Shopee Data That Actually Helps You Sell More

Hi, I’m David.

I’ve been selling on Shopee for a little over three years now. I run a single store, handle my own listings, manage ads myself, and make decisions the same way most independent sellers do — with limited time and very real consequences when I get things wrong.

When people talk about Shopee data, I often notice something interesting. Most sellers already have data. They can see their daily sales, SKU performance, traffic trends, and conversion rates inside Shopee’s Seller Center. Yet despite all that information, many decisions still feel uncertain, slow, or reactive.

I’ve been there. And over time, I realized the problem wasn’t a lack of data — it was a lack of market visibility.

Why Shopee Data Inside Seller Center Is Not Enough

Shopee Seller Center does a good job showing you what’s happening inside your own store. You can track which SKUs are selling, how your prices change results, and whether yesterday was better than last week.

What it doesn’t show you is what’s happening around you.

You can’t see how fast competing products are actually selling. You can’t tell which SKU variants drive most of a competitor’s revenue. You don’t know whether a category slowdown is caused by your listing — or by the entire market cooling down. When prices drop across the category, Seller Center won’t tell you whether that’s a temporary promotion or a long-term trend.

That’s the blind spot most Shopee sellers operate in. You’re judging your performance in isolation, without knowing whether you’re ahead of the market, falling behind, or simply moving with it.

This is where Shopee data becomes misleading — not because it’s wrong, but because it’s incomplete.

Seeing Shopee Data as Market Behavior, Not Store Metrics

The biggest shift in my own thinking happened when I stopped treating Shopee data as “my numbers” and started treating it as market behavior.

Instead of asking, “Why did my sales drop this week?”

I began asking, “What changed in the category this month?”

To answer questions like that, I needed access to data beyond my own listings. That’s when I started using Shopdora — not as a replacement for Seller Center, but as a way to understand competitors and the broader market context I was operating in.

Three features, in particular, fundamentally changed how I make decisions.

