Shopee Product Research: Why Most Sellers Fail Before the Product Even Launches

Hi, I’m David.

I’ve been selling on Shopee for just over three years as a solo seller. Most of what I know comes from launching products that worked, and more importantly, killing products that didn’t.

If you’ve been around Shopee long enough, you’ve probably realized this:

Most product failures don’t happen because of bad execution.

They happen because of bad product research.

And when people talk about Shopee product research, they often mean something very shallow — scrolling through the app, checking prices, or copying whatever looks popular this week.

That’s not research. That’s guessing.

This article is about how I changed my approach to Shopee product research by focusing on market data and competitor behavior, and how tools like Shopdora helped me answer questions Shopee itself doesn’t give sellers visibility into.

The Core Problem With Shopee Product Research

Let’s start with an uncomfortable truth.

Shopee is very good at showing you:

- What’s selling now

- What’s ranking today

- What’s cheap at this moment

But Shopee is very bad at showing you:

- Why a product is selling

- How long it’s been selling

- Whether the demand is growing or already peaking

That’s why many sellers experience this pattern:

- Spot a “hot” product

- Source it quickly

- Launch fast

- Compete on price

- Sales fade within weeks

The issue isn’t speed.

It’s that Shopee product research is often done without historical and competitive context.

What Real Shopee Product Research Should Answer

Before I touch any product, I want clear answers to three questions:

- Is this demand real, or just temporary noise?

- Who is actually making money in this category?

- What does the winning product structure look like — not just the price?

Shopee’s seller center can’t answer these.

Browsing the app can’t answer these either.

This is where data-driven product research becomes essential.

