Shopee Price Tracker That Actually Works: How I Monitor Competitor Pricing Without Guesswork

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now, mostly in competitive, fast-moving categories. I’m not part of a big team, and I don’t have the luxury of burning budget just to “test and see.” Every pricing decision I make has to be backed by data, not gut feeling.

If you’ve ever searched for a Shopee price tracker, you probably had the same problem I did early on: Shopee’s seller center only tells you your own SKU prices and sales. It gives you almost nothing about how competitors are pricing, how often they change prices, or whether a sudden price drop is a short-term promotion or a long-term strategy.

That blind spot is exactly what this article is about.

I want to share how I approach competitor price tracking on Shopee today, and how I use Shopdora’s Comprehensive Analysis and Market Analysis features to solve a very real problem: pricing competitively without racing to the bottom.

This isn’t theory. It’s the workflow I actually use.

Why “price tracking” on Shopee is harder than most sellers expect

Most Shopee sellers think price tracking means checking competitor listings once in a while and writing numbers into a spreadsheet. I used to do that too. The problem is that Shopee is extremely dynamic. Prices change because of flash sales, vouchers, campaign days, and even inventory pressure. Looking at a single snapshot tells you almost nothing.

What you really need to understand is price behavior over time.

Is this competitor always cheaper than you, or only during campaigns?

Is the market price drifting downward, or staying stable while volume grows?

Are higher-priced products still selling, or is the market shifting toward budget options?

Shopee’s own backend doesn’t answer these questions, because it’s designed for store management, not market-level analysis. That’s where an external Shopee price tracker becomes necessary.

For me, that tracker is not just about prices alone—it’s about prices in context.

