Why Most Shopee Sellers Misread Shopee Data — And How to Actually See the Market

Hi, I'm David.

I’ve been selling on Shopee for a little over three years now. Not as an agency, not managing dozens of stores — just one seller running my own shop, testing products, killing SKUs, rebuilding listings, and slowly figuring out what actually moves the needle.

For a long time, I thought I was “data-driven.” I checked my Shopee dashboard daily. I tracked my own sales, conversion rate, ad spend, and traffic. I had spreadsheets. I had routines.

And yet, I kept making the same mistakes: entering categories that were already overcrowded, pricing too aggressively for markets that couldn’t support it, and reacting too late to competitors who were clearly scaling faster than me.

The problem wasn’t that I lacked Shopee data.

The problem was that I was only seeing my own.

The biggest misunderstanding about Shopee data

Most sellers assume Shopee data means “store performance.” Sales, orders, clicks, ads — the things your seller center shows you every day. That data is useful, but it’s also incomplete.

What Shopee doesn’t show you is the part that matters most when you’re making decisions: what’s happening outside your store.

You don’t know how fast competing products are growing.

You don’t know how many SKUs competitors are running in the same category.

You don’t know whether a market is expanding or already saturated.

So when sellers say, “I followed the data, but it still failed,” what they usually mean is: I followed only my own data.

That’s where external Shopee data — real market and competitor data — changes everything.

Seeing beyond your store: why market-level Shopee data matters

Once you start looking at Shopee data from a market perspective, your thinking shifts. Instead of asking “How is my product performing?”, you start asking better questions:

Is this category still growing, or just rotating sellers?

Are top products winning because of demand, or because of early entry?

Is price the real driver, or is SKU structure doing the heavy lifting?

This is the point where tools like Shopdora start to matter — not because they replace Shopee’s backend, but because they show what Shopee doesn’t: competitor and market-level data.

I’ll focus on three Shopdora features that completely changed how I read Shopee data, especially when researching markets and competitors.

