Shopee Product Research: How I Actually Find Winning Products Without Guessing

Hi, I’m David.

I’ve been working with Shopee sellers across different markets for 3 years. And if there’s one question I hear more than any other, it’s this:

“How do I know which product is actually worth selling?”

Not trending on TikTok.

Not recommended by a random YouTube video.

But products that real Shopee buyers are already searching for and buying.

That’s what this article is about: Shopee product research that’s grounded in data, not luck. I’ll walk you through how I personally approach product research using Shopdora, and how it helps sellers avoid the most common (and expensive) mistakes.

Why Shopee Product Research Is Harder Than It Looks

Most sellers don’t fail because they don’t work hard. They fail because their inputs are wrong.

Here’s what I see all the time:

- Picking products based on front-page visibility

- Assuming “high sales = good opportunity”

- Entering categories that are already overcrowded and price-driven

- Missing early-stage products that are just starting to grow

Shopee doesn’t openly show you market-level trends, growth curves, or competitive density. That’s where proper product research tools become necessary.

Step 1: Start With Market-Wide Product Signals (Not Individual Listings)

When I begin Shopee product research, I never start from a single product page.

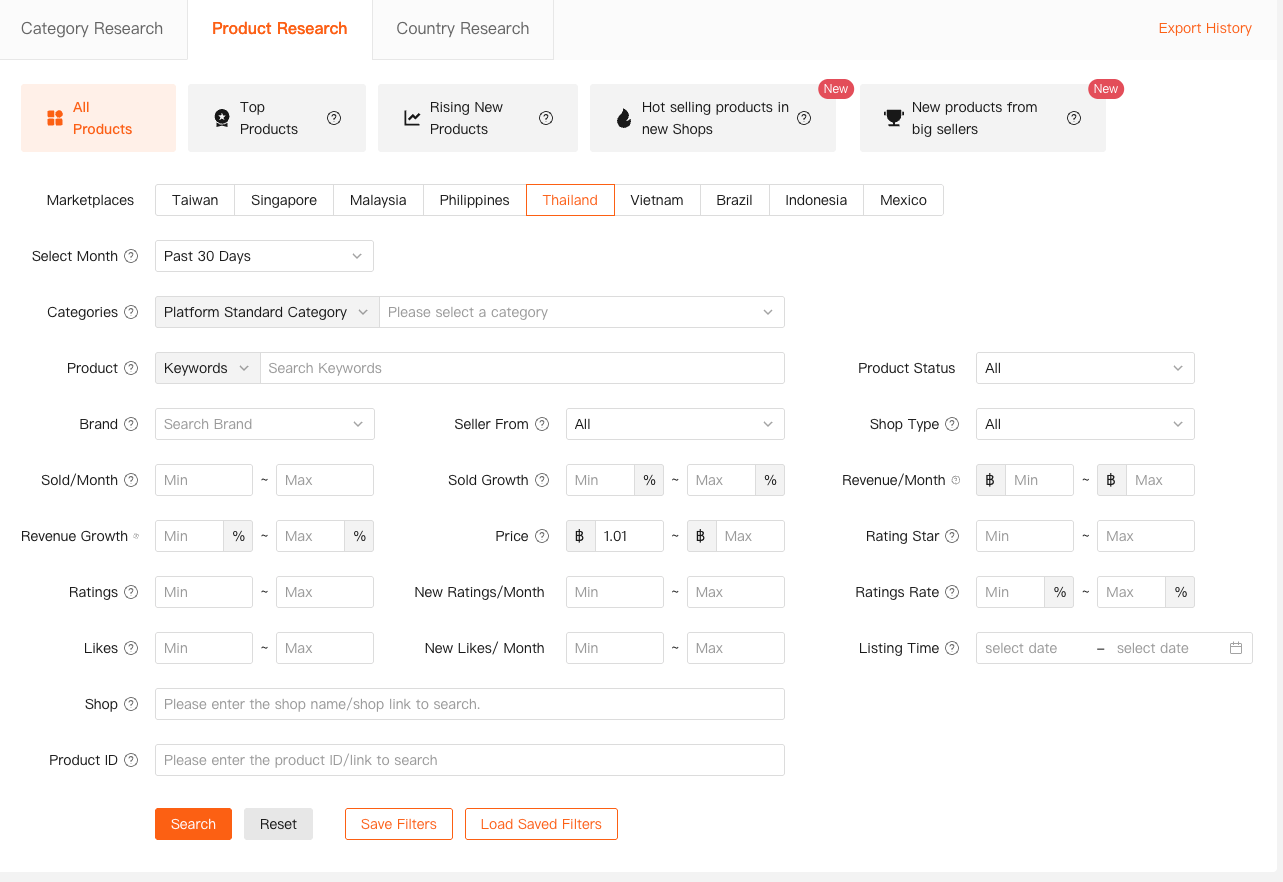

Instead, I start from market-level data, using Shopdora’s Product Research.

