Shopee Seller Guide: How a Proper Shopee Analytics Tool Boost Your Selling

Hi, I’m David.

I’ve been selling on Shopee for over three years, running my own store without a big team or outside funding. Like most sellers, I started by living inside the Shopee Seller Center—checking sales, ads, conversion rates, and SKU performance every day.

And here’s something I learned the hard way:

Your own backend already tells you what’s happening in your store.

What it doesn’t tell you is what’s happening in the market.

That blind spot is where most bad decisions come from.

This is why, when people ask me what a real Shopee analytics tool should do, my answer is always the same:

It shouldn’t focus on your data.

It should help you understand everyone else’s.

Why “Knowing Your Numbers” Is Not Enough on Shopee

Shopee Seller Center is fine—for internal operations.

You can see:

- Your sales

- Your SKUs

- Your inventory

- Your ad performance

But when you’re deciding whether to:

- Enter a category

- Scale a product

- Copy a competitor

- Fight a price war

- Or exit a market

Your own data is almost useless on its own.

Because every strategic decision on Shopee is relative.

You’re not competing against your past self.

You’re competing against hundreds or thousands of other listings.

That’s where external analytics becomes critical.

Market Analysis: Understanding the Game Before You Play

The first thing I look at is never my product.

It’s the category.

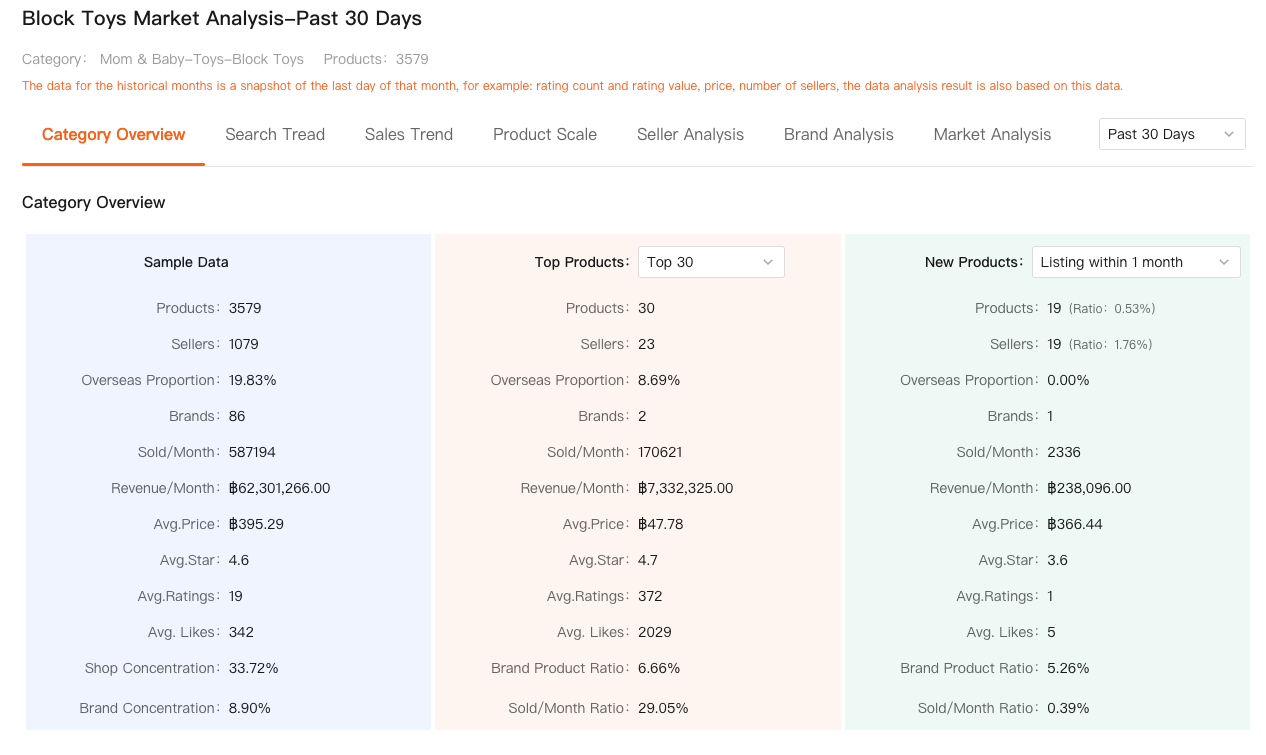

Using market-level analytics (like Market Analysis in Shopdora), I try to answer three questions:

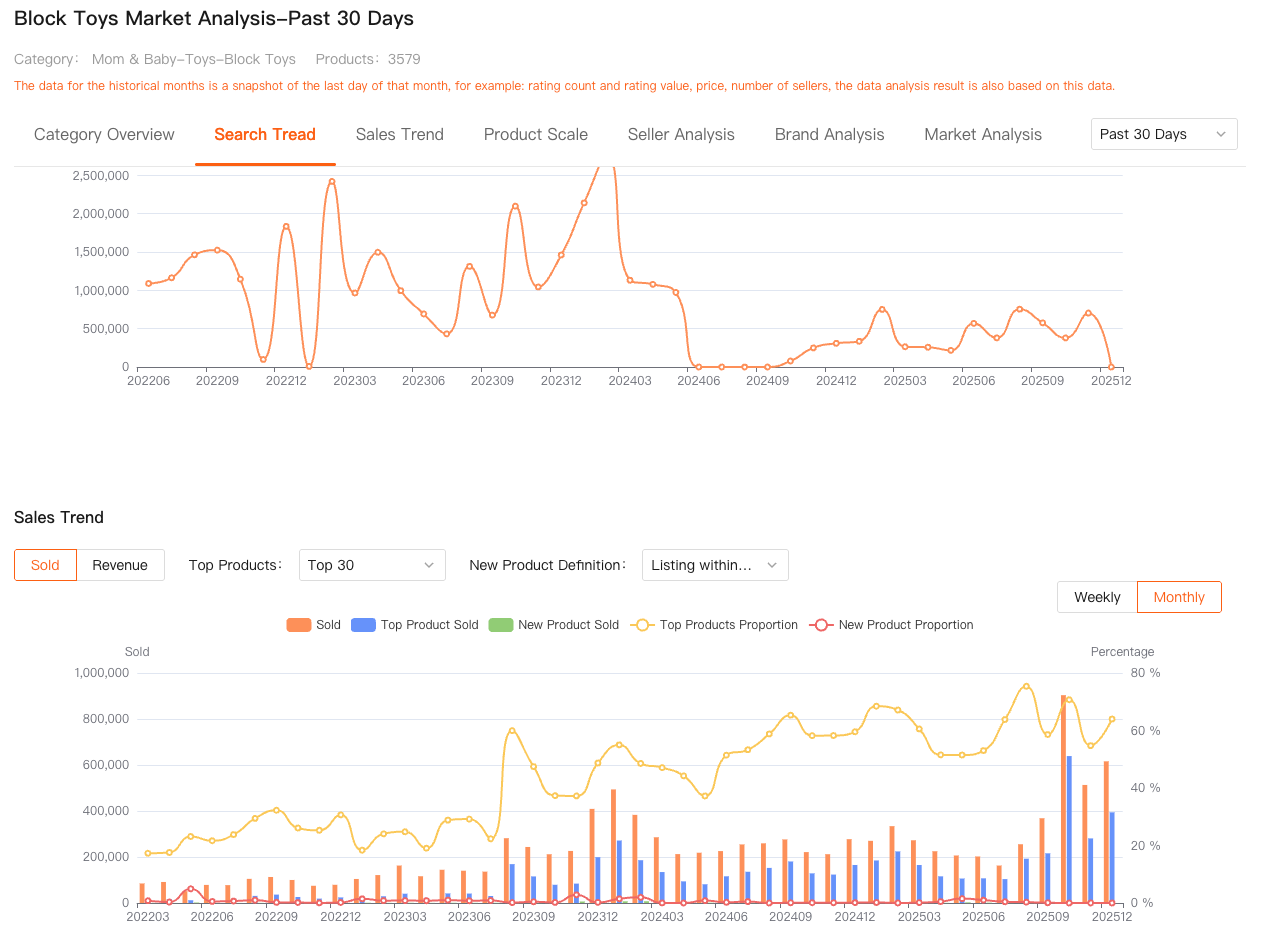

1. Is This Market Still Growing — or Already Saturated?

A product “not selling” doesn’t always mean bad execution.

Sometimes:

- Demand is flat

- Buyers are already loyal to existing brands

- New sellers are flooding in faster than demand grows

Market trend data—sales volume, revenue movement, competition density—tells you whether the game is still worth playing.

Without this view, sellers often:

- Over-optimize dying products

- Add inventory into shrinking demand

- Burn ad budget chasing a trend that already peaked

A proper Shopee analytics tool should help you avoid losing battles, not just fight harder.

