The Shopee Analysis Tool I Wish I Had When I Started Selling

Hi, I’m David. I’ve been selling on Shopee for a little over three years now, running a small shop on my own, making almost every mistake a seller can make at least once. If you’ve been on Shopee long enough, you’ll probably recognize this phase: orders are coming in, ads are running, but deep down you’re never fully sure why one product works and another one doesn’t. You’re surrounded by numbers, but most of them only describe your own store, not the market you’re actually competing in.

That gap—between store-level data and real market-level insight—is exactly where most Shopee sellers get stuck. And it’s also the reason I eventually started relying on a proper Shopee analysis tool, rather than just the Seller Center dashboard.

In this article, I want to share a real problem I ran into, how I tried (and failed) to solve it using native Shopee data, and how a few specific features from Shopdora helped me make better decisions with less guesswork. This isn’t a sales pitch. It’s simply what worked for me.

Why Shopee Seller Center Data Isn’t Enough

Shopee Seller Center is useful, but only up to a point. It tells you what already happened in your own shop: your sales, your clicks, your conversion rate. What it doesn’t tell you is what’s happening around you.

I remember launching a new SKU in a category that looked promising. My early sales were decent, but after two weeks, growth stalled. Seller Center showed stable impressions and okay conversion, yet competitors around me were clearly moving faster. I couldn’t answer some basic questions:

Are they pricing more aggressively?

Are they riding a broader category trend?

Is the market itself shrinking or growing?

This is where I realized I wasn’t lacking effort—I was lacking context. And context requires market-level data, not just store-level metrics.

Understanding the Market Before Blaming the Product

The first turning point for me was learning to separate product performance from market performance. Instead of immediately tweaking prices or burning more ad budget, I started looking at category-level data using Shopdora’s Market Analysis feature.