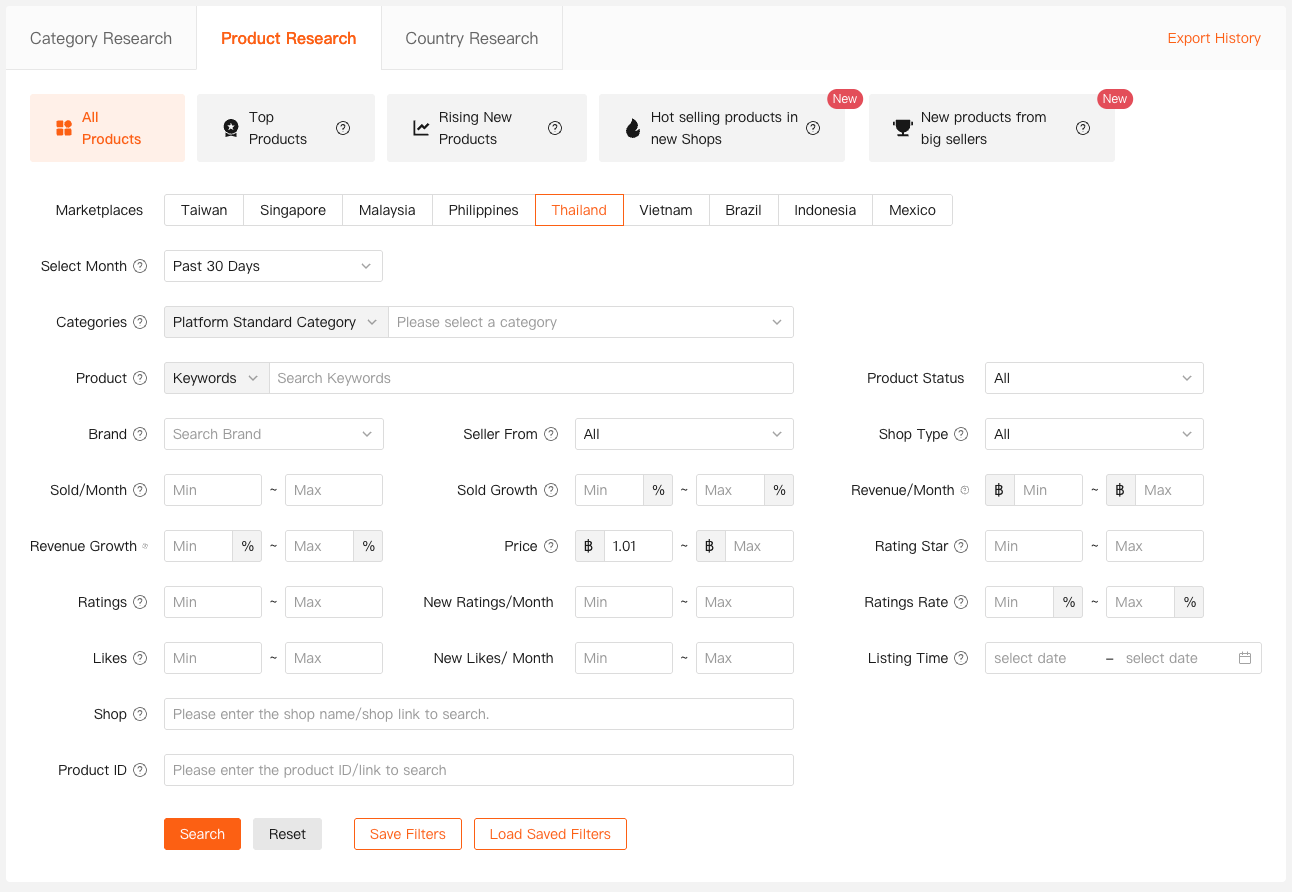

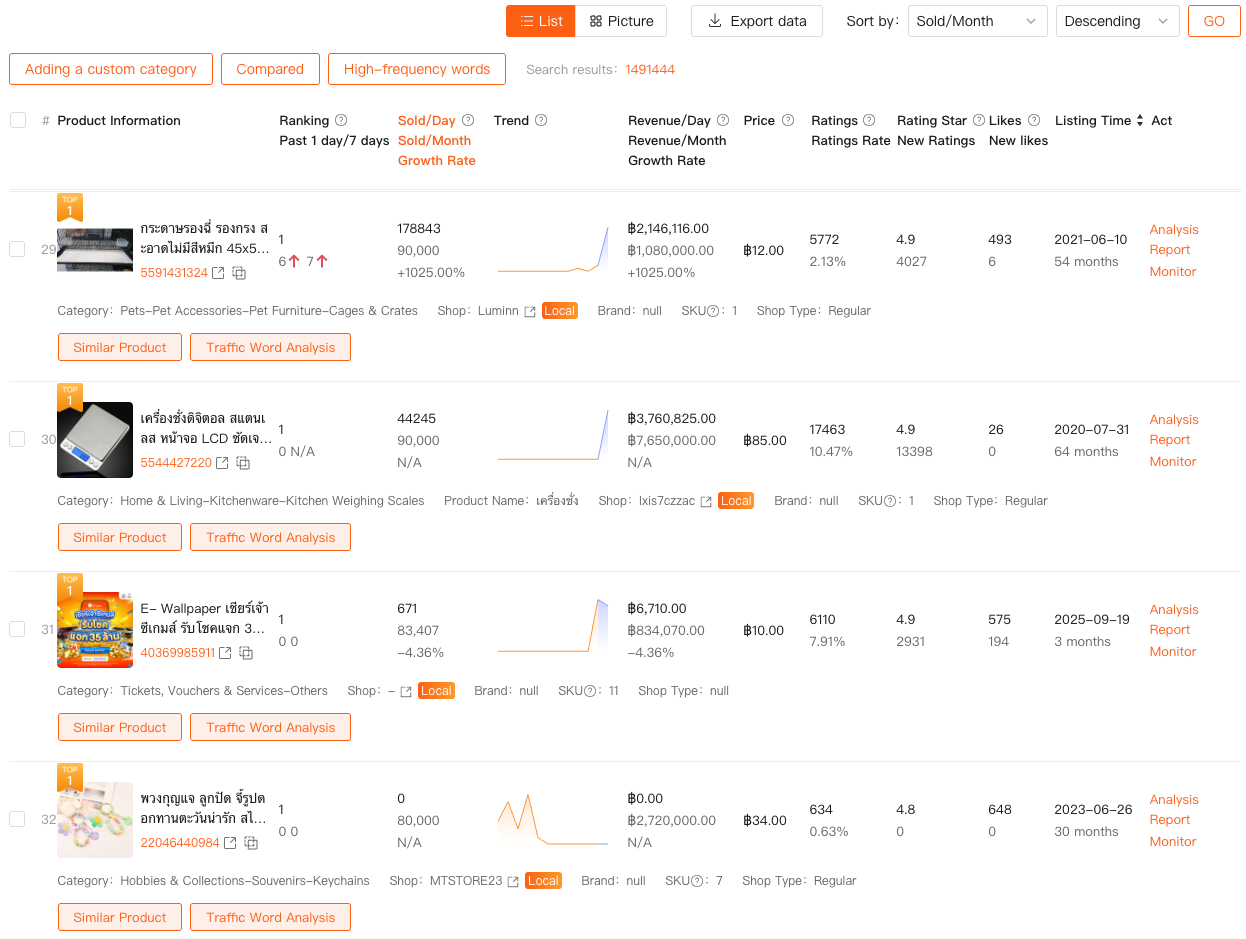

Feature 1: Product Research (Market-Level, Not Store-Level)

One of the biggest mindset shifts I made was moving away from “store-based thinking” to market-based thinking.

With Shopdora’s Product Research, I’m not looking at my own products at all. I’m looking at the entire market.

This feature allows me to:

- Filter products by site, category, price range, sales volume, growth rate

- See historical sales trends, not just current performance

- Identify products that are consistently selling, not just spiking

Why this matters for Shopee product research:

A product that sold 1,000 units last week but has been declining for months is far riskier than a product selling 300 units steadily with upward momentum.

When I research products now, I actively avoid:

- Sharp one-week spikes

- Products with long declining sales curves

- Categories where only one or two listings dominate everything

This alone has dramatically reduced bad launches.