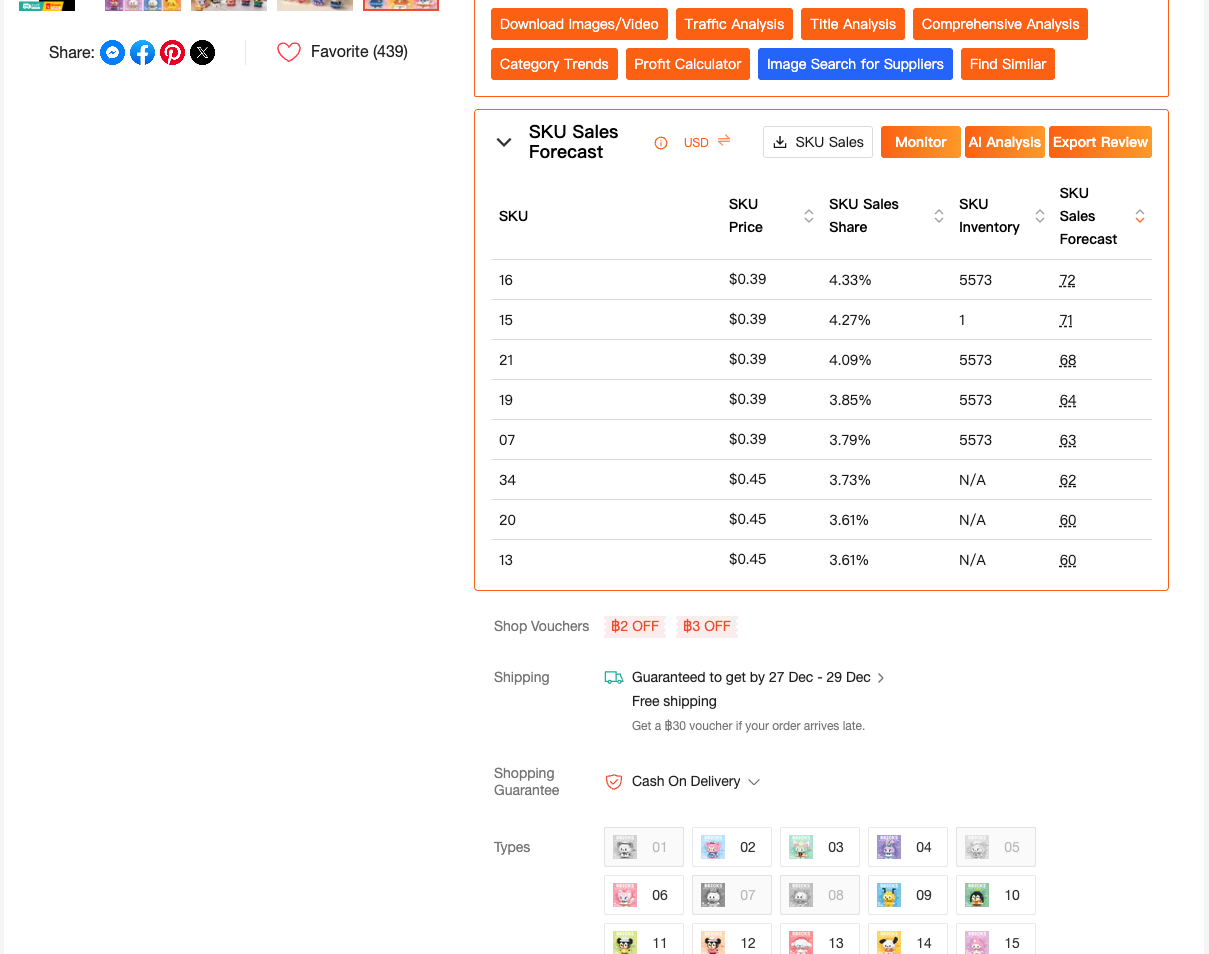

SKU Insight Isn’t About Your SKUs — It’s About Theirs

Here’s a misconception I see all the time:

“I already know my SKU sales. Why do I need SKU analysis?”

Because your competitors’ SKU data is what actually matters.

