Shopee Data Isn’t the Problem — Not Knowing Which Data Matters Is

Hi, I’m David.

I’ve been running my own Shopee store for a little over three years now. No agency background, no big team — just a solo seller trying to make better decisions with limited time and budget.

If there’s one thing I’ve learned the hard way, it’s this:

Shopee data is everywhere — but useful Shopee data is rare.

Most sellers don’t actually lack data. We lack visibility.

You can see your own orders, your own SKUs, your own conversion rate. That’s fine. But the moment you want to answer bigger questions like:

- Is this product really trending, or is it just my store?

- Are competitors growing faster than me — and why?

- Is the market price moving, or am I just discounting too much?

Shopee’s seller center goes silent.

This article is about how I started using Shopee data differently — not just store data, but market and competitor data — and how tools like Shopdora helped fill the gaps Shopee itself doesn’t show you.

The Real Gap in Shopee Data (That Sellers Don’t Talk About)

Let’s be honest about what Shopee gives us by default.

Shopee Seller Center is great for execution:

- Order volume

- Revenue

- SKU performance

- Ads metrics (for your own campaigns)

But it’s weak for decision-making.

What’s missing is everything outside your store:

- Competitor sales trends

- Market-wide pricing behavior

- Category growth vs. saturation

- SKU structure of top-selling products

And this is exactly where most sellers get stuck.

You don’t lose money because you didn’t check your own data.

You lose money because you didn’t know what was happening around you.

That’s where external Shopee data becomes critical.

Problem #1: You Can’t Tell If Growth Is Real or Just Temporary

One of the most common mistakes I see (and made myself early on) is reacting too quickly to short-term performance.

Sales spike for 7 days → seller increases stock

Sales drop the next week → seller panics, cuts price

The issue isn’t reaction speed.

It’s lack of context.

How I Started Looking at Market-Level Shopee Data

Instead of asking:

“Why did my sales go up or down?”

I started asking:

“What’s happening in this category as a whole?”

