Shopee Market Data: How Sellers Read the Market Correctly

Hi, I’m David.

I’ve been running my own Shopee store for over three years now. No team. No agency. No outside analysts. Every decision—what to sell, when to enter a category, when to exit—has been made by reading signals from the market and taking responsibility for the outcome.

If there’s one lesson I’ve learned the hard way, it’s this:

your store data is not the same as shopee market data.

For a long time, I believed that as long as my own sales were growing, I was doing fine. Then one day, demand dried up almost overnight. No warning. No obvious mistake. Just a sudden shift I didn’t see coming.

That experience forced me to rethink how I look at shopee market data—and what kind of tools actually help sellers understand the market instead of reacting too late.

This article is about that shift.

What shopee market data really is, what data actually matters, and how tools like Shopdora are designed to make market-level signals visible before they hit your bottom line.

Why Shopee Market Data Is Not What Most Sellers Think

Most sellers think shopee market data means charts, totals, and growth rates.

In reality, market data is about structure.

It’s about understanding how a category is distributed, who controls demand, how concentrated competition is, and whether growth is coming from new entrants or existing players expanding their share.

Seller Center can’t show you this. It only reflects your own store. That’s not enough when you’re competing in an open marketplace.

Real shopee market data answers uncomfortable questions:

Is this category already locked by dominant brands?

Are new sellers actually succeeding here, or just entering?

Is demand growing because of real buyers—or short-term trends?

These are not questions about your store. They’re questions about the market itself.