How I use Comprehensive Analysis as my core Shopee price tracker

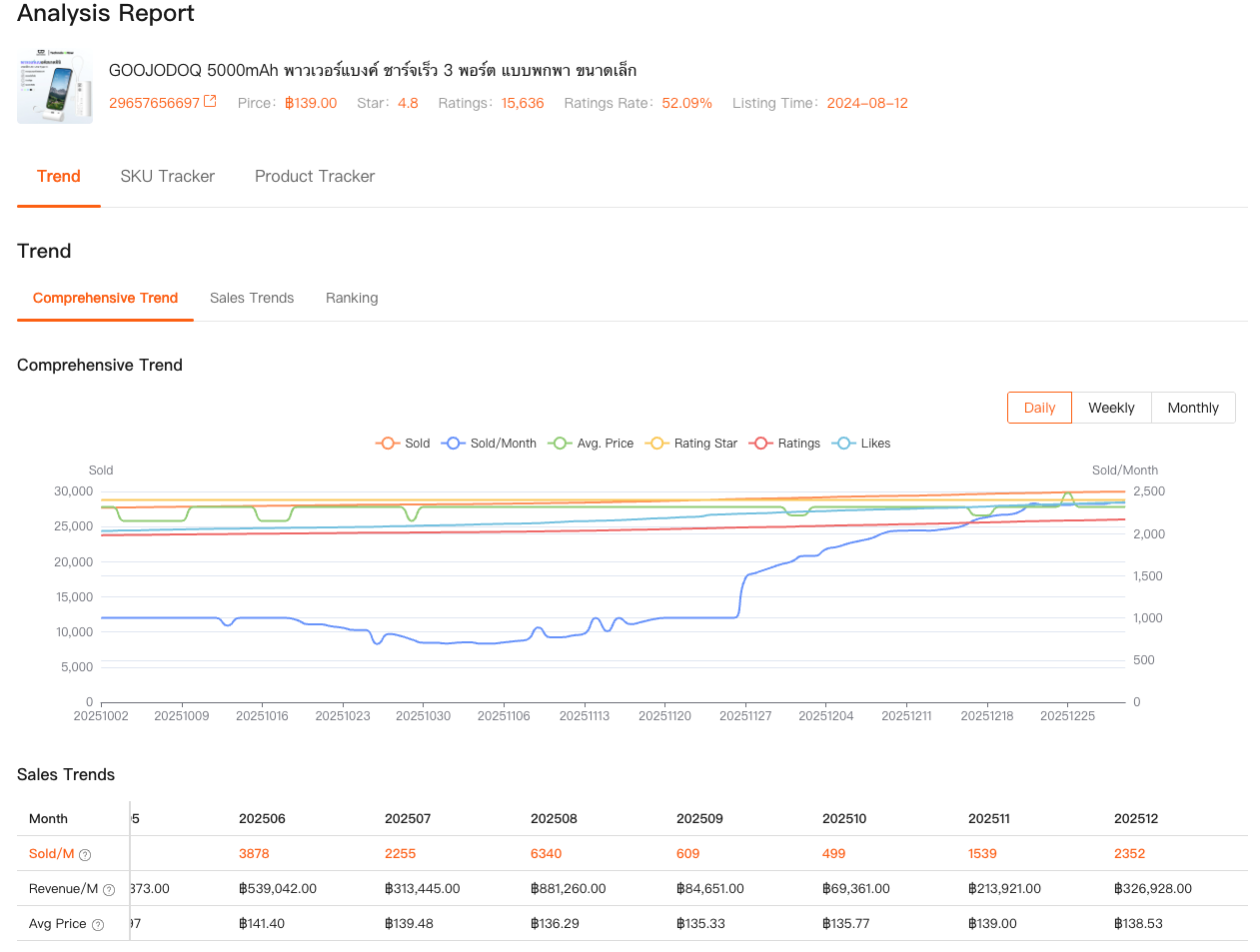

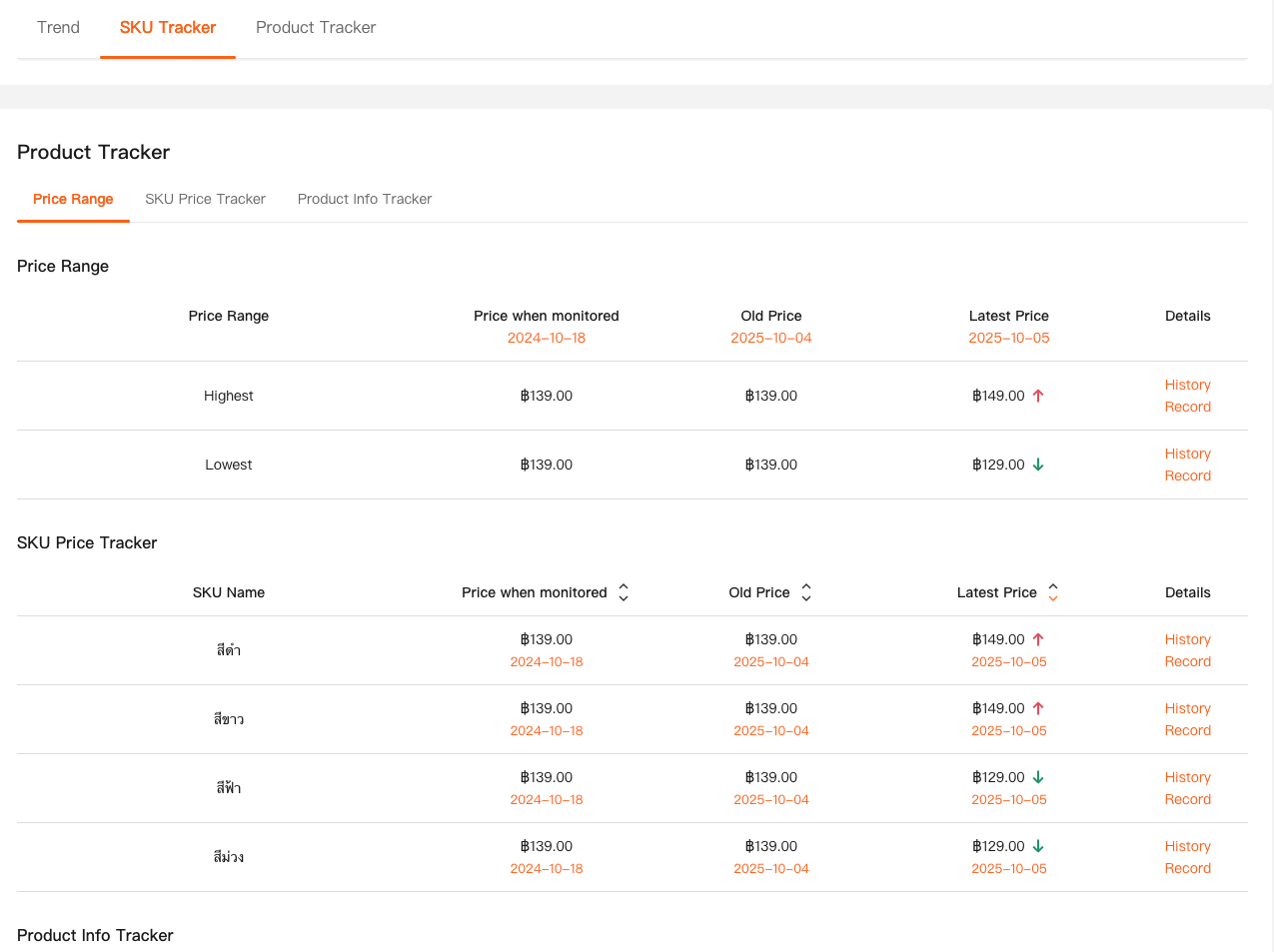

The feature I rely on most is Shopdora’s Comprehensive Analysis. Despite the name, I don’t treat it as a generic “overview” tool. I use it very specifically to track how competitor prices evolve alongside sales, rankings, and lifecycle changes.

When I analyze a competitor product, I’m not just looking at today’s price. I’m looking at historical price movement, sales trends, ranking changes, and how long the product has been listed. This matters because a low price means very different things depending on timing. A new product priced aggressively is testing the market. An old product suddenly cutting price may be clearing stock. Those are two completely different competitive signals.

What makes Comprehensive Analysis effective as a Shopee price tracker is that it lets me see pricing as part of a bigger pattern. If I notice that several top-ranking products in my niche lowered prices at the same time, and sales volume increased rather than dropped, that tells me the market can absorb lower prices without killing margin through volume. On the other hand, if prices drop but sales stay flat, I know a price war is likely underway—and I should think twice before following.

Over time, this has helped me avoid emotional pricing decisions. I don’t react to one competitor anymore. I react to market behavior.