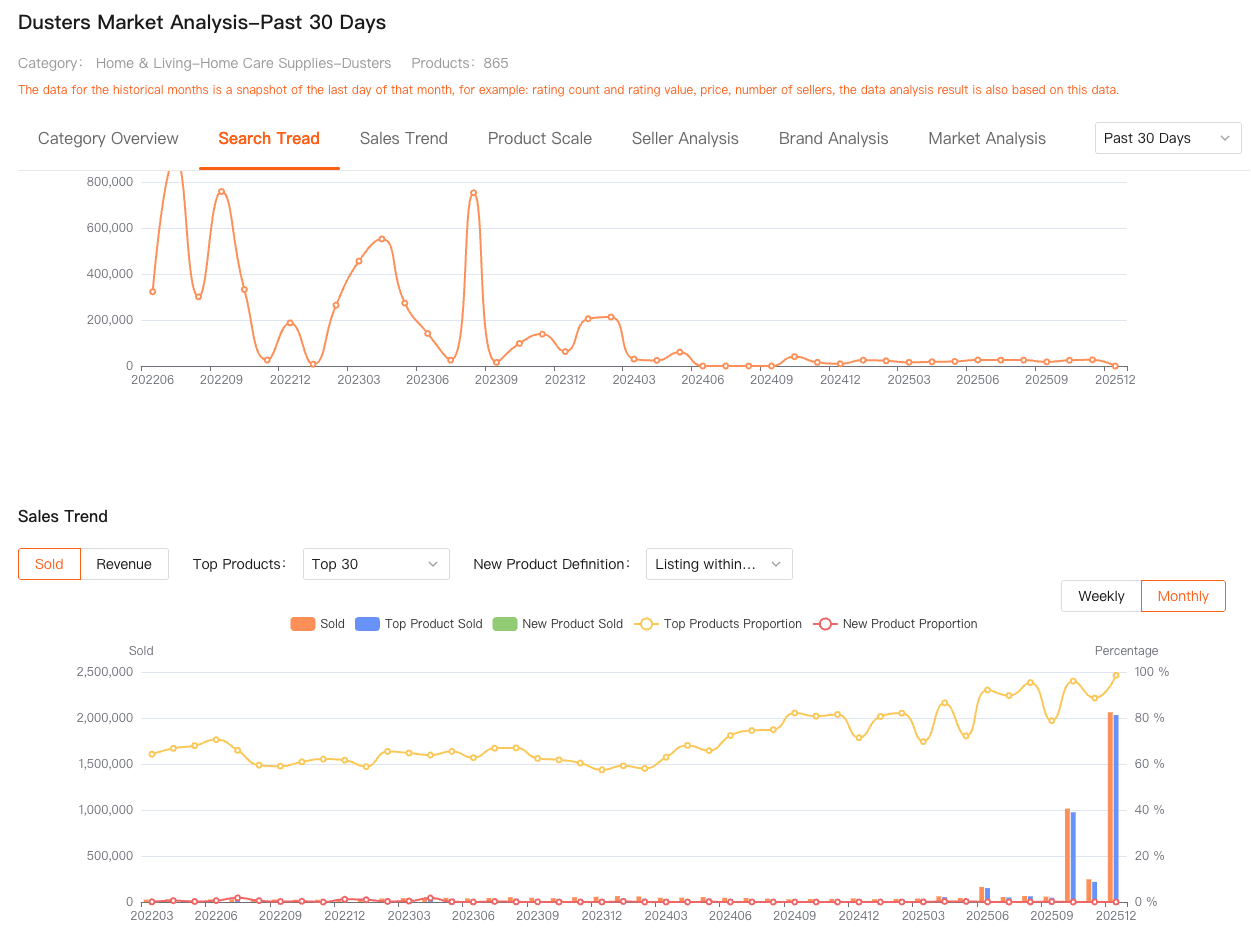

Market Analysis: understanding demand before entering

Before I used market-level Shopee data, my product research process was mostly reactive. I would see something trending, jump in, and hope my execution was good enough.

With Shopdora’s Market Analysis, the process flipped.

Instead of starting with a product, I started with a category. By filtering by site, category, and time range, I could see whether total sales volume was actually growing, stagnating, or declining. This matters more than most sellers realize.

A category with high sales but flat growth usually means heavy competition and thin margins. A smaller category with consistent growth often offers more room for new sellers to enter and scale.

This kind of Shopee data isn’t available in the seller center because it’s not about you. It’s about the market as a whole. And once you understand the difference, you stop confusing “busy” markets with “healthy” ones.