Start With Category Structure, Not Product Ideas

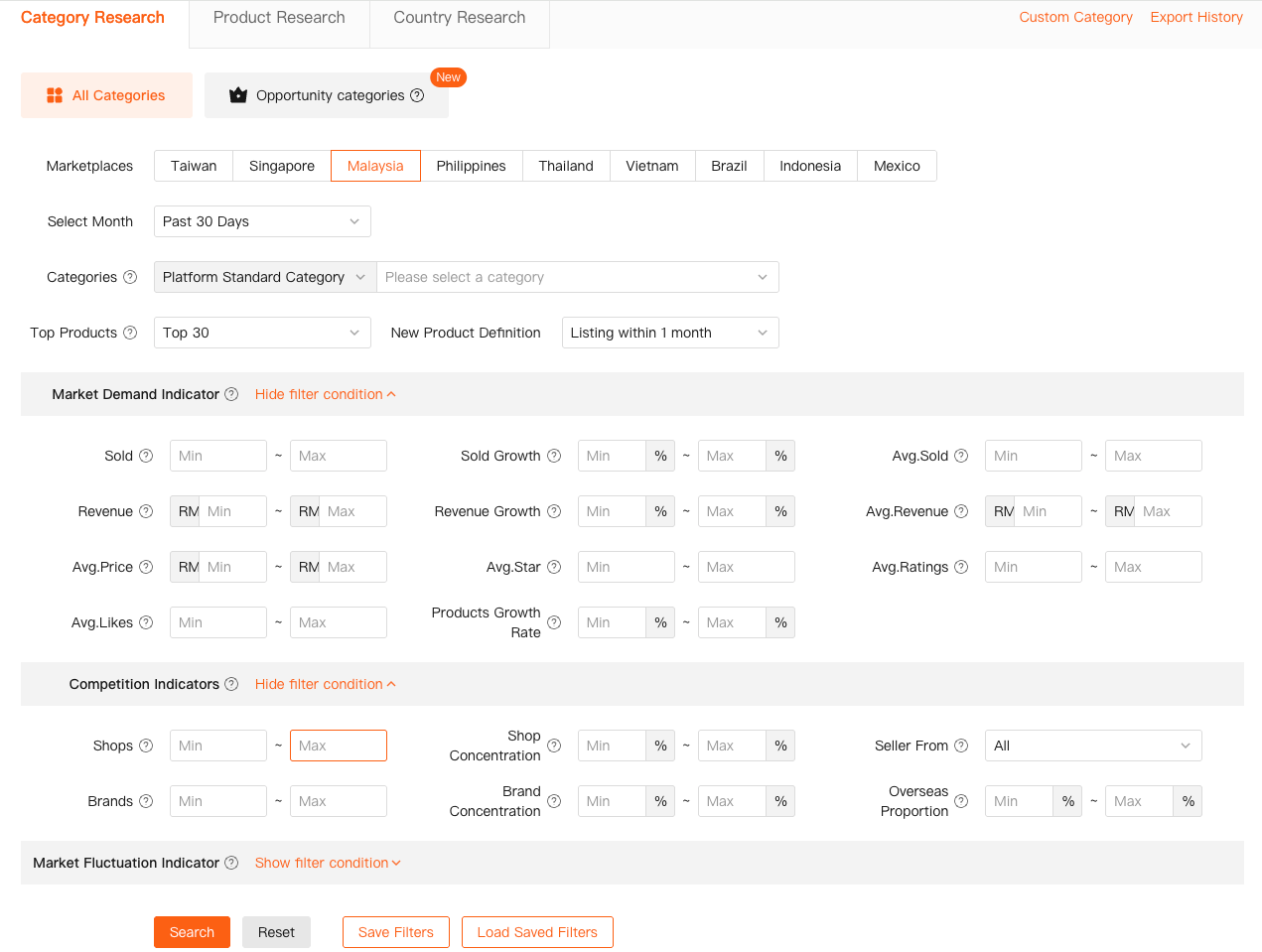

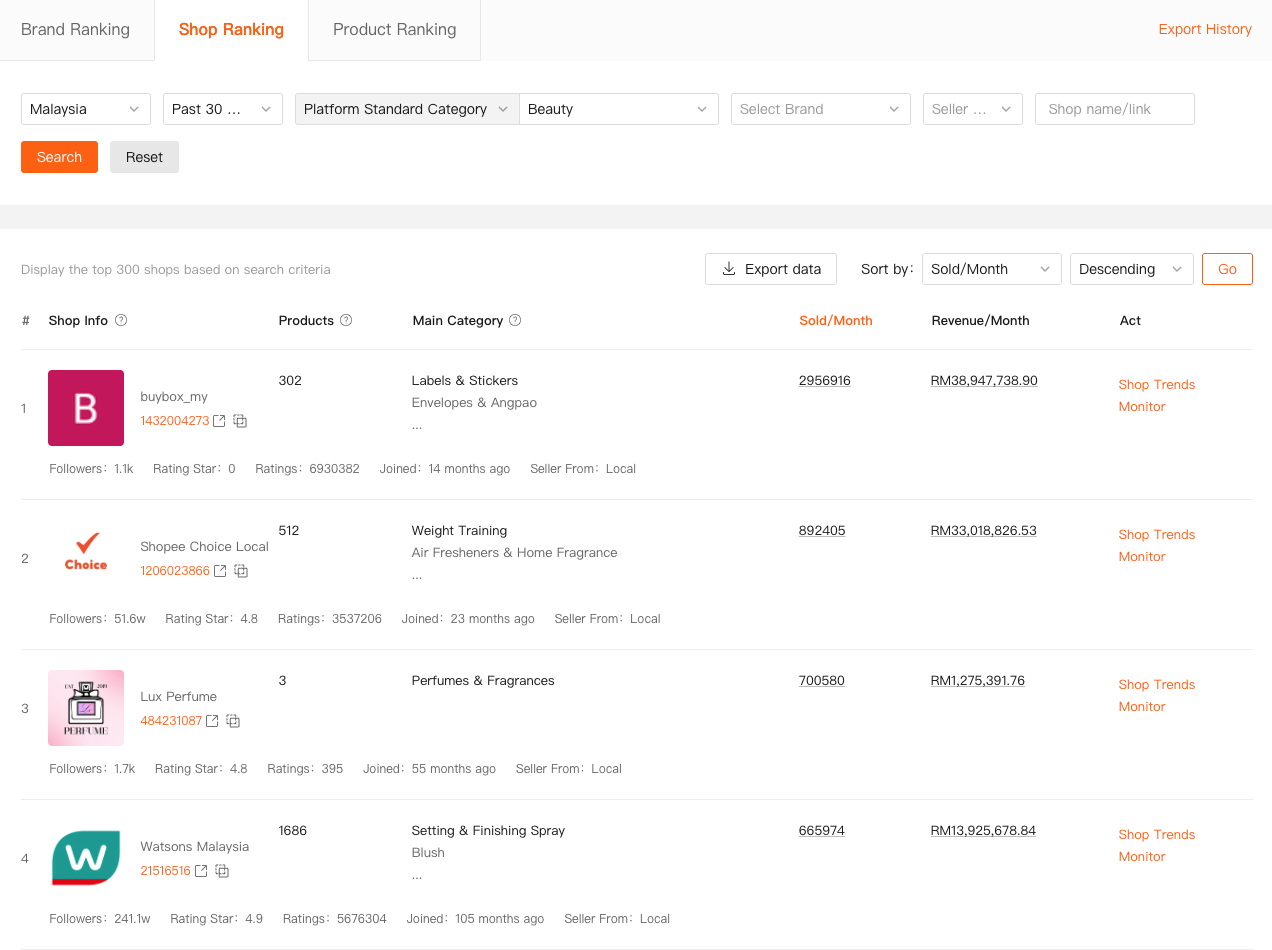

Before I even look at a single product today, I start with Category Research inside Shopdora.

This feature is accessed directly from the Shopdora website, not the browser plugin. That’s intentional—it forces you to analyze the market before browsing Shopee listings.

Category Research allows filtering by country, time range, and Shopee’s standard category system. More importantly, it shows market demand metrics (sales volume, revenue, growth) alongside competition structure (number of shops, number of brands, concentration ratios, cross-border share).

I still remember a category that looked promising based on sales size alone. Category Research showed that over 70% of revenue was controlled by a handful of brands. That wasn’t opportunity—it was a closed door.

This is where shopee market data becomes practical. Not “is the category big?” but “is there room to breathe?”

Market Health Matters More Than Market Size

One mistake I see new sellers make repeatedly is chasing large categories without understanding their internal balance.

With Category Research, I don’t just look at total volume. I look at new product share, top product dominance, and growth quality. If growth comes mainly from existing top sellers, late entry becomes expensive fast.

Shopdora presents these signals clearly in category-level dashboards. It’s not guessing. It’s aggregated market data across Shopee, updated daily.

This is the difference between browsing trends and reading the market.