Using Market Analysis to understand “price bands,” not just prices

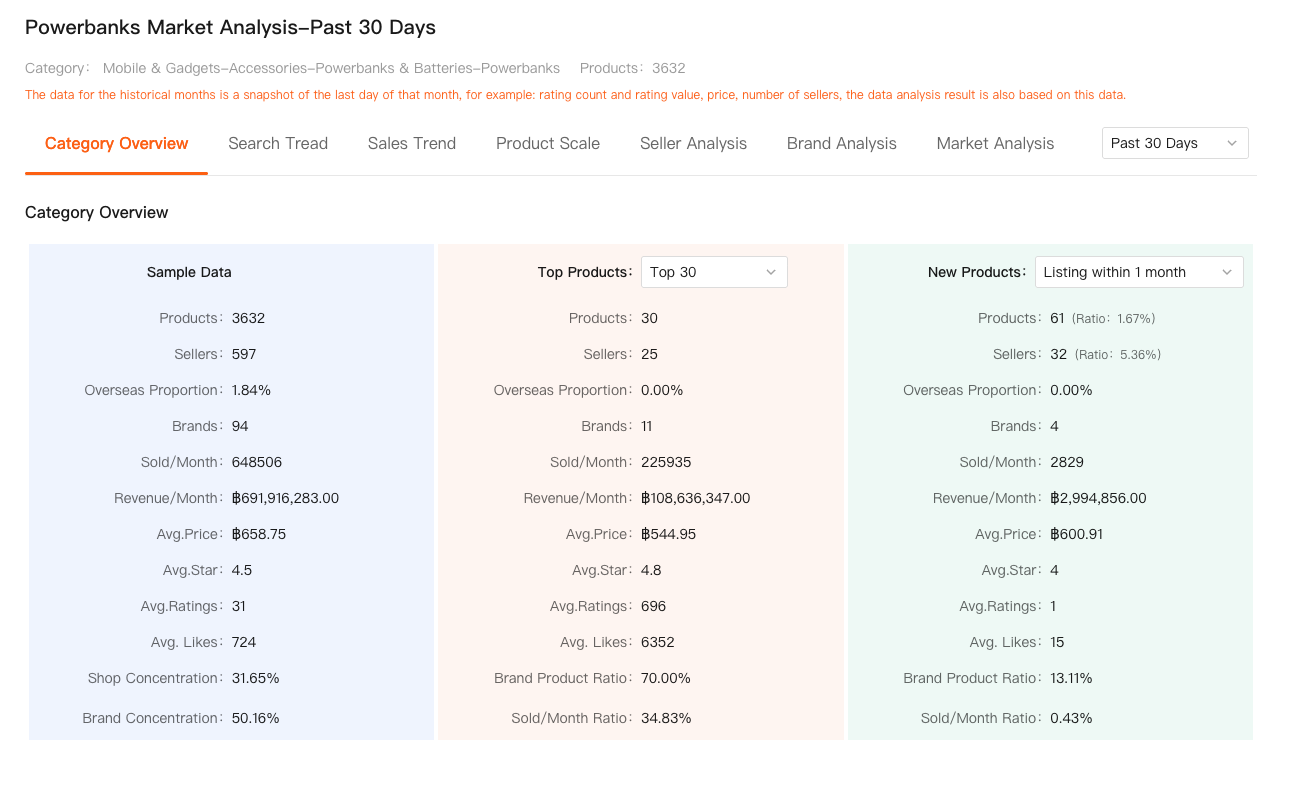

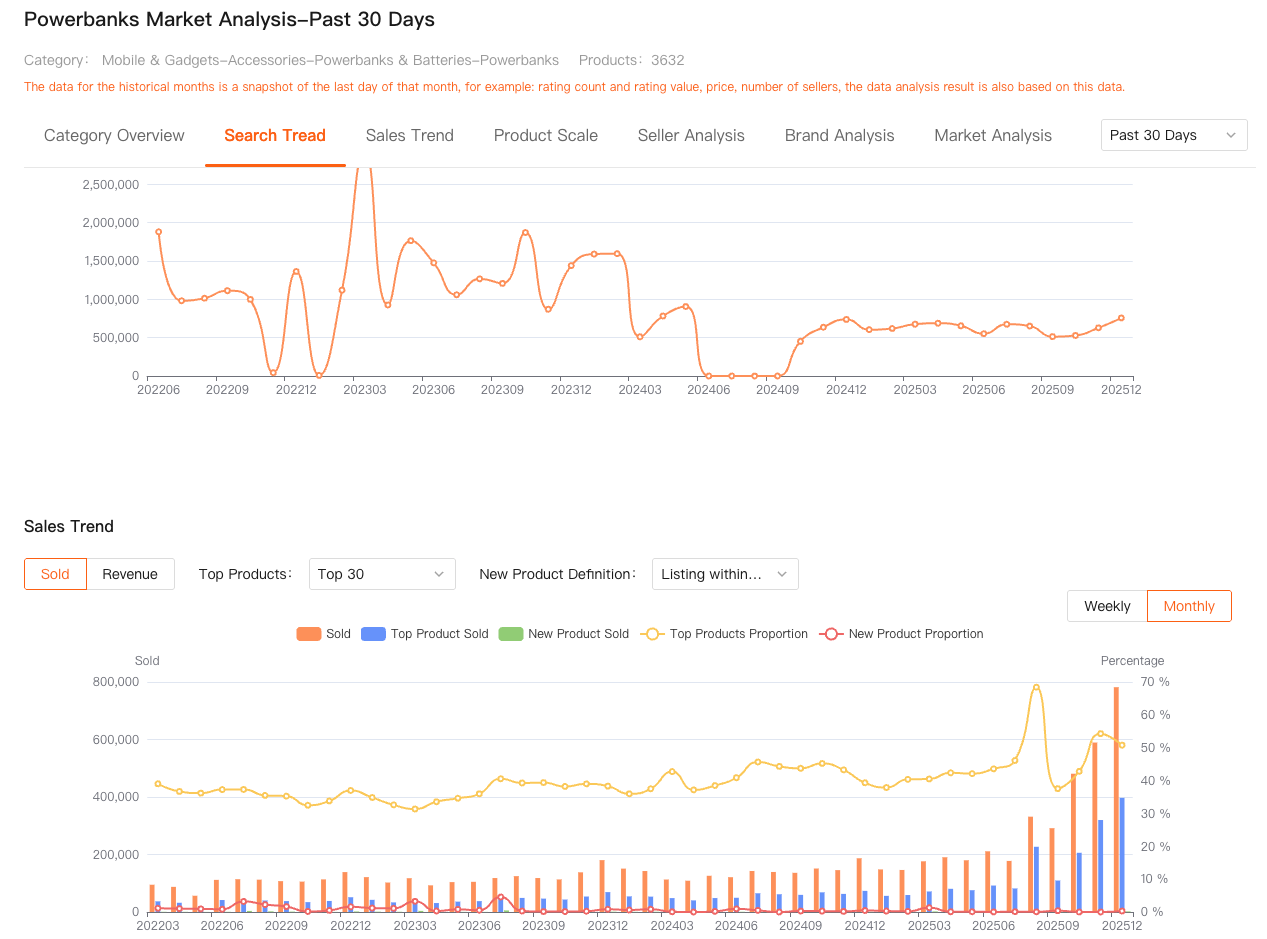

The second feature that completely changed how I price products is Market Analysis.

Instead of focusing on individual competitors, Market Analysis lets me step back and look at the entire category: how many products exist, how prices are distributed, and how concentrated sales are at different price levels. This is critical, because the best price on Shopee is rarely the lowest price—it’s the right price for the right segment.

In many categories, especially non-standard or semi-branded products, the market naturally splits into price bands. There’s usually a low-price cluster with intense competition and thin margins, a mid-range cluster where most volume happens, and a premium segment that sells less but more steadily. Market Analysis helps me see where my product realistically belongs.

From a Shopee price tracker perspective, this is powerful. Instead of asking “Who is cheaper than me?”, I’m asking “Which price band is actually driving revenue in this market right now?” Sometimes I discover that lowering my price would push me into a more competitive band with worse ROI. Other times, I realize my product is overpriced relative to where the demand actually is.

Without market-level pricing context, price tracking is just noise.

Tracking price changes without chasing every competitor

One of the biggest mistakes I see newer Shopee sellers make is obsessively following competitor prices day by day. That usually ends in panic-driven discounts. I’ve been there.

What I learned is that not every price change matters. What matters are patterns. Shopdora helps me identify those patterns because I can consistently observe how multiple competing products behave over time, rather than reacting to isolated changes.

For example, if a competitor lowers price but their sales ranking drops, I don’t care. That’s not a signal worth responding to. But if several products in the same market segment slowly lower prices over weeks while maintaining or improving sales, that’s a structural shift. That’s when I reconsider my pricing.