What I look at first:

- Marketplace & category filters

(Taiwan vs Thailand behave very differently) - Sales volume ranges

I avoid both “too low” (no demand) and “too high” (overcrowded) - Growth rate

This is critical — I prefer rising products over already-peaked ones - Time since listing

Newer products with stable growth often signal opportunity

This step helps me answer a simple but powerful question:

Is this product category expanding, or am I late to the party?

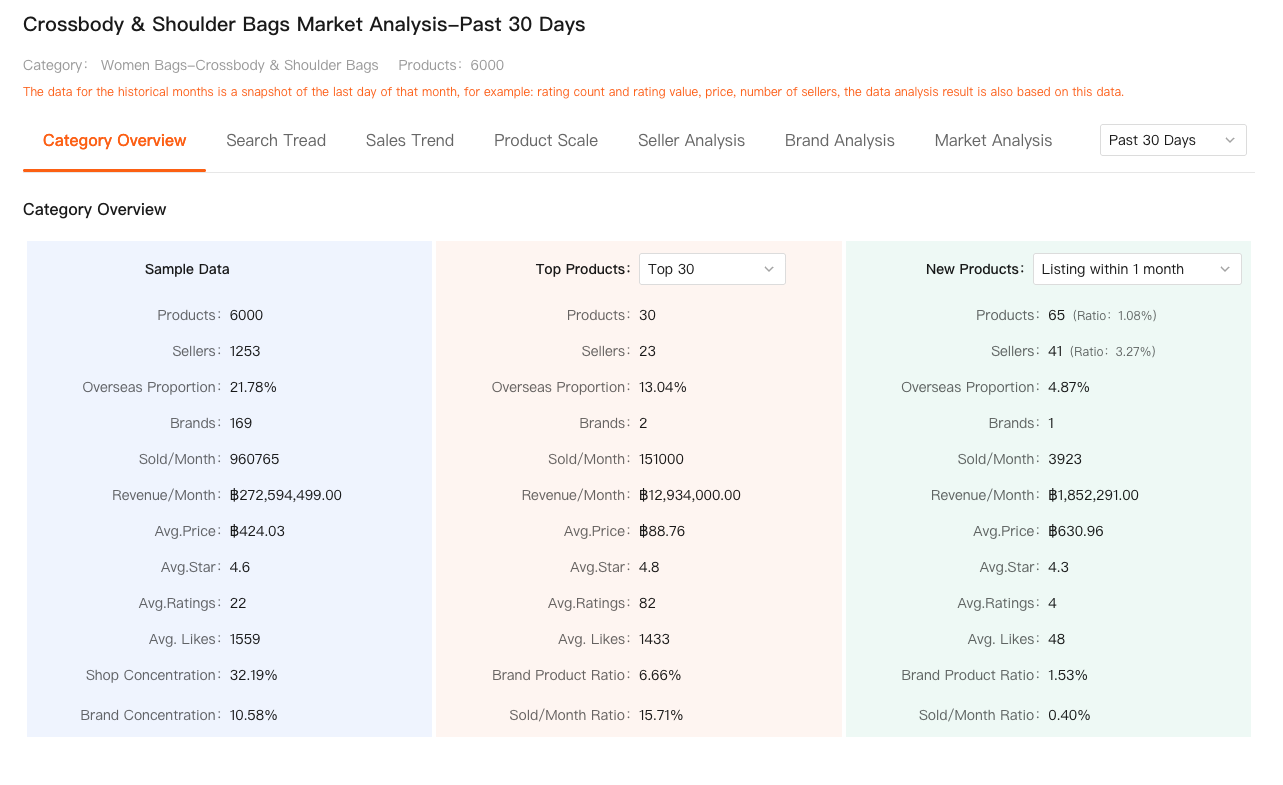

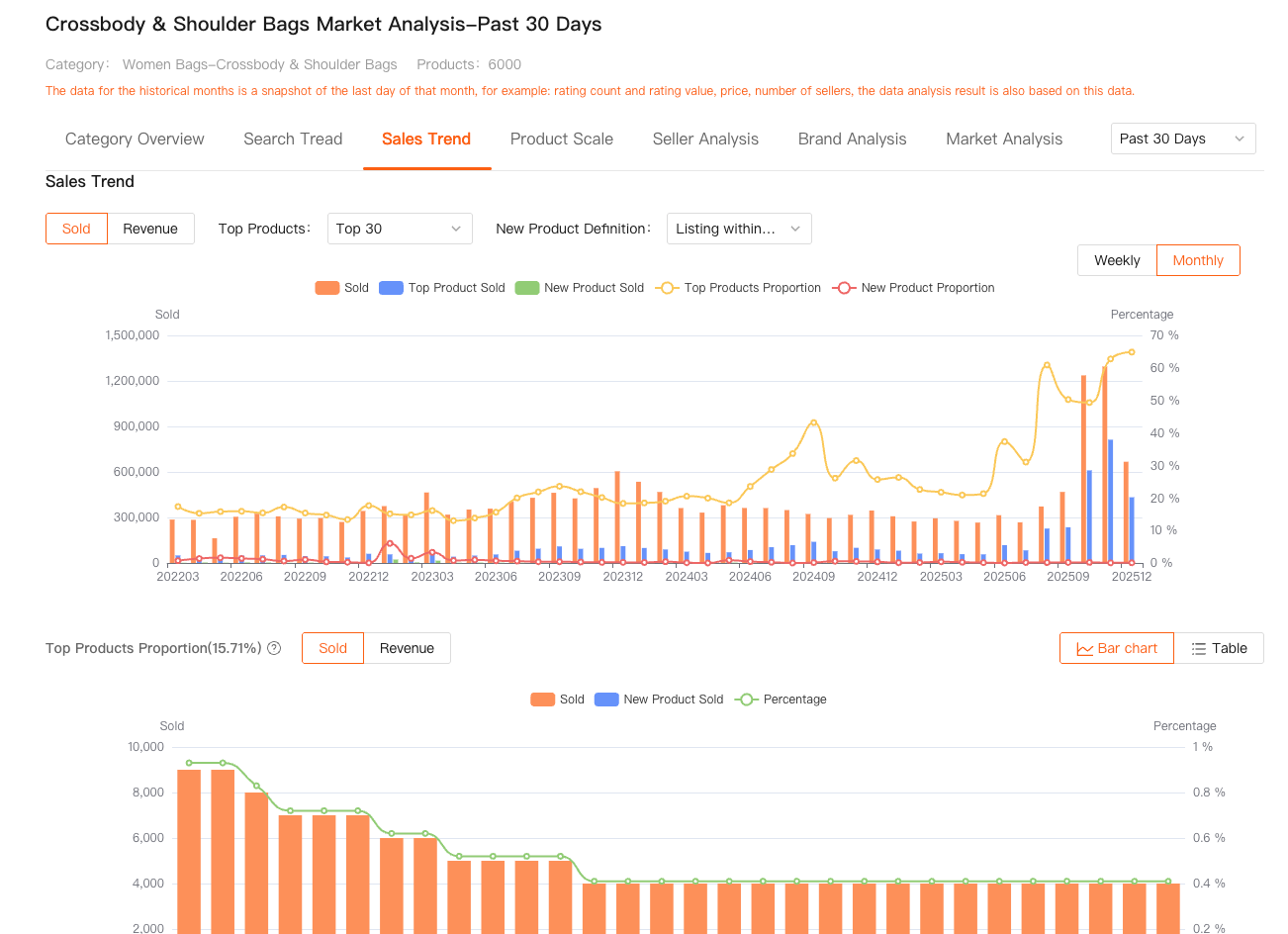

Step 2: Use Market Analysis to Avoid Red-Ocean Categories

A product can sell well and still be a bad business decision.

That’s why I always layer Market Analysis on top of product research.

Here’s what I analyze:

- Overall category trend direction

- Number of active competitors

- Sales distribution (top-heavy vs fragmented)

- Price ranges and margin compression

For example, if I see:

- Flat category growth

- Hundreds of sellers clustered around the same price

- Minimal differentiation

That’s a clear warning sign.

On the other hand, categories with:

- Steady upward trends

- Moderate competition

- Clear price tiers

are where new sellers still have room to enter.

This step alone saves sellers months of trial-and-error.