Product Research: Understanding Demand Before Committing Resources

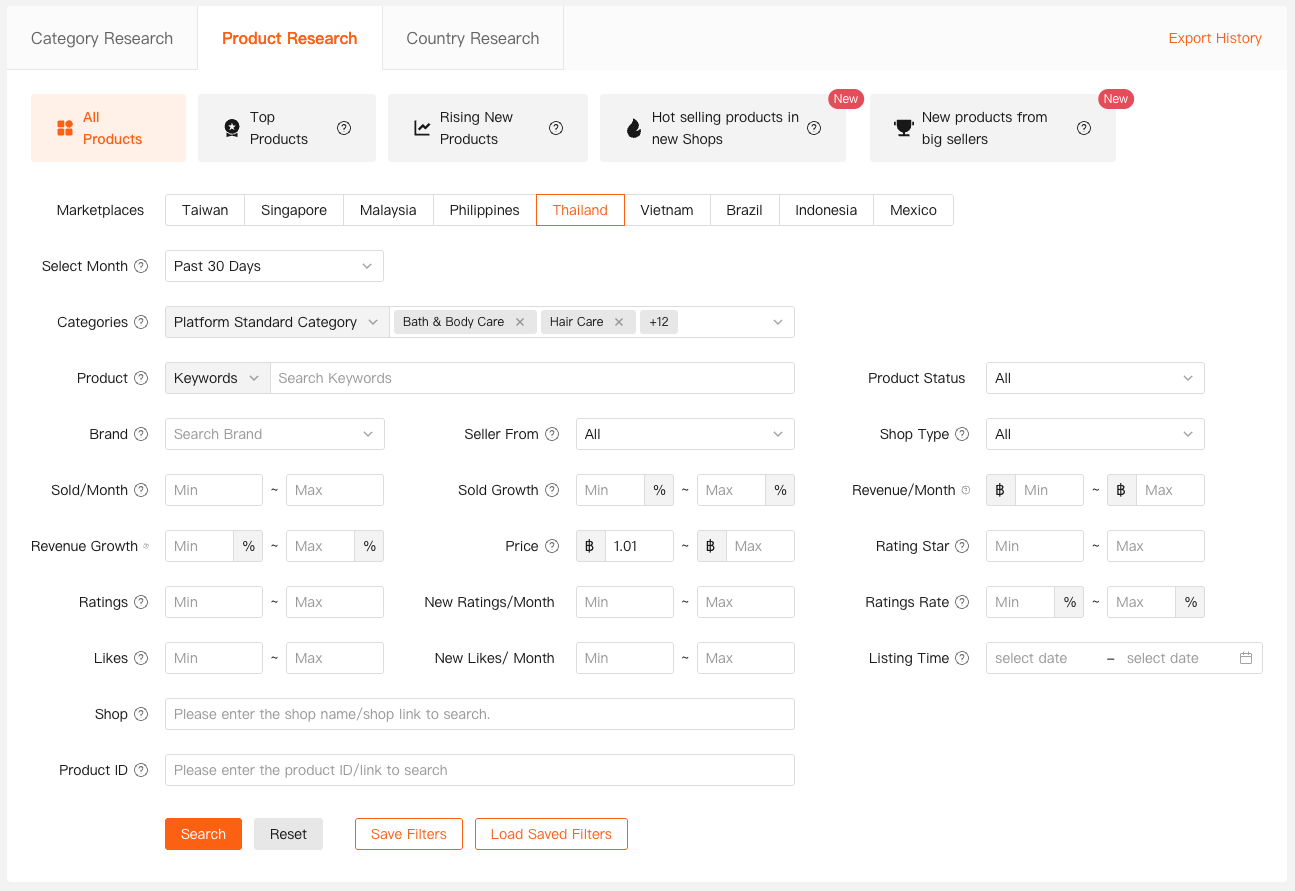

Before I launch a new product or expand into a category, I now start with Product Research.

What matters to me here isn’t rankings or hype. It’s whether real sales are happening — and who is capturing them.

By filtering products by site, category, and recent time periods, I can see how demand is actually distributed across the market. I can tell whether sales are concentrated among a few established products or whether newer listings are gaining traction. I can see whether growth is steady, accelerating, or already tapering off.

This kind of Shopee data answers questions Seller Center never can. It helps me avoid entering categories where demand looks strong on the surface but is actually locked up by a handful of dominant players. It also shows me when new products — even from smaller shops — are breaking through, which often signals opportunity.

Instead of betting on intuition, I’m validating ideas against what the market is already proving.

