Shopee Data Isn’t the Problem — Most Sellers Just Don’t Know How to Read It

Hi, I’m David.

I’ve been running my own Shopee store for over three years, and like most sellers, I didn’t fail because I didn’t work hard enough. I failed early on because I didn’t understand the data I was looking at—or worse, the data I couldn’t see.

When people talk about “Shopee data,” beginners usually think of the seller center: orders, traffic, conversion rate, ads. That’s useful, but it’s also incomplete. It only tells you what’s happening inside your own store, not what’s happening in the market around you.

And that gap is exactly where most wrong decisions come from.

In this article, I want to talk about how Shopee data actually works in real operations, why internal data alone often misleads sellers, and how external market-level data—when used correctly—can help you avoid months of trial and error.

Why Shopee Seller Center Data Alone Is Never Enough

Shopee gives you plenty of internal metrics: impressions, clicks, orders, conversion rate, ad spend. On paper, that sounds like everything you need.

In reality, those numbers are context-free.

If a product isn’t selling, Shopee doesn’t tell you whether:

- The category demand is shrinking

- Competitors are aggressively undercutting price

- A new wave of similar products just entered the market

- Traffic keywords are shifting away from your listing

From the seller center’s perspective, it just looks like “low performance.”

This is why many sellers make the wrong move: they kill products too early, over-invest in ads, or constantly change prices without understanding the market forces behind the numbers.

To make better decisions, you need market-facing Shopee data, not just store-facing data.

Starting From the Right Place: Category-Level Shopee Data

One of the biggest mindset shifts I had was stopping product-first thinking and starting with category-first analysis.

Before you worry about images, titles, or ads, you need to answer a much simpler question:

Is this category even worth competing in right now?

This is where category-level Shopee data matters far more than individual product metrics.