In practice, this means I don’t use Shopdora to micro-manage prices daily. I use it to make fewer but better pricing decisions, backed by market evidence rather than fear.

Why this approach scales better than manual tracking

Before using a proper Shopee price tracker workflow, I tried manual methods: browser bookmarks, Excel sheets, even screenshots. None of them scale. As soon as you manage more than a handful of SKUs, manual tracking collapses.

The advantage of using tools like Shopdora isn’t convenience—it’s consistency. Because the data updates regularly and is structured around products, categories, and markets, I can revisit my pricing logic weeks or months later and still understand why I made a decision.

That’s something most sellers underestimate. Good pricing strategy isn’t about reacting faster; it’s about being consistently rational.

A realistic note on what a Shopee price tracker can and cannot do

It’s important to be honest here. No Shopee price tracker can tell you your competitor’s costs, profit margins, or internal strategy. Shopdora doesn’t pretend to do that, and neither should you.

What it gives you is visibility into the market reality: how products are priced, how those prices change, and how the market responds. That’s more than enough to make smarter decisions—if you interpret it correctly.

Pricing still requires judgment. The difference is that now, that judgment is informed by real data, not assumptions.

Final thoughts

If you’re searching for a Shopee price tracker because you want to undercut everyone else, you’ll probably be disappointed in the long run. That path leads to margin erosion and burnout.

But if you use price tracking to understand your market, position your product intelligently, and choose when not to compete on price, it becomes one of the most valuable parts of your Shopee data analytics stack.

For me, Shopdora’s Comprehensive Analysis and Market Analysis didn’t just help me track prices. They helped me stop guessing—and that alone paid for itself many times over.

If you’re serious about building a sustainable Shopee business, that shift in mindset matters far more than any single price change.