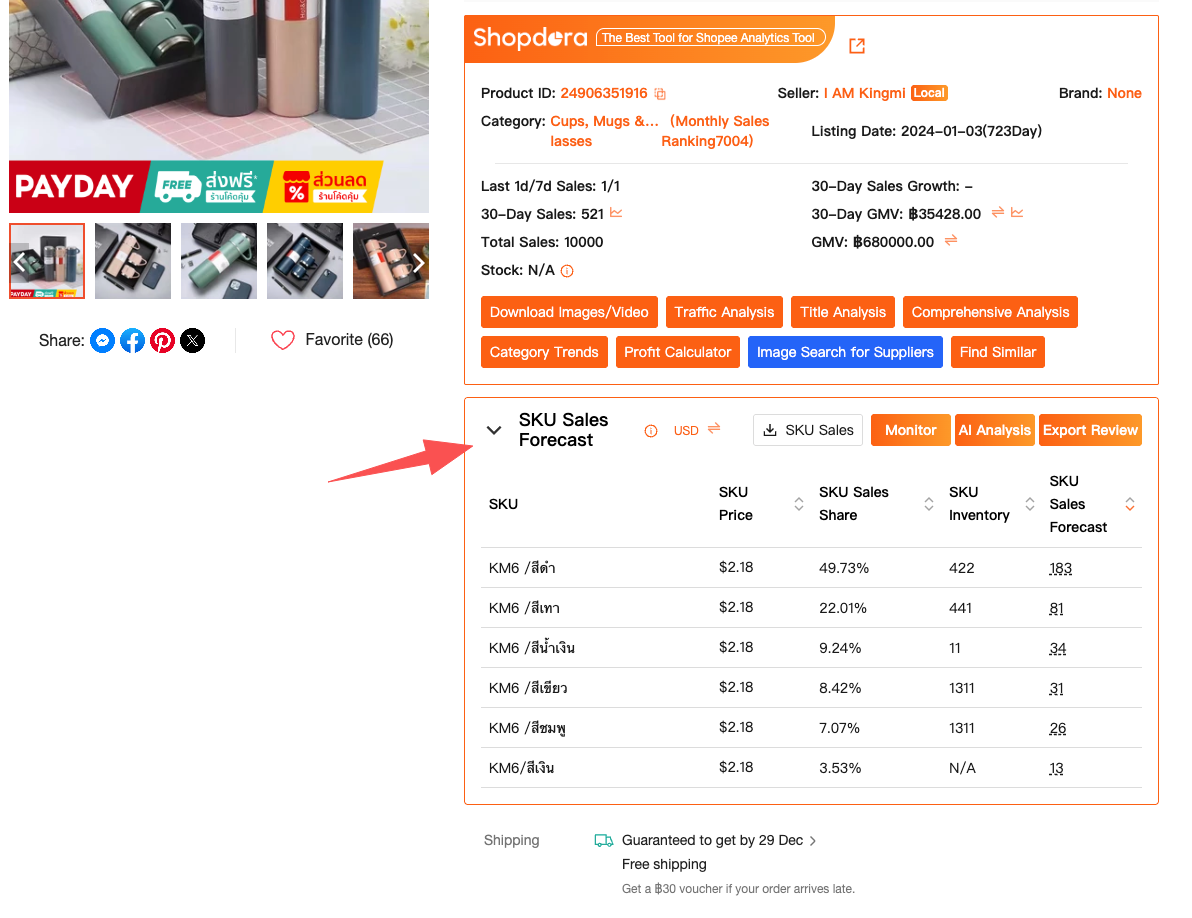

Feature #2: SKU Insight — The Most Ignored Part of Product Research

Most sellers evaluate products at the listing level.

But buyers don’t buy listings.

They buy specific SKUs.

Using SKU Insight, I can break down:

- Which variants actually drive sales

- How revenue is distributed across SKUs

- Whether a product relies on one hero SKU or many

This is critical for Shopee product research because it answers questions like:

- Do customers prefer a specific size or bundle?

- Is the “cheap” option actually selling, or just attracting clicks?

- Are competitors using SKU structure to control AOV?

I’ve avoided multiple bad products simply by realizing:

“Yes, this listing sells — but only one SKU sells, and it’s not profitable for me.”

Shopee’s interface doesn’t show this.

Without SKU-level insight, your research is incomplete.