Who Really Controls the Market? Follow the Brands and Shops

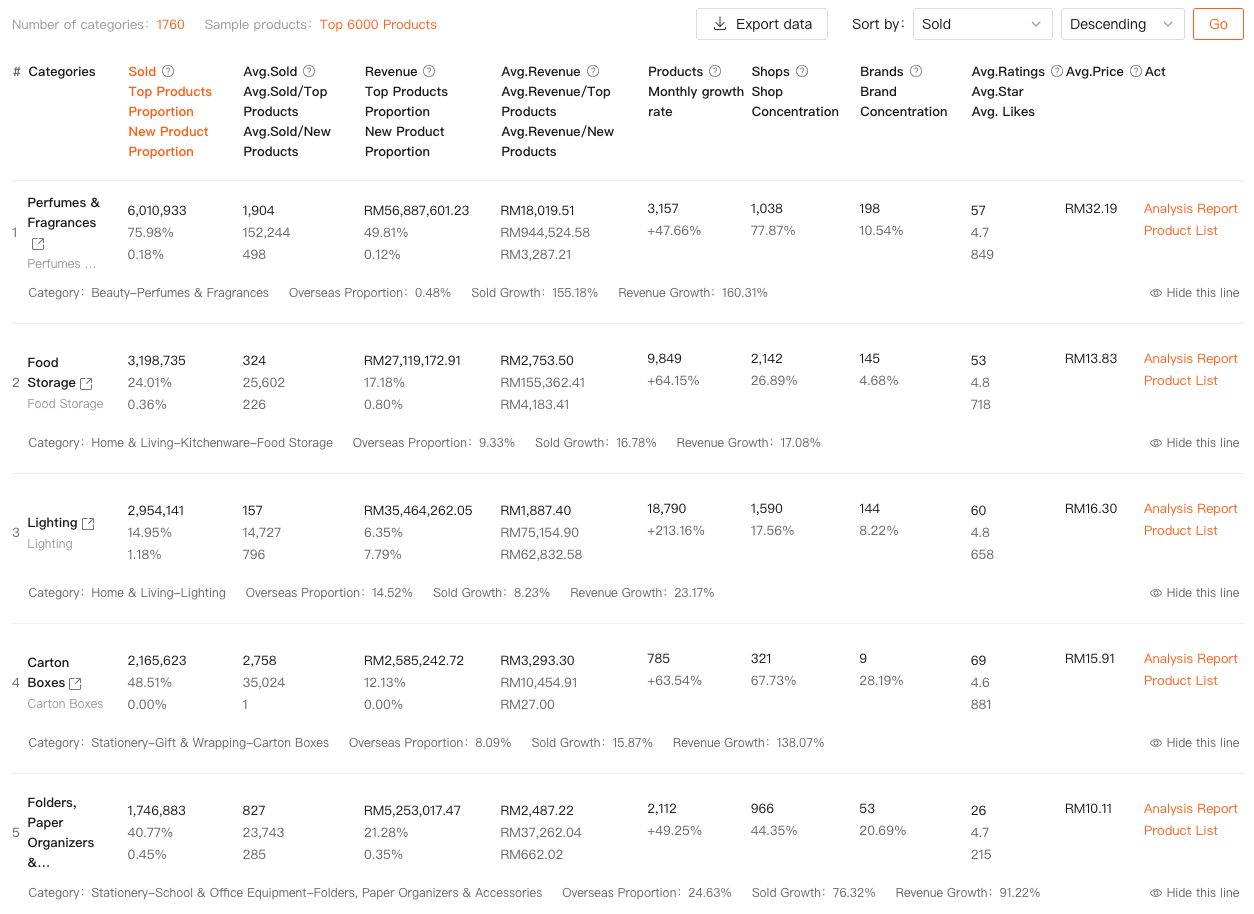

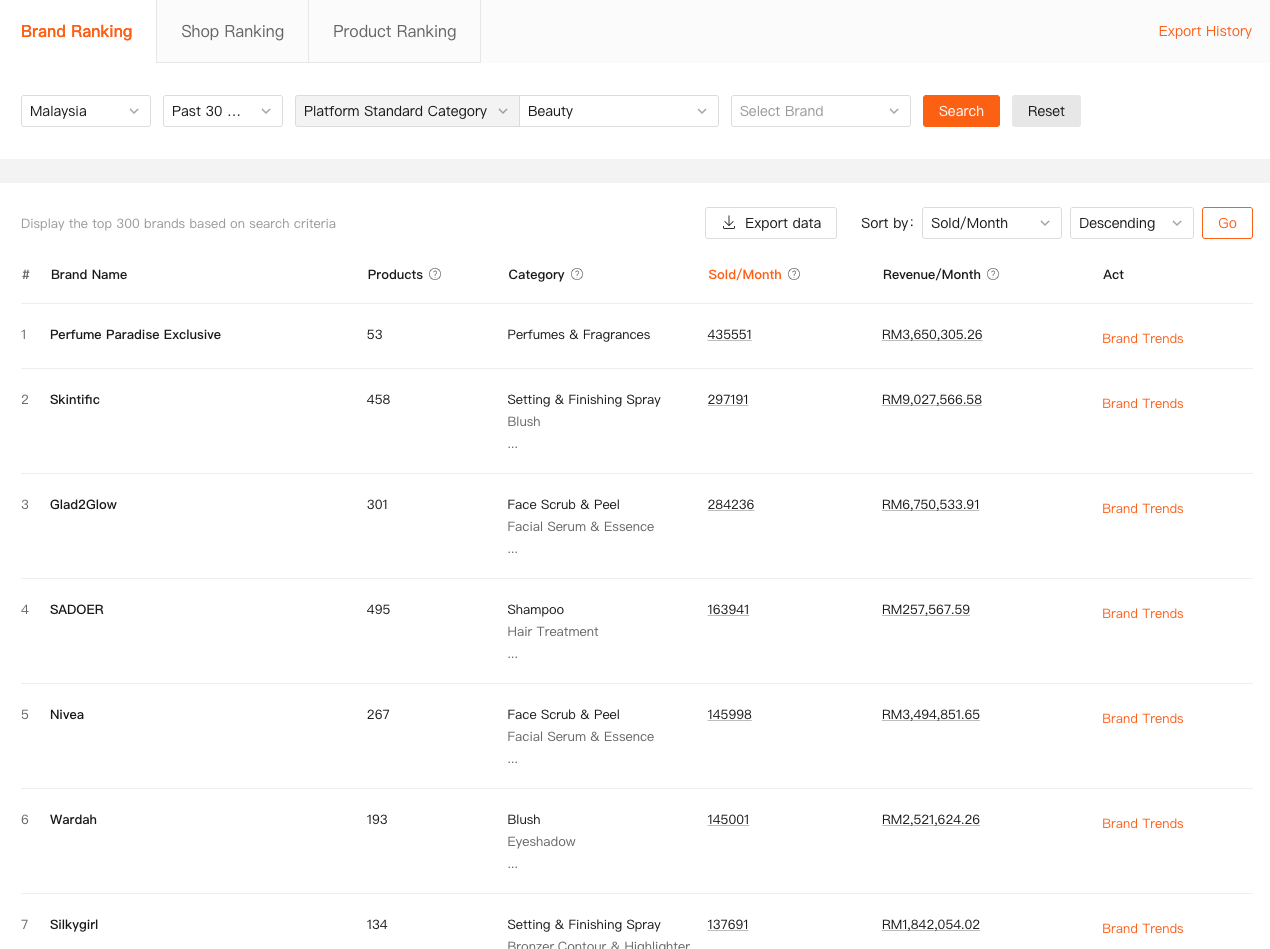

Once category structure is clear, the next layer of shopee market data I look at is control.

That’s where Brand Ranking and Shop Ranking come in.

These features live on the Shopdora web platform and allow you to rank brands and shops by sales and revenue across specific countries, categories, and time periods. You’re not guessing who the leaders are—you’re seeing them.

I’ve used Brand Ranking to identify categories where brands are fragmented rather than dominant. Those markets behave very differently from brand-led categories. Pricing, trust, and listing quality all play different roles.

Shop Ranking, on the other hand, shows whether success is concentrated among a few super sellers or spread across many mid-sized shops. That distinction changes how risky entry is.

This is shopee market data most sellers never see, simply because Seller Center doesn’t allow it.

Keywords Reveal Demand Before Products Do

Another layer of market data that sellers consistently underestimate is search behavior.