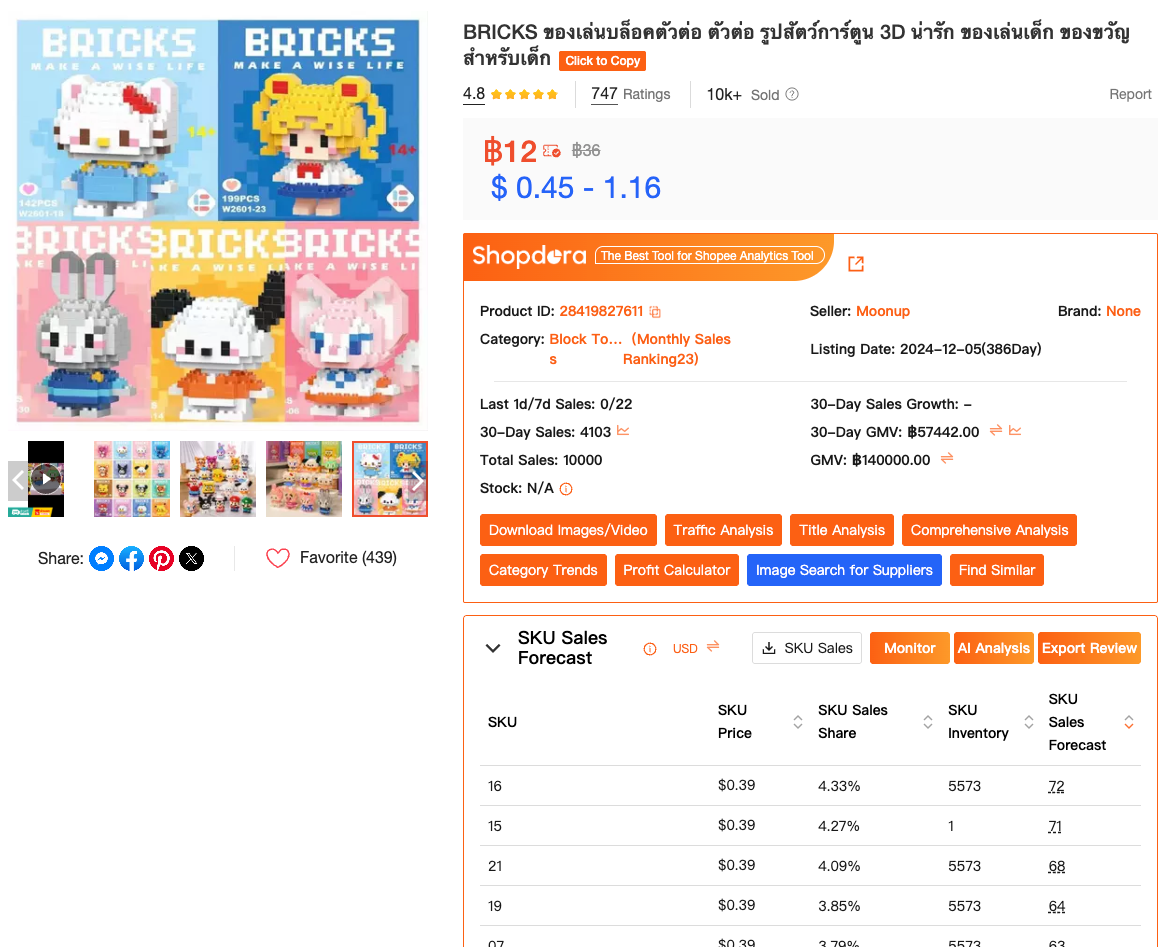

With competitor-facing SKU insight (like what Shopdora surfaces directly on product pages), you can observe:

- Which variant actually drives most sales

- How pricing differs by SKU

- Whether sales are concentrated or evenly distributed

- Which SKUs are likely being pushed by ads or inventory strategy

This answers questions your backend never can:

- Is the bestseller really the cheapest SKU?

- Are competitors winning by focusing on one hero SKU?

- Are certain variants just there for anchoring price?

I’ve avoided countless bad product copies by realizing:

“The product looks hot, but only one SKU is moving — and margins are terrible.”

That’s market intelligence, not internal reporting.