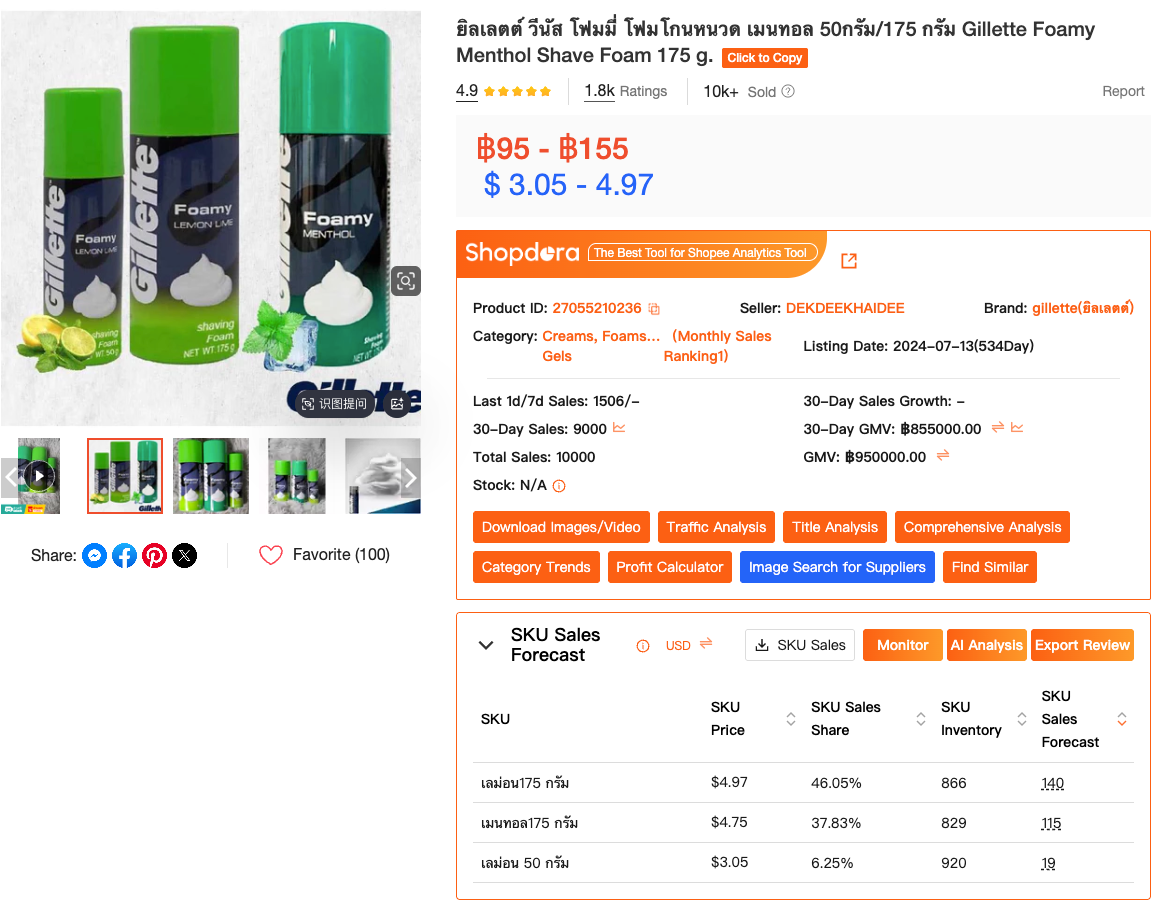

SKU Insight: Learning How Competitors Really Make Money

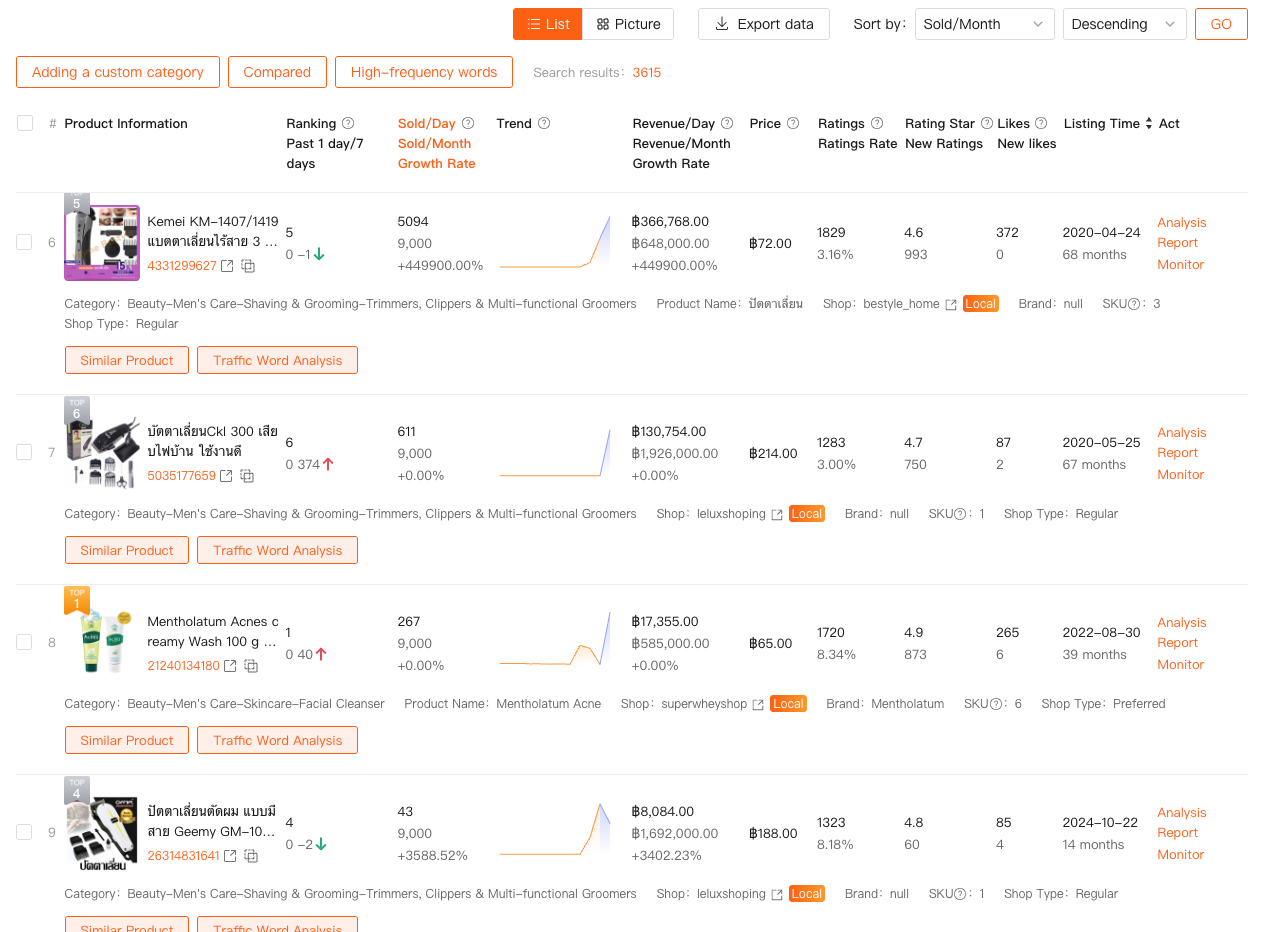

One of the biggest misconceptions among Shopee sellers is that competitors with many SKUs are selling evenly across all of them.

In reality, most revenue usually comes from a very small number of variants.

With SKU Insight, I can see competitor SKU prices, sales share, inventory signals, and SKU-level sales forecasts. This allows me to understand how their listings are actually structured — not how they look on the surface.

This has changed how I approach my own listings. Instead of trying to push every SKU equally, I focus my ads, inventory, and creative assets on the variants that matter most. It also helps me avoid copying competitors blindly. Sometimes what looks like a strong multi-variant listing is really just one SKU carrying the entire product.

This is Shopee data that directly affects pricing decisions, inventory planning, and advertising focus — and it’s something you simply can’t access through your own backend alone.

Comprehensive Analysis: Tracking Trends Instead of Reacting to Noise

Daily fluctuations are normal on Shopee. Sales go up, rankings drop, prices shift. The problem is reacting to short-term noise without understanding long-term movement.

This is where Comprehensive Analysis becomes critical.

By combining sales trends, revenue changes, price history, ranking movements, and product tracking into one view, I can see how a product or category evolves over time. I can tell whether a ranking jump is sustained or temporary, whether price drops are isolated or part of a broader pattern, and whether a competitor is scaling aggressively or slowly pulling back.

Instead of guessing, I’m observing behavior across weeks and months. That perspective has helped me avoid panic decisions — like cutting prices too early or killing products that were simply in a temporary dip.

