What Is Cross-Border Product Research? How Beginners With No Resources Can Choose the Right Product

For people starting cross-border e-commerce with no capital, no team, and no prior experience, the hardest part is not running ads or managing operations—it’s choosing the right product.

Cross-border e-commerce is not a skill you can fully grasp in a month or two. Product selection, sourcing, pricing, listing optimization, campaigns, and advertising all require continuous trial and error. But among all these steps, product research is the foundation. If this step goes wrong, every effort that follows will be diluted.

After years of hands-on experience with Shopee product research, one thing is clear:

There is no tool or bestseller list that can “pick” a winning product for you.

Tools provide data—but decisions still require human judgment.

Where Data Tools Like Shopdora Fit In

Before talking about methods, it’s important to clarify the role of data tools.

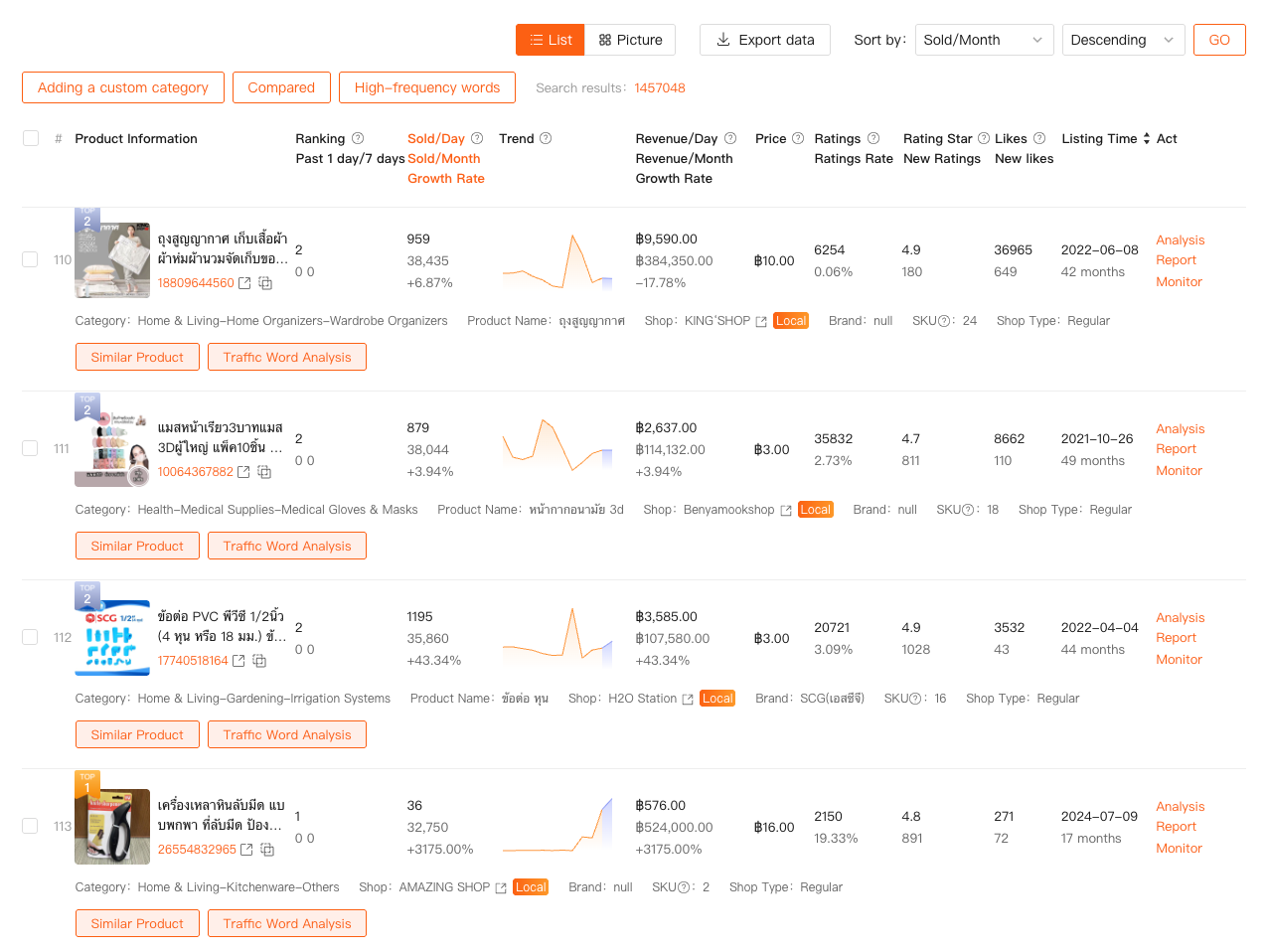

Platforms like Shopdora are best used at the category validation stage, not as final decision-makers. With its big-data product research features, sellers can quickly understand:

- Demand trends across Shopee categories

- Competition intensity in different sub-niches

- Price distribution and sales concentration

This helps answer one key question early:

Is this category worth deeper research?

What tools cannot do is replace real product understanding. That part still relies on structured analysis and experience.

Why Most Beginners Fail at Product Research

Many beginners believe product research means finding “hot products.” In reality, that mindset often leads to overcrowded niches and razor-thin margins.

Good Shopee product research is not about chasing popularity—it’s about identifying products that:

- Have real demand

- Face manageable competition

- Still leave room for profit after all costs

To achieve that, beginners need a method that builds understanding, not shortcuts.

A Beginner-Friendly Product Research Method That Works

Among several proven approaches, this is the most suitable for beginners. It produces results relatively fast while keeping risks controllable—critical for maintaining confidence early on.

Step 1: Choose a Category With Demand and Low-to-Medium Competition

Use data tools and platform trends to identify categories with stable or growing demand.

For example, automotive accessories in Southeast Asia have shown continuous growth in recent years, while competition remains lower than in categories like fashion or beauty.

Once a category is chosen, narrow it down to a specific sub-category before moving forward.

Step 2: Research From the Buyer’s Perspective

Go to Shopee and search real buyer keywords. Click into product listings, then enter the seller’s store.

Select 7–8 competitor stores that meet these criteria:

- Store age under one year

- Total sales around 5,000–8,000 orders

- Focused on one vertical category

- Stable pricing and consistent sales

Spend a full day analyzing their higher-priced, high-volume products.

Step 3: Reverse-Calculate Profit Before Anything Else

Never assume profit—calculate it.

Example:

- Selling price: 280 THB (~62 RMB)

- Weight: 0.3 kg

- 1688 sourcing cost: 24 RMB

Calculation:

- 62 (price)

- – 7.8 (shipping)

- – 11.1 (platform commission)

- – 2 (agent fee)

- – 24 (product cost)

= 17.1 RMB net profit

If the numbers don’t work here, optimization later won’t fix it.

Step 4: Understand Why the Product Converts

Profit alone is not enough. You need to understand why buyers choose this product.

Using car phone holders as an example:

- Magnetic vs. clamp-style

- Air-vent vs. windshield mounting

- Single-arm vs. dual-arm designs

Which type sells better?

Which colors convert more consistently?

What do reviews praise or criticize most?

This qualitative insight is what separates guesswork from real product judgment.

What Product Research Is Really About

After completing these steps, you’re no longer blindly selecting products. You understand:

- Buyer motivation

- Cost structure

- Competitive positioning

- Conversion drivers

At that point, sourcing becomes execution—not gambling.

Product research is not about finding shortcuts. It’s about forcing yourself to deeply understand a product and its market. Once you grasp this mindset, Shopee product research becomes repeatable—and scalable.