I had entered someone else’s territory.

If I had looked at brand data earlier, I would have known that differentiation alone wasn’t enough. That mistake cost me months of inventory turnover.

Why Shopee Analytics Tools Should Be Brand-Aware

Many sellers believe Shopee is a “platform for individuals.” That might have been true years ago. Today, brands are deeply embedded in the ecosystem.

Shopee analytics tools that focus only on keywords or products miss this reality. Brand Ranking adds a strategic layer that aligns more closely with how Shopee’s algorithm actually works.

Brands benefit from accumulated sales, stronger conversion signals, and user trust. Competing against them requires either a clear gap or a clear trend shift. Without brand-level Shopee data, you’re guessing.

How Shopdora Fits Naturally Into a Seller’s Workflow

I don’t treat Shopdora as a forecasting machine. I treat it as a decision filter.

Brand Ranking helps me decide whether a market is brand-controlled or still flexible. Comprehensive Analysis helps me judge whether products are trending, stable, or declining. Together, they shape whether I enter, avoid, or delay a launch.

Shopdora appears in my workflow not as the hero, but as the lens. The decisions are still mine. The data simply removes illusions.

And that’s the real value of a Shopee analytics tool—not telling you what to sell, but showing you what’s actually happening.

Shopee Product Analysis Is About Context, Not Tricks

There’s no trick to beating brands. Sometimes the right move is to walk away. Other times, it’s to wait. Occasionally, it’s to enter with a smarter angle.

Shopee data doesn’t eliminate risk. It helps you understand it.

Today, before I launch anything, I ask one question first:

Who already owns this space?

Brand Ranking gives me that answer quickly and honestly.

Final Thoughts From One Seller to Another

If you’re serious about Shopee, stop analyzing products in isolation. Start analyzing power structures within categories.

Use Shopee data to understand brands, not just listings. Use a Shopee analytics tool that shows you market control, not just surface activity. And treat Shopee product analysis as an ongoing process, not a one-time check.

I’ve made enough mistakes to know this: competing blindly is far more expensive than waiting with clarity.

That’s not theory. That’s lived experience.