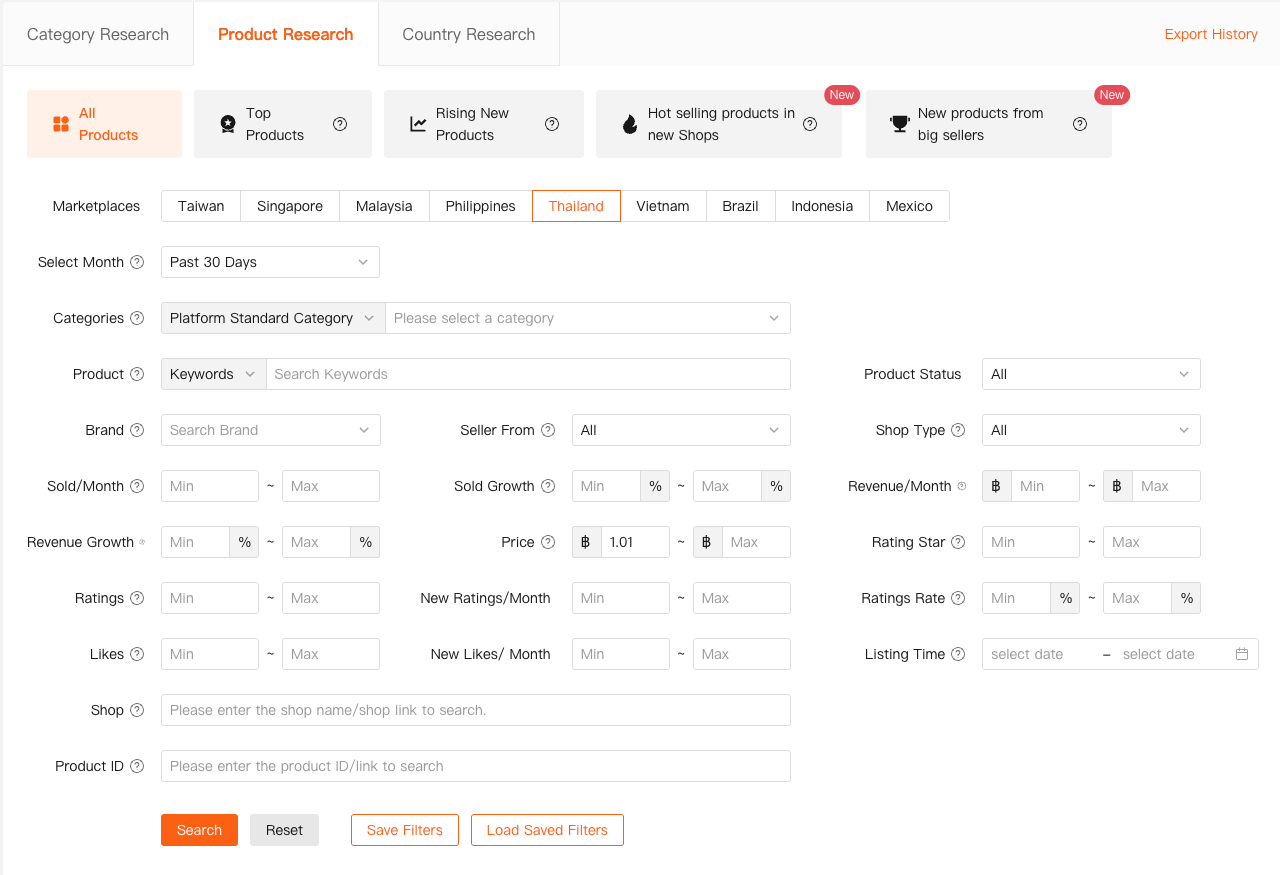

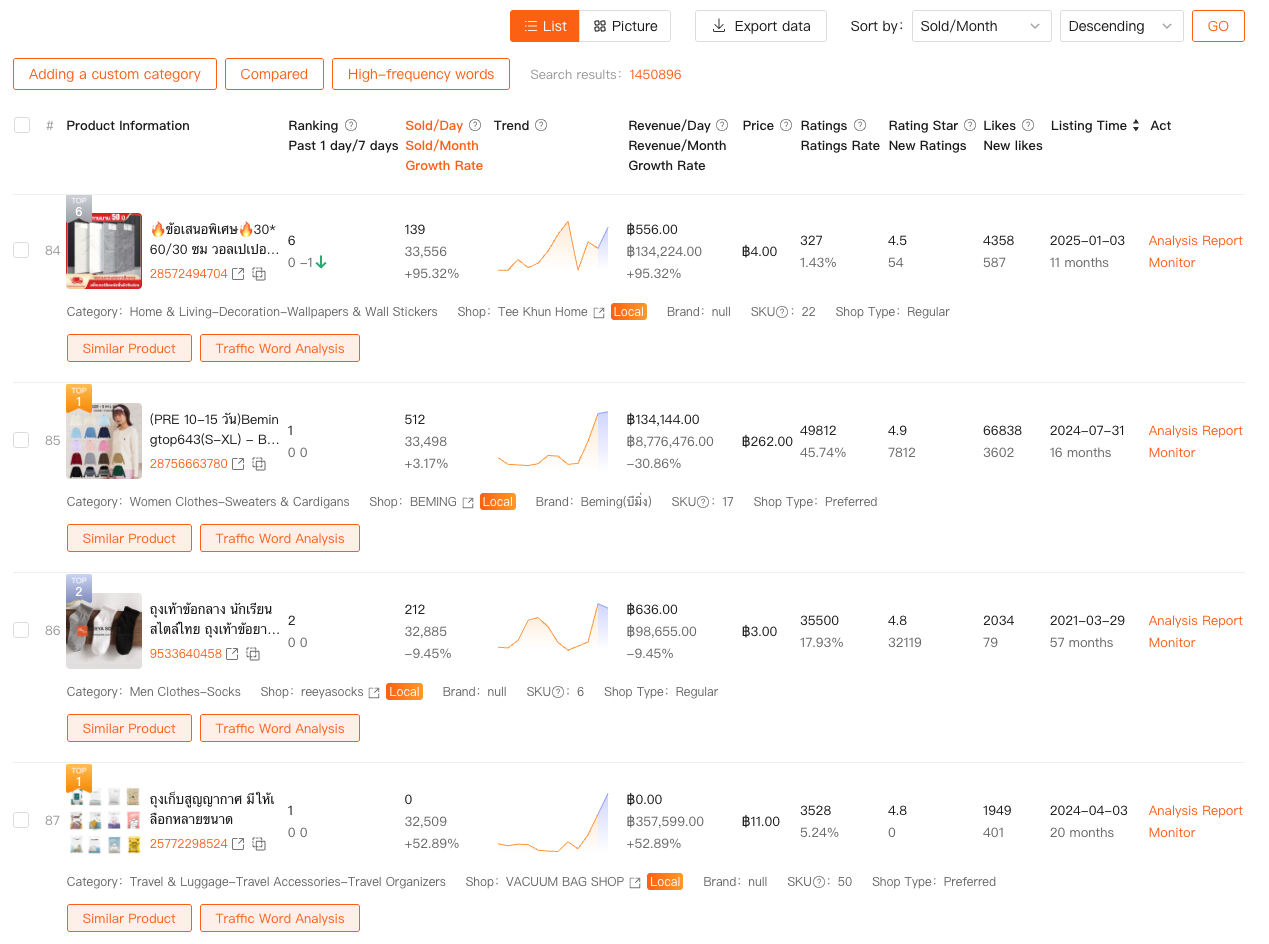

Product Research: turning Shopee data into decisions, not guesses

Most sellers use product research tools to find “hot products.” I use them to answer harder questions.

With Shopdora’s Product Research, I’m not just looking at sales numbers. I’m looking at patterns: how long products have been listed, how sales trend over time, how many competitors are entering with similar SKUs, and whether growth is concentrated or spread out.

This matters because Shopee data without context can be misleading. A product doing 5,000 orders a month might look attractive — until you realize it launched two years ago and growth has flattened. Another product doing 800 orders might be far more interesting if it’s doubling month over month.

Because Shopdora aggregates competitor product data across the platform, it allows you to see these trends clearly. You’re no longer guessing whether you’re early or late — the data tells you.

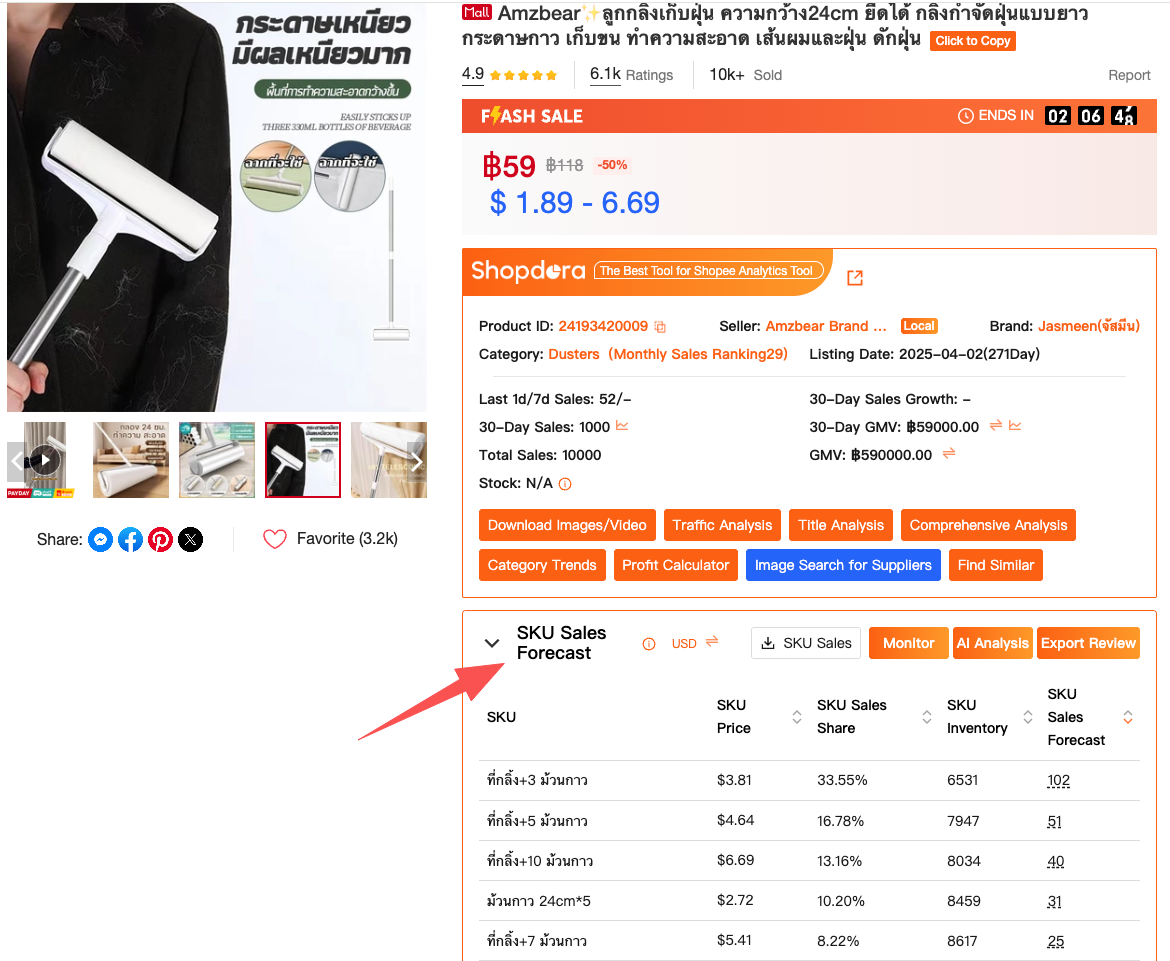

SKU Insight: why some competitors scale while others stall

One of the most overlooked parts of Shopee data is SKU structure.

From the outside, two products might look identical. Same price range, same category, similar images. But one scales steadily while the other stalls. The difference often comes down to how SKUs are structured.

Shopdora’s SKU Insight lets you see how competitors organize their variants — pricing spread, best-selling SKUs, and how sales are distributed across options.

This matters because SKU strategy affects conversion, ad efficiency, and even algorithm exposure. Shopee doesn’t show you how competitors are structuring this — but when you can see it at a market level, your own SKU decisions become far more intentional.

Instead of blindly copying listings, you start understanding why certain setups work.

Why Shopee data alone isn’t enough

None of these insights replace Shopee’s seller backend. You still need your own performance data to optimize operations, ads, and listings.

But relying only on internal data is like driving while looking only in the rearview mirror. You can see where you’ve been — not where the market is going.

External Shopee data, especially competitor and market-level data, fills that gap. It helps you make decisions before problems show up in your own numbers.

That’s the real value of tools like Shopdora. Not automation. Not shortcuts. But visibility.

How my decision-making changed as a seller

Once I started using Shopee data at the market level, I noticed something unexpected: I became more patient.

I stopped rushing into categories just because they looked busy. I stopped panicking over short-term dips when the market trend was still healthy. And I stopped blaming execution when the real issue was market saturation.

Good data doesn’t just give you answers. It gives you confidence.

Final thoughts

I’m still selling on Shopee. I still make mistakes. But I make fewer blind ones now.

If there’s one thing I wish I understood earlier, it’s this: Shopee data is only powerful when it extends beyond your own store.

Market trends, competitor behavior, SKU structure — these are the signals that shape long-term results. Tools like Shopdora don’t magically make you successful, but they give you access to the kind of Shopee data that lets you think like a serious seller, not just an operator reacting to yesterday’s numbers.

And in the long run, that mindset makes all the difference.