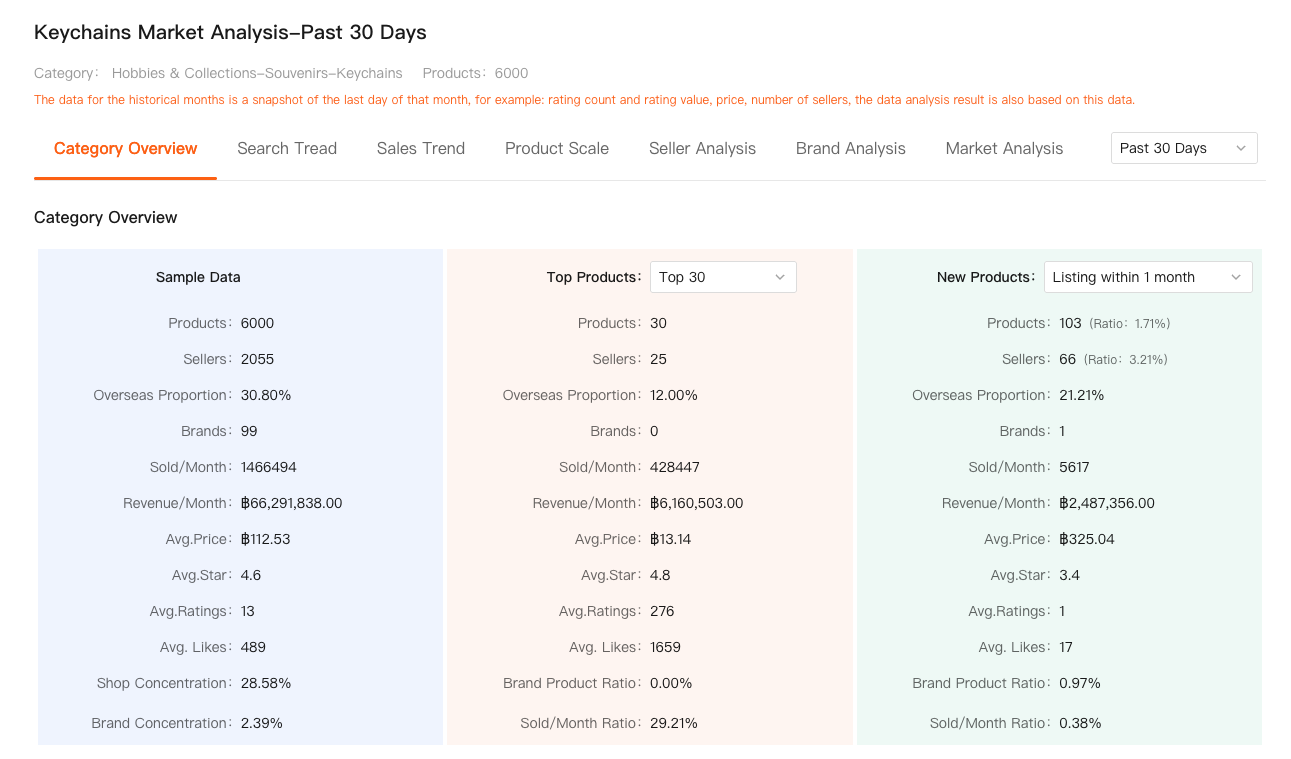

This is where Shopdora’s Market Analysis + Product Research changed how I plan inventory.

With these two features combined, I can:

- See category-level sales trends over time

- Identify whether demand is growing, flat, or declining

- Compare my product’s performance against similar products, not just my own history

This matters because:

- If the entire category is declining, your issue may not be pricing or ads

- If the category is growing but your product is flat, then you have a problem to solve

That distinction alone has saved me from multiple bad restocking decisions.

Problem #2: Competitor Data Is the Missing Half of Shopee Data

Shopee sellers talk about “data-driven decisions,” but most decisions are still made blind.

You know your own SKUs inside out.

But you don’t know:

- How many units competitors sell per day

- Whether their growth comes from new SKUs or a hero product

- How aggressive their pricing really is over time

What Competitor-Focused Shopee Data Looks Like in Practice

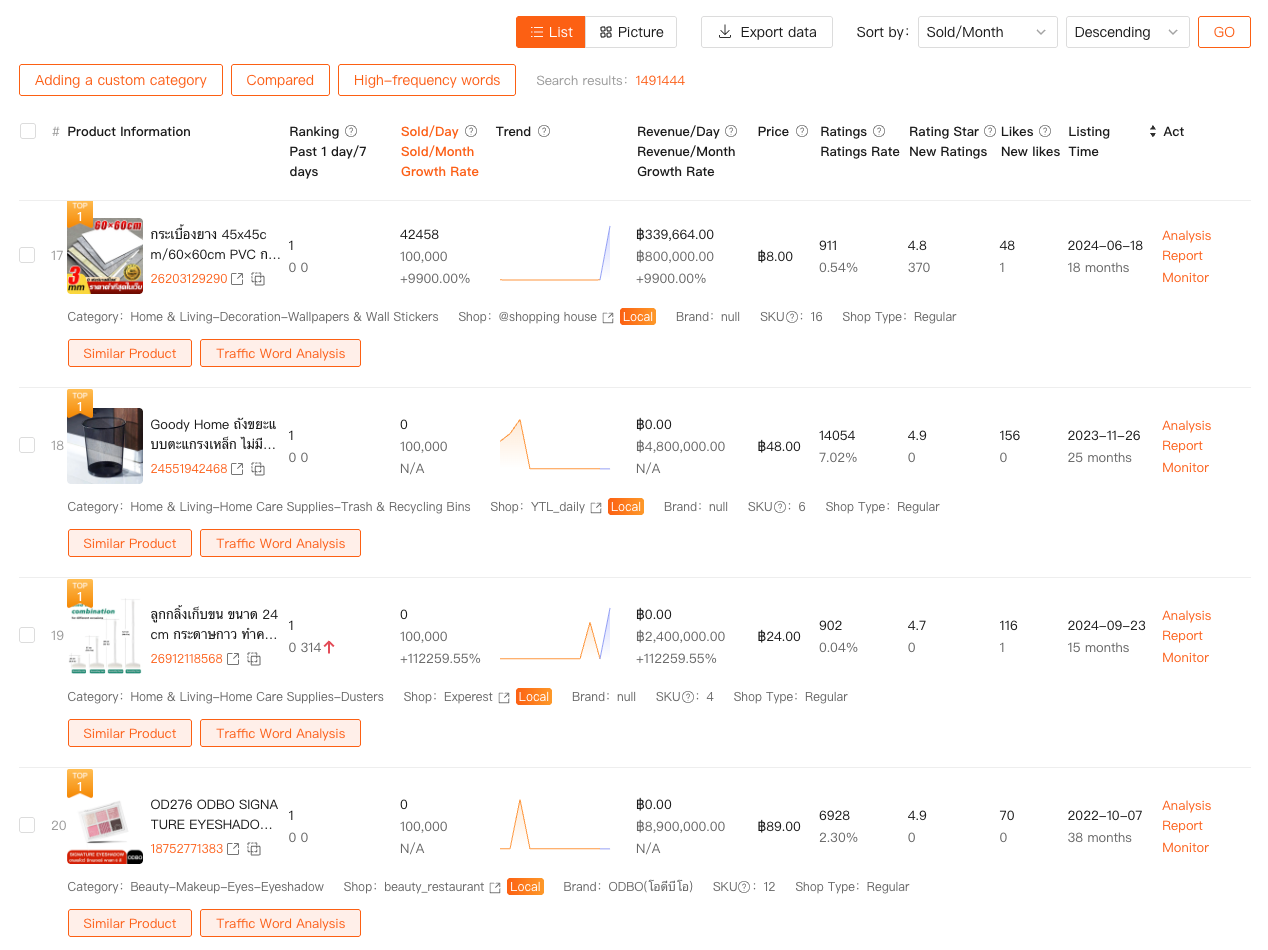

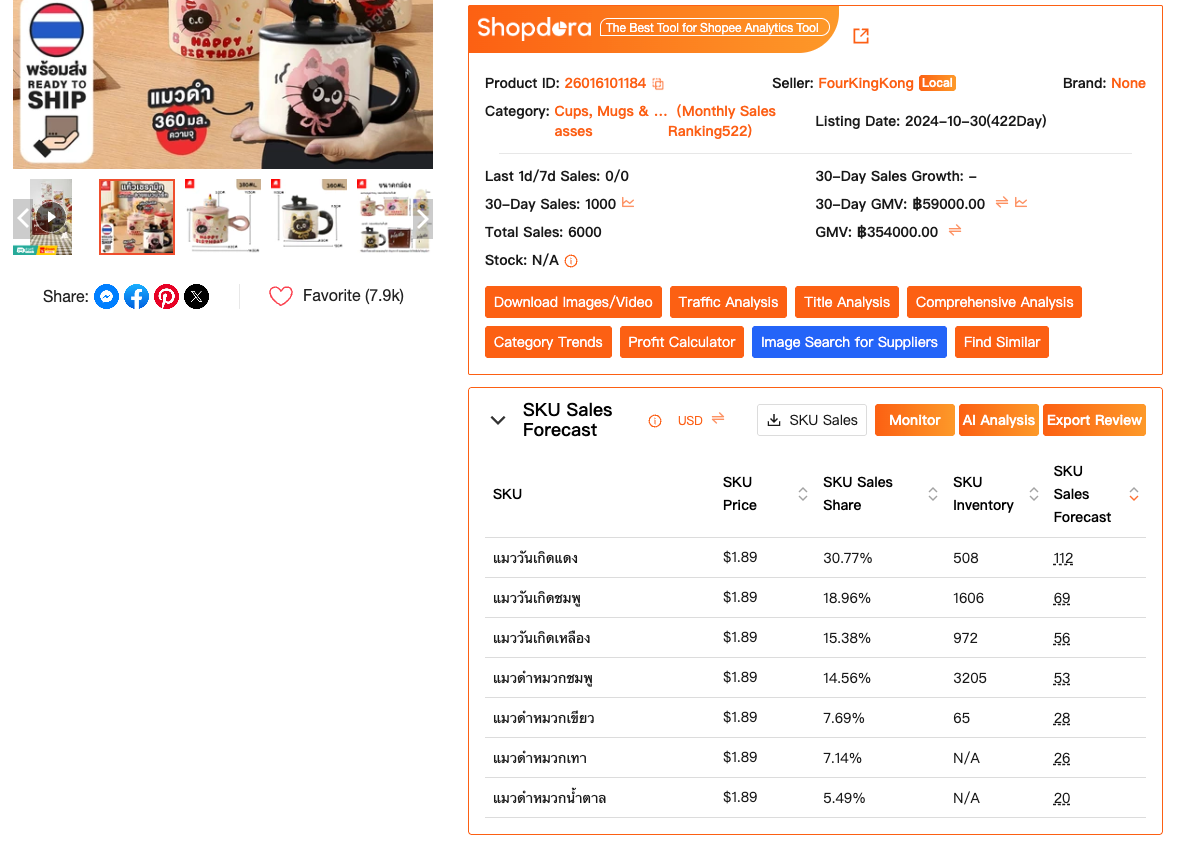

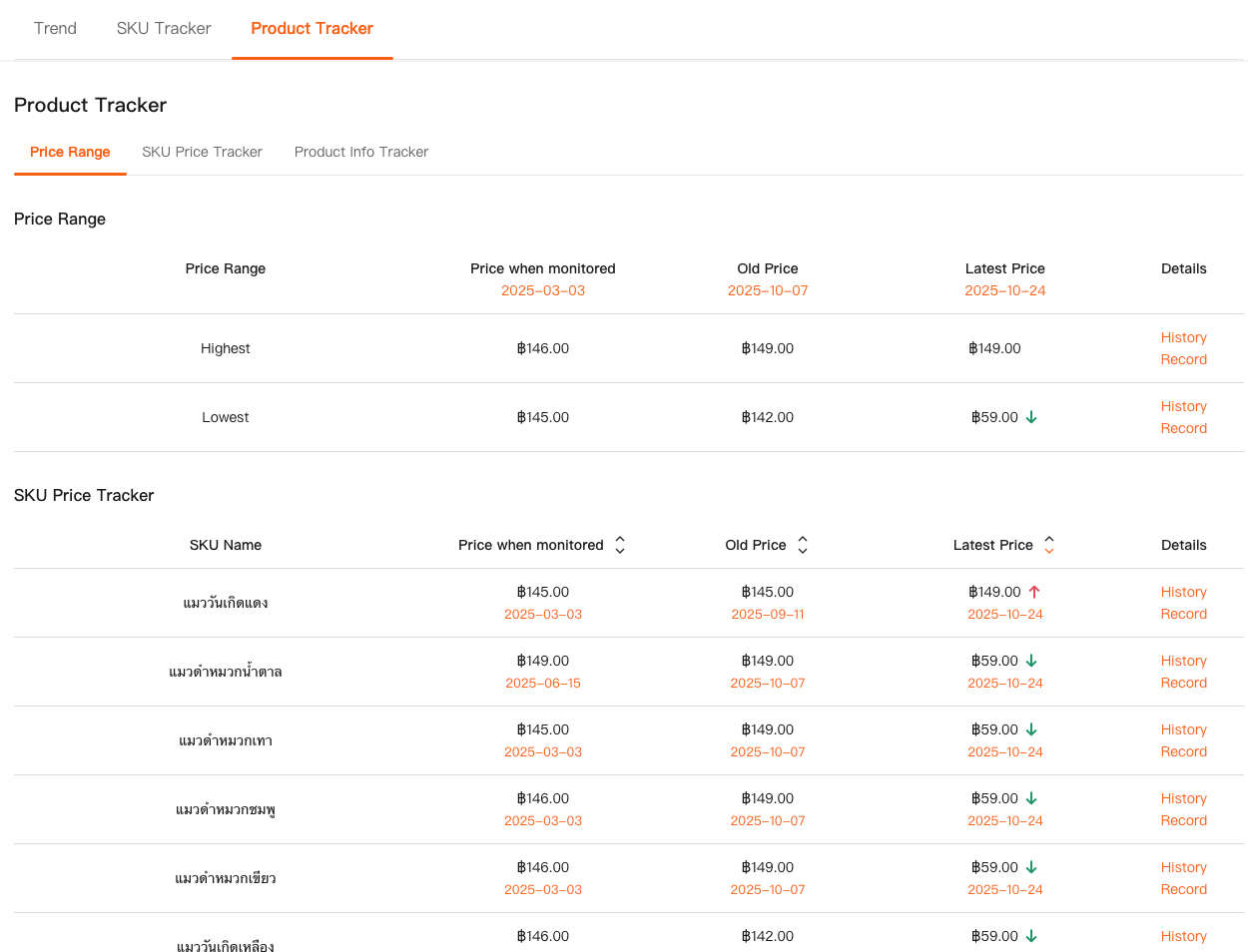

Using Shopdora’s Product Research + SKU Insight, I can break down competitor listings in ways Shopee never shows:

- Total estimated sales and revenue

- SKU-level contribution (which variants actually sell)

- Launch timing vs. growth curve

- Price range evolution instead of just current price

This changes how you compete.

Instead of:

“This competitor is cheaper than me”

You start seeing:

“This competitor sells 70% of volume from one mid-priced SKU, not the cheapest one”

That insight alone helps you:

- Stop racing to the bottom on price

- Focus on SKU structure instead of discounts

- Position your product more intelligently

This is Shopee data that actually affects strategy, not just daily operations.

Problem #3: Sellers Track Prices, But Ignore Sales Momentum

Many sellers rely heavily on price tracking.

Price goes down → react.

Price goes up → react.

But price without sales context is misleading.

A competitor dropping price doesn’t matter if:

- Their sales volume is shrinking

- Their product is at the end of its lifecycle

Turning Price Data Into Actionable Shopee Data

Instead of pure price tracking, I look at:

- Price + sales trend

- Price + ranking movement

- Price + SKU stock behavior

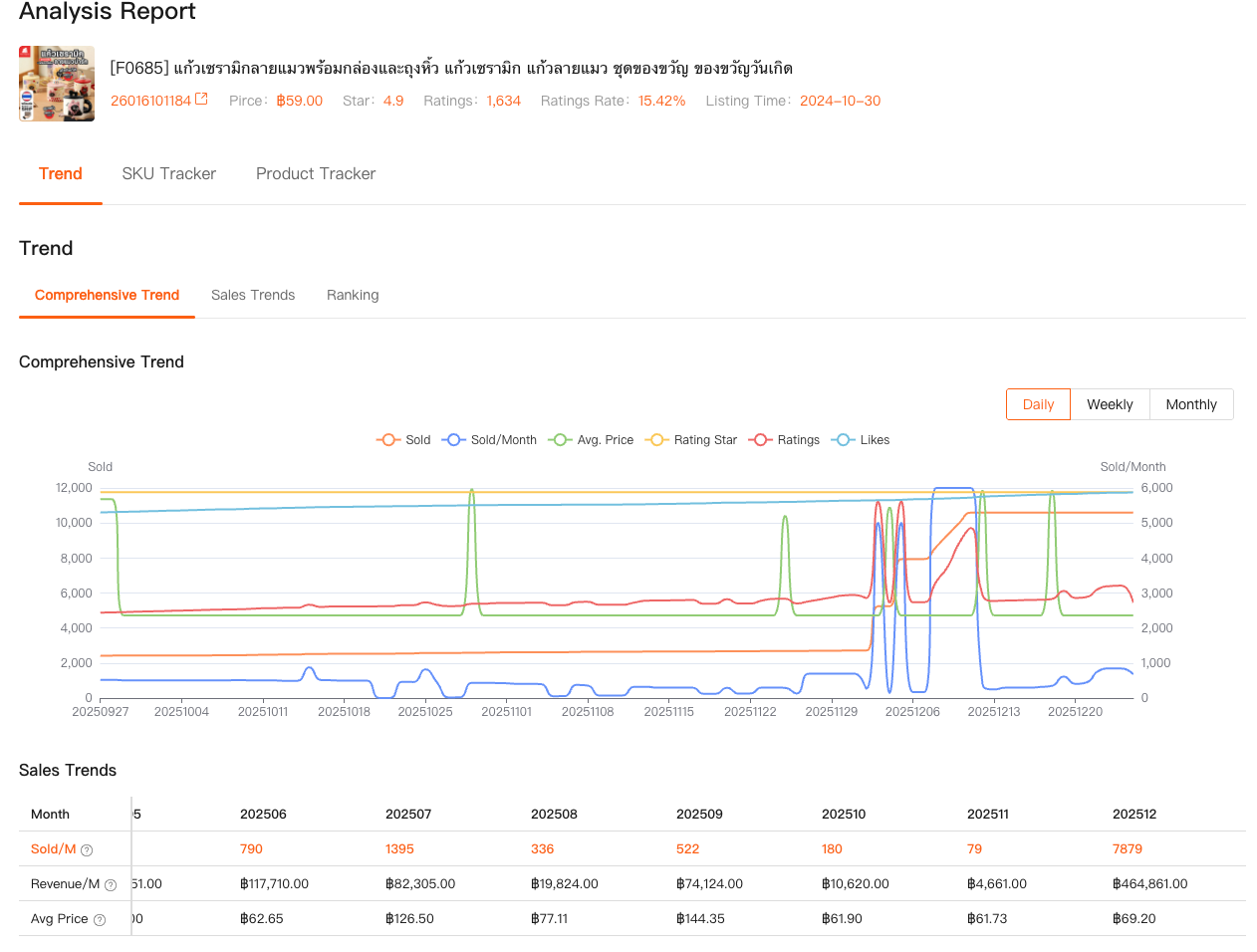

With Shopdora’s Comprehensive Analysis and Product Tracker, I can monitor:

- Long-term sales momentum

- Ranking stability

- Seasonal demand patterns

This lets me answer questions like:

- Is this product still worth entering?

- Is the market cooling down or just stabilizing?

- Are competitors scaling, or just burning ads?

That’s a completely different level of Shopee data — and one that actually reduces risk.

Why Shopee Data Needs to Be Market-First, Not Store-First

Shopee gives you store data because it’s easy.

Market data is harder — and more valuable.

Once I shifted my mindset, my workflow changed:

- Start with market-level Shopee data

- Validate with competitor performance

- Only then adjust my own product and pricing

Shopdora fits into this flow naturally because:

- It focuses on external visibility

- It complements, rather than replaces, Seller Center

- It helps answer questions Seller Center never will

I still use Shopee’s backend every day.

But I no longer rely on it to make strategic decisions alone.

Final Thoughts

If you’re searching for “Shopee data,” you’re probably not looking for more dashboards.

You’re looking for clarity:

- What to sell

- When to scale

- When to stop

Good Shopee data doesn’t tell you what to do.

It helps you avoid doing the wrong thing.

That’s the biggest value it’s brought to my business.