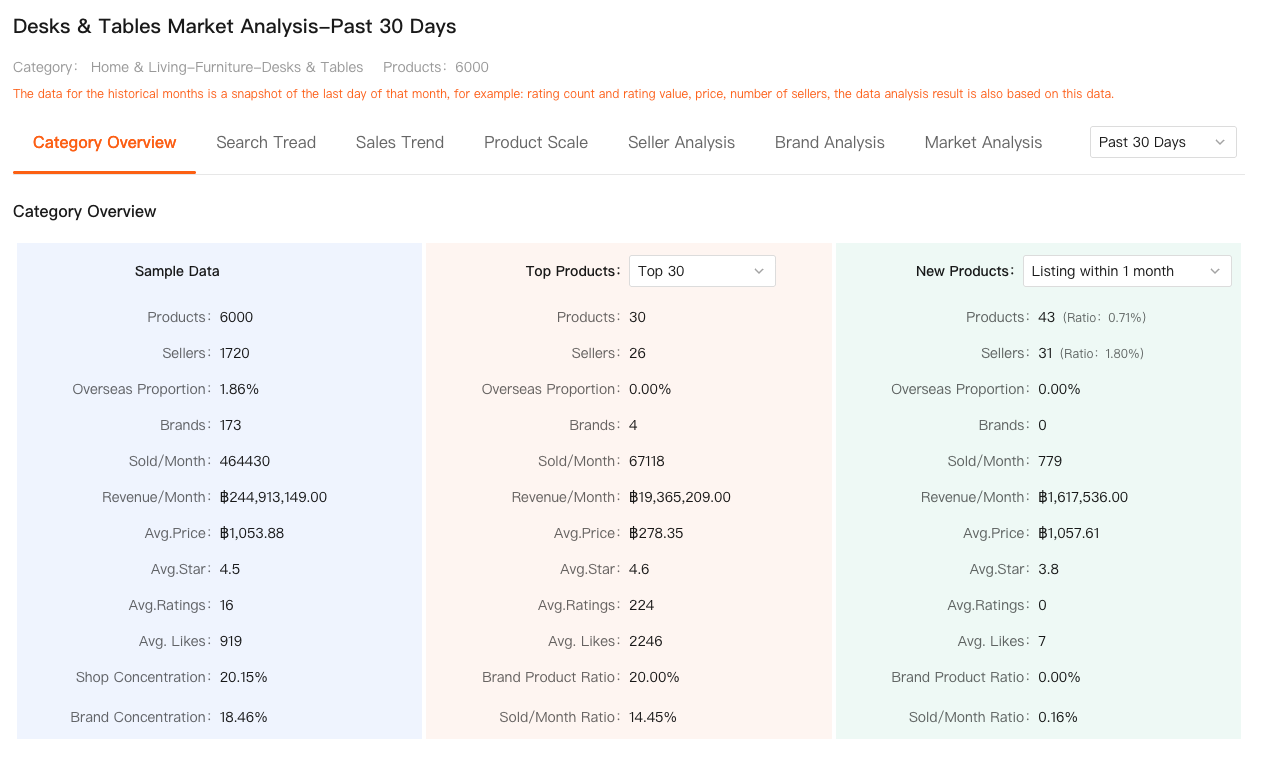

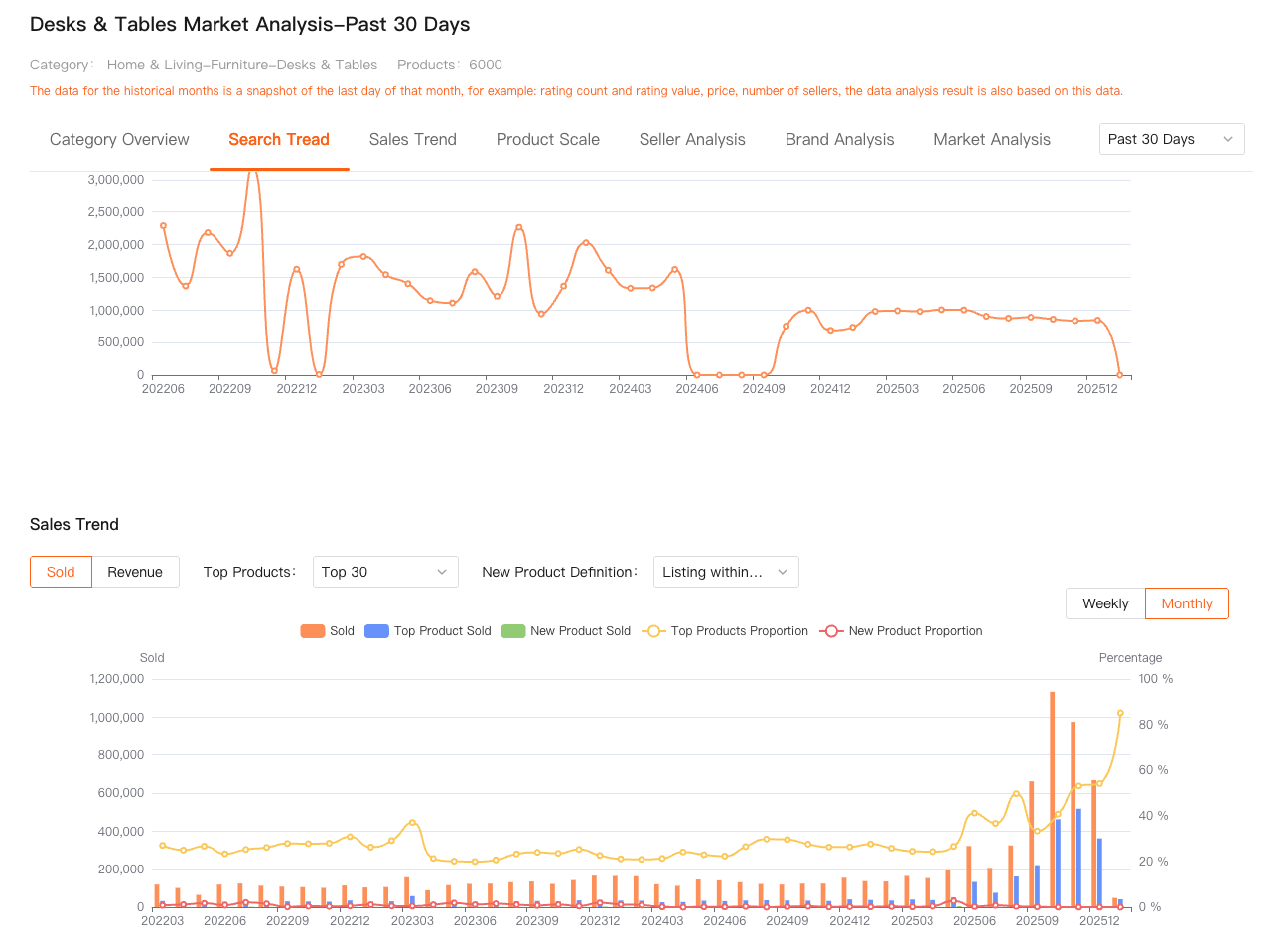

What stood out immediately was how different reality looked when viewed from above. Market Analysis doesn’t focus on individual shops—it shows how an entire category is behaving over time. You can see whether overall sales are growing, flat, or declining, how concentrated the category is, and whether a few top products are dominating most of the demand.

In one case, I discovered that the category I was in had actually peaked two months earlier. My product wasn’t failing; the market momentum had already cooled. That single insight saved me from sinking more money into ads for a product that was never going to scale.

This is something no Shopee Seller Center report can tell you. A proper Shopee analysis tool should help you decide whether a fight is worth fighting at all.