Shopee data becomes much more useful when it’s viewed as a timeline, not a snapshot.

What Shopee Data Actually Helps You Decide

When sellers rely only on their own store data, they often misdiagnose problems. They assume poor performance is a listing issue when it’s really a market slowdown. Or they chase optimizations while competitors are quietly changing pricing or SKU strategies.

Market-level Shopee data changes that dynamic.

It allows you to understand whether your results are caused by internal execution or external conditions. It gives context to every metric you already track. And most importantly, it helps you make decisions with awareness instead of assumption.

That’s the real value of tools like Shopdora — not more dashboards, but better judgment.

How I Personally Use Shopee Data Today

My workflow today is simple.

I use Seller Center to manage my own store.

I use market-level data to understand the battlefield I’m competing in.

Before launching, I validate demand and competition through Product Research.

When optimizing listings, I study competitor SKU structures with SKU Insight.

When deciding whether to scale, pause, or exit, I rely on trend signals from Comprehensive Analysis.

Each piece answers a different question — and together, they prevent me from making decisions in the dark.

Final Thoughts: Shopee Data Is About Perspective, Not Control

Shopee gives every seller access to their own performance data. What it doesn’t give you is perspective.

You don’t need more numbers. You need to understand where you stand in the market — who’s growing, who’s slowing down, and why.

Once you start looking at Shopee data this way, decisions stop feeling emotional. You’re no longer reacting to yesterday’s sales; you’re responding to patterns that are already forming.

And that shift alone can change how you sell.