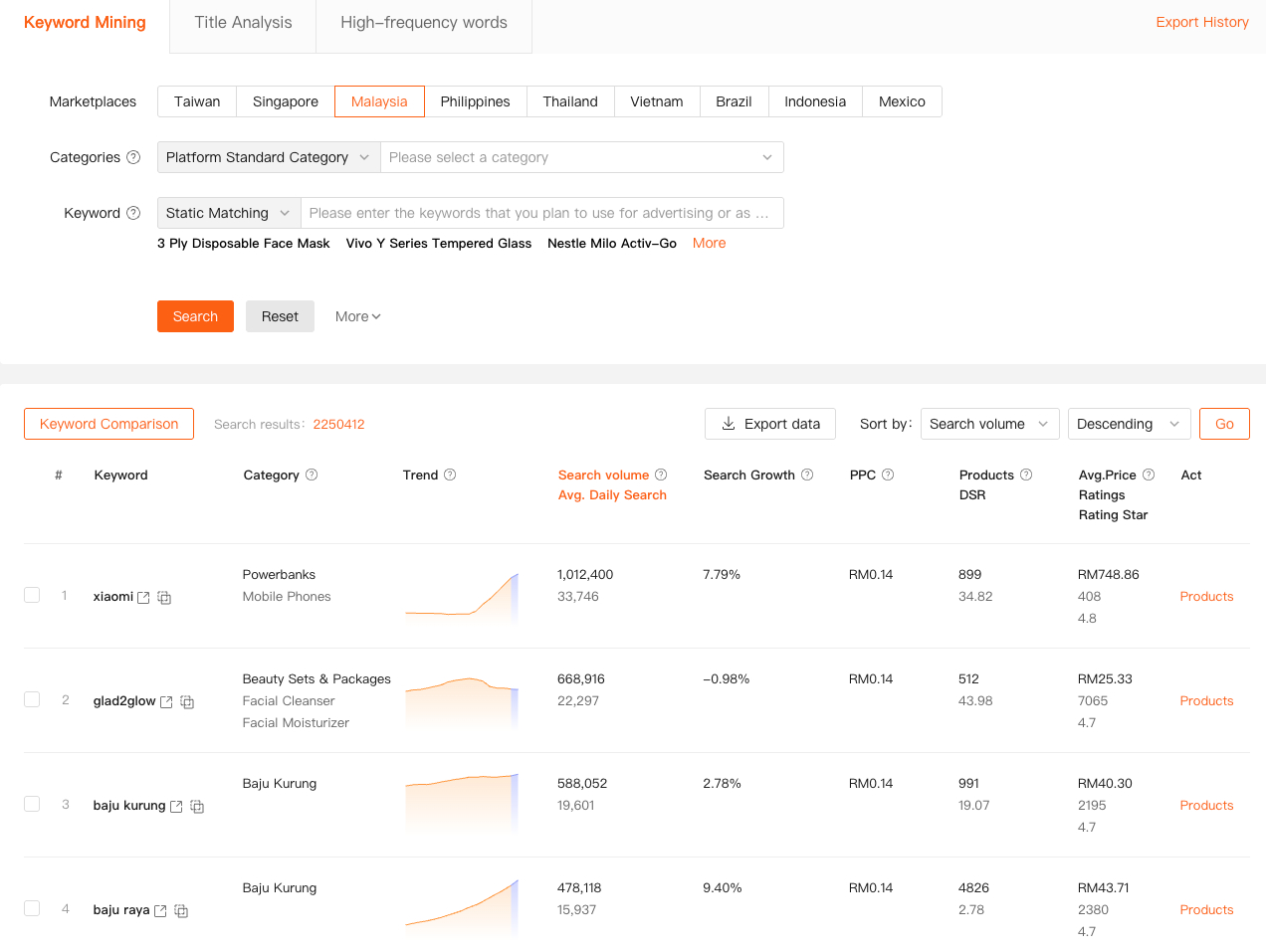

Shopdora’s Keywords Mining feature exists specifically for this reason. It’s accessed via the Shopdora website and operates at the platform keyword level, not individual listings.

Here, I can see real search volume, trends, growth rates, PPC intensity, and how many products are competing for the same keyword. I’ve often found keywords with rising demand but relatively low product saturation—signals that the market is moving before listings catch up.

One time, this helped me avoid entering a category that looked hot based on products alone. Keyword data showed demand was already plateauing. The listings were late, not early.

That’s the power of shopee market data when it’s read from the demand side, not the supply side.

From Keywords to Market Positioning

Keywords Mining isn’t just about traffic. It’s about understanding how buyers describe their needs.

When keyword growth outpaces product growth, the market is opening. When the opposite happens, competition is racing ahead of demand.

This insight directly affects how you position a product—or whether you launch at all.

For sellers serious about market research, this feature alone changes how “opportunity” is defined.