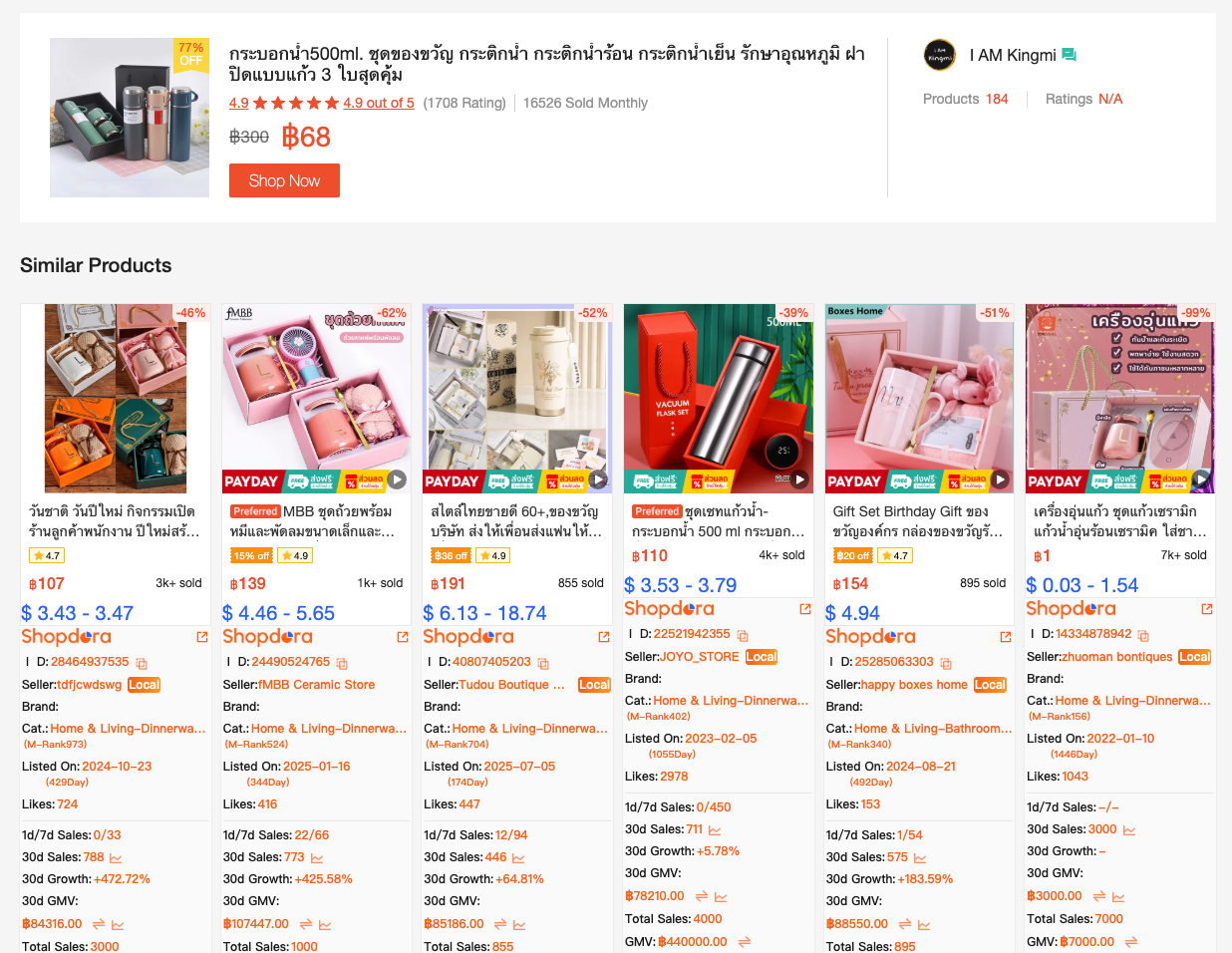

Feature #3: Competitive Context Beats Copying

Many sellers still do product research by copying top listings:

- Same images

- Same pricing

- Same positioning

That approach worked years ago. It doesn’t anymore.

What I care about now is competitive structure, not surface imitation.

By combining Product Research with Find Similar and trend data, I look for:

- How many competitors exist at each price band

- Whether new listings are entering or exiting the market

- How fast winning products were able to scale

This tells me:

- If the market is still open

- If differentiation is possible

- If I’m too late

That’s real Shopee product research — not just cloning.

Why Good Shopee Product Research Is About Saying “No”

Here’s something nobody tells new sellers:

The goal of product research isn’t to find products to sell.

It’s to find products not to sell.

Once I started using deeper Shopee data:

- I launched fewer products

- I invested more confidently

- My hit rate improved

Tools like Shopdora didn’t magically make products win.

They helped me avoid obvious traps:

- Oversaturated categories

- Declining trends

- Low-margin SKU structures

That’s what good research does — it removes blind spots.

How I Structure My Shopee Product Research Workflow

This is roughly how I do it today:

- Start with market-level Product Research

→ Filter for stable demand and growth - Analyze SKU Insight of top products

→ Understand real buying behavior - Check competitive density and trends

→ Decide if entry still makes sense

Only after that do I think about sourcing, pricing, or branding.

Shopee’s seller tools help me operate my store.

External Shopee data helps me decide what deserves to exist in my store.

Final Thoughts

If you’re searching for “Shopee product research,” you’re probably tired of guessing.

The truth is:

- No tool guarantees winning products

- But bad research guarantees losing ones

Learning how to read market data, competitor behavior, and SKU structures has done more for my business than any tactic or ad strategy.

Shopdora is part of that process for me — not because it replaces thinking, but because it gives visibility where Shopee stays silent.