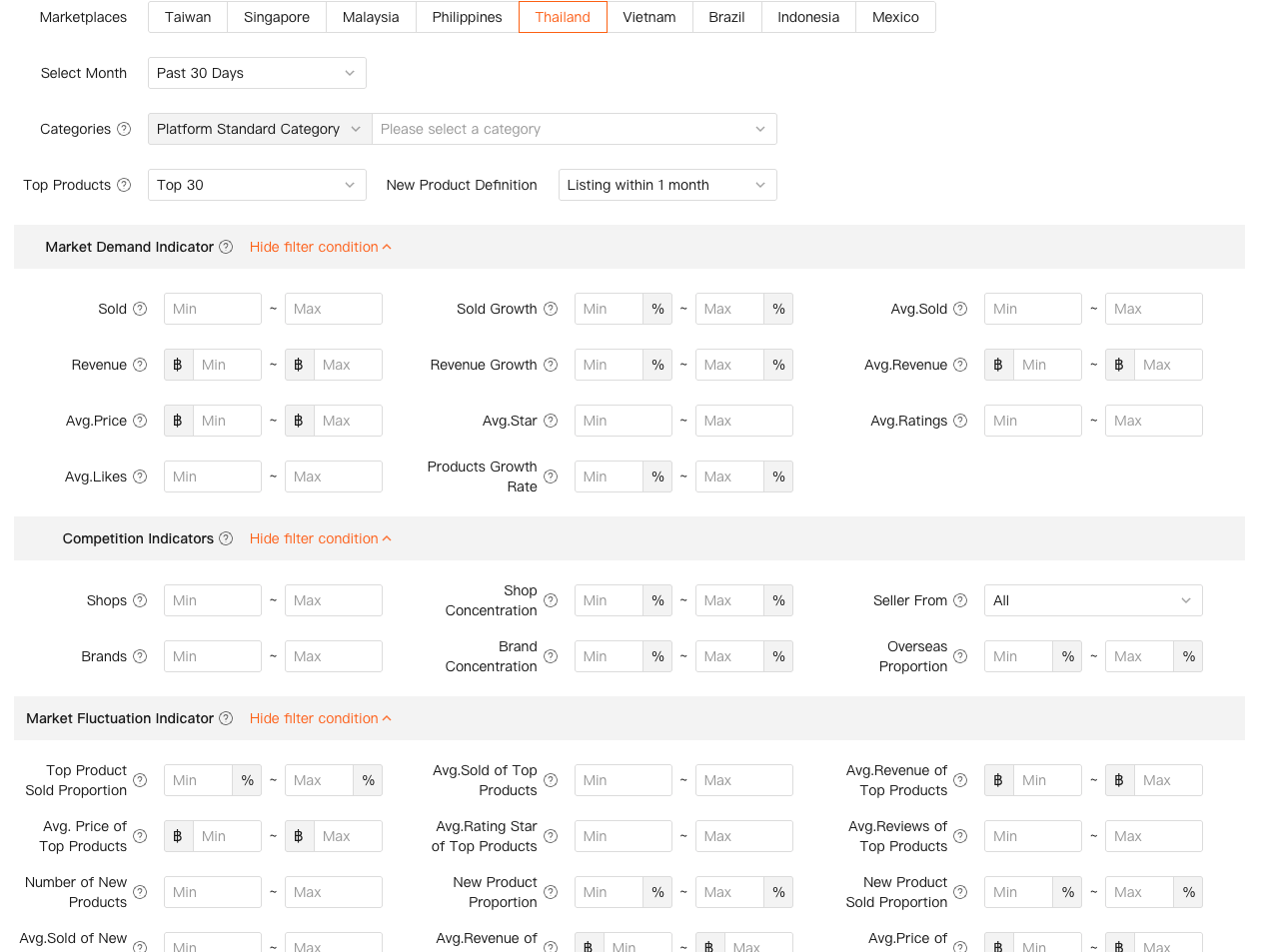

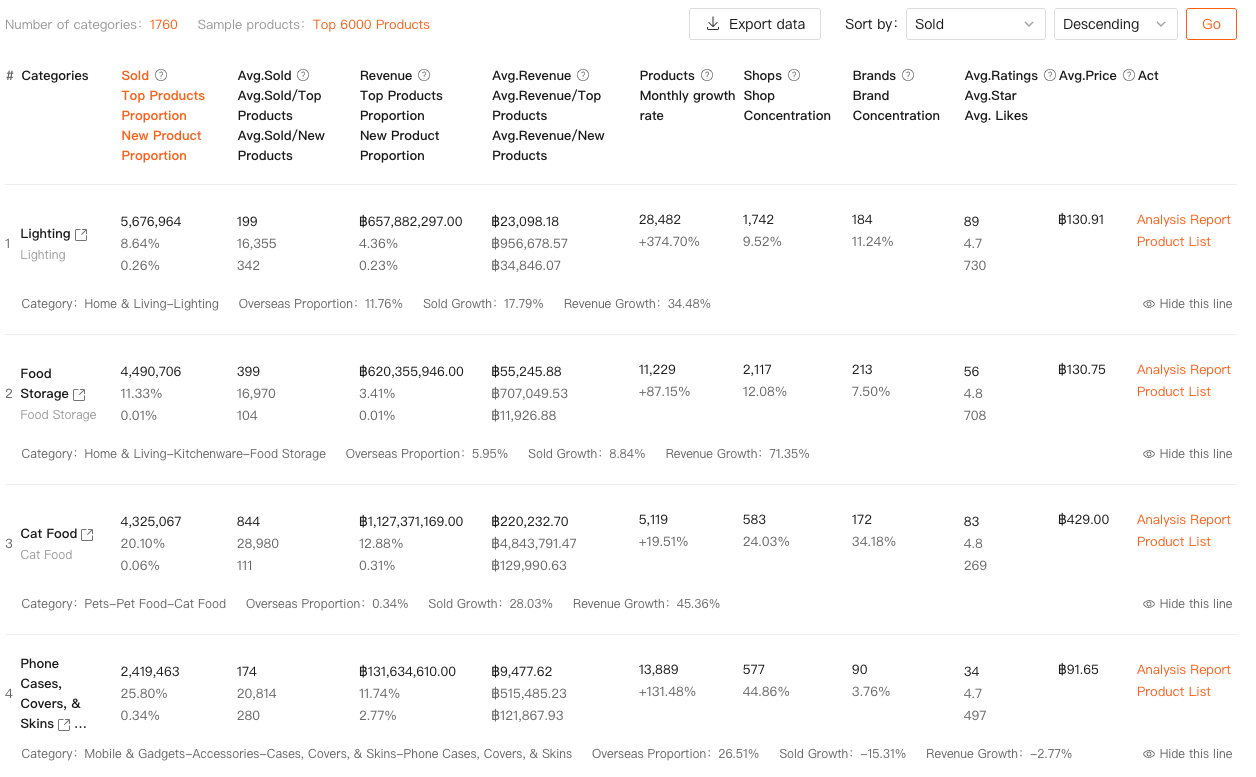

Using a category research tool like Shopdora’s Category Research, you can evaluate entire categories across different Shopee sites before committing time and money. Instead of guessing, you’re looking at objective signals: total sales volume, revenue trends, number of products, number of sellers, brand concentration, and how much of the category is controlled by top listings.

This kind of data doesn’t tell you what to sell, but it tells you where not to waste your effort.

I’ve seen sellers obsess over optimizing listings in categories where:

- The top 10 products take most of the traffic

- New products barely get exposure

- Price wars leave no profit margin

No amount of listing optimization fixes a structurally bad category. Shopee data at the category level helps you avoid that trap early.

Turning Market Data Into Real Product Decisions

Once you’ve identified a category with healthy demand and reasonable competition, the next challenge is narrowing down what kind of products actually work inside that space.

This is where most sellers fall back into intuition. They scroll, they guess, they follow trends on social media.

A more reliable approach is to analyze existing product performance patterns using structured Shopee data.

