How to Use Shopee Analytics Tools to Identify Underserved Market Demand

Let’s be honest—most Shopee sellers are playing a frustrating game of follow-the-leader. They see a product selling well, rush to list something similar, and then wonder why they’re stuck in a price war with tiny margins. Sound familiar?

What if you could skip that race entirely? The real treasure isn’t in the crowded main aisles of the marketplace; it’s in the quiet corners where customers are practically holding up signs saying, “I wish someone sold this.” That’s underserved market demand—the gap between what shoppers want and what they can actually find.

What “Underserved Market Demand” Really Means on Shopee

First, let’s define what we’re hunting. On Shopee, underserved demand usually wears one of these disguises:

- “I guess this’ll do” products – High search volume, but the top results have reviews that read like mild complaints. (Think: “It’s okay, but I wish it was more durable.”)

- Trends that haven’t hit critical mass – The early whispers before a trend becomes a shout. Getting in here is like buying stock before the announcement.

- The forgotten customers – Maybe it’s a regional preference, an age group, or a specific need that current sellers are ignoring.

Spotting these isn’t about having a psychic gut—it’s about knowing where to look in the data. A powerful Shopee analytics tool helps you see these patterns clearly.

The Shopee Analytics Tool: What’s Actually Useful

The Secret Weapon: Third-Party Analytics Tools

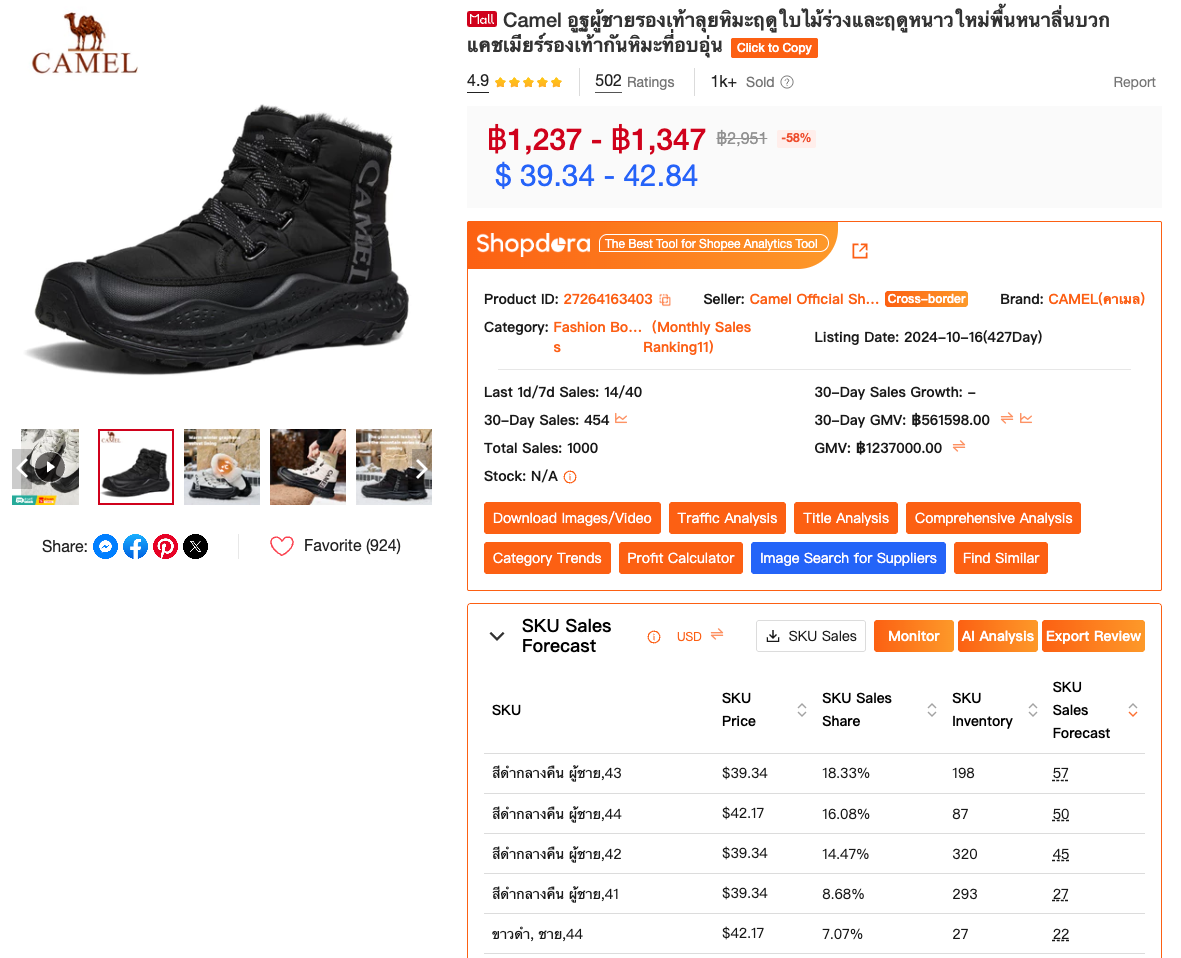

Here’s where the real market detective work begins. A dedicated third-party Shopee analytics tool like Shopdora (a Chrome extension) acts like a pair of X-ray glasses while you browse Shopee. Instead of just seeing a product page, you can see its sales history, pricing trends, and performance metrics right there on the spot.

Why is this a game-changer? Imagine you’re researching phone cases. With a robust Shopee analytics tool, you can instantly see that, say, “rugged cases for Model X” have rising search volume but all the top listings have average ratings below 4.3 because they’re too bulky. Bingo—you’ve just identified a potential gap for a sleek, protective case. It turns hours of manual research into minutes of informed browsing.

Step-by-Step: From Data to Opportunity

Step 1: Mine the Search Bar for Clues

The search bar is where customers literally type out their desires. Your job is to read between the lines.

- Look for the “high effort” searches: Long-tail keywords (e.g., “odor-resistant workout shirt for sensitive skin”) are gold. They signal a specific need that generic products might not satisfy.

- Spot the disappointment gap: Use a keyword Shopee analytics tool to find terms with solid search volume where the top-ranked products have mediocre ratings (below 4.5). High demand + low satisfaction = your entry point.

Pro Tip:

Don’t just track what’s trending now. Look at the growth rate of search terms. A keyword growing 20% month-over-month is a quieter, but often richer, signal than a static high-volume term.