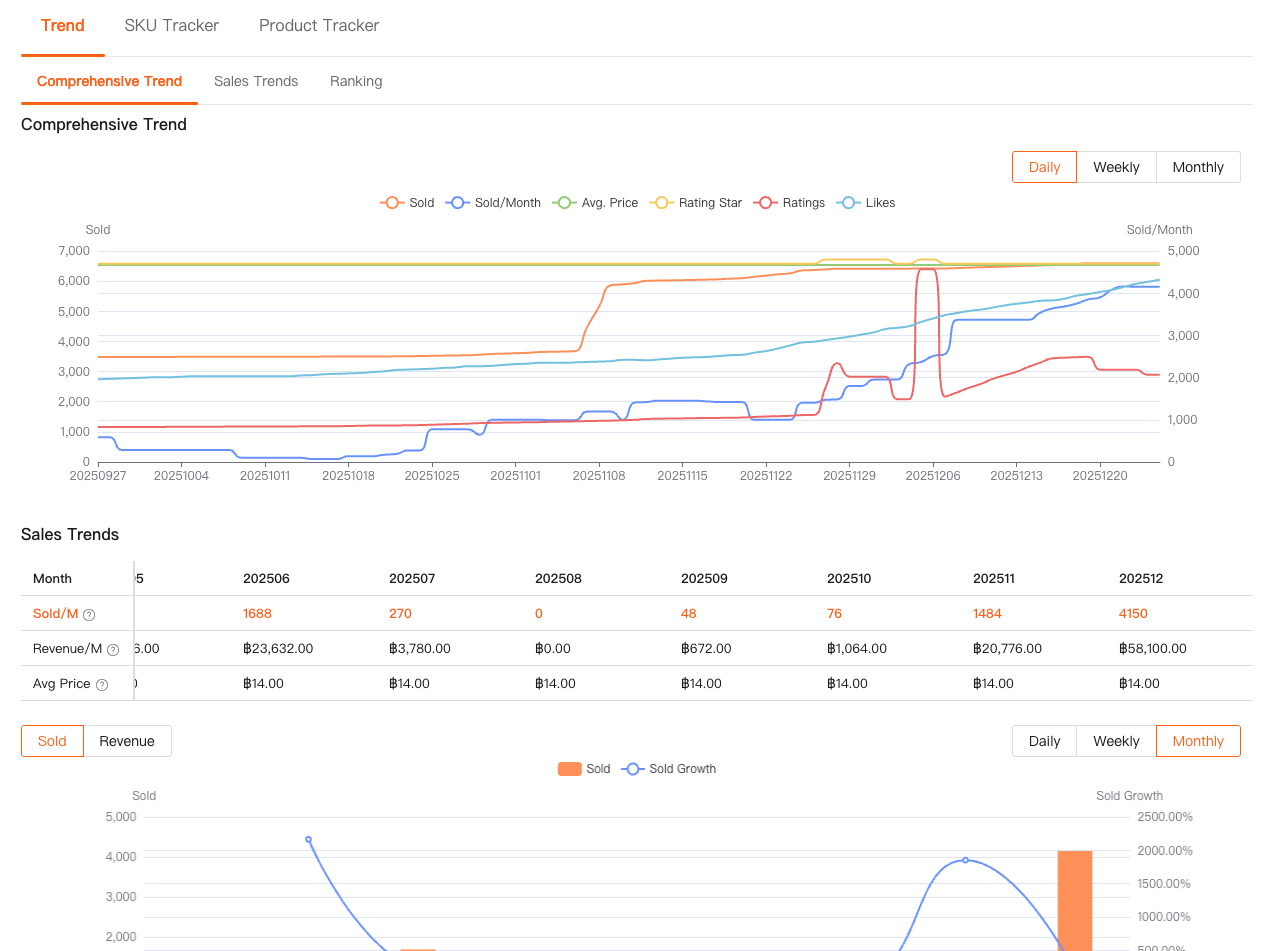

Comprehensive Analysis: Tracking Competitors Over Time, Not in Snapshots

Most sellers judge competitors by what they see today:

- Current price

- Current sales

- Current ranking

That’s dangerous.

What matters is direction, not position.

Using comprehensive competitor analysis (trend, ranking, pricing, SKU changes), I watch:

- Is this product rising fast or slowly declining?

- Did sales spike because of discounts?

- Are rankings stable or artificially boosted?

- Have they changed pricing or SKUs recently?

This kind of historical visibility reveals intent.

For example:

- Sudden price drops often signal inventory pressure

- Ranking volatility may indicate heavy ad dependence

- Stable SKU pricing over months usually means healthy margins

A Shopee analytics tool should help you read competitor behavior, not just competitor stats.

Why This Matters More Than Optimizing Your Own Store

Here’s the uncomfortable truth:

Most sellers fail not because they execute poorly, but because they choose the wrong battles.

They:

- Enter saturated markets too late

- Copy products without understanding SKU economics

- Scale when competitors are already exiting

External analytics flips the decision flow.

Instead of asking:

“How do I improve this product?”

You start asking:

“Is this product worth improving at all?”

That shift alone changed how I run my store.

Where Shopdora Fits Into This Workflow

The features I rely on—Market Analysis, competitor SKU Insight, and Comprehensive competitor tracking—are tools I use inside Shopdora.

Not because it tells me how my store is doing

—but because it shows me what the rest of the market is doing.

That includes:

- Category-level trends beyond my own sales

- SKU-level performance of competing listings

- Historical movement that reveals real momentum

For me, Shopdora functions as an external decision lens, not a performance report.

And that distinction matters.

Final Thought

After three years on Shopee, I’ve learned this:

You can fix execution mistakes.

You can’t fix bad market choices.

A real Shopee analytics tool exists to reduce uncertainty before you commit money, inventory, and time.

If you only analyze your own store, you’re always reacting.

When you analyze the market, you get to choose.

I’m David.

Still selling. Still testing. Still writing from experience—not theory.

And if this article saves you from launching just one bad product, it’s already done its job.