Step 3: Validate With Real Product Performance Data

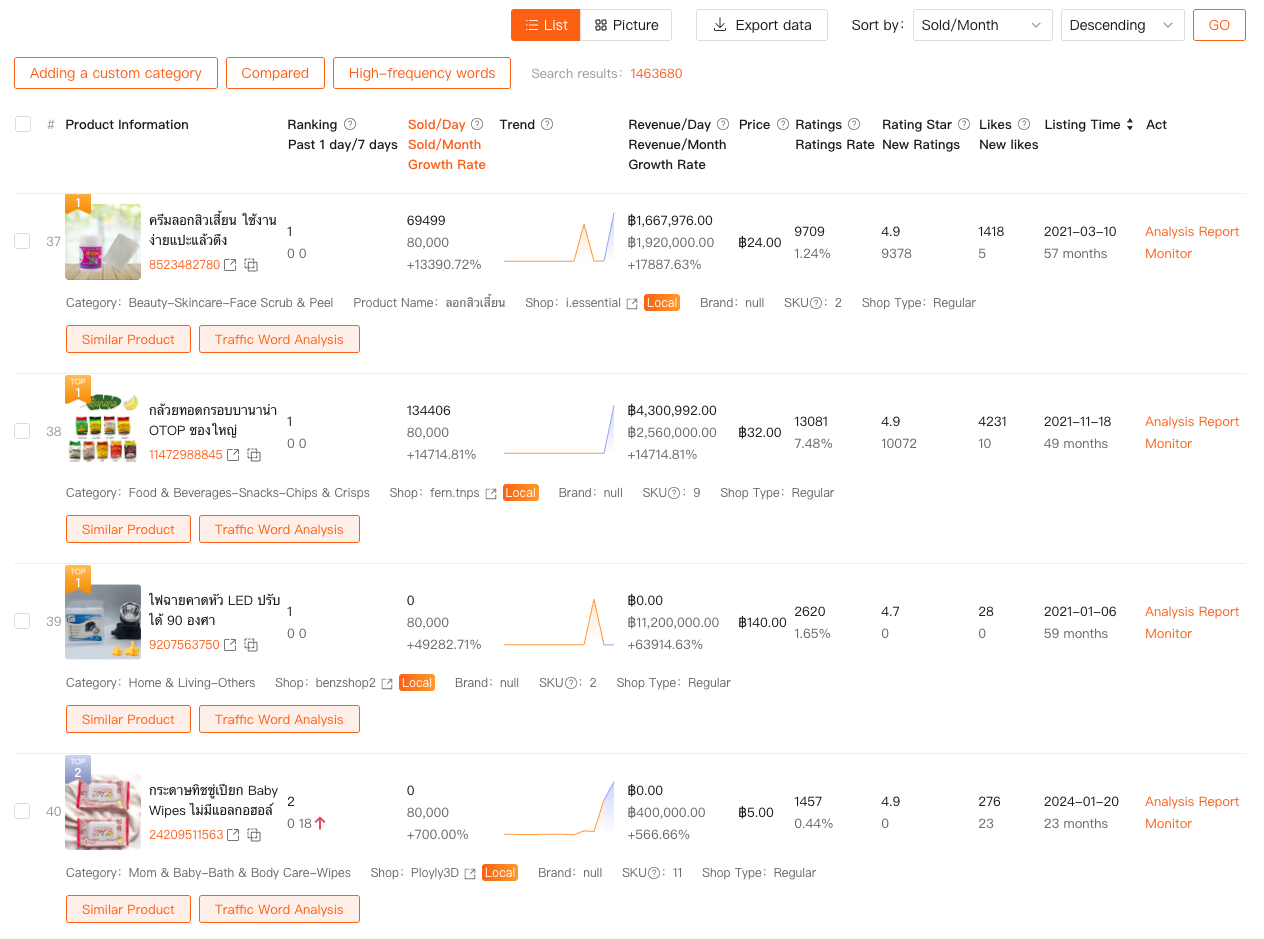

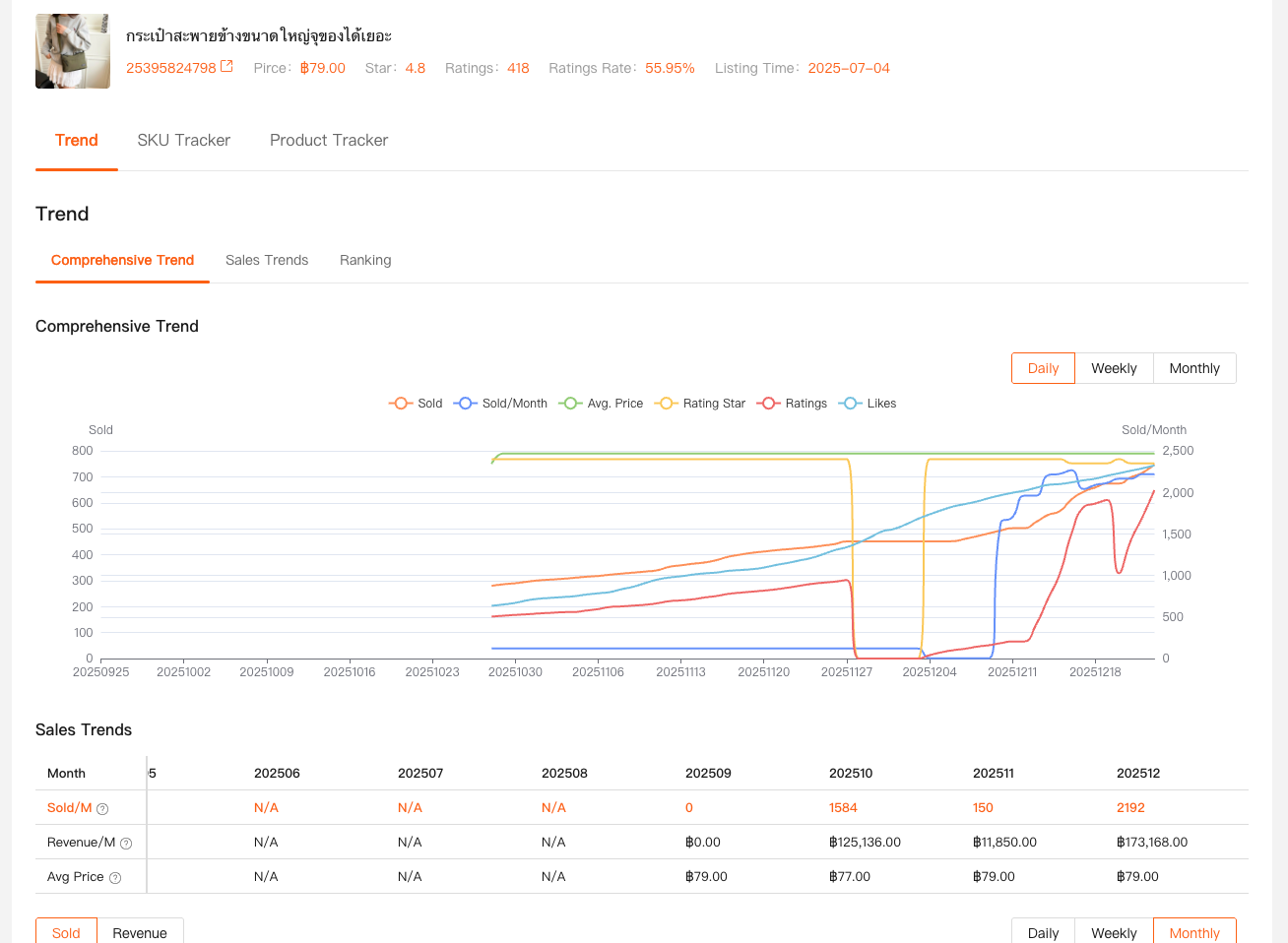

Once I’ve shortlisted potential products, I move into Comprehensive Analysis.

This is where assumptions meet reality.

I typically review:

- Sales trends over time

- Revenue stability

- Ranking movement

- SKU-level performance

- Whether growth is organic or campaign-driven

If a product spikes only during promotions and collapses afterward, that’s a red flag.

If sales grow steadily without aggressive discounting, that’s a strong signal.

This level of analysis helps answer:

Can this product sustain sales, or is it just temporarily inflated?

Common Product Research Mistakes I See Shopee Sellers Make

After reviewing thousands of stores, the patterns are obvious:

- Chasing viral products too late

- Ignoring competition density

- Confusing “high sales” with “high opportunity”

- Not validating long-term demand

- Relying on intuition instead of data

Shopee product research isn’t about being faster than everyone else — it’s about being more informed.

How My Product Research Workflow Looks Today

To summarize my process:

- Product Research

→ Identify demand, growth, and early-stage products - Market Analysis

→ Check category health and competitive pressure - Comprehensive Analysis

→ Validate sustainability and performance patterns

This workflow is repeatable, scalable, and works across different Shopee markets.

Final Thoughts

Good Shopee sellers don’t guess.

They observe, compare, validate, and then act.

Product research isn’t about finding a “magic product”. It’s about stacking small data advantages until the decision becomes obvious.

If you’re serious about building a Shopee business that lasts beyond a few campaigns, start treating product research like a system — not a gamble.

I’m David, and I’ll continue sharing what actually works in real Shopee markets, not just what sounds good on paper.

If you build with data, the results tend to follow.