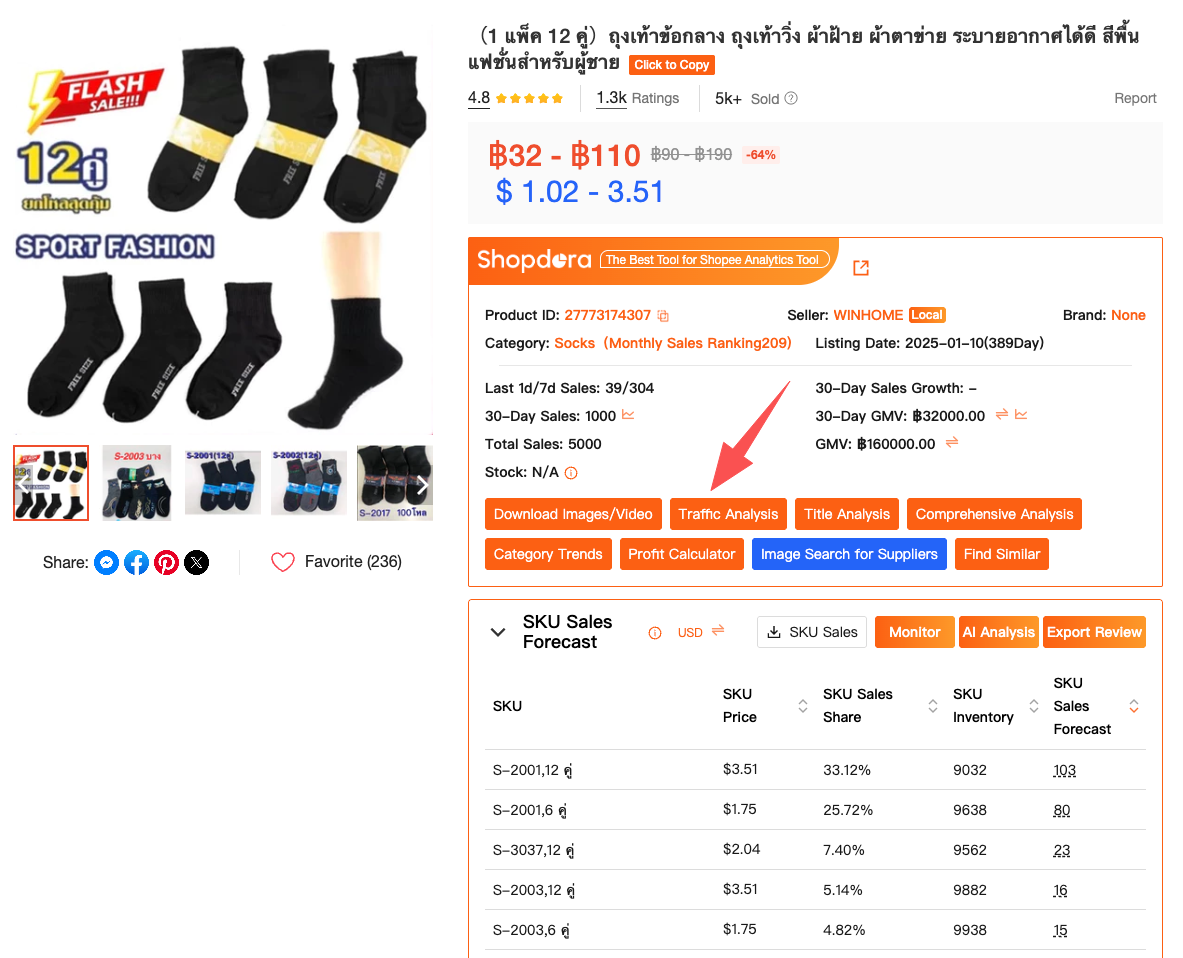

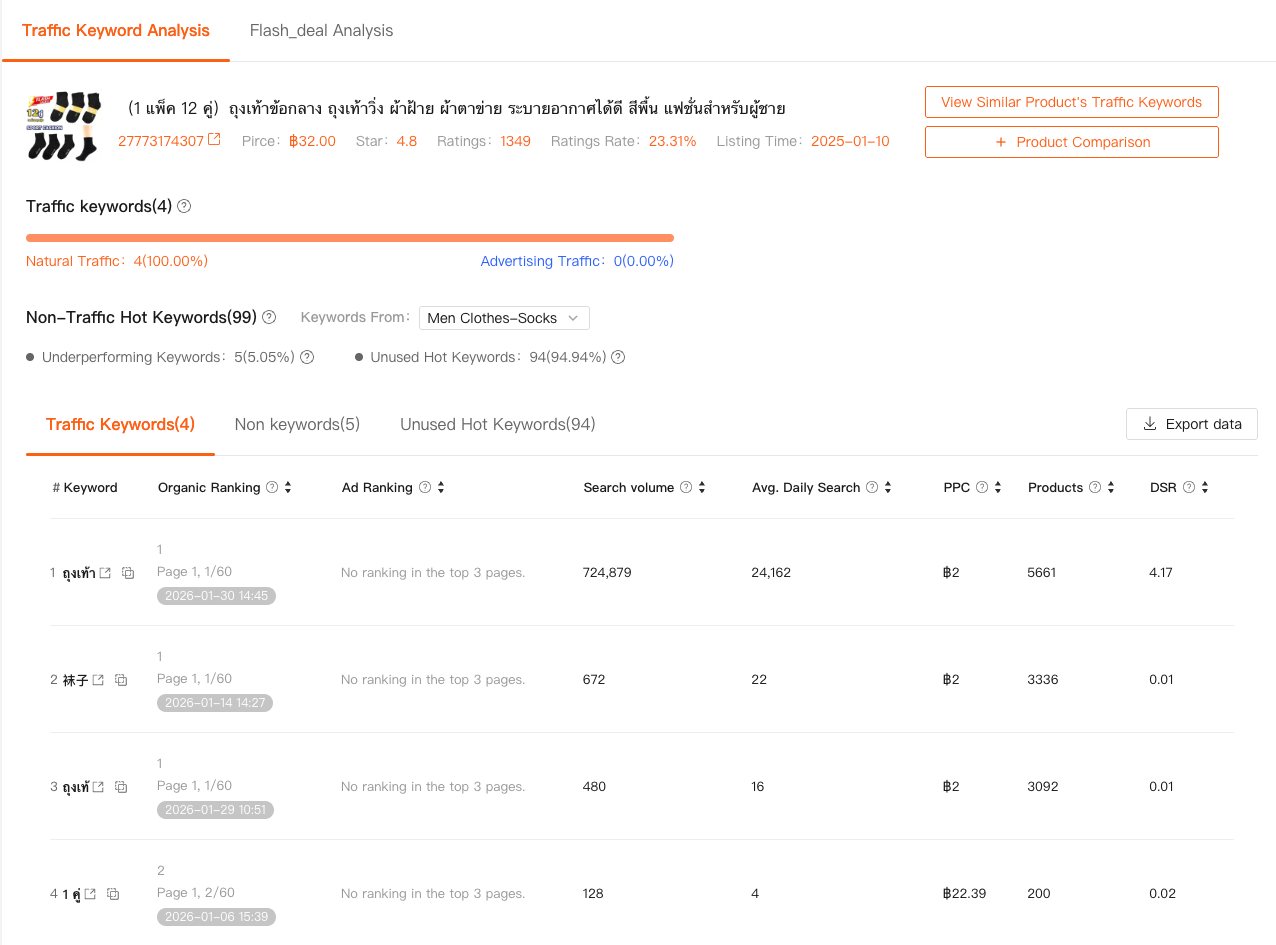

Connecting Market Signals With Traffic Reality

Once I understand category structure, brand control, and keyword demand, I connect those insights with Traffic Analysis at the market level.

Traffic Analysis inside Shopdora helps identify where traffic is coming from across the market, which keywords drive attention, and which high-potential keywords are still underutilized.

This feature is accessible both via the Shopdora plugin on Shopee pages and through dedicated market views on the website. I usually use it to validate whether keyword demand is translating into real traffic flow—or staying theoretical.

This step has saved me from chasing keywords that look good on paper but don’t move buyers in practice.

Choosing the Right Tool to Read the Market

If you’re evaluating tools for shopee market data, don’t ask how much data they show.

Ask:

Can this tool show me category structure?

Can it reveal who controls demand?

Can it expose keyword-level market shifts before products respond?

If not, it’s not market data. It’s decoration.

Shopdora exists because sellers need visibility beyond their own store. Market data is the layer that connects instinct with evidence.

Final Thought: Markets Speak Before Sales Do

I don’t wait for my sales to tell me something is wrong anymore.

Markets move first. Data whispers before it shouts.

Learning how to read shopee market data changed how I operate as a seller. And once you start seeing the market clearly, you stop gambling—and start choosing.

That’s the real value of market data done right.