What Is Shopee Analysis — and How Sellers Use It to Avoid Bad Product Decisions

Many Shopee sellers don’t actually fail at execution.

They fail much earlier — at the analysis stage.

From the outside, a product category might look “hot”: plenty of listings, decent prices, constant promotions. But once you launch, sales stall, ads burn cash, and margins disappear.

In most cases, the issue isn’t effort.

It’s that the seller never did proper Shopee analysis before committing.

Shopee analysis isn’t about staring at one bestseller. It’s about understanding the entire category structure — demand, competition, pricing, seller concentration, and brand dominance — before you decide whether a product is even worth entering.

Why Shopee Analysis Comes Before Product Selection

After years of working with Shopee sellers across Southeast Asia, one pattern is consistent:

Sellers who analyze categories first make fewer irreversible mistakes.

Before you think about sourcing, pricing, or ads, you need answers to questions like:

- Is demand stable or artificially inflated?

- Are sales controlled by a few dominant sellers?

- Are new products actually surviving in this category?

- Is this a brand-driven market or a generic one?

Without category-level data, sellers often confuse visibility with opportunity.

How Sellers Use Shopdora’s Market Analysis for Shopee Analysis

This is where Shopdora’s Market Analysis feature becomes useful in real-world decision-making.

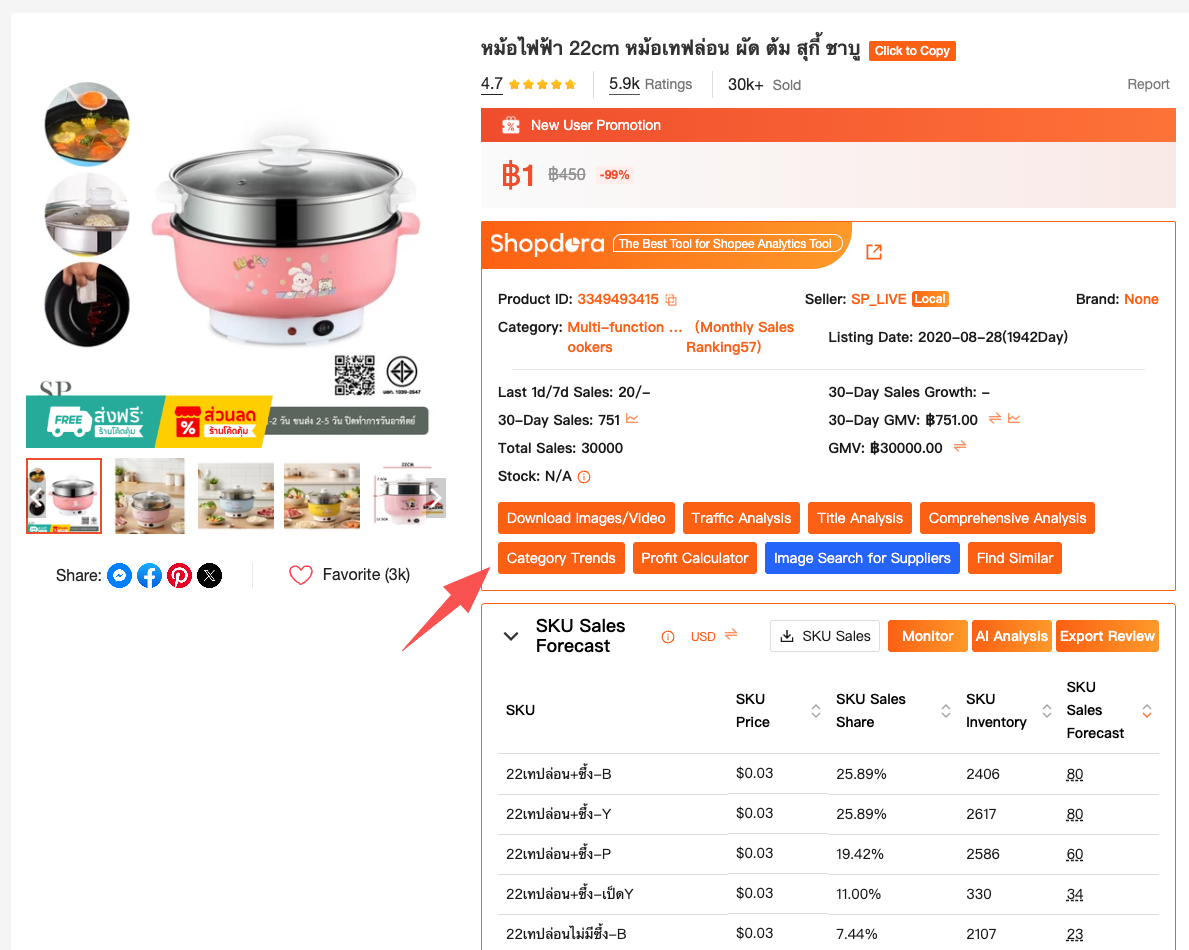

From any Shopee product front-end page, sellers can click “Category Trend” and instantly access a full market-level overview of that category — not just one product.