Seeing the Full Picture with Comprehensive Analysis

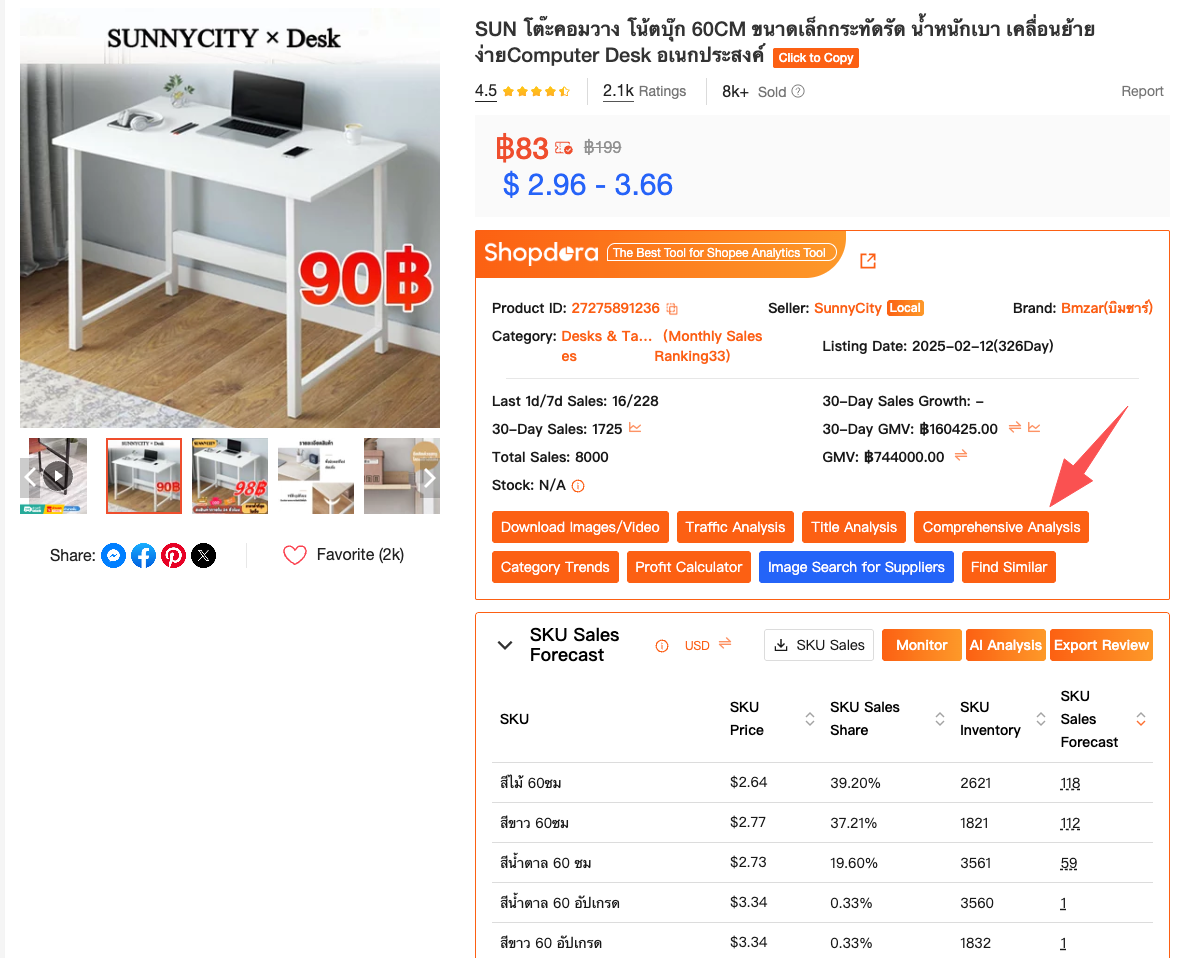

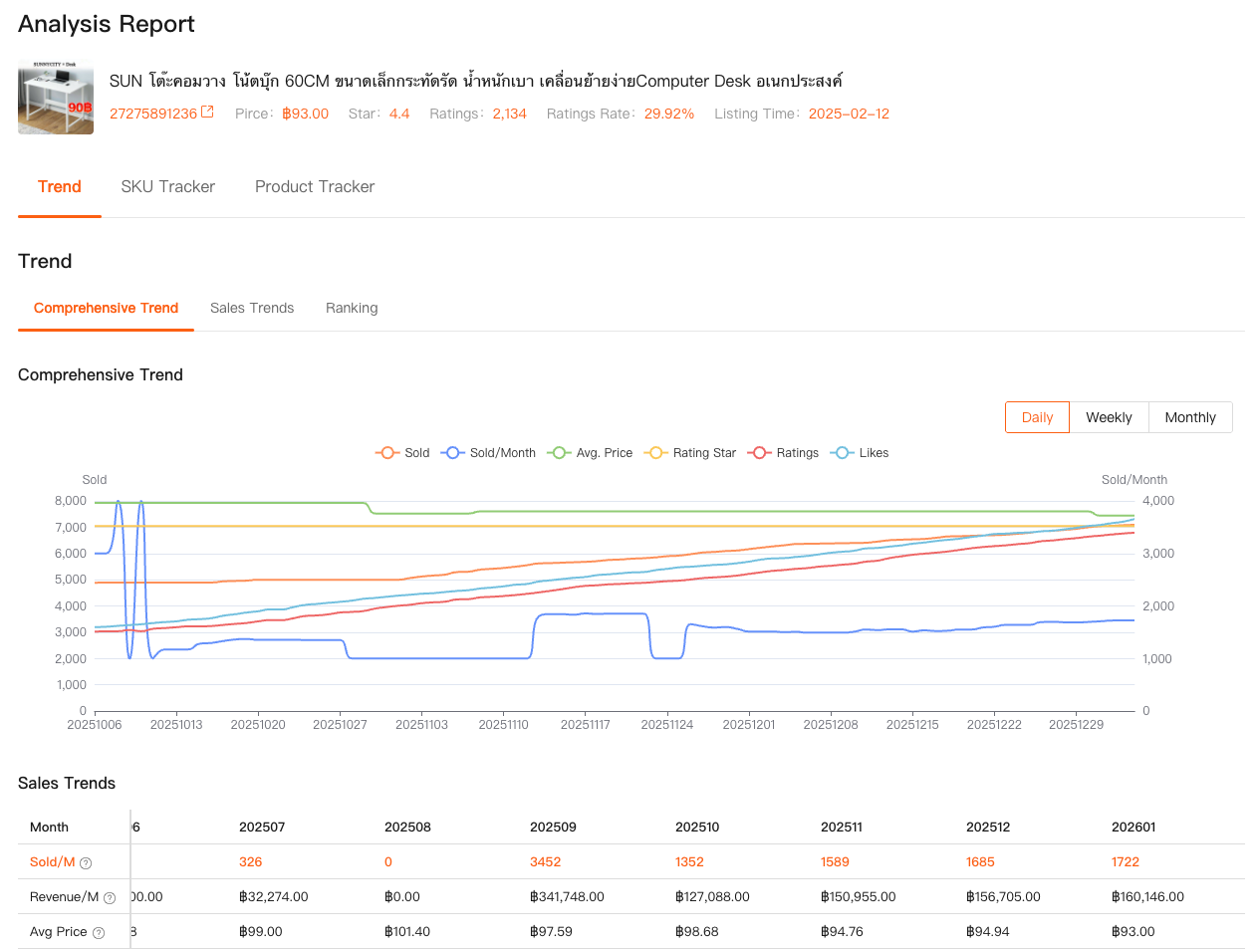

Once I understood the market, the next problem was evaluating specific products, including my own and my competitors’. This is where Shopdora’s Comprehensive Analysis became part of my daily workflow.

What I like about this feature is that it doesn’t isolate metrics. Instead of looking at sales, rankings, and trends separately, it puts them together into one coherent picture. I could see how a product’s sales evolved over time, whether spikes were sustainable or campaign-driven, and how rankings moved alongside revenue.

I once compared my SKU against two competing products that seemed identical at first glance. Seller Center data made them look evenly matched. But Comprehensive Analysis showed that one competitor had extremely volatile sales—huge spikes followed by sharp drops—while the other was growing steadily week by week. That told me a lot about which pricing and promotion strategy was actually sustainable.

For me, that’s what a Shopee analysis tool should do: help you interpret patterns, not just stare at numbers.

Choosing Categories More Carefully with Category Research

After a few painful lessons, I stopped asking “How do I optimize this product?” and started asking “Should I even be in this category?”

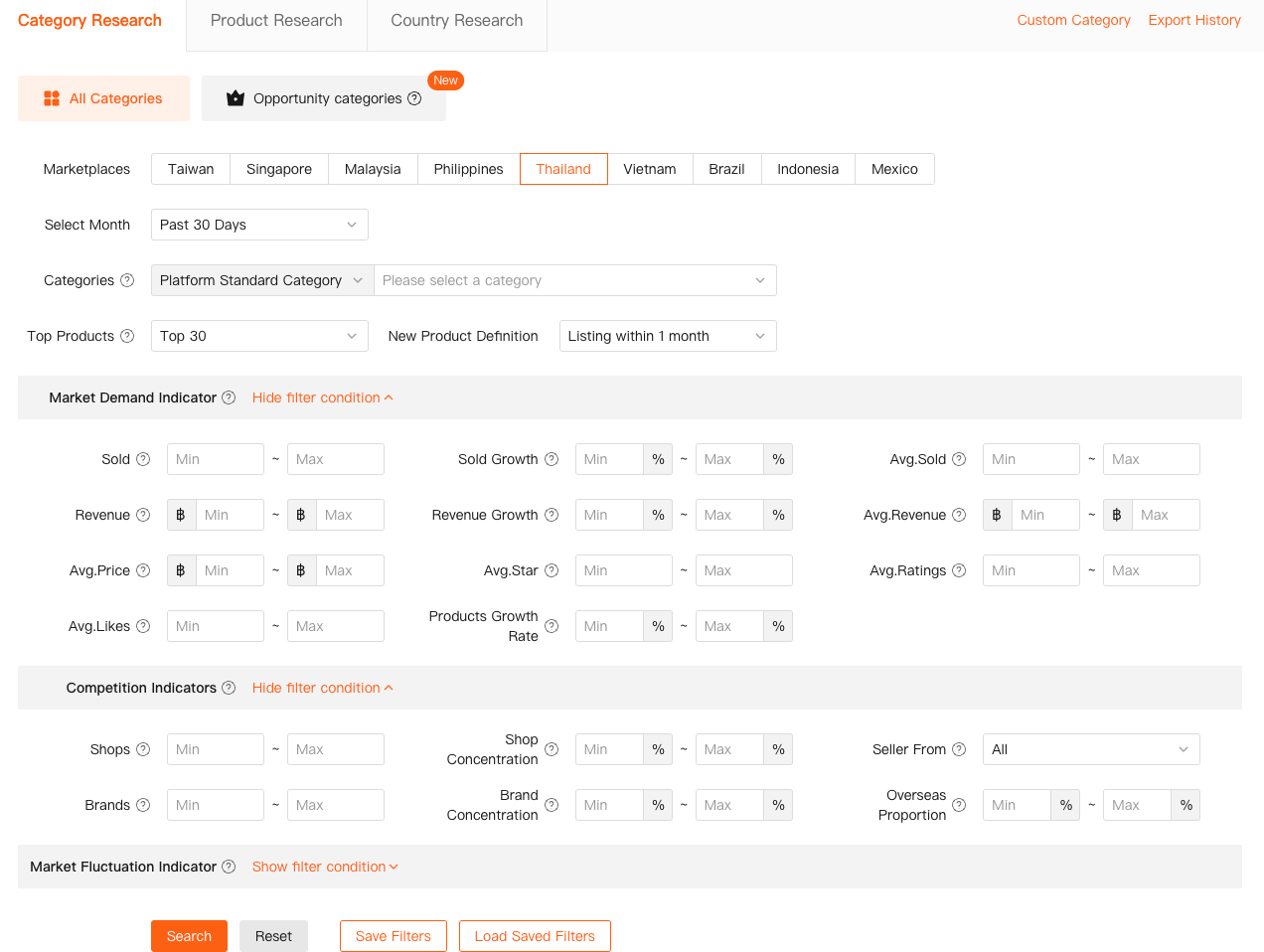

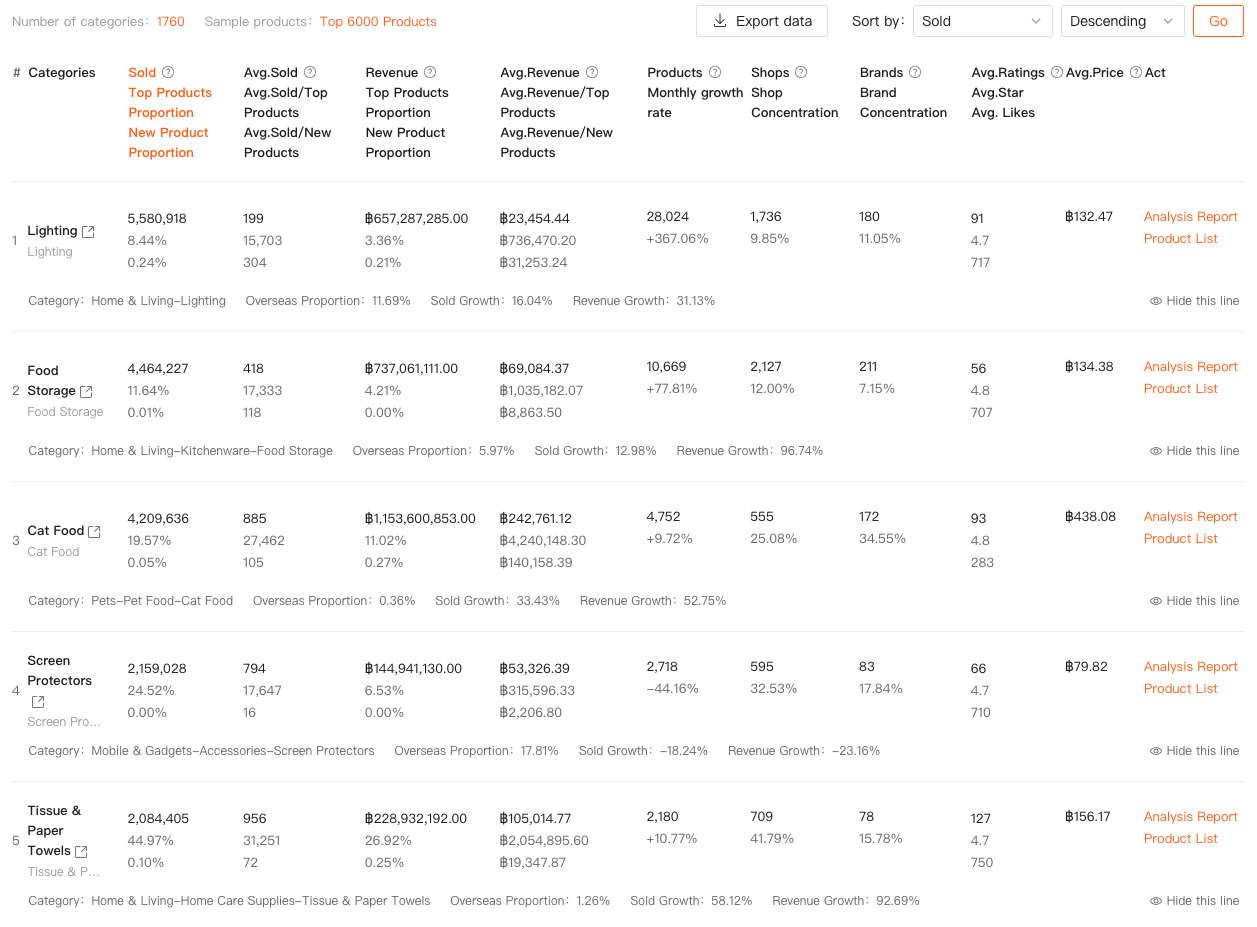

Shopdora’s Category Research feature helped me shift my thinking upstream. Instead of guessing based on search results or gut feeling, I could evaluate entire categories before committing resources. Category Research lets you filter by site, category, and time range, then shows you high-level indicators like total sales, growth rate, product count, brand concentration, and the share of new products.

One insight that changed my approach completely was realizing how misleading “high sales” categories can be. Some categories look attractive until you notice that a small number of top brands control most of the revenue. Others might have lower total volume but much healthier room for new entrants.

Using this data, I started avoiding categories where competition structure was already locked in—and focused instead on those with steady demand and reasonable fragmentation. That shift alone improved my hit rate when launching new products.

Turning Data into Decisions, Not Anxiety

One thing I want to be honest about: more data doesn’t automatically mean better decisions. Early on, I actually felt more stressed after looking at market data because everything suddenly seemed complex.

What changed was how I used it. Instead of checking numbers every day, I built a simple habit: market check first, product check second, optimization last. Tools like Market Analysis, Comprehensive Analysis, and Category Research helped me answer higher-level questions before worrying about tactics.

That’s the real value of a good Shopee analysis tool. It doesn’t replace experience—it accelerates it. It shortens the painful trial-and-error cycle most sellers go through.

Final Thoughts

If you’re early in your Shopee journey, it’s tempting to believe that better creatives or lower prices will solve everything. Sometimes they do. But often, the real problem is that you’re making decisions with incomplete information.

For me, Shopdora became useful not because it showed “secret data,” but because it showed the right layer of data—market, category, and competitive context that Shopee itself doesn’t provide in Seller Center.

You don’t need every tool. You don’t need to analyze everything. But if you’re serious about scaling, having a reliable Shopee analysis tool that helps you see beyond your own shop can make the difference between guessing and deciding.

And after three years of selling, that’s a difference I wish I’d understood much earlier.