Step 2: Become a Review Detective

Forget five-star raves. The most valuable intel is in the 3 and 4-star reviews. This is where polite people detail their mild disappointments—a blueprint for your next product.

- Pattern recognition: If 50 reviews for different baking mats say, “wish it didn’t curl at the edges,” you’ve found a universal pain point.

- Listen for the workarounds: Phrases like “I ended up using this for…” reveal unmet needs. If people are buying small cosmetic bags to organize tech cords, maybe there’s a market for a better-designed tech organizer.

Step 3: Learn from Your Competitors’ Mistakes

Your competitors’ weaknesses are your business plan. Use your Shopee analytics tool to dissect their offerings.

- The Price Spectrum Hole: Is there a barren wasteland between the dirt-cheap, flimsy option and the luxury-priced one? The “affordable quality” middle ground is often wide open.

- The Feature Void: Are all the top-selling water bottles non-insulated? Do all the popular desk lamps lack a USB port? These are features waiting for a hero.

Step 4: Catch the Trend Wave Early

Underserved demand often appears at the very beginning of a trend, before the market is flooded.

- Cross-market sleuthing: Is a home product trending on social media abroad but only has cheap, low-quality knock-offs on Shopee locally? That’s a signal.

- Event-spotting: Notice a spike in searches for “portable blender” every June? Maybe people want them for summer trips, but the current options are all bulky home models. A travel-sized version could own that seasonal niche.

Advanced Moves: Thinking Like a Market Insider

Connect the Dots Between Categories

Sometimes the opportunity isn’t within a category, but between them. A good Shopee analytics tool can help you spot these hybrids.

Example: A pet bed that doubles as a stylish side table. You might find strong search volume for “space-saving pet furniture” but only basic beds or crates in the results.

Serve the Forgotten Crowd

Dive into demographic data. Are there products popular with Gen Z that are only marketed in boring, generic ways? Is there a regional snack beloved in Central Vietnam that’s hard to find shipped to the South? Analytics can reveal these geographic and demographic pockets.

The Quality-Price Sweet Spot

One of the most common gaps is the “value sweet spot.” Use data from your Shopee analytics tool to find categories where the jump from “budget” to “premium” is a canyon, not a step. Customers will often pay 30% more for 80% of the quality of the top-tier product—if someone offers it.

Stop Following, Start Finding

Finding underserved demand on Shopee isn’t about having a bigger budget; it’s about having better insight. By using a sophisticated Shopee analytics tool as your spotlight instead of just your rearview mirror, you shift from competing in red oceans to sailing in blue ones.

The tools are there. The data is waiting. Your next best-selling product isn’t the one already at the top of the search results—it’s the one that should be, based on what customers are truly asking for. Now you know how to listen.