What sellers can analyze at a glance includes:

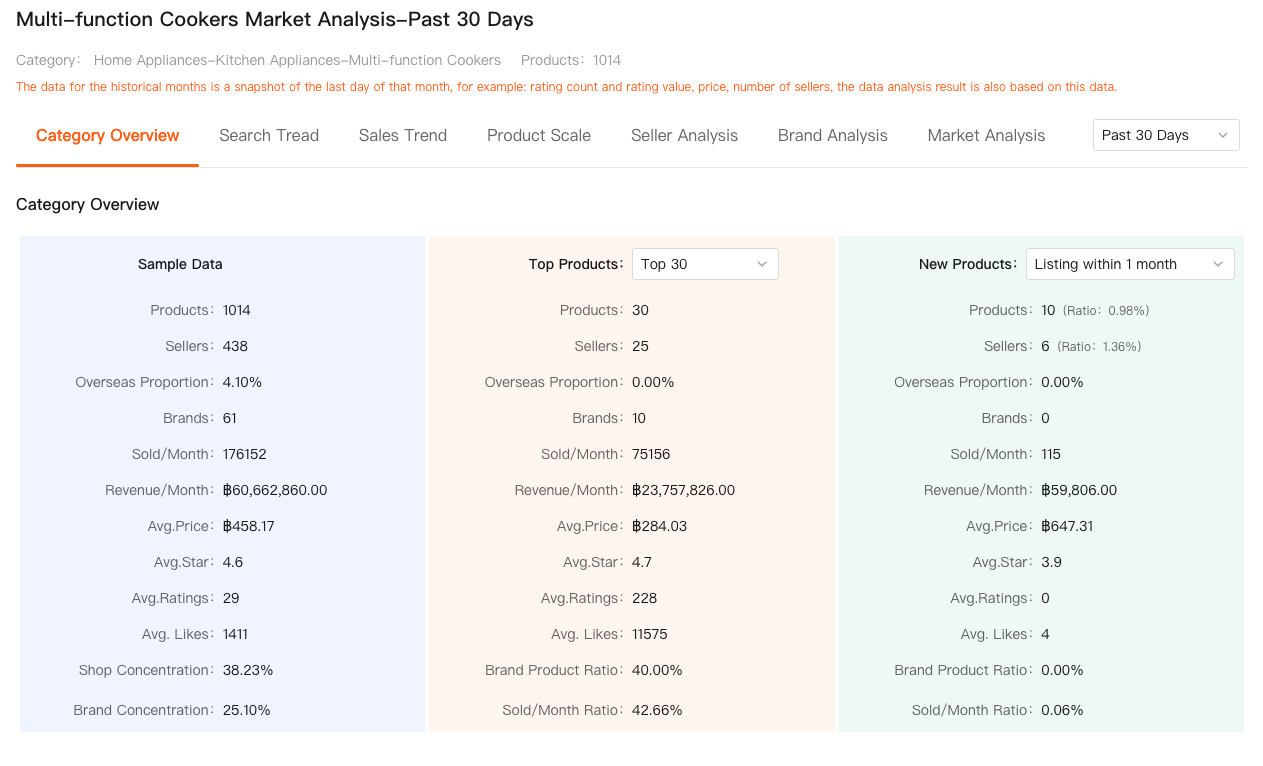

Category Overview (30-Day Snapshot)

- Total number of products and sellers

- Monthly sales volume and revenue

- Average price, ratings, and likes

- Brand and shop concentration levels

- Proportion of overseas sellers

This matters because categories with high sales but extreme concentration often look attractive — until you realize most revenue is controlled by a small group of sellers.

Top Products vs. New Products

Shopdora separates:

- Top-performing products (sales leaders)

- Newly listed products (typically within 30 days)

This comparison tells you whether:

- New listings are gaining traction

- The market is still open to newcomers

- Or growth is locked behind established players

In many “crowded” categories, sellers are surprised to see that new products contribute less than 1% of total sales — a major red flag.

Turning Shopee Analysis Data into Real Decisions

Data alone doesn’t make decisions — interpretation does.

Here’s how experienced sellers read Shopee analysis reports:

1. Look beyond total sales

High monthly revenue means nothing if:

- Shop concentration is too high

- Brand dominance is overwhelming

- New products fail to convert

Healthy categories usually show balanced sales distribution, not extreme skew.

2. Compare average price vs. top product price

If top products sell far below the category average, price wars are likely already happening.

3. Study seller count vs. product count

A large number of products with relatively few sellers often signals:

- Aggressive listing duplication

- Thin differentiation

- Rising competition without real innovation

4. Use competitor links for deeper checks

By pasting competitor links into analysis tools, sellers can connect category data with actual listing behavior, instead of relying on assumptions.

Common Shopee Analysis Mistakes Sellers Make

Even with access to data, many sellers still misjudge categories. The most common mistakes include:

- Only checking bestsellers, not the full market

- Ignoring new product survival rates

- Confusing temporary promotions with real demand

- Entering brand-heavy categories without brand leverage

Good Shopee analysis isn’t about finding the biggest market — it’s about finding the most survivable one.

Shopee Analysis as a Long-Term Skill

Shopee analysis isn’t a one-time task. Markets shift constantly:

- Prices compress

- Sellers enter and exit

- Algorithms change how exposure is distributed

Sellers who regularly review category trends adapt faster — and usually avoid chasing “hot” products that are already past their peak.

Tools like Shopdora don’t replace experience, but they compress learning curves, allowing sellers to see patterns that would otherwise take months of trial and error.

Final Thoughts

If you skip Shopee analysis, every later decision becomes riskier:

- Product selection turns into guessing

- Pricing becomes reactive

- Ads become expensive experiments

But when you start with category-level analysis, you gain clarity before commitment.

For Shopee sellers who want sustainable growth, analysis isn’t optional — it’s foundational.