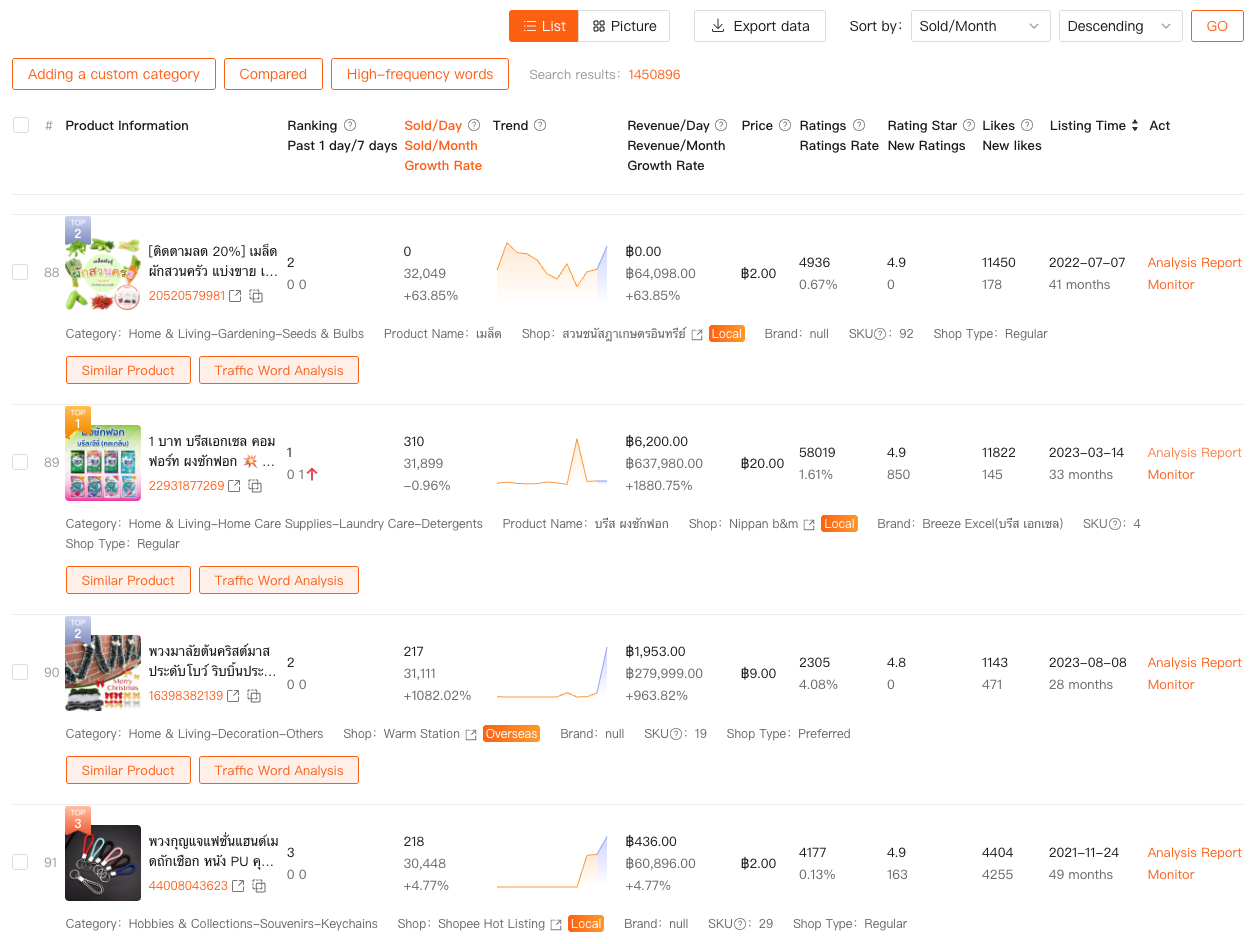

With tools like Shopdora’s Product Research, you can filter products inside a category by sales, growth rate, price range, ratings, and launch time. This helps you spot products that aren’t just selling—but are selling recently and consistently.

What matters here isn’t copying top sellers. It’s understanding patterns:

- Are mid-priced products outperforming cheaper ones?

- Are newer listings gaining traction or stuck?

- Are sales spread across many products or concentrated at the top?

These patterns tell you how forgiving the category is to newcomers.

Shopee seller center data can’t answer these questions, because it only reflects your own listing. Market-level Shopee data shows you the rules of the game before you step onto the field.

Reading Between the Numbers: Traffic and Keywords Matter More Than You Think

One of the most misunderstood parts of Shopee data is traffic.

Many sellers assume that if traffic drops, the problem must be images, pricing, or ads. Sometimes that’s true. Often, it’s not.

Traffic behavior changes at the market level first, not the store level.

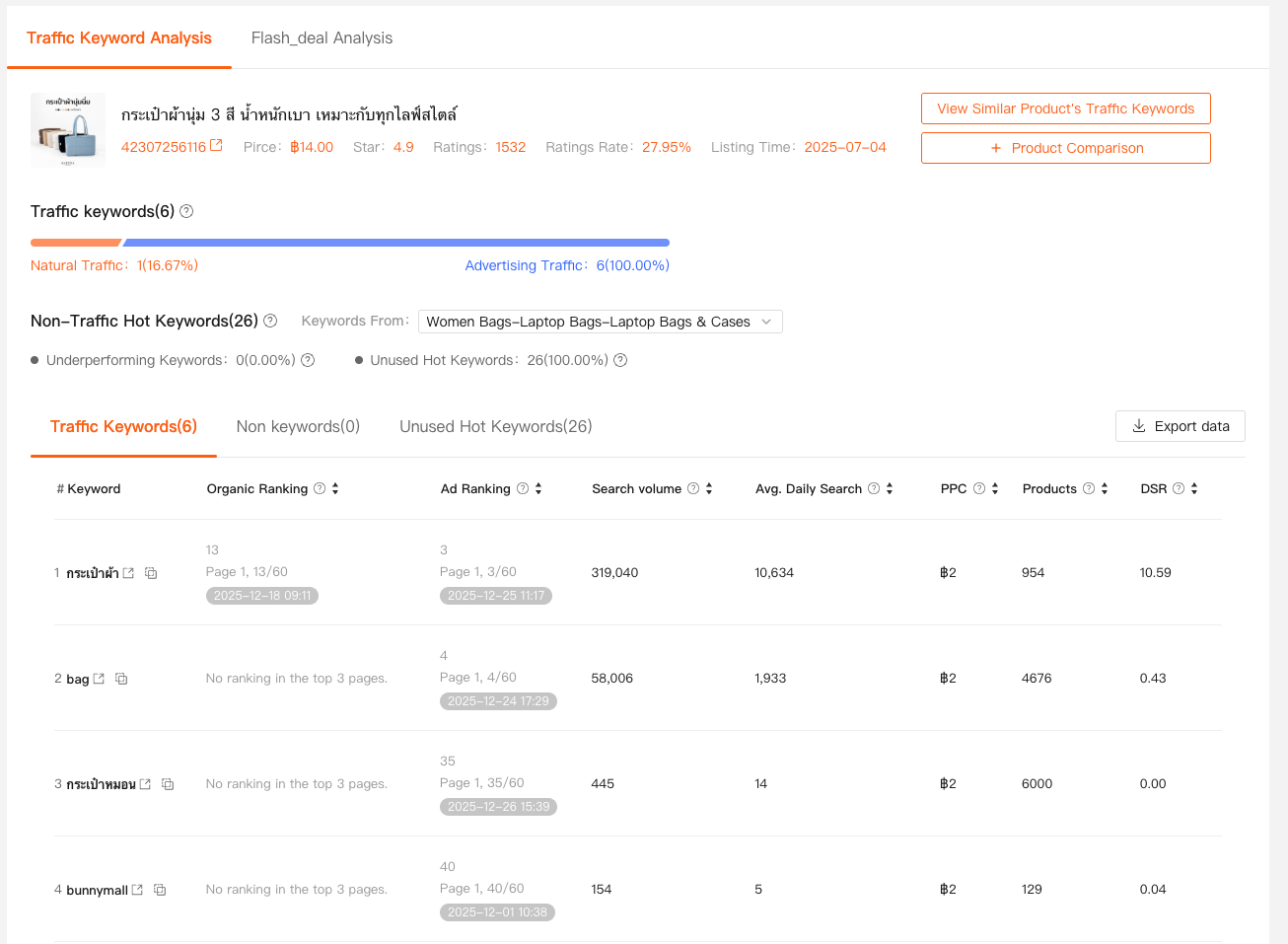

Using Shopdora’s Traffic Analysis and keyword-related data, you can see which keywords are actually driving traffic to competing products, which keywords are trending up or down, and which high-demand keywords aren’t fully utilized yet.

This kind of data changes how you optimize listings. Instead of blindly rewriting titles, you’re validating whether:

- Demand for your main keywords still exists

- Competitors are shifting focus to different search terms

- Your product is missing traffic opportunities entirely

What I like about this approach is that it removes guesswork. You’re not “optimizing for SEO” in theory—you’re aligning with real user search behavior on Shopee.

That’s a fundamental difference.

Why Shopee Data Helps You Decide What Not to Do

Good data isn’t just about finding opportunities. It’s about avoiding mistakes.

Some of the most expensive lessons I learned came from ignoring Shopee data signals:

- Scaling ads in a declining category

- Stocking inventory for a product with shrinking search demand

- Entering categories with extremely high seller concentration

Market-level data would have warned me earlier.

This is where tools like Shopdora are useful—not because they magically create winning products, but because they expose information that Shopee itself doesn’t show you.

Seller center data answers: “How am I doing?”

Market data answers: “Does this even make sense?”

You need both.

Bringing It All Together: Data Is a Decision Tool, Not a Crystal Ball

Shopee data doesn’t guarantee success. No tool does.

What it does is shorten the feedback loop. It helps you move from emotional decisions to informed ones, especially when you’re still building experience.

The sellers who last aren’t the ones who guess better—they’re the ones who correct faster.

Category data helps you choose better battles.

Product data helps you avoid weak demand.

Traffic and keyword data help you align with real buyer behavior.

Used together, these data points turn Shopee from a guessing game into a process.

Final Thoughts

If you’re new to Shopee or still struggling to scale, don’t ask yourself why a single product isn’t selling.

Ask bigger questions first:

- Is the category healthy?

- Is demand growing or shrinking?

- Am I competing in a space that allows new sellers to win?

Shopee data—especially market-facing data—won’t make decisions for you. But it will stop you from making the wrong ones blindly.

That alone can save you months. And in eCommerce, time saved is often the biggest